Enlarge image

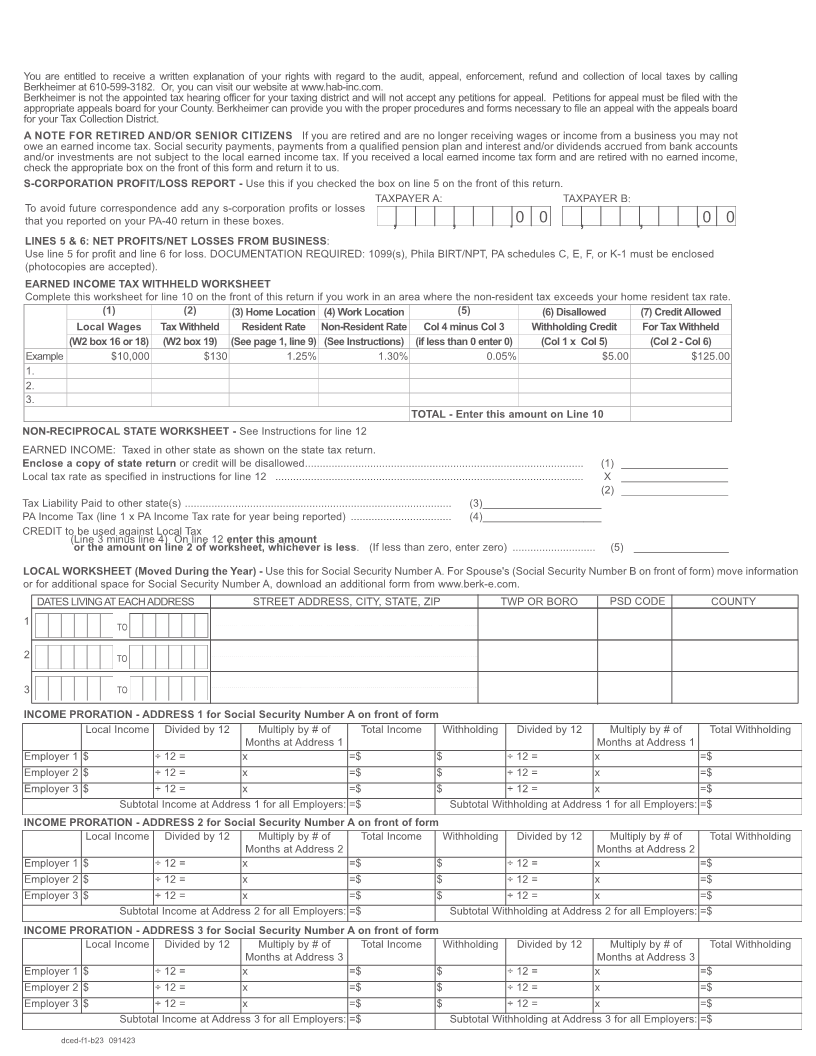

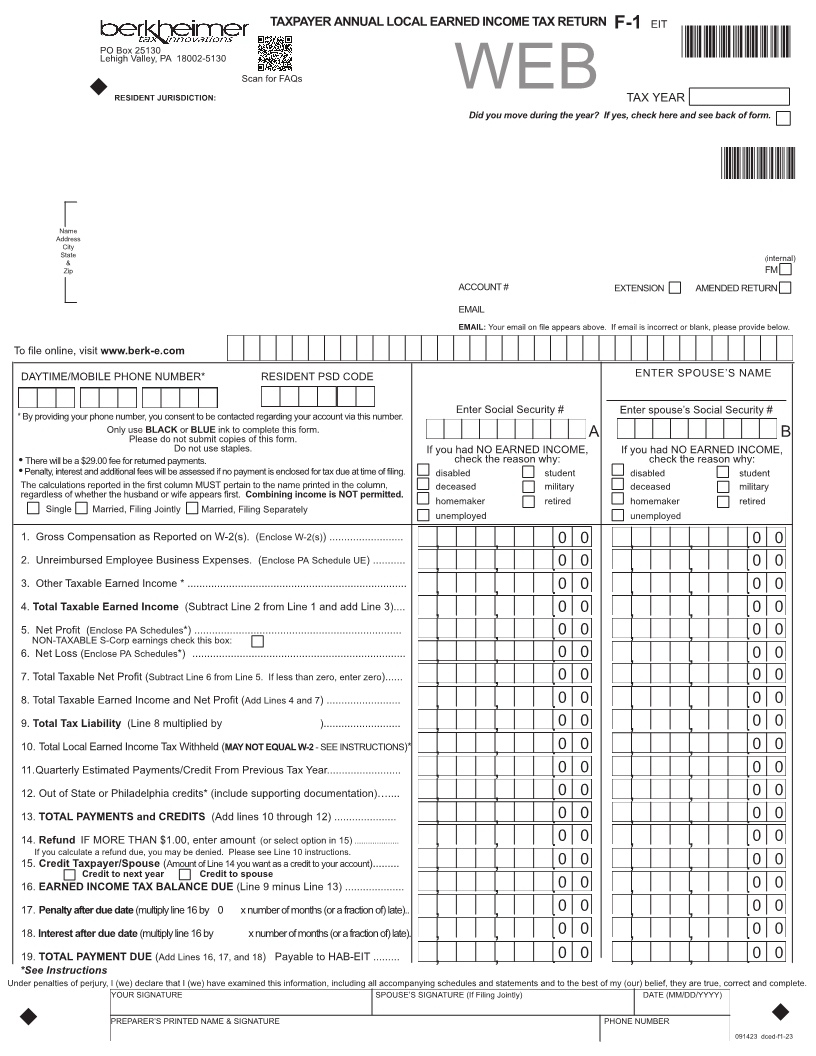

TAXPAYER ANNUAL LOCAL EARNED INCOME TAX RETURNF-1 EIT

PO Box 25130 *DCEDF1*

Lehigh Valley, PA 18002-5130

Scan for FAQs

RESIDENT JURISDICTION: WEB TAX YEAR

Did you move during the year? If yes, check here and see back of form.

*COPY*

Name

Address

City

State (internal)

&

Zip FM

ACCOUNT # EXTENSION AMENDED RETURN

EMAIL

EMAIL: Your email on file appears above. If email is incorrect or blank, please provide below.

To file online, visit www.berk-e.com

DAYTIME/MOBILE PHONE NUMBER* RESIDENT PSD CODE ENTER SPOUSE’S NAME

* By providing your phone number, you consent to be contacted regarding your account via this number. Enter Social Security # Enter spouse’s Social Security #

Only use BLACK or BLUE ink to complete this form. AB

Please do not submit copies of this form.

Do not use staples.

l If you had NO EARNED INCOME, If you had NO EARNED INCOME,

check the reason why: check the reason why:

There will be a $29.00 fee for returned payments.

lThe Penalty,calculationsinterestreportedand additionalin the firstfeescolumnwill be assessedMUST pertainif notopaymentthe nameis enclosedprinted inforthetaxcolumn, due at time of filing. disabled student

disabled student

deceased military

regardless of whether the husband or wife appears first. Combining income is NOT permitted. deceased military

homemaker retired

Single Married, Filing Jointly Married, Filing Separately homemaker retired

unemployed unemployed

1. Gross Compensation as Reported on W-2(s). (Enclose W-2(s)) ......................... , , . 0 0 0 0

, , .

2. Unreimbursed Employee Business Expenses. (Enclose PA Schedule UE) ........... , , .0 0 0 0

, , .

3. Other Taxable Earned Income * .......................................................................... , , . 0 0 0 0

, , .

4. Total Taxable Earned Income (Subtract Line 2 from Line 1 and add Line 3).... , , . 0 0 0 0

, , .

5. Net Profit (Enclose PA Schedules*) ...................................................................... , , .0 0 , , .0 0

