Enlarge image

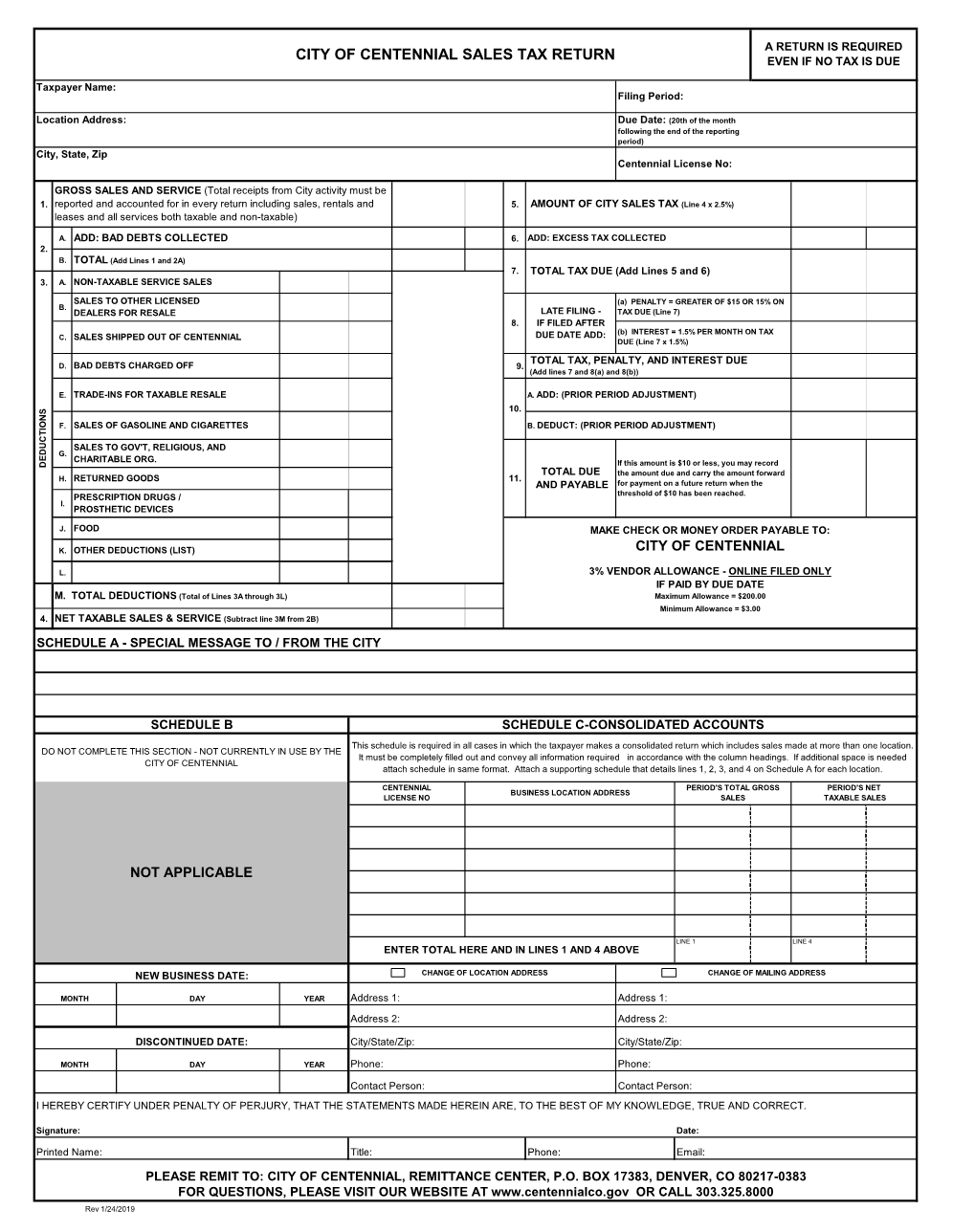

A RETURN IS REQUIRED

CITY OF CENTENNIAL SALES TAX RETURN EVEN IF NO TAX IS DUE

Taxpayer Name:

Filing Period:

Location Address: Due Date: (20th of the month

following the end of the reporting

period)

City, State, Zip

Centennial License No:

GROSS SALES AND SERVICE (Total receipts from City activity must be

1. reported and accounted for in every return including sales, rentals and 5. AMOUNT OF CITY SALES TAX (Line 4 x 2.5%)

leases and all services both taxable and non-taxable)

A. ADD: BAD DEBTS COLLECTED 6. ADD: EXCESS TAX COLLECTED

2.

B. TOTAL (Add Lines 1 and 2A)

7. TOTAL TAX DUE (Add Lines 5 and 6)

3. A. NON-TAXABLE SERVICE SALES

B. SALES TO OTHER LICENSED (a) PENALTY = GREATER OF $15 OR 15% ON

DEALERS FOR RESALE LATE FILING - TAX DUE (Line 7)

8. IF FILED AFTER

C. SALES SHIPPED OUT OF CENTENNIAL DUE DATE ADD: (b) INTEREST = 1.5% PER MONTH ON TAX

DUE (Line 7 x 1.5%)

D. BAD DEBTS CHARGED OFF 9. TOTAL TAX, PENALTY, AND INTEREST DUE

(Add lines 7 and 8(a) and 8(b))

E. TRADE-INS FOR TAXABLE RESALE A. ADD: (PRIOR PERIOD ADJUSTMENT)

10.

F. SALES OF GASOLINE AND CIGARETTES B. DEDUCT: (PRIOR PERIOD ADJUSTMENT)

G. SALES TO GOV'T, RELIGIOUS, AND

DEDUCTIONS CHARITABLE ORG. If this amount is $10 or less, you may record

H. RETURNED GOODS 11. TOTAL DUE the amount due and carry the amount forward

AND PAYABLE for payment on a future return when the

I. PRESCRIPTION DRUGS / threshold of $10 has been reached.

PROSTHETIC DEVICES

J. FOOD MAKE CHECK OR MONEY ORDER PAYABLE TO:

K. OTHER DEDUCTIONS (LIST) CITY OF CENTENNIAL

L. 3% VENDOR ALLOWANCE - ONLINE FILED ONLY

IF PAID BY DUE DATE

M. TOTAL DEDUCTIONS (Total of Lines 3A through 3L) Maximum Allowance = $200.00

Minimum Allowance = $3.00

4. NET TAXABLE SALES & SERVICE (Subtract line 3M from 2B)

SCHEDULE A - SPECIAL MESSAGE TO / FROM THE CITY

SCHEDULE B SCHEDULE C-CONSOLIDATED ACCOUNTS

DO NOT COMPLETE THIS SECTION - NOT CURRENTLY IN USE BY THE This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location.

CITY OF CENTENNIAL It must be completely filled out and convey all information required in accordance with the column headings. If additional space is needed

attach schedule in same format. Attach a supporting schedule that details lines 1, 2, 3, and 4 on Schedule A for each location.

CENTENNIAL BUSINESS LOCATION ADDRESS PERIOD'S TOTAL GROSS PERIOD'S NET

LICENSE NO SALES TAXABLE SALES

NOT APPLICABLE

LINE 1 LINE 4

ENTER TOTAL HERE AND IN LINES 1 AND 4 ABOVE

NEW BUSINESS DATE: CHANGE OF LOCATION ADDRESS CHANGE OF MAILING ADDRESS

MONTH DAY YEAR Address 1: Address 1:

Address 2: Address 2:

DISCONTINUED DATE: City/State/Zip: City/State/Zip:

MONTH DAY YEAR Phone: Phone:

Contact Person: Contact Person:

I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE STATEMENTS MADE HEREIN ARE, TO THE BEST OF MY KNOWLEDGE, TRUE AND CORRECT.

Signature: Date:

Printed Name: Title: Phone: Email:

PLEASE REMIT TO: CITY OF CENTENNIAL, REMITTANCE CENTER, P.O. BOX 17383, DENVER, CO 80217-0383

FOR QUESTIONS, PLEASE VISIT OUR WEBSITE AT www.centennialco.gov OR CALL 303.325.8000

Rev 1/24/2019