Enlarge image

Page 1 of 2

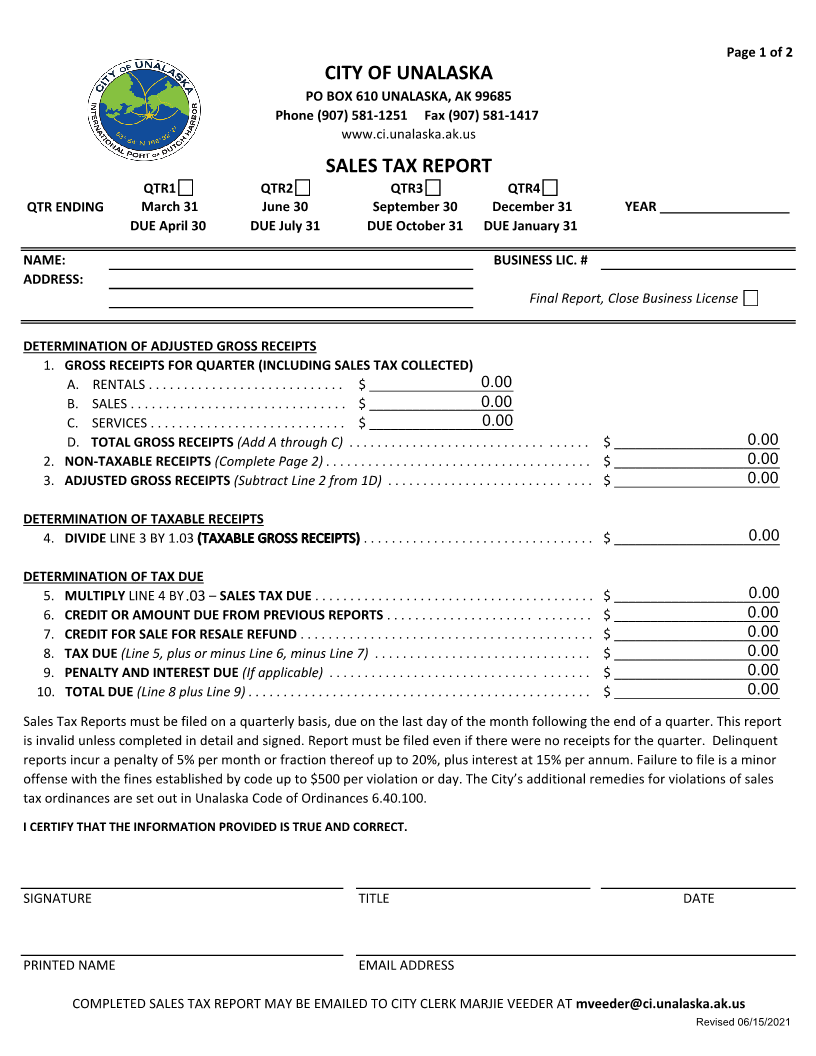

CITY OF UNALASKA

PO BOX 610 UNALASKA, AK 99685

Phone (907) 581-1251 Fax (907) 581-1417

www.ci.unalaska.ak.us

SALES TAX REPORT

QTR1 o QTR2 o QTR3 o QTR4 o

QTR ENDING March 31 June 30 September 30 December 31 YEAR __________________

DUE April 30 DUE July 31 DUE October 31 DUE January 31

NAME: BUSINESS LIC. #

ADDRESS:

Final Report, Close Business License o

DETERMINATION OF ADJUSTED GROSS RECEIPTS

1. GROSS RECEIPTS FOR QUARTER (INCLUDING SALES TAX COLLECTED)

A. RENTALS . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ____________________0.00

B. SALES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ____________________0.00

C. SERVICES . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ____________________0.00

D. TOTAL GROSS RECEIPTS(Add A through C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

2. NON-TAXABLE RECEIPTS (Complete Page 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

3. ADJUSTED GROSS RECEIPTS (Subtract Line 2 from 1D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

DETERMINATION OF TAXABLE RECEIPTS

4. DIVIDELINE 3 BY 1.03 (TAXABLE GROSS RECEIPTS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

DETERMINATION OF TAX DUE

5. MULTIPLYLINE 4 BY.03.03 –SALES TAX DUE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

6. CREDIT OR AMOUNT DUE FROM PREVIOUS REPORTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

7. CREDIT FOR SALE FOR RESALE REFUND. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

8. TAX DUE (Line 5, plus or minus Line 6, minus Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

9. PENALTY AND INTEREST DUE (If applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

10. TOTAL DUE (Line 8 plus Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _______________________0.00

Sales Tax Reports must be filed on a quarterly basis, due on the last day of the month following the end of a quarter. This report

is invalid unless completed in detail and signed. Report must be filed even if there were no receipts for the quarter. Delinquent

reports incur a penalty of 5% per month or fraction thereof up to 20%, plus interest at 15% per annum. Failure to file is a minor

offense with the fines established by code up to $500 per violation or day. The City’s additional remedies for violations of sales

tax ordinances are set out in Unalaska Code of Ordinances 6.40.100.

I CERTIFY THAT THE INFORMATION PROVIDED IS TRUE AND CORRECT.

SIGNATURE TITLE DATE

PRINTED NAME EMAIL ADDRESS

COMPLETED SALES TAX REPORT MAY BE EMAILED TO CITY CLERK MARJIE VEEDER AT mveeder@ci.unalaska.ak.us

Revised 06/15/2021