NON-TAXABLE S-Corp earnings check this box:

6. Net Loss (Enclose PA Schedules*) ........................................................................ , , .0 0 , , .0 0

7. Total Taxable Net Profit (Subtract Line 6 from Line 5. If less than zero, enter zero)...... , , .0 0 , , .0 0

8. Total Taxable Earned Income and Net Profit (Add Lines 4 and 7) ......................... , , . 0 0 , , . 0 0

9. Total Tax Liability (Line 8 multiplied by ).......................... , , . 0 0 , , . 0 0

10. Total Local Earned Income Tax Withheld (MAY NOT EQUAL W-2 - SEE INSTRUCTIONS)* , , . 0 0 , , . 0 0

11.Quarterly Estimated Payments/Credit From Previous Tax Year......................... , , . 0 0 , , . 0 0

12. Out of State or Philadelphia credits* (include supporting documentation)….... , , . 0 0 , , . 0 0

13. TOTAL PAYMENTS and CREDITS (Add lines 10 through 12) ..................... , , .0 0 , , .0 0

14. Refund IF MORE THAN $1.00, enter amount (or select option in 15) .................... , , .0 0 , , .0 0

If you calculate a refund due, you may be denied. Please see Line 10 instructions.

15. Credit Taxpayer/Spouse (Amount of Line 14 you want as a credit to your account)......... , , . 0 0 , , . 0 0

Credit to next year Credit to spouse

16. EARNED INCOME TAX BALANCE DUE(Line 9 minus Line 13) .................... , , .0 0 , , .0 0

17. Penalty after due date (multiply line 16 by 0 x number of months (or a fraction of) late).. , , . 0 0 , , . 0 0

18. Interest after due date (multiply line 16 by x number of months (or a fraction of) late). , , . 0 0 , , . 0 0

19. TOTAL PAYMENT DUE (Add Lines 16, 17, and 18) Payable to HAB-EIT ......... , , .0 0 , , .0 0

*See Instructions

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying schedules and statements and to the best of my (our) belief, they are true, correct and complete.

YOUR SIGNATURE SPOUSE’S SIGNATURE (If Filing Jointly) DATE (MM/DD/YYYY)

PREPARER’S PRINTED NAME & SIGNATURE PHONE NUMBER

091423 dced-f1-23