Enlarge image

Colorado Department of Labor and Employment, Unemployment Insurance Employer Services, P.O. Box 8789, Denver, CO 80201-8789

303-318-9100 (Denver-metro area) or 1-800-480-8299 (outside Denver-metro area)

www.coloradoui.gov

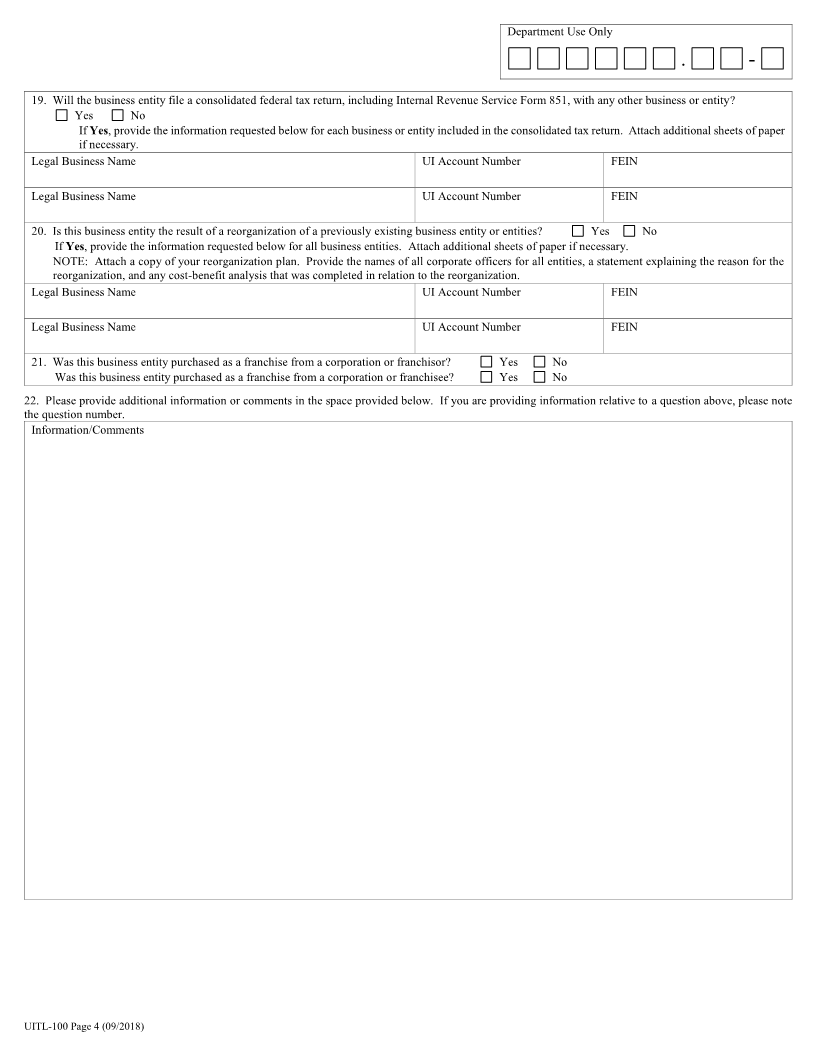

Department Use Only

. -

APPLICATION FOR UNEMPLOYMENT INSURANCE ACCOUNT

AND DETERMINATION OF EMPLOYER LIABILITY

Complete and mail this application to the address at the top of this page to register your business with us for unemployment insurance (UI) purposes. We will

review your application and determine whether you must provide UI coverage for your employees. All items must be completed. If an item is not applicable

(NA) to you or your business, enter “NA.” You can provide additional information at the bottom of page 4 of this application or attach additional sheets of paper.

1. First Date of Payroll in Colorado (Do not provide a future date. If the first date of payroll in Colorado has not occurred, do not complete this application.)

2. Provide the reason for filing this application.

Original application66666666666 Reinstatement of existing account

Account Number

Change of ownership (enclose a copy of the sales agreement and a list of the board of directors for the new business and all acquired businesses)

3. Type of Organization (check only one box)

Individual/Sole Proprietor Joint Venture

General Partnership Limited Partnership

Corporation Limited Liability Partnership

“S” Corporation Limited Liability Limited Partnership

Association Limited Liability Company (reported as corporation on Internal Revenue Service Form 8832)

Trust Limited Liability Company (reported as sole proprietor or partnership on Internal Revenue Service Form 8832)

Estate Stock Sale (only complete page 1 of this application and sign on page 4)

Government Other ________________________________________________

Religious Organization

Nonprofit as defined by section 501(c)(3) of the Internal Revenue Code (enclose a copy of your exemption letter from the Internal Revenue Service)

Other Nonprofit

4. Basic Information—Provide the requested employer, address, and contact information.

Legal Business Name (Enter the actual name of the business registered with the Secretary of State, including suffixes such as Inc or LLC, if applicable)

Trade Name/Doing-Business-As Name (if applicable) Federal Employer Identification Number (required)

Street Address of Principal Place of Business in Colorado (provide a residence address only if it is the only Colorado address; include city, state, and ZIP code)

Telephone Number Cellular Telephone Number E-mail Address Web-site Address

Mailing Address if Different From Above (include city, state, and ZIP code, and in-care-of name, if applicable) Telephone Number

Legal Name of Owner, Partner, or Corporate Officer Title Social Security Number Telephone Number

Complete Address of Owner, Partner, or Corporate Officer (Residence or P.O. Box, include city, state, and ZIP code) Cellular Telephone Number

Legal Name of Owner, Partner, or Corporate Officer Title Social Security Number Telephone Number

Complete Address of Owner, Partner, or Corporate Officer (Residence or P.O. Box, include city, state, and ZIP code) Cellular Telephone Number

Attach additional sheets of paper if there are additional owners, partners, or corporate officers.

Bank Name and Address (provide complete address; include city, state, and ZIP code)

Payroll-Records Location (provide complete address; include city, state, and ZIP code) Payroll-Records Telephone Number

Office Use Only Coding “Q” Number Coding Date Input “Q” Number ________________

Account Type NAICS Organization Code Liability Code Liability Date ________________

Qualifying Date Status Code _______________ UITR-1 ____________________

UITL-100 (R 09/2018)