Enlarge image

LOCAL SERVICES TAX – REFUND APPLICATION

___________________________________________

Tax Year

APPLICATION FOR REFUND FROM LOCAL SERVICES TAX

A copy of this application for a refund of the Local Services Tax (LST), and all necessary supporting

documents, must be completed and presented to the tax office charged with collecting the Local Services

Tax.

This application for a refund of the Local Services Tax must be signed and dated.

No refund will be approved until proper documents have been received .

Name: _____________________________________ Soc Sec #: ____________________________________

Address: ___________________________________ Phone #: _____________________________________

City/State: _________________________________ Zip: _________________________________________

REASON FOR REFUND – CHECK ALL THAT APPLY

1.__________ I overpaid by more than $1.

2.__________ I had the tax withheld when it should have been exempted.

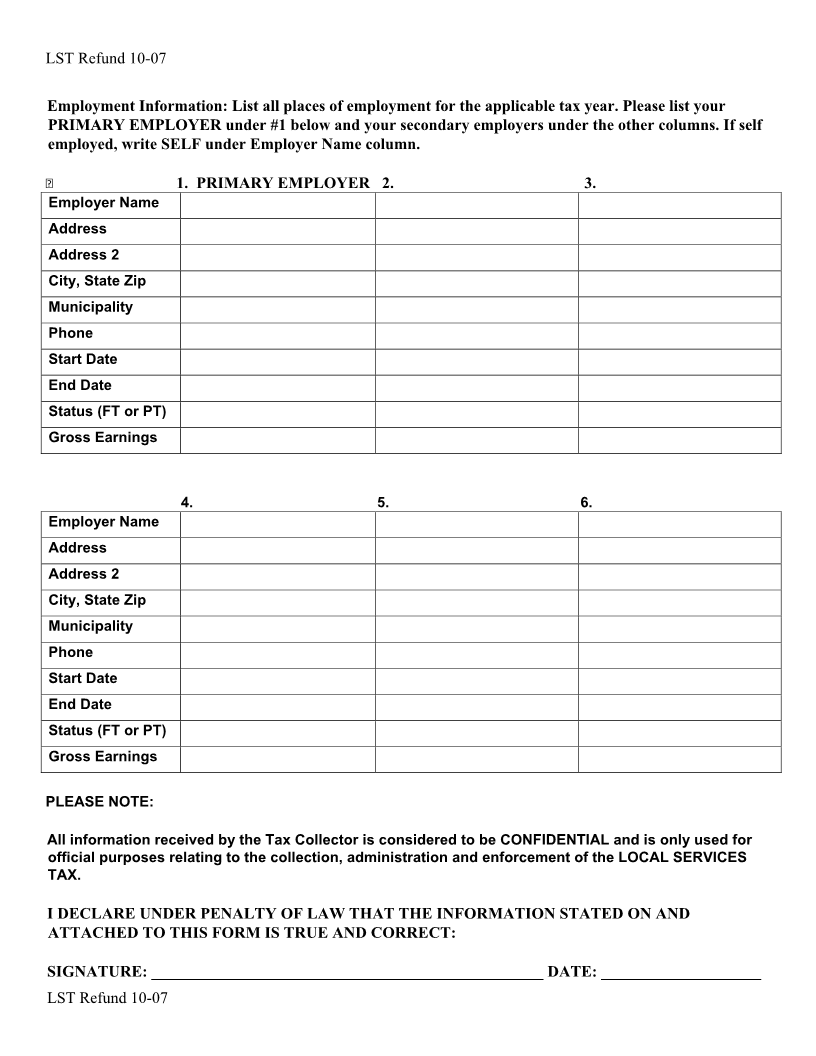

3.__________ MULTIPLE EMPLOYERS: Please attach a copy of a current pay statement from your

principal employer that shows the name of the employer, the length of the payroll period and the amount of

Local Services Tax withheld. Please list all employers on the reverse side of this form.

4.__________ TOTAL EARNED INCOME AND NET PROFITS FROM ALL SOURCES WITHIN

_____________________________________ (municipality or school district) WAS

LESS THAN $_____________: Please attach a copy of all of your last pay statements

from all employers within the political subdivision for the year prior to the fiscal year for

which you are requesting to be exempted from the Local Services Tax.

If you are self-employed, please attach a copy of your PA Schedule C, F, or RK-1 for the

year prior to the fiscal year for which you are requesting to receive a refund of the Local

Services Tax.

5.__________ ACTIVE DUTY MILITARY EXEMPTION: Please attach a copy of your orders

directing you to active duty status.

6.__________ MILITARY DISABILITY EXEMPTION: Please attach copy of your discharge orders

and a statement from the United States Veterans Administrator or its successor declaring your disability to be

a total one hundred percent permanent disability.

Tax Office: Berkheimer Tax Innovations

Address: PO Box 25156 Phone #: (610) 588-0965

City/State: Lehigh Valley, PA Zip: 18002