Enlarge image

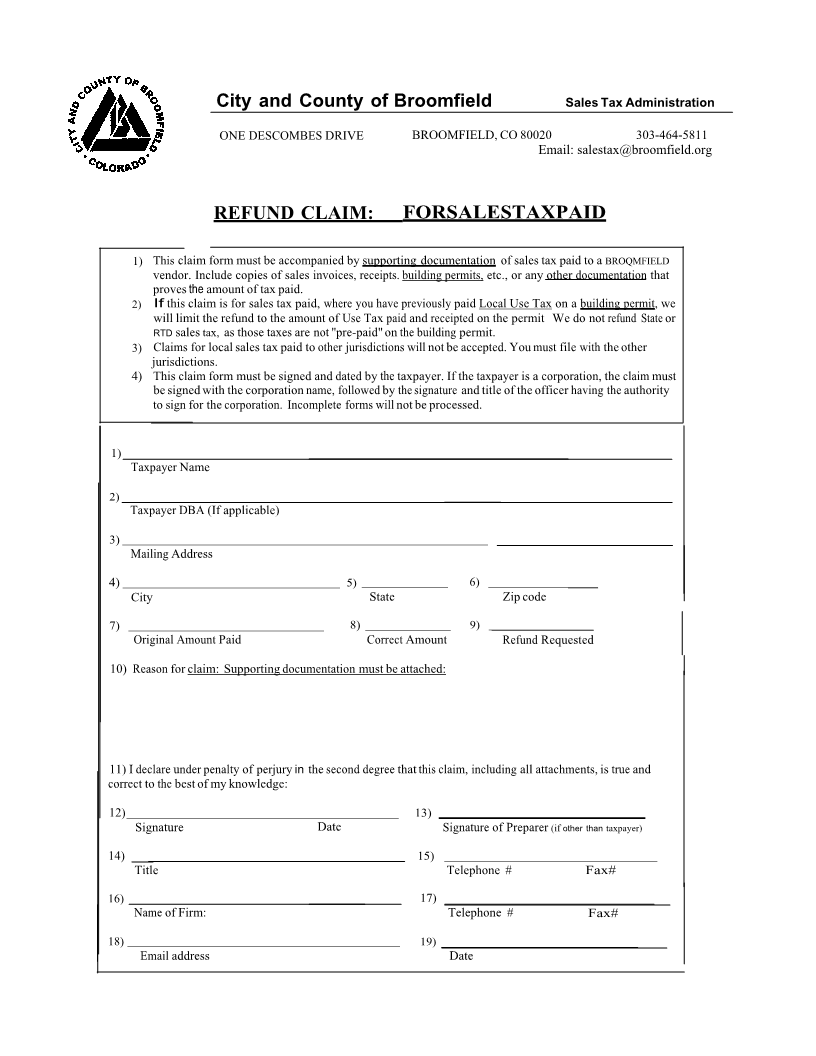

City and County of Broomfield Sales Tax Administration

ONE DESCOMBES DRIVE BROOMFIELD, CO 80020 303-464-5811

Email: salestax@broomfield.org

REFUND CLAIM: FORSALESTAXPAID

1) This claim form must be accompanied by supporting documentation of sales tax paid to a BROQMFIELD

vendor. Include copies of sales invoices, receipts. building permits,etc., or any other documentation that

proves the amount of tax paid.

2) If this claim is for sales tax paid, where you have previously paid Local Use Tax on a building permit, we

will limit the refund to the amount of Use Tax paid and receipted on the permit We do not refund State or

RTD sales tax, as those taxes are not ''pre-paid" on the building permit.

3) Claims for local sales tax paid to other jurisdictions will not be accepted. You must file with the other

jurisdictions.

4) This claim form must be signed and dated by the taxpayer. If the taxpayer is a corporation, the claim must

be signed with the corporation name, followed by the signature and title of the officer having the authority

to sign for the corporation. Incomplete forms will not be processed.

1)

Taxpayer Name

2)

Taxpayer DBA (If applicable)

3)

Mailing Address

4) 5) 6) _____

City State Zip code

7) 8) 9) __________________

Original Amount Paid Correct Amount Refund Requested

10) Reason for claim: Supporting documentation must be attached:

11) I declare under penalty of perjury in the second degree that this claim, including all attachments, is true and

correct to the best of my knowledge:

12) 13)

Signature Date Signature of Preparer (if other than taxpayer)

14) 15)

Title Telephone # Fax#

16) 17)

Name of Firm: Telephone # Fax#

18) 19)

Email address Date