Enlarge image

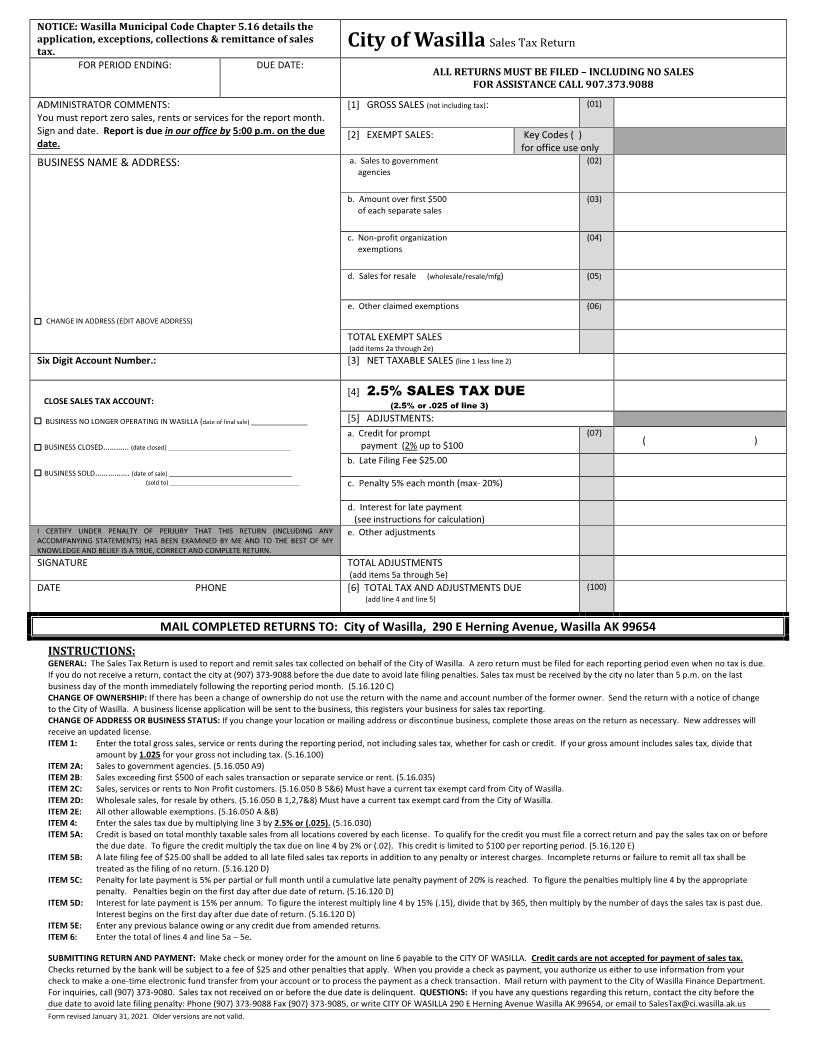

NOTICE: Wasilla Municipal Code Chapter 5.16 details the

application, exceptions, collections & remittance of sales City of Wasilla Sales Tax Return

tax.

FOR PERIOD ENDING: DUE DATE:

ALL RETURNS MUST BE FILED –INCLUDING NO SALES

FOR ASSISTANCE CALL 907.373.9088

ADMINISTRATOR COMMENTS: [1] GROSS SALES (not including tax): (01)

You must report zero sales, rents or services for the report month.

Sign and date. Report is due in our office by 5:00 p.m. on the due [2] EXEMPT SALES: Key Codes ( )

date. for office use only

BUSINESS NAME & ADDRESS: a. Sales to government (02)

agencies

b. Amount over first $500 (03)

of each separate sales

c. Non-profit organization (04)

exemptions

d. Sales for resale (wholesale/resale/mfg) (05 )

e. Other claimed exemptions (06 )

CHANGE IN ADDRESS (EDIT ABOVE ADDRESS)

TOTAL EXEMPT SALES

(add items 2a through 2e)

Six Digit Account Number.: [3] NET TAXABLE SALES (line 1 less line 2)

[4] 2.5% SALES TAX DUE

CLOSE SALES TAX ACCOUNT: (2.5% or .025 of line 3)

BUSINESS NO LONGER OPERATING IN WASILLA (date of final sale) _________________ [5] ADJUSTMENTS:

a. Credit for prompt (07)

BUSINESS CLOSED………… (date closed) _____________________________________ payment (2% up to $100 ( )

b. Late Filing Fee $25.00

BUSINESS SOLD……………. (date of sale) _____________________________________

(sold to) _______________________________________ c. Penalty 5% each month (max- 20%)

d. Interest for late payment

(see instructions for calculation)

I CERTIFY UNDER PENALTY OF PERJURY THAT THIS RETURN (INCLUDING ANY e. Other adjustments

ACCOMPANYING STATEMENTS) HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN.

