Enlarge image

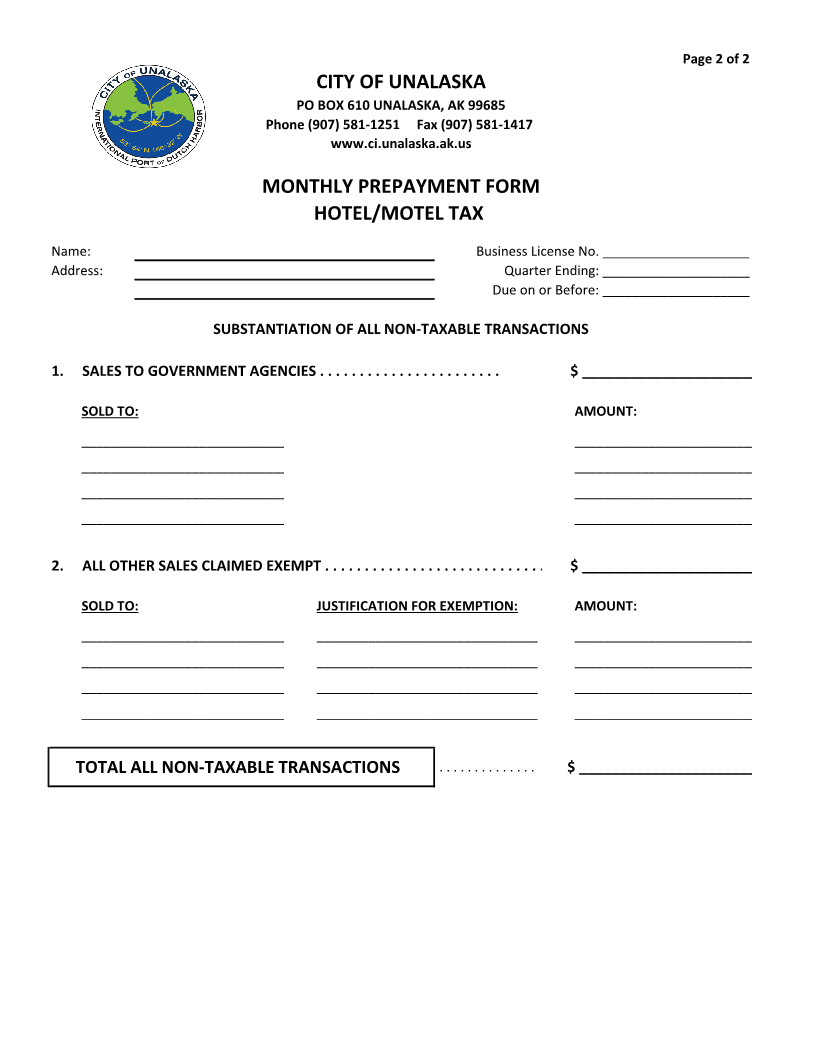

Page 1 of 2

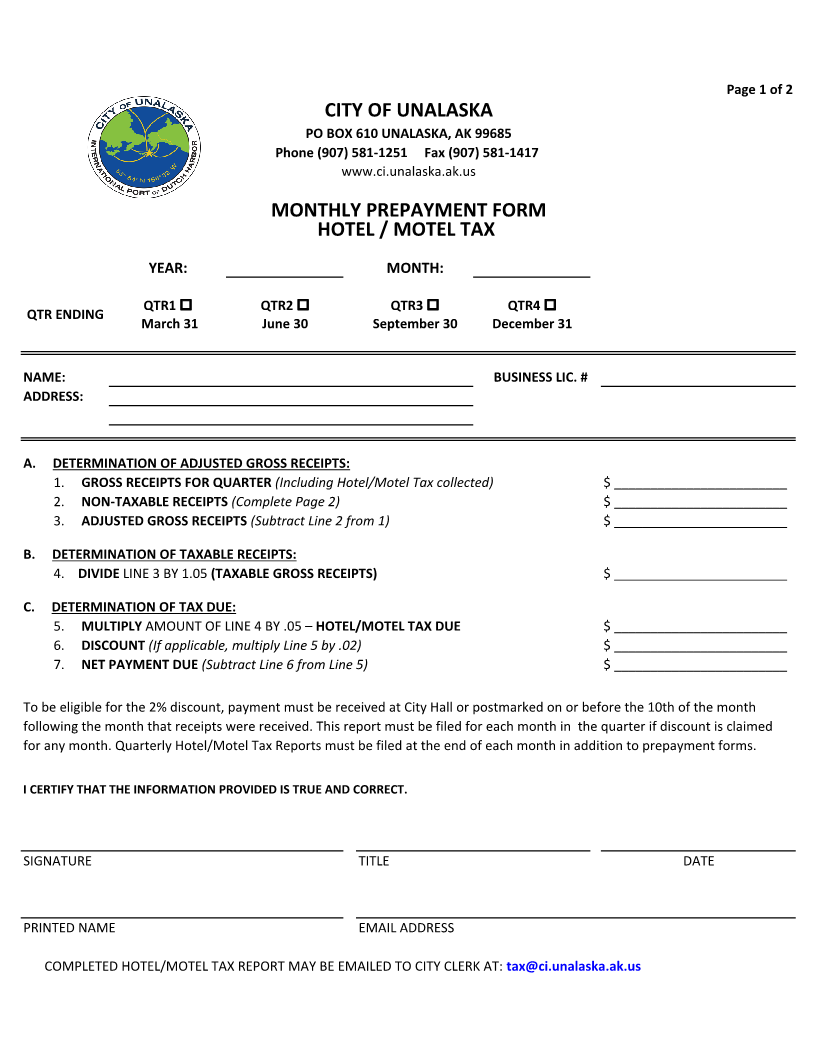

CITY OF UNALASKA

PO BOX 610 UNALASKA, AK 99685

Phone (907) 581-1251 Fax (907) 581-1417

www.ci.unalaska.ak.us

MONTHLY PREPAYMENT FORM

HOTEL / MOTEL TAX

YEAR: MONTH:

QTR1 o QTR2 o QTR3 o QTR4 o

QTR ENDING

March 31 June 30 September 30 December 31

NAME: BUSINESS LIC. #

ADDRESS:

A. DETERMINATION OF ADJUSTED GROSS RECEIPTS:

1. GROSS RECEIPTS FOR QUARTER (Including Hotel/Motel Tax collected) $ ________________________

2. NON-TAXABLE RECEIPTS (Complete Page 2) $ ________________________

3. ADJUSTED GROSS RECEIPTS (Subtract Line 2 from 1) $ ________________________

B. DETERMINATION OF TAXABLE RECEIPTS:

4. DIVIDE LINE 3 BY 1.05 (TAXABLE GROSS RECEIPTS) $ ________________________

C. DETERMINATION OF TAX DUE:

5. MULTIPLY AMOUNT OF LINE 4 BY .05 – HOTEL/MOTEL TAX DUE $ ________________________

6. DISCOUNT (If applicable, multiply Line 5 by .02) $ ________________________

7. NET PAYMENT DUE (Subtract Line 6 from Line 5) $ ________________________

To be eligible for the 2% discount, payment must be received at City Hall or postmarked on or before the 10th of the month

following the month that receipts were received. This report must be filed for each month in the quarter if discount is claimed

for any month. Quarterly Hotel/Motel Tax Reports must be filed at the end of each month in addition to prepayment forms.

I CERTIFY THAT THE INFORMATION PROVIDED IS TRUE AND CORRECT.

SIGNATURE TITLE DATE

PRINTED NAME EMAIL ADDRESS

COMPLETED HOTEL/MOTEL TAX REPORT MAY BE EMAILED TO CITY CLERK AT: tax@ci.unalaska.ak.us