Enlarge image

RETURN THIS ENTIRE SHEET WITH YOUR PAYMENT

BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

Re: Tax Year:

PO BOX 21810 LEHIGH VALLEY, PA 18002-1810

Send documentation to eBPT@goberk.com

District:

Account Number:

Name:

Address: *STD*

City,

State,

Zip DO NOT WRITE IN BOX

WEB

POSTMARK DATE OF POST OFFICE ACCEPTED — NO EXTENSIONS

Failure to receive a tax return does not entitle owner to disregard the penalty or interest on taxes owed.

SECTION A: COMPUTATION OF GROSS VOLUME OF BUSINESS ON REVERSE SIDE TAX DUE ON OR BEFORE

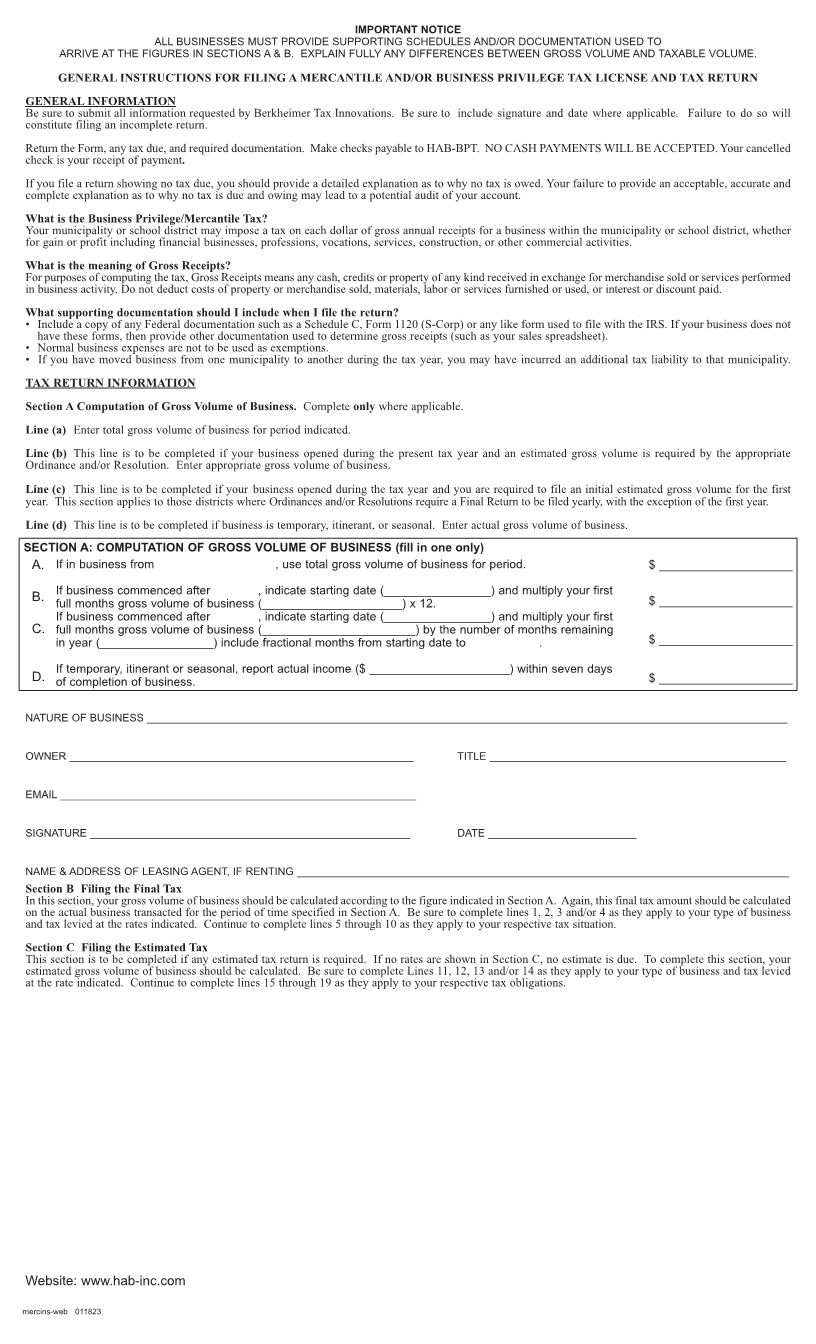

SECTION B: FINAL TAX - BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

NATURE OF GROSS VOLUME OF BUSINESS EXEMPTIONS & TAXABLE VOLUME TAX RATE AMOUNT OF TAX DUE

BUSINESS ROUND TO NEAREST DOLLAR EXCLUSIONS ROUND TO NEAREST DOLLAR ROUND TO NEAREST DOLLAR

1. Service , , , , , , x , ,

2. Rentals , , , , , , x , ,

3. Retail , , , , , , x , ,

4. Wholesale , , , , , , x , ,

5. TOTAL TAX DUE (Add lines 1, 2, 3, & 4) , ,

6. Less last year’s credit and/or estimated payment (excluding penalty & interest) , ,

7. SUBTOTAL (Line 5 minus Line 6) , ,

8. Add interest of (after due date) , ,

9. Add penalty of (after due date) , ,

10. TOTAL SECTION B (Add Lines 7, 8, & 9) , ,

SECTION C: ESTIMATED TAX - BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

NATURE OF GROSS VOLUME OF BUSINESS EXEMPTIONS & TAXABLE VOLUME TAX AMOUNT OF TAX DUE

BUSINESS ROUND TO NEAREST DOLLAR EXCLUSIONS ROUND TO NEAREST DOLLAR RATE ROUND TO NEAREST DOLLAR

11. Service , , , , , , x , ,

12. Rentals , , , , , , x , ,

13. Retail , , , , , , x , ,

14. Wholesale , , , , , , x , ,

15. TOTAL ESTIMATED TAX DUE (Add Lines 11, 12, 13, & 14) , ,

16. Add interest of (after due date) , ,

17. Add penalty of (after due date) , ,

18. TOTAL SECTION C (Add Lines 15, 16 & 17) , ,

19. TOTAL AMOUNT DUE (Add Lines 10 & 18) PAYMENT DUE BY , ,

E.I.N. # _____________________ Please check one: Refund Due

BUSINESS TELEPHONE ____________________________ No Payment Due

DATE OPERATION BEGAN IN DISTRICT _______________ *STD* Payment Included

DO NOT TEAR APART NO CASH PAYMENTS WILL BE ACCEPTED.

BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN Your cancelled check is your receipt of payment.

There will be a $29 fee for returned checks.

Make any corrections to Business Name & Address and check here.

Tax Year:

Business Name:

Re:

District:

Account Number:

Make check payable to and remit to:

HAB-BPT

PO BOX 21810 Amount of Payment: $ _____________________

LEHIGH VALLEY, PA 18002-1810

DO NOT WRITE BELOW THIS LINE

mercre-web 011823

*STD*