SIGNATURE TOTAL ADJUSTMENTS

(add items 5a through 5e)

DATE PHONE [6] TOTAL TAX AND ADJUSTMENTS DUE (100)

(add line 4 and line 5)

MAIL COMPLETED RETURNS TO: City of Wasilla, 290 E Herning Avenue, Wasilla AK 99654

INSTRUCTIONS:

GENERAL: The Sales Tax Return is used to report and remit sales tax collected on behalf of the City of Wasilla. A zero return must be filed for each reporting period even when no tax is due.

If you do not receive a return, contact the city at (907) 373-9088 before the due date to avoid late filing penalties. Sales tax must be received by the city no later than 5 p.m. on the last

business day of the month immediately following the reporting period month. (5.16.120 C)

CHANGE OF OWNERSHIP: If there has been a change of ownership do not use the return with the name and account number of the former owner. Send the return with a notice of change

to the City of Wasilla. A business license application will be sent to the business, this registers your business for sales tax reporting.

CHANGE OF ADDRESS OR BUSINESS STATUS: If you change your location or mailing address or discontinue business, complete those areas on the return as necessary. New addresses will

receive an updated license.

ITEM 1: Enter the total gross sales, service or rents during the reporting period, not including sales tax, whether for cash or credit. If your gross amount includes sales tax, divide that

amount by 1.025 for your gross not including tax. (5.16.100)

ITEM 2A: Sales to government agencies. (5.16.050 A9)

ITEM 2B: Sales exceeding first $500 of each sales transaction or separate service or rent. (5.16.035)

ITEM 2C: Sales, services or rents to Non Profit customers. (5.16.050 B 5&6) Must have a current tax exempt card from City of Wasilla.

ITEM 2D: Wholesale sales, for resale by others. (5.16.050 B 1,2,7&8) Must have a current tax exempt card from the City of Wasilla.

ITEM 2E: All other allowable exemptions. (5.16.050 A &B)

ITEM 4: Enter the sales tax due by multiplying line 3 by 2.5% or (.025). (5.16.030)

ITEM 5A: Credit is based on total monthly taxable sales from all locations covered by each license. To qualify for the credit you must file a correct return and pay the sales tax on or before

the due date. To figure the credit multiply the tax due on line 4 by 2% or (.02). This credit is limited to $100 per reporting period. (5.16.120 E)

ITEM 5B: A late filing fee of $25.00 shall be added to all late filed sales tax reports in addition to any penalty or interest charges. Incomplete returns or failure to remit all tax shall be

treated as the filing of no return. (5.16.120 D)

ITEM 5C: Penalty for late payment is 5% per partial or full month until a cumulative late penalty payment of 20% is reached. To figure the penalties multiply line 4 by the appropriate

penalty. Penalties begin on the first day after due date of return. (5.16.120 D)

ITEM 5D: Interest for late payment is 15% per annum. To figure the interest multiply line 4 by 15% (.15), divide that by 365, then multiply by the number of days the sales tax is past due.

Interest begins on the first day after due date of return. (5.16.120 D)

ITEM 5E: Enter any previous balance owing or any credit due from amended returns.

ITEM 6: Enter the total of lines 4 and line 5a –5e.

SUBMITTING RETURN AND PAYMENT: Make check or money order for the amount on line 6 payable to the CITY OF WASILLA. Credit cards are not accepted for payment of sales tax.

Checks returned by the bank will be subject to a fee of $25 and other penalties that apply. When you provide a check as payment, you authorize us either to use information from your

check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction. Mail return with payment to the City of Wasilla Finance Department.

For inquiries, call (907) 373-9080. Sales tax not received on or before the due date is delinquent. QUESTIONS: If you have any questions regarding this return, contact the city before the

due date to avoid late filing penalty: Phone (907) 373-9088 Fax (907) 373-9085, or write CITY OF WASILLA 290 E Herning Avenue Wasilla AK 99654, or email to SalesTax@ci.wasilla.ak.us

Form revised January 31, 2021. Older versions are not valid.