Enlarge image

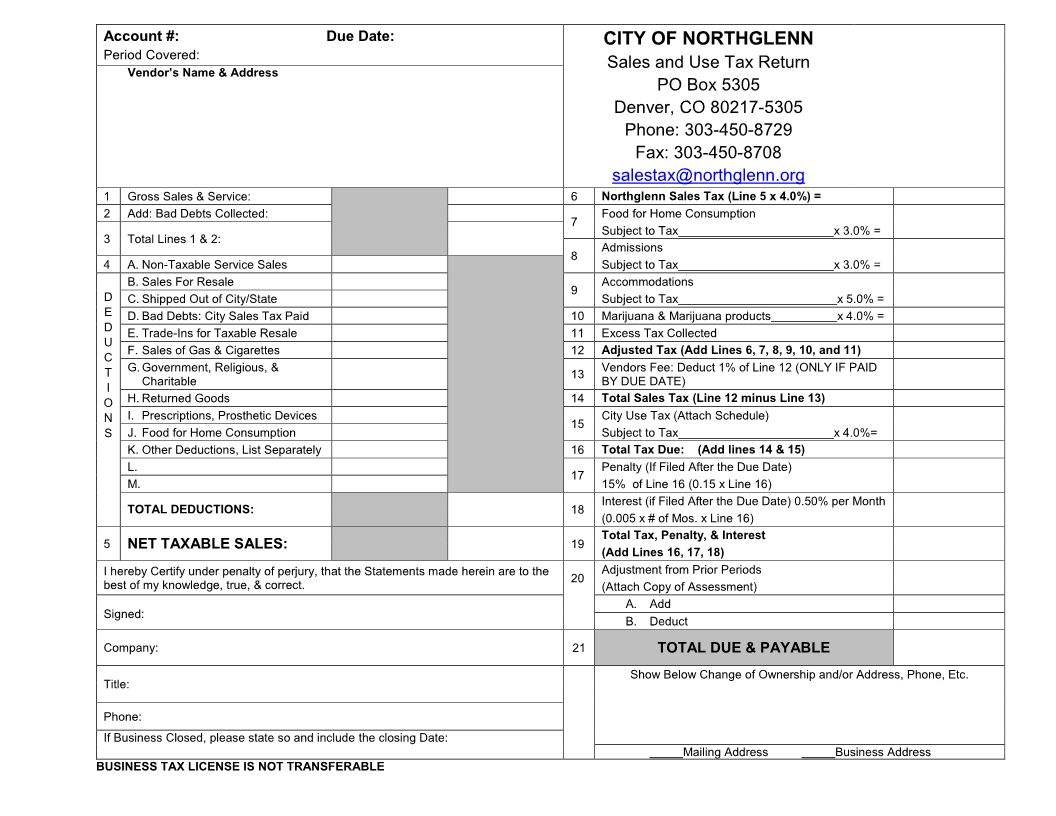

Account #: Due Date: CITY OF NORTHGLENN

Period Covered:

Sales and Use Tax Return

Vendor’s Name & Address

PO Box 5305

Denver, CO 80217-5305

Phone: 303-450-8729

Fax: 303-450-8708

salestax@northglenn.org

1 Gross Sales & Service: 6 Northglenn Sales Tax (Line 5 x 4.0%) =

2 Add: Bad Debts Collected: Food for Home Consumption

7

Subject to Tax x 3.0% =

3 Total Lines 1 & 2:

Admissions

8

4 A. Non-Taxable Service Sales Subject to Tax x 3.0% =

B. Sales For Resale Accommodations

9

D C. Shipped Out of City/State Subject to Tax x 5.0% =

E D. Bad Debts: City Sales Tax Paid 10 Marijuana & Marijuana products x 4.0% =

D E. Trade-Ins for Taxable Resale 11 Excess Tax Collected

U

F. Sales of Gas & Cigarettes 12 Adjusted Tax (Add Lines 6, 7, 8, 9, 10, and 11)

C

T G. Government, Religious, & Vendors Fee: Deduct 1% of Line 12 (ONLY IF PAID

13

I Charitable BY DUE DATE)

O H. Returned Goods 14 Total Sales Tax (Line 12 minus Line 13)

N I. Prescriptions, Prosthetic Devices City Use Tax (Attach Schedule)

15

S J. Food for Home Consumption Subject to Tax x 4.0%=

K. Other Deductions, List Separately 16 Total Tax Due: (Add lines 14 & 15)

L. Penalty (If Filed After the Due Date)

17

M. 15% of Line 16 (0.15 x Line 16)

Interest (if Filed After the Due Date) 0.50% per Month

TOTAL DEDUCTIONS: 18

(0.005 x # of Mos. x Line 16)

Total Tax, Penalty, & Interest

5 NET TAXABLE SALES: 19

(Add Lines 16, 17, 18)

I hereby Certify under penalty of perjury, that the Statements made herein are to the Adjustment from Prior Periods

20

best of my knowledge, true, & correct. (Attach Copy of Assessment)

Signed: A. Add

B. Deduct

Company: 21 TOTAL DUE & PAYABLE

Show Below Change of Ownership and/or Address, Phone, Etc.

Title:

Phone:

If Business Closed, please state so and include the closing Date:

Mailing Address Business Address

BUSINESS TAX LICENSE IS NOT TRANSFERABLE