Enlarge image

Financial Services

Sales Tax Division

215 North Mason Street, 2 ndFloor

P.O. Box 580

Fort Collins, CO 80522

970.221.6780

970.221.6782 - fax

fcgov.com/salestax

A GUIDE TO THE MANUFACTURING EQUIPMENT USE TAX REBATE PROGRAM

2020 Program

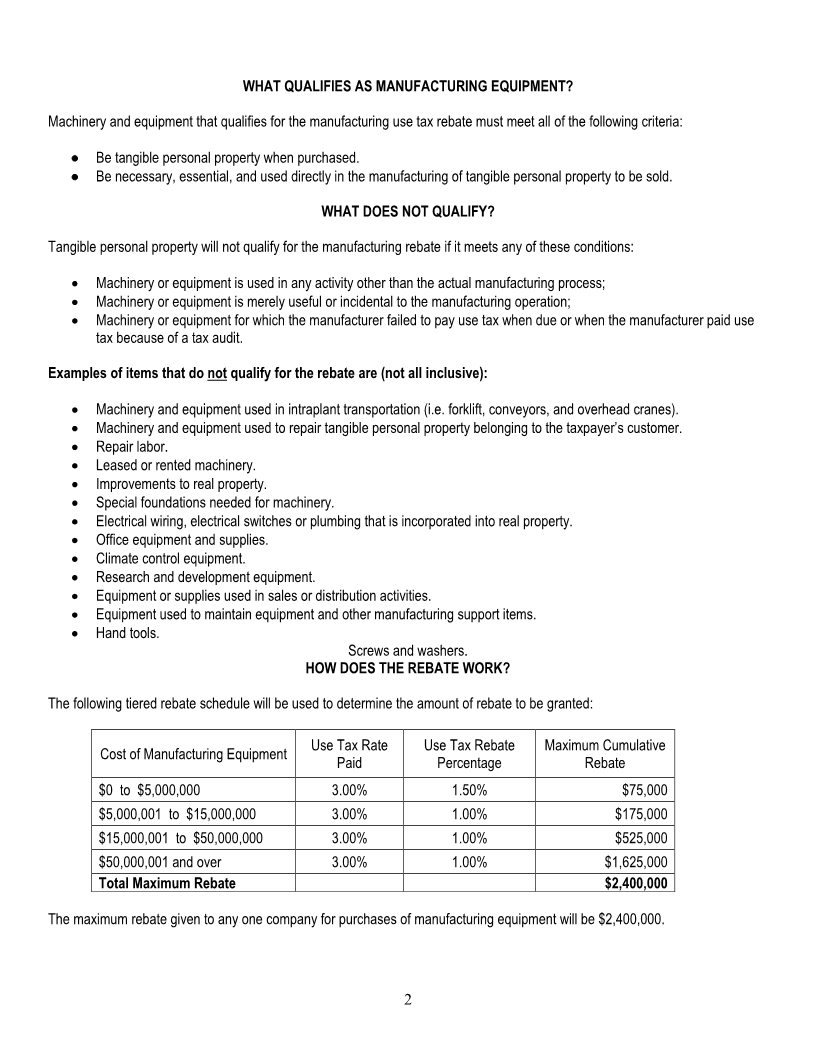

Purchasers of qualifying manufacturing equipment can apply directly to the City of Fort Collins Finance Department for a rebate of

a portion of the use tax paid to the City. The 3% use tax must have been paid in full to the City of Fort Collins prior to the request

for the rebate. The taxpayer will be responsible for providing proof that the use tax was paid. Sales taxes paid directly to vendors

are not eligible for the rebate. Use tax paid on purchases made from a vendor that fails to collect City of Fort Collins sales

tax on the purchases as required by law are not eligible for the rebate. Sales or use taxes paid to another taxing jurisdiction

for purchases of manufacturing equipment are not eligible for the rebate.

The rebate program is governed by Chapter 25 of the Code of the City of Fort Collins, and in particular, Sections 25-63 through 25-

69. The Code may be found here: https://www.municode.com/library/co/fort_collins/codes/municipal_code. To the extent this

Guide conflicts with the Code, the Code shall control.

WHO QUALIFIES?

Manufacturers, who in an industrial setting, produce a new product, article, substance or commodity that is different from and has

a distinctive name, character or use from the raw or prepared materials used to manufacture the product.

WHO DOES NOT QUALIFY?

Companies that do not directly manufacture new products will not qualify for the rebate program. Examples of such companies

include: publishers, ready-mix concrete producers, loggers, mining operations, farmers, construction contractors and wood

preservers. Additionally, the following processing is not considered to be manufacturing for the purposes of this program:

electroplating, plating, metal heat treating or polishing, lapidary work, fabrication of signs and advertising displays, milk bottling and

pasteurizing, typesetting, engraving, plate printing, preparing electrotyping and stereotype plates. Manufacturing shall not include

product research, development and testing.

ADDITIONAL QUALIFICATIONS:

Only purchases of manufacturing machinery to be used in the City of Fort Collins directly and exclusively in the manufacture of

tangible personal property, for sale or profit, are eligible for the rebate.

The firm applying must have a sales and use tax license with the City and be classified as a manufacturer under the NAICS. The

firm applying for the rebate must certify compliance with all Federal, State and local laws and regulations for the manufacturing

facility located in Fort Collins. Firms must be current with all payments to the City of Fort Collins and in compliance with any

contractual agreements with the City.