Enlarge image

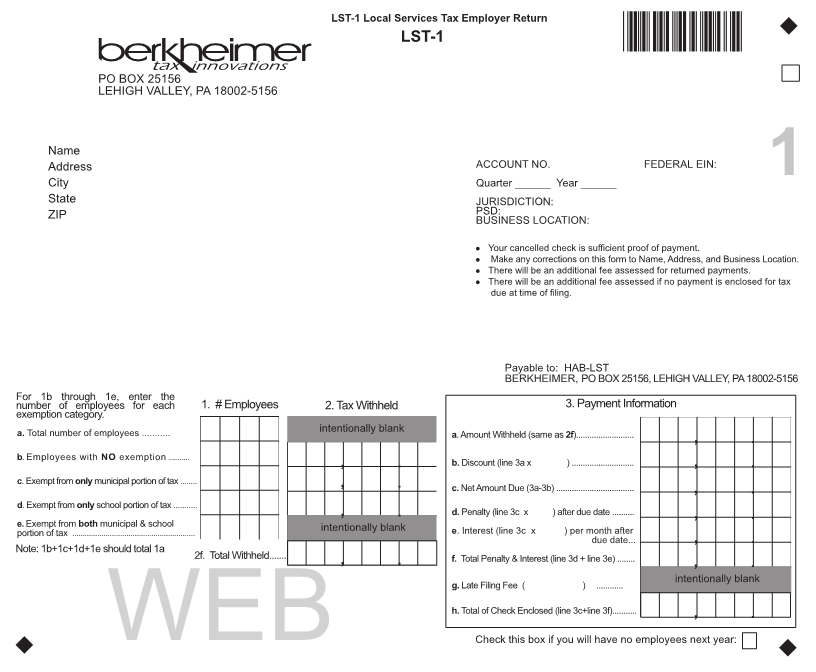

LST-1 Local Services Tax Employer Return

LST-1 *LST1R*

PO BOX 25156

LEHIGH VALLEY, PA 18002-5156

Name

Address ACCOUNT NO. FEDERAL EIN:

City Quarter ______ Year ______ 1

State JURISDICTION:

ZIP PSD:

BUSINESS LOCATION:

l Your cancelled check is sufficient proof of payment.

l Make any corrections on this form to Name, Address, and Business Location.

l There will be an additional fee assessed for returned payments.

l There will be an additional fee assessed if no payment is enclosed for tax

due at time of filing.

Payable to: HAB-LST

BERKHEIMER, PO BOX 25156, LEHIGH VALLEY, PA 18002-5156

For 1b through 1e, enter the

number of employees for each 1. # Employees 2. Tax Withheld 3. Payment Information

exemption category.

a. Total number of employees ........... intentionally blank a. Amount Withheld (same as 2f ).......................... , .

b. Employees with NO exemption ..........

, . b. Discount (line 3a x ) ............................ , .

c. Exempt fromonly municipal portion of tax ........ , . c. Net Amount Due (3a-3b) ................................... , .

d. Exempt from only school portion of tax ...........

, . d. Penalty (line 3c x ) after due date .......... , .

e. Exempt fromboth municipal & school intentionally blank e. Interest (line 3c x ) per month after

portion of tax ...........................................................

due date... , .

Note: 1b+1c+1d+1e should total 1a

2f. Total Withheld....... , . f. Total Penalty & Interest (line 3d + line 3e) ........ , .

intentionally blank

g. Late Filing Fee ( ) ............

h. Total of Check Enclosed (line 3c+line 3f)........... , .

Check this box if you will have no employees next year:

WEB