Enlarge image

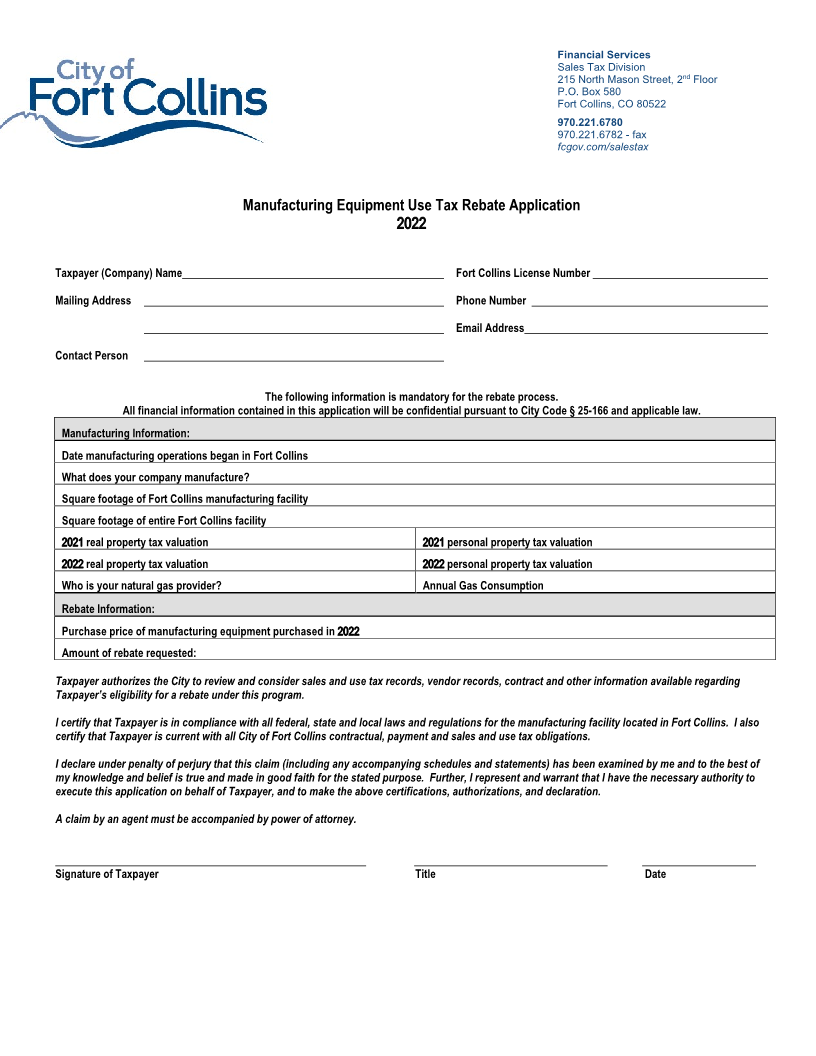

Financial Services

Sales Tax Division

215 North Mason Street, 2 ndFloor

P.O. Box 580

Fort Collins, CO 80522

970.221.6780

970.221.6782 - fax

fcgov.com/salestax

Manufacturing Equipment Use Tax Rebate Application

2022

Taxpayer (Company) Name Fort Collins License Number

Mailing Address Phone Number

Email Address

Contact Person

The following information is mandatory for the rebate process.

All financial information contained in this application will be confidential pursuant to City Code § 25-166 and applicable law.

Manufacturing Information:

Date manufacturing operations began in Fort Collins

What does your company manufacture?

Square footage of Fort Collins manufacturing facility

Square footage of entire Fort Collins facility

2021 real property tax valuation 2021 personal property tax valuation

2022 real property tax valuation 2022 personal property tax valuation

Who is your natural gas provider? Annual Gas Consumption

Rebate Information:

Purchase price of manufacturing equipment purchased in 2022

Amount of rebate requested:

Taxpayer authorizes the City to review and consider sales and use tax records, vendor records, contract and other information available regarding

Taxpayer’s eligibility for a rebate under this program.

I certify that Taxpayer is in compliance with all federal, state and local laws and regulations for the manufacturing facility located in Fort Collins. I also

certify that Taxpayer is current with all City of Fort Collins contractual, payment and sales and use tax obligations.

I declare under penalty of perjury that this claim (including any accompanying schedules and statements) has been examined by me and to the best of

my knowledge and belief is true and made in good faith for the stated purpose. Further, I represent and warrant that I have the necessary authority to

execute this application on behalf of Taxpayer, and to make the above certifications, authorizations, and declaration.

A claim by an agent must be accompanied by power of attorney.

Signature of Taxpayer Title Date