Enlarge image

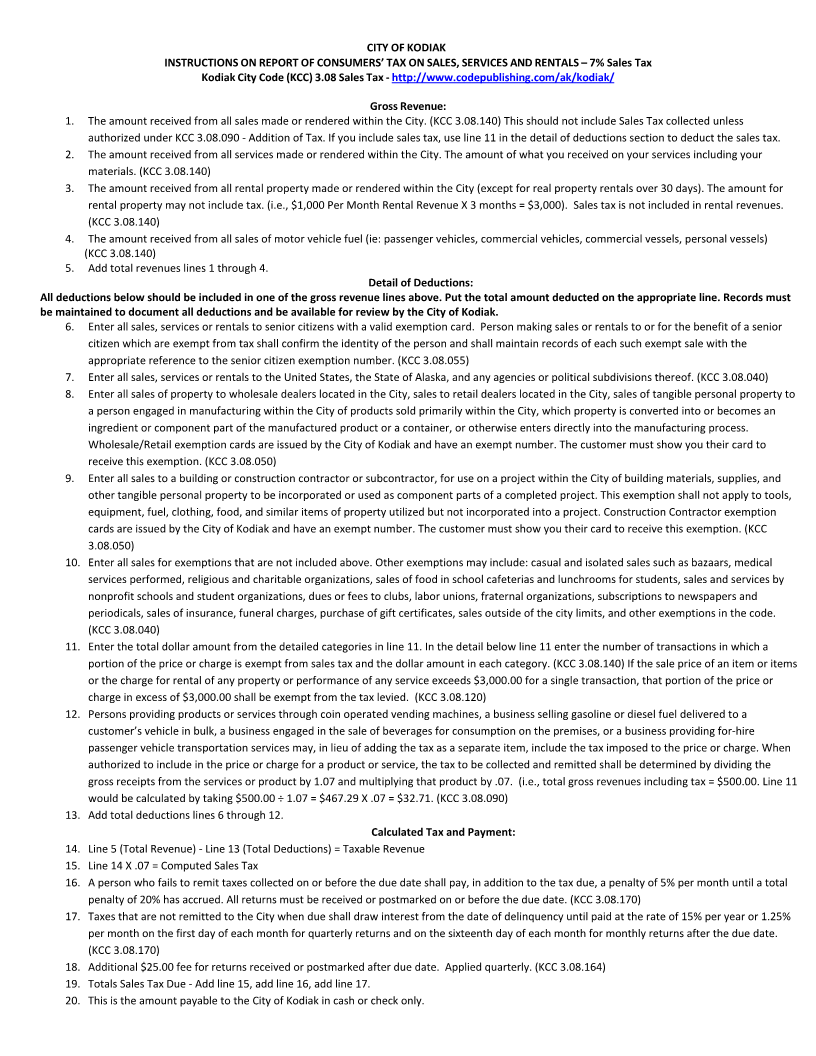

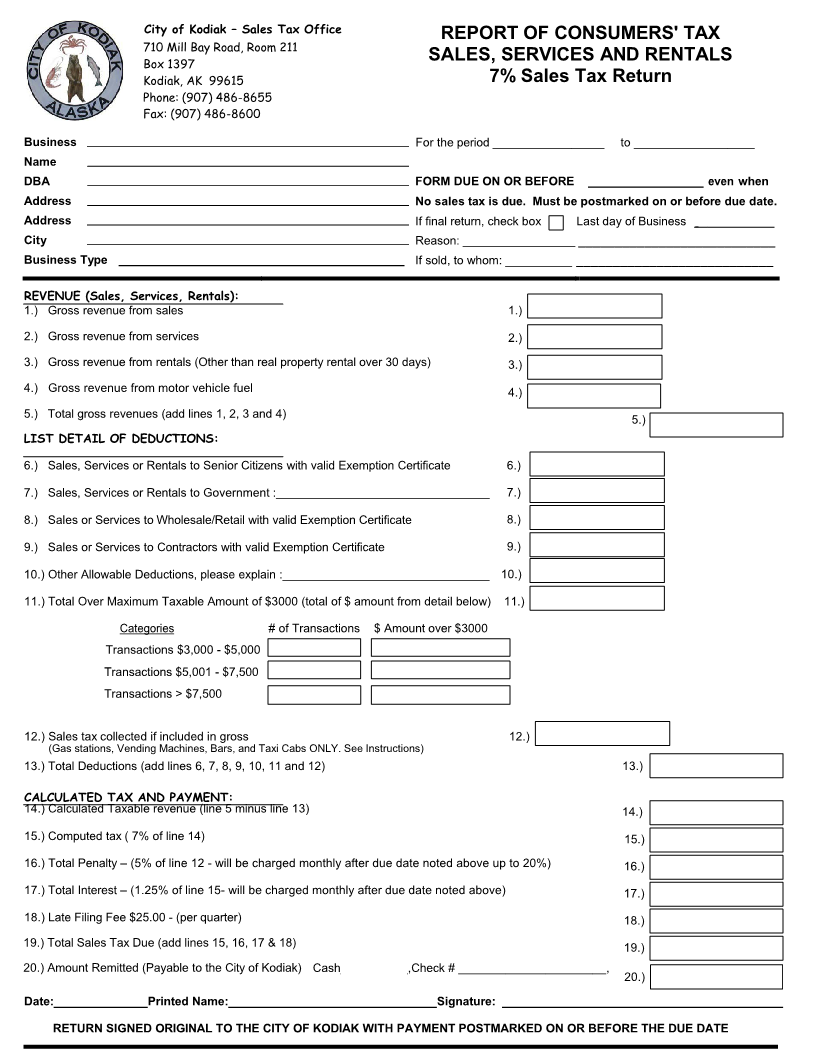

City of Kodiak – Sales Tax Office

REPORT OF CONSUMERS' TAX

710 Mill Bay Road, Room 211

Box 1397 SALES, SERVICES AND RENTALS

Kodiak, AK 99615 7% Sales Tax Return

Phone: (907) 486-8655

Fax: (907) 486-8600

Business For the period _________________ to __________________

Name

DBA FORM DUE ON OR BEFORE even when

Address No sales tax is due. Must be postmarked on or before due date.

Address If final return, check box Last day of Business ____________

City Reason: _________________ ___________________________

Business Type If sold, to whom: __________ ___________________________

REVENUE (Sales, Services, Rentals):

1.) Gross revenue from sales 1.)

2.) Gross revenue from services 2.)

3.) Gross revenue from rentals (Other than real property rental over 30 days ) 3.)

4.) Gross revenue from motor vehicle fuel 4.)

5.) Total gross revenues (add lines 1, 2, 3 and 4) 5.)

LIST DETAIL OF DEDUCTIONS:

6.) Sales, Services or Rentals to Senior Citizens with valid Exemption Certificate 6.)

7.) Sales, Services or Rentals to Government :________________________________ 7.)

8.) Sales or Services to Wholesale/Retail with valid Exemption Certificate 8.)

9.) Sales or Services to Contractors with valid Exemption Certificate 9.)

10.) Other Allowable Deductions, please explain :_______________________________ 10.)

11.) Total Over Maximum Taxable Amount of $3000 (total of $ amount from detail below) 11.)

Categories # of Transactions $ Amount over $3000

Transactions $3,000 - $5,000

Transactions $5,001 - $7,500

Transactions > $7,500

12.) Sales tax collected if included in gross 12.)

(Gas stations, Vending Machines, Bars, and Taxi Cabs ONLY. See Instructions)

13.) Total Deductions (add lines 6, 7, 8, 9, 10, 11 and 12) 13.)

CALCULATED TAX AND PAYMENT:

14.) Calculated Taxable revenue (line 5 minus line 13) 14.)

15.) Computed tax ( 7% of line 14) 15.)

16.) Total Penalty – (5% of line 12 - will be charged monthly after due date noted above up to 20%) 16.)

17.) Total Interest – (1.25% of line 1 5-will be charged monthly after due date noted above) 17.)

18.) Late Filing Fee $25.00 - (per quarter) 18.)

19.) Total Sales Tax Due (add lines 15, 16, 17 & 18) 19.)

20.) Amount Remitted (Payable to the City of Kodiak) Cash__________,Check # ______________________,

20.)

Date: Printed Name: Signature:

RETURN SIGNED ORIGINAL TO THE CITY OF KODIAK WITH PAYMENT POSTMARKED ON OR BEFORE THE DUE DATE