Enlarge image

EIT

W2-R Annual Reconciliation of Earned Income Tax Withheld From Wages

As reported on Employer’s Quarterly Return (Form E-1); with income tax withheld as shown

PO Box 25113 on Withholding Statements (W-2) *W2R*

Lehigh Valley, PA 18002-5113 PAGE OF

W2R

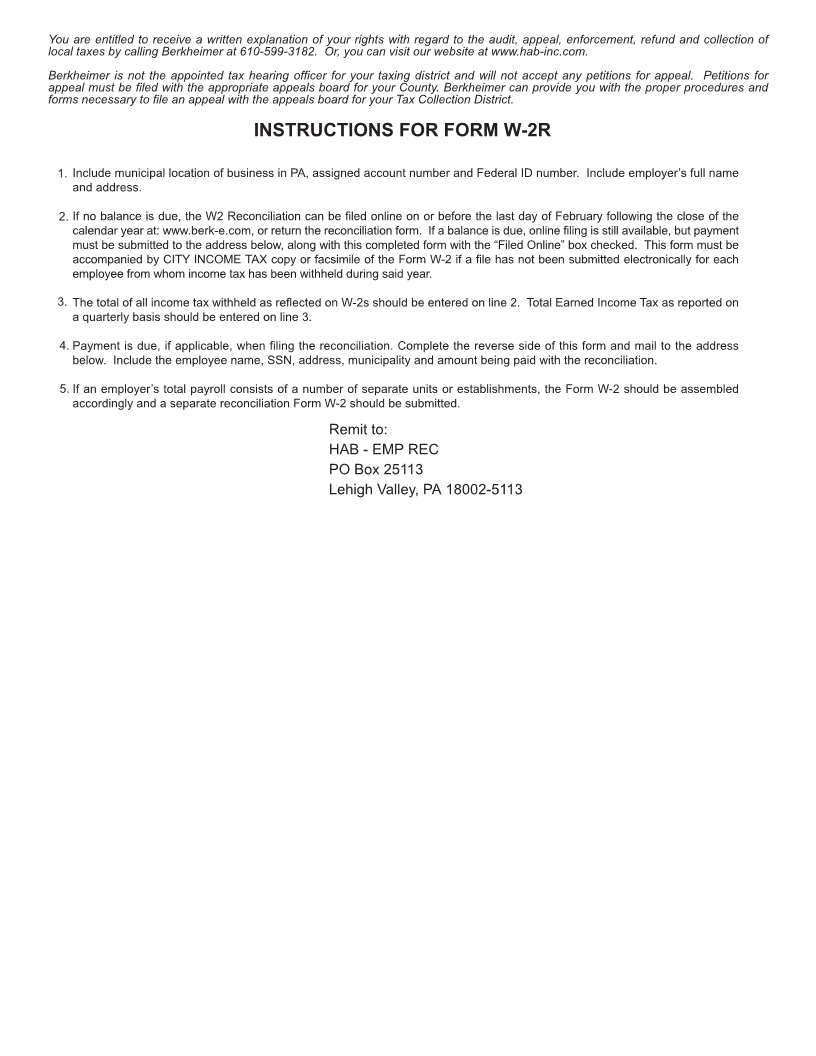

Please see reverse for instructions.

Scan for FAQs

or to file online

W2

Year:

Due by Last Day of February

Filed Online (see instructions)

Employer Name WEB

Address

City State Zip

Municipal Location of Business

PSD Number Employer Acct No. Federal ID No. TCD Filed With

EMAIL: Your email on file appears above. If email is incorrect or blank, please provide below.

Phone Number: Your phone number on file appears above. If phone is incorrect or blank, please provide below. By providing your number, you agree to allow us to contact you regarding your account by phone.

1. Total number of withholding statements (W-2s) accompanying this report

2. Total income tax withheld from all wages during the year as shown on (W-2s) (A) $ , .

EARNED INCOME TAX Tax Paid

Quarter ended March 31 .................... $ , .

Quarter ended June 30 ...................... $ , .

Quarter ended September 30 ............ $ , .

Quarter ended December 31 .............. $ , .

3. Total quarterly income tax from wages during the year as reported on Quarterly E-1 Reports (B) $

, .

TOTAL AMOUNT OF ENCLOSED CHECK , .

4. Any difference between A and B must be explained in attached statement. Where A and B do not agree, please remit or request refund.

I DECLARE UNDER PENALTIES PROVIDED BY THE LAW THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST

OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN.

Signature_______________________________________________ Phone___________________________ Date_______________

There will be a $29.00 fee for returned payments.

There will be an additional fee assessed if no payment is enclosed for tax due at time of filing.