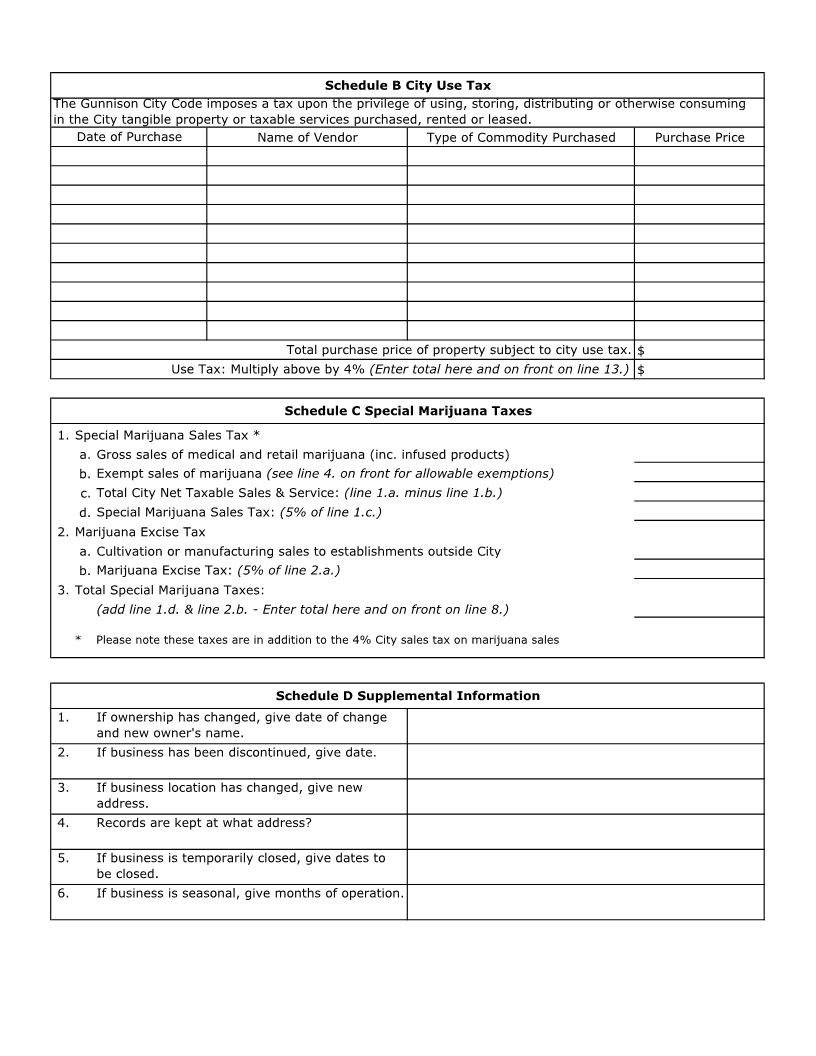

Enlarge image

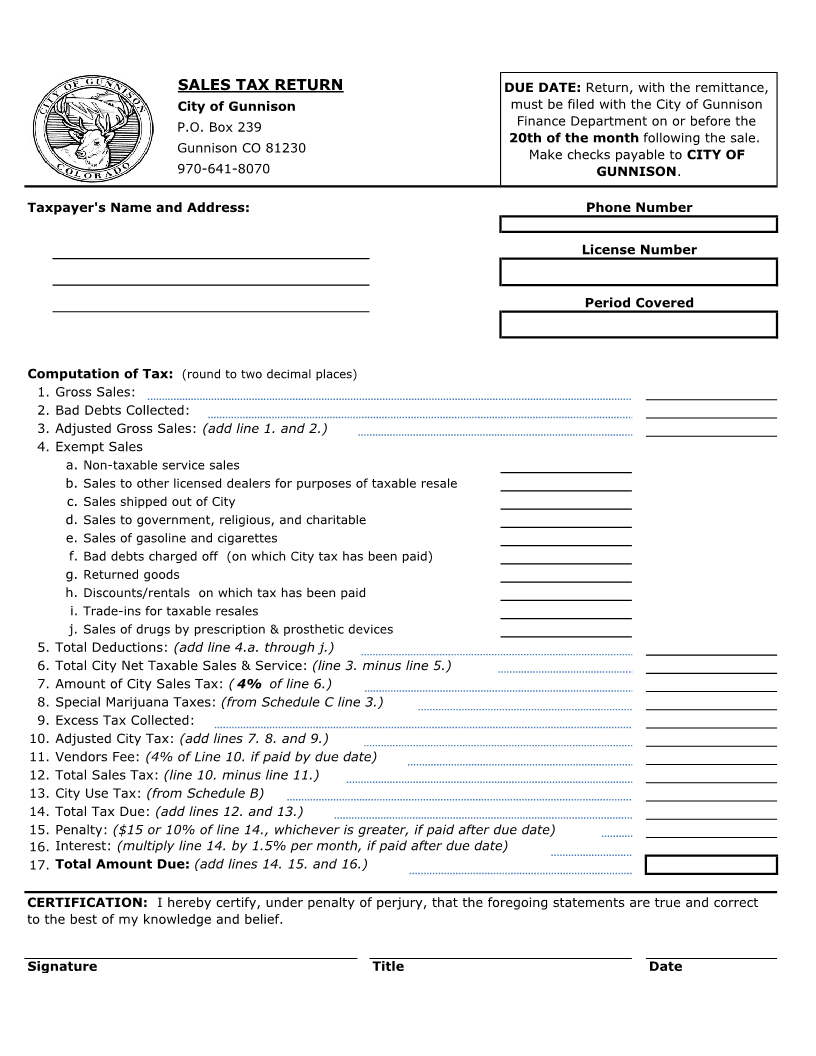

SALES TAX RETURN DUE DATE: Return, with the remittance,

City of Gunnison must be filed with the City of Gunnison

P.O. Box 239 Finance Department on or before the

20th of the month following the sale.

Gunnison CO 81230

Make checks payable to CITY OF

970-641-8070 GUNNISON.

Taxpayer's Name and Address: Phone Number

License Number

Period Covered

Computation of Tax: (round to two decimal places)

1. Gross Sales:

2. Bad Debts Collected:

3. Adjusted Gross Sales: (add line 1. and 2.)

4. Exempt Sales

a. Non-taxable service sales

b. Sales to other licensed dealers for purposes of taxable resale

c. Sales shipped out of City

d. Sales to government, religious, and charitable

e. Sales of gasoline and cigarettes

f. Bad debts charged off (on which City tax has been paid)

g. Returned goods

h. Discounts/rentals on which tax has been paid

i. Trade-ins for taxable resales

j. Sales of drugs by prescription & prosthetic devices

5. Total Deductions: (add line 4.a. through j.)

6. Total City Net Taxable Sales & Service: (line 3. minus line 5.)

7. Amount of City Sales Tax: ( 4% of line 6.)

8. Special Marijuana Taxes: (from Schedule C line 3.)

9. Excess Tax Collected:

10. Adjusted City Tax: (add lines 7. 8. and 9.)

11. Vendors Fee: (4% of Line 10. if paid by due date)

12. Total Sales Tax: (line 10. minus line 11.)

13. City Use Tax: (from Schedule B)

14. Total Tax Due: (add lines 12. and 13.)

15. Penalty: ($15 or 10% of line 14., whichever is greater, if paid after due date)

16. Interest: (multiply line 14. by 1.5% per month, if paid after due date)

17. Total Amount Due: (add lines 14. 15. and 16.)

CERTIFICATION: I hereby certify, under penalty of perjury, that the foregoing statements are true and correct

to the best of my knowledge and belief.

Signature Title Date