Enlarge image

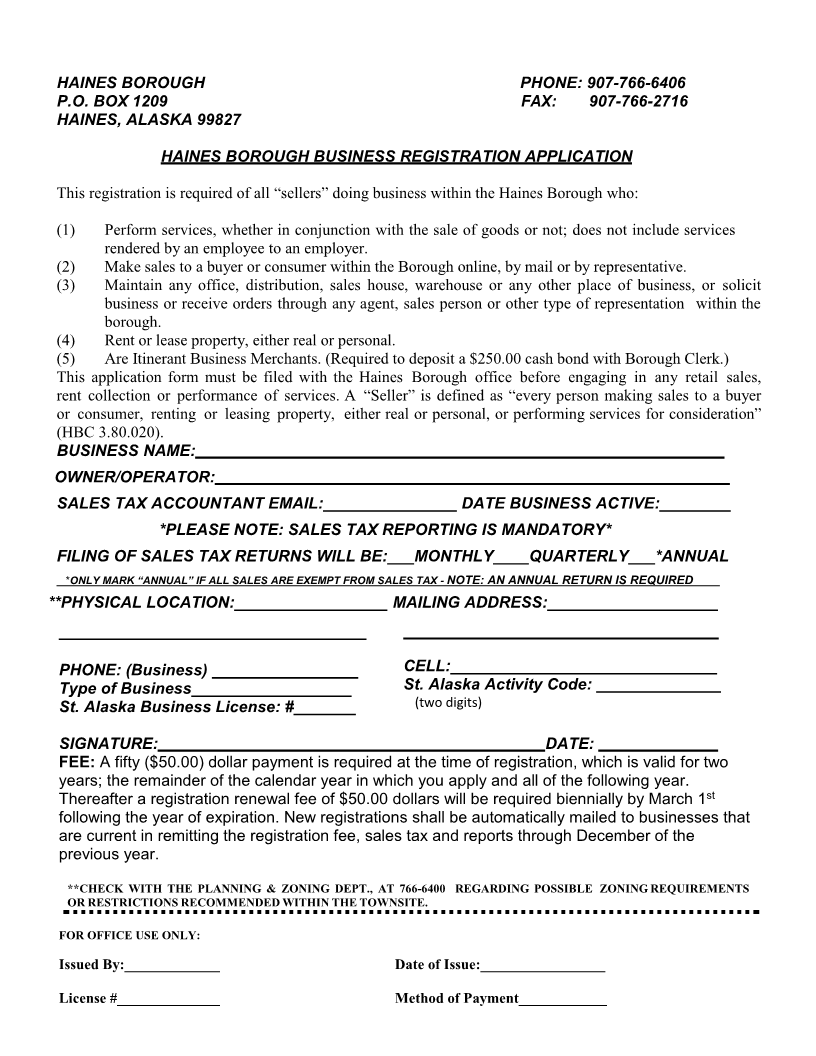

HAINES BOROUGH PHONE: 907-766-6406

P.O. BOX 1209 FAX: 907-766-2716

HAINES, ALASKA 99827

HAINES BOROUGH BUSINESS REGISTRATION APPLICATION

This registration is required of all “sellers” doing business within the Haines Borough who:

(1) Perform services, whether in conjunction with the sale of goods or not; does not include services

rendered by an employee to an employer.

(2) Make sales to a buyer or consumer within the Borough online, by mail or by representative.

(3) Maintain any office, distribution, sales house, warehouse or any other place of business, or solicit

business or receive orders through any agent, sales person or other type of representation within the

borough.

(4) Rent or lease property, either real or personal.

(5) Are Itinerant Business Merchants. (Required to deposit a $250.00 cash bond with Borough Clerk.)

This application form must be filed with the Haines Borough office before engaging in any retail sales,

rent collection or performance of services. A “Seller” is defined as “every person making sales to a buyer

or consumer, renting or leasing property, either real or personal, or performing services for consideration”

(HBC 3.80.020).

BUSINESS NAME:

OWNER/OPERATOR:

SALES TAX ACCOUNTANT EMAIL:_______________ DATE BUSINESS ACTIVE:________

*PLEASE NOTE: SALES TAX REPORTING IS MANDATORY*

FILING OF SALES TAX RETURNS WILL BE:___MONTHLY____QUARTERLY___*ANNUAL

*ONLY MARK “ANNUAL” IF ALL SALES ARE EXEMPT FROM SALES TAX - NOTE: AN ANNUAL RETURN IS REQUIRED

**PHYSICAL LOCATION: MAILING ADDRESS:

PHONE: (Business) CELL:

Type of Business__________________ St. Alaska Activity Code: ______________

St. Alaska Business License: #_______ (two digits)

SIGNATURE: DATE:

FEE: A fifty ($50.00) dollar payment is required at the time of registration, which is valid for two

years; the remainder of the calendar year in which you apply and all of the following year.

st

Thereafter a registration renewal fee of $50.00 dollars will be required biennially by March 1

following the year of expiration. New registrations shall be automatically mailed to businesses that

are current in remitting the registration fee, sales tax and reports through December of the

previous year.

**CHECK WITH THE PLANNING & ZONING DEPT., AT 766-6400 REGARDING POSSIBLE ZONING REQUIREMENTS

OR RESTRICTIONS RECOMMENDED WITHIN THE TOWNSITE.

FOR OFFICE USE ONLY:

Issued By:_____________ Date of Issue:_________________

License #______________ Method of Payment____________