Enlarge image

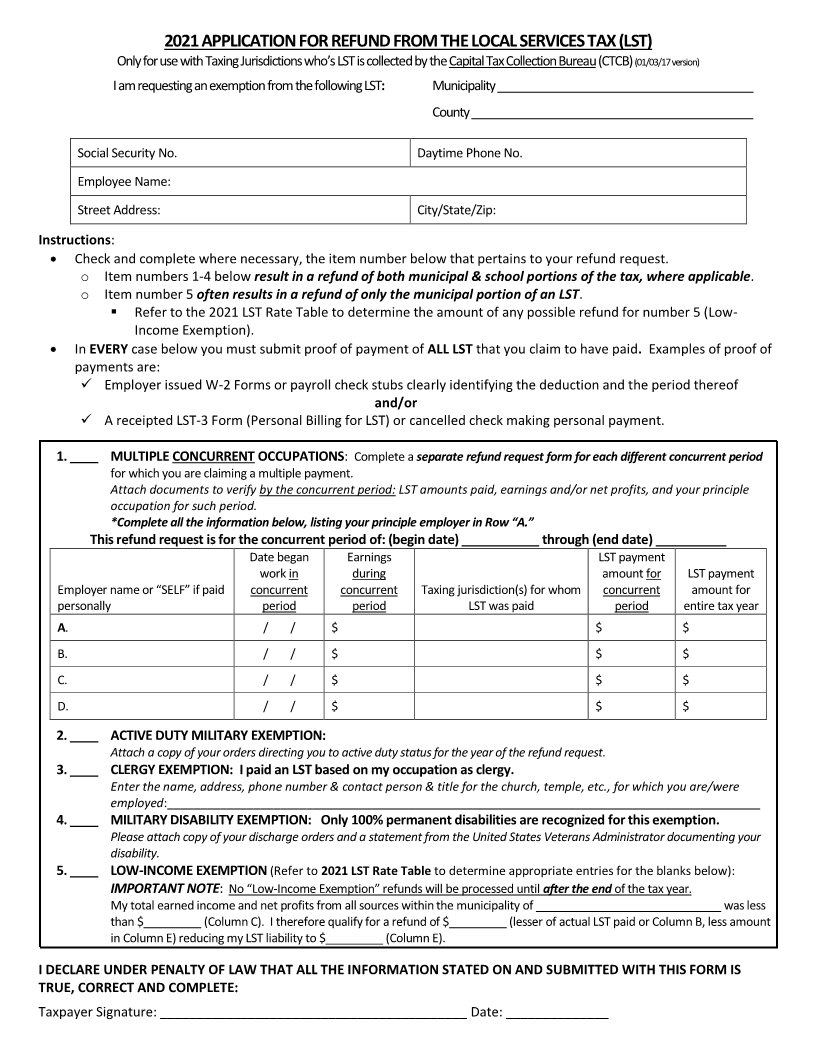

2021 APPLICATION FOR REFUND FROM THE LOCAL SERVICES TAX (LST)

Only for use with Taxing Jurisdictions who’s LST is collected by the Capital Tax Collection(01/03/17Bureauversion)(CTCB)

I am requesting an exemption from the following: LST Municipality________________________________________

County ____________________________________________

Social Security No. Daytime Phone No.

Employee Name:

Street Address: City/State/Zip:

Instructions:

Check and complete where necessary, the item number below that pertains to your refund request.

o Item numbers 1-4 below result in a refund of both municipal & school portions of the tax, where applicable .

o Item number 5 often results in a refund of only the municipal portion of an LST.

Refer to the 2021 LST Rate Table to determine the amount of any possible refund for number 5 (Low-

Income Exemption).

In EVERYcase below you must submit proof of payment of ALL LST that you claim to have paid. Examples of proof of

payments are:

Employer issued W-2 Forms or payroll check stubs clearly identifying the deduction and the period thereof

and/or

A receipted LST-3 Form (Personal Billing for LST) or cancelled check making personal payment.

1. ____ MULTIPLE CONCURRENT OCCUPATIONS: Complete aseparate refund request form for each different concurrent period

for which you are claiming a multiple payment.

Attach documents to verify by the concurrent period: LST amounts paid, earnings and/or net profits, and your principle

occupation for such period.

*Complete all the information below, listing your principle employer in Row “A.”

This refund request is for the concurrent period of: (begin date) ___________ through (end date) __________

Date began Earnings LST payment

work in during amount for LST payment

Employer name or “SELF” if paid concurrent concurrent Taxing jurisdiction(s) for whom concurrent amount for

personally period period LST was paid period entire tax year

A. / / $ $ $

B. / / $ $ $

C. / / $ $ $

D. / / $ $ $

2. ____ ACTIVE DUTY MILITARY EXEMPTION:

Attach a copy of your orders directing you to active duty status for the year of the refund request.

3. ____ CLERGY EXEMPTION: I paid an LST based on my occupation as clergy.

Enter the name, address, phone number & contact person & title for the church, temple, etc., for which you are/were

employed:____________________________________________________________________________________________

4. ____ MILITARY DISABILITY EXEMPTION: Only 100% permanent disabilities are recognized for this exemption.

Please attach copy of your discharge orders and a statement from the United States Veterans Administrator documenting your

disability.

5. ____ LOW-INCOME EXEMPTION (Refer to2021 LST Rate Table to determine appropriate entries for the blanks below):

IMPORTANT NOTE: No “Low-Income Exemption” refunds will be processed untilafter the end of the tax year.

My total earned income and net profits from all sources within the municipality of _____________________________ was less

than $_________ (Column C). I therefore qualify for a refund of $_________ (lesser of actual LST paid or Column B, less amount

in Column E) reducing my LST liability to $_________ (Column E).

I DECLARE UNDER PENALTY OF LAW THAT ALL THE INFORMATION STATED ON AND SUBMITTED WITH THIS FORM IS

TRUE, CORRECT AND COMPLETE:

Taxpayer Signature: __________________________________________ Date: ______________