Enlarge image

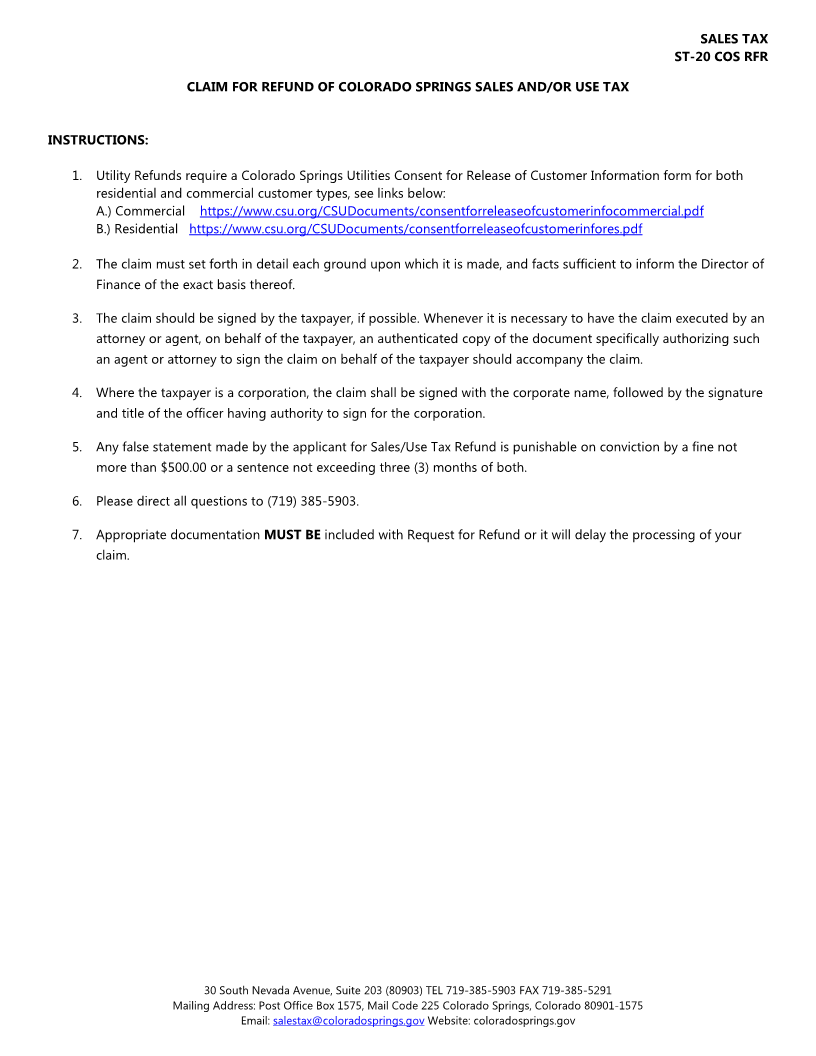

SALES TAX

ST-20 COS RFR

STANDARD CLAIM FOR REFUND OF COLORADO SPRINGS SALES AND/OR USE TAX

Utility Refunds require a Colorado Springs Utilities Consent for Release of Customer Information form for both residential and

commercial customer types, see links below:

A.) Commercial Consent for Release of Commercial Customer Info

B. ) Residential Consent for Release of Residential Customer Info

A claim by an agent must be accompanied by a power of attorney, if necessary

Name of Claimant: License/Account#

Residence or Business Address:

Post Office Box or Street Address City. State Zip Code

Mailing Address:

(If different from Residence/Bus Add)

Contact Name: Phone:

Email:

Date(s)/Period(s) From: To:

Items Purchased From:

Address:

Total Price of Items Purchased: $

Amount of Sales/Use Tax Paid: $

Amount of Claim: $

Reason for Claim:

I declare, under penalty of perjury, that this claim, and all accompanying schedules and statements, have been examined

by me and to the best of my knowledge and belief are true, correct, and made in good faith, pursuant to City of Colorado

Springs Sales and Use Tax Code and Regulations issued under authority thereof.

Authorized Representative/Title (Print):

Signature of Authorized Representative: Date:

OFFICE USE ONLY

Original Amount of Claim: $ 65120-001-6110 $

Amount added/(rejected): $ 65120-118-5901-9160028 $

Total Claim Allowed/Paid: $ 65120-171-1300-9160028 $

I Hereby Authorize the Refund of: $ 65120-173-1300-9160028 $

45100-166-1300 $

Audited By: Date:

For Director of Finance Date:

30 South Nevada Avenue, Suite 203 (80903) TEL 719-385-5903 FAX 719-385-5291

Mailing Address: Post Office Box 1575, Mail Code 225 Colorado Springs, Colorado 80901-1575

Email: salestax@coloradosprings.gov Website: coloradosprings.gov Revised 1/2020