Enlarge image

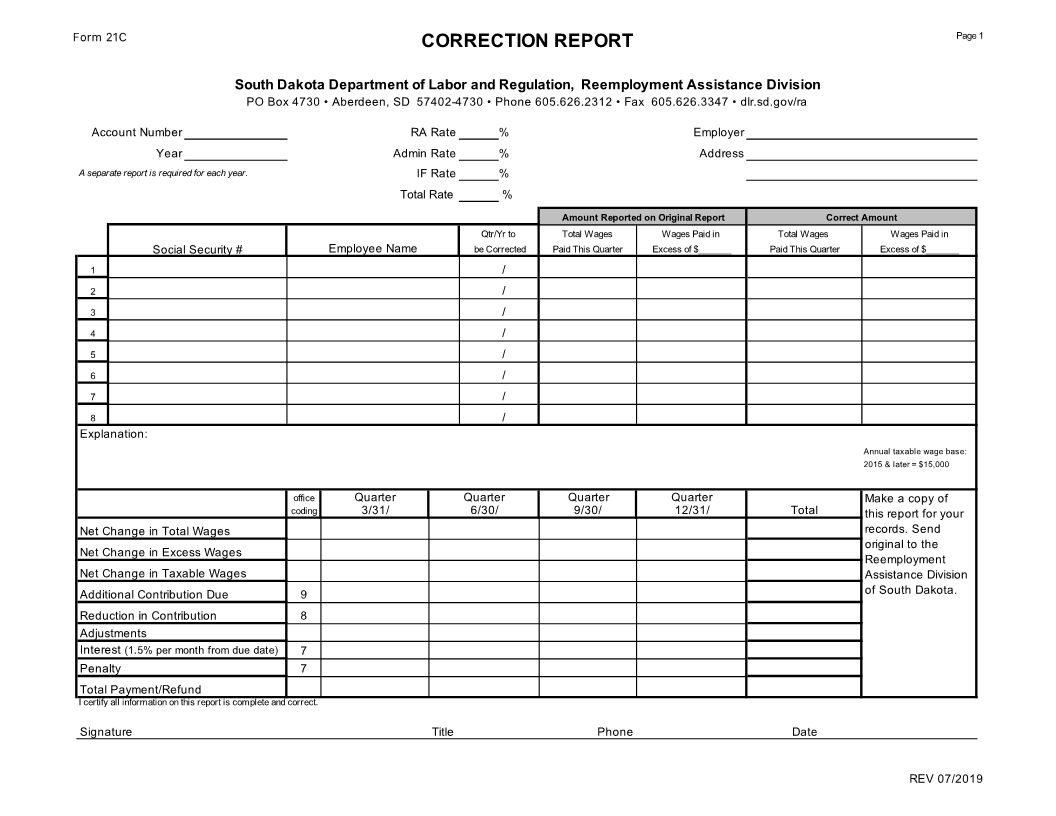

Form 21C Page 1

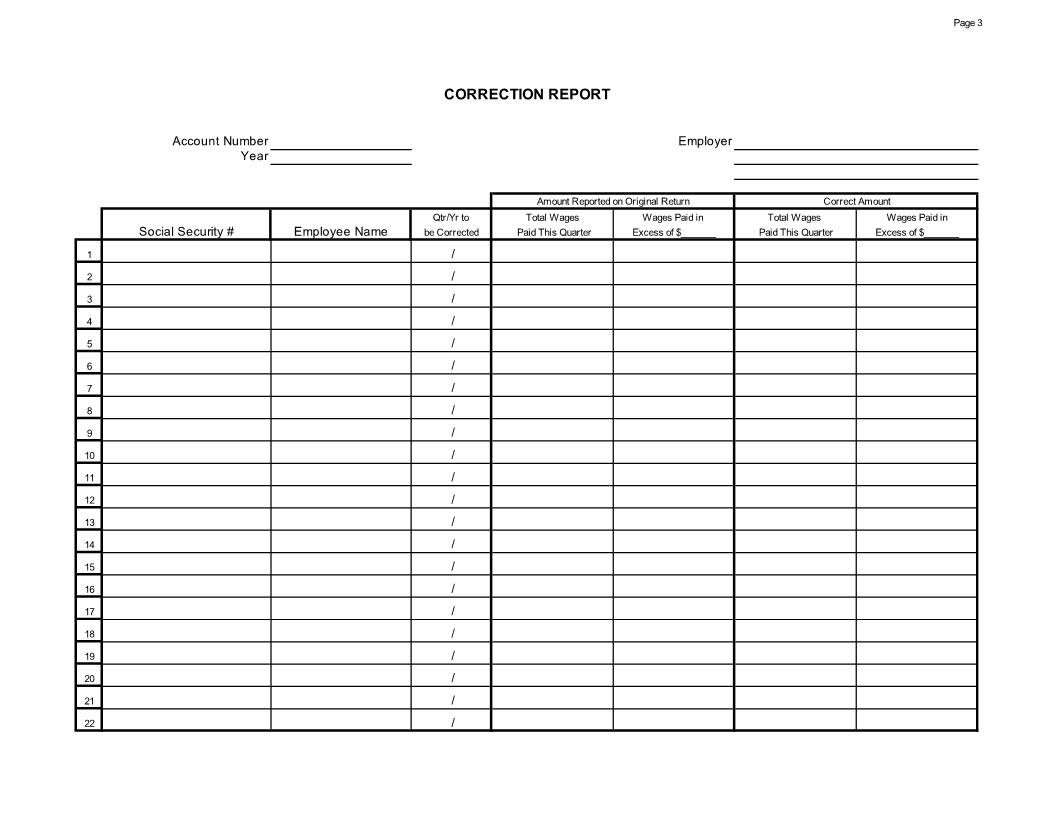

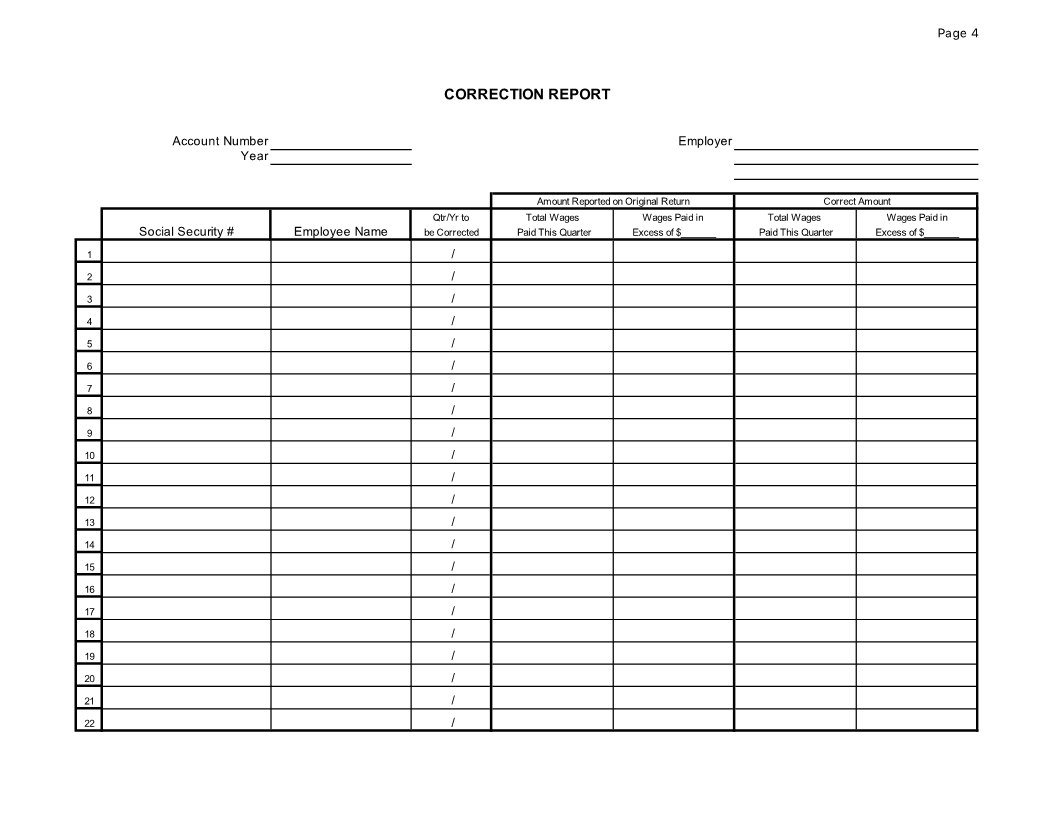

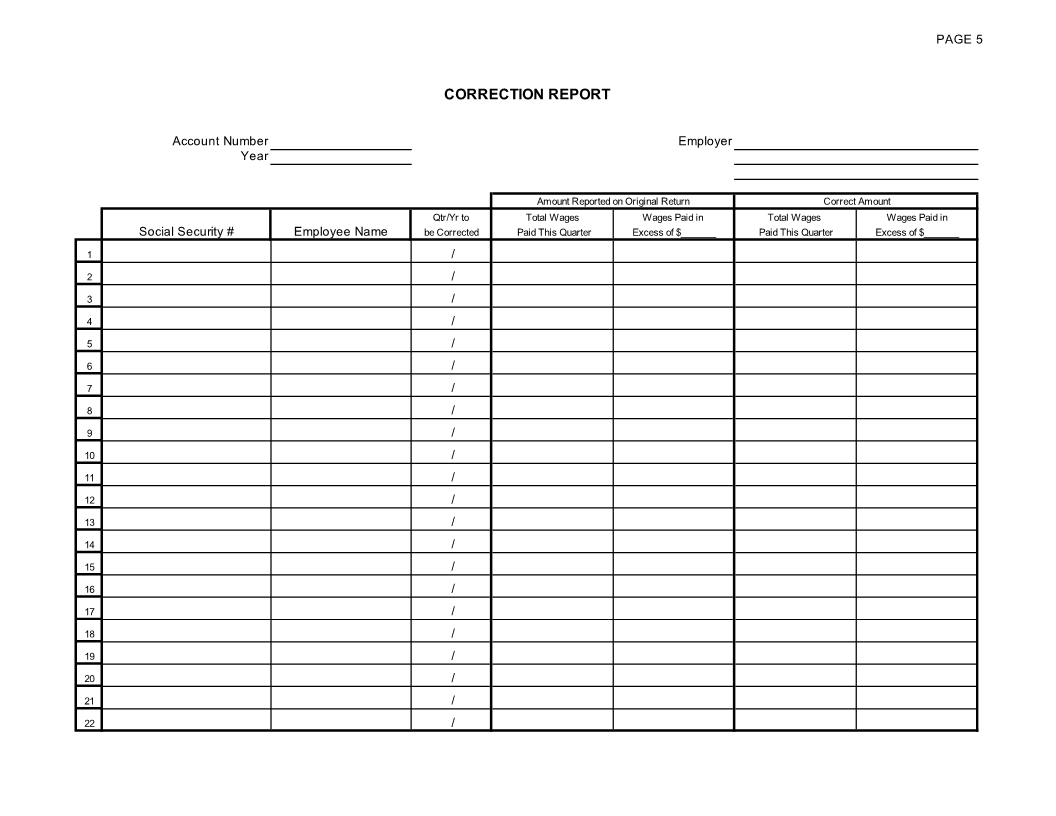

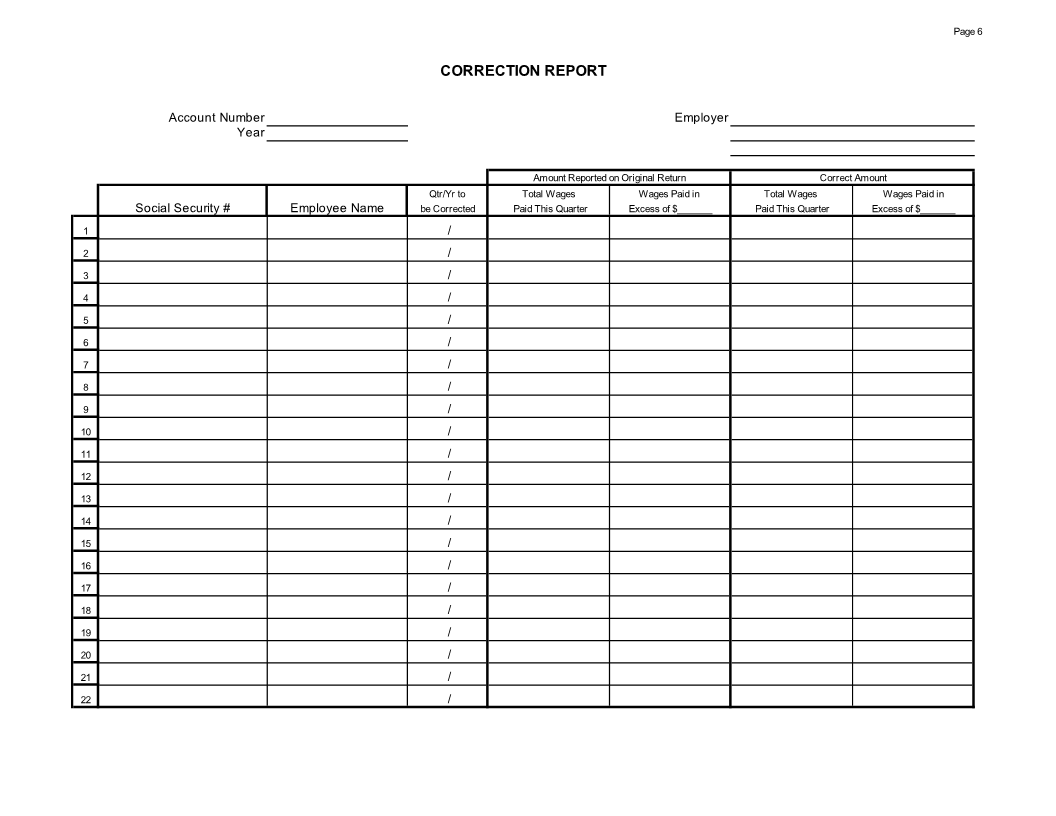

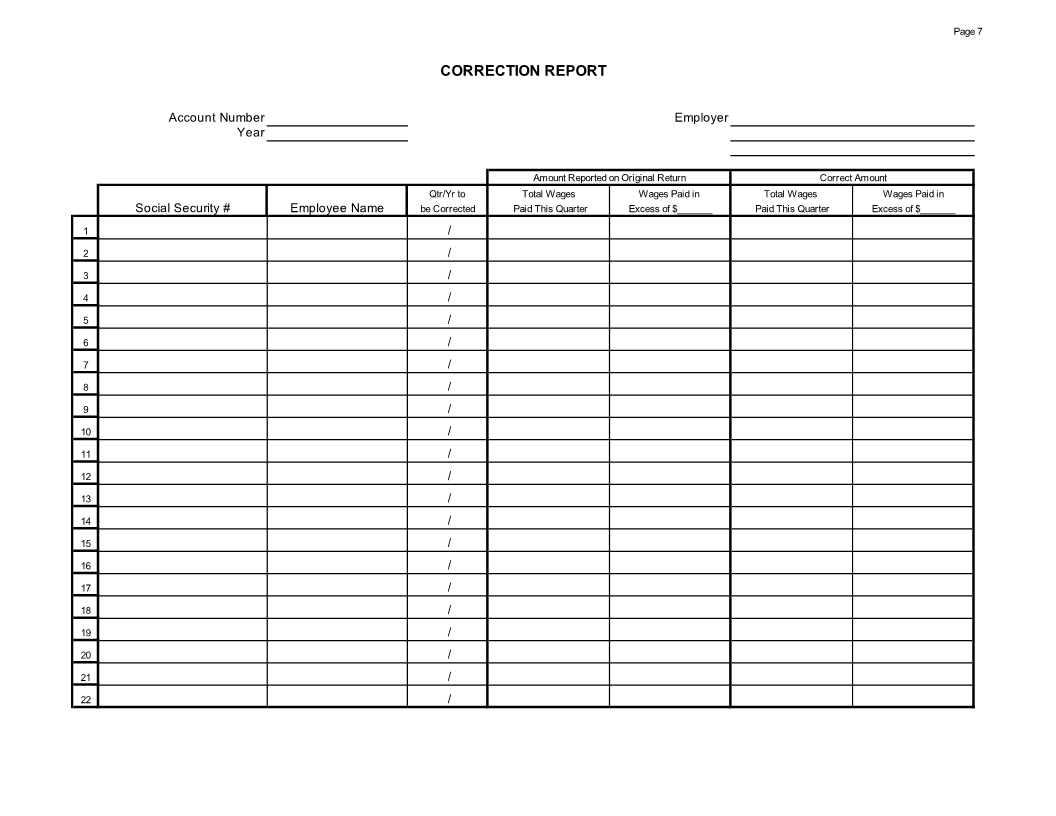

CORRECTION REPORT

South Dakota Department of Labor and Regulation, Reemployment Assistance Division

PO Box 4730 • Aberdeen, SD 57402-4730 • Phone 605.626.2312 • Fax 605.626.3347 • dlr.sd.gov/ra

Account Number RA Rate % Employer

Year Admin Rate % Address

A separate report is required for each year. IF Rate %

Total Rate %

Amount Reported on Original Report Correct Amount

Qtr/Yr to Total Wages Wages Paid in Total Wages Wages Paid in

Social Security # Employee Name be Corrected Paid This Quarter Excess of $_______ Paid This Quarter Excess of $_______

1 /

2 /

3 /

4 /

5 /

6 /

7 /

8 /

Explanation:

Annual taxable wage base:

2015 & later = $15,000

office Quarter Quarter Quarter Quarter Make a copy of

coding 3/31/ 6/30/ 9/30/ 12/31/ Total this report for your

Net Change in Total Wages records. Send

original to the

Net Change in Excess Wages

Reemployment

Net Change in Taxable Wages Assistance Division

Additional Contribution Due 9 of South Dakota.

Reduction in Contribution 8

Adjustments

Interest (1.5% per month from due date) 7

Penalty 7

Total Payment/Refund

I certify all information on this report is complete and correct.

Signature Title Phone Date

REV 07/2019