Enlarge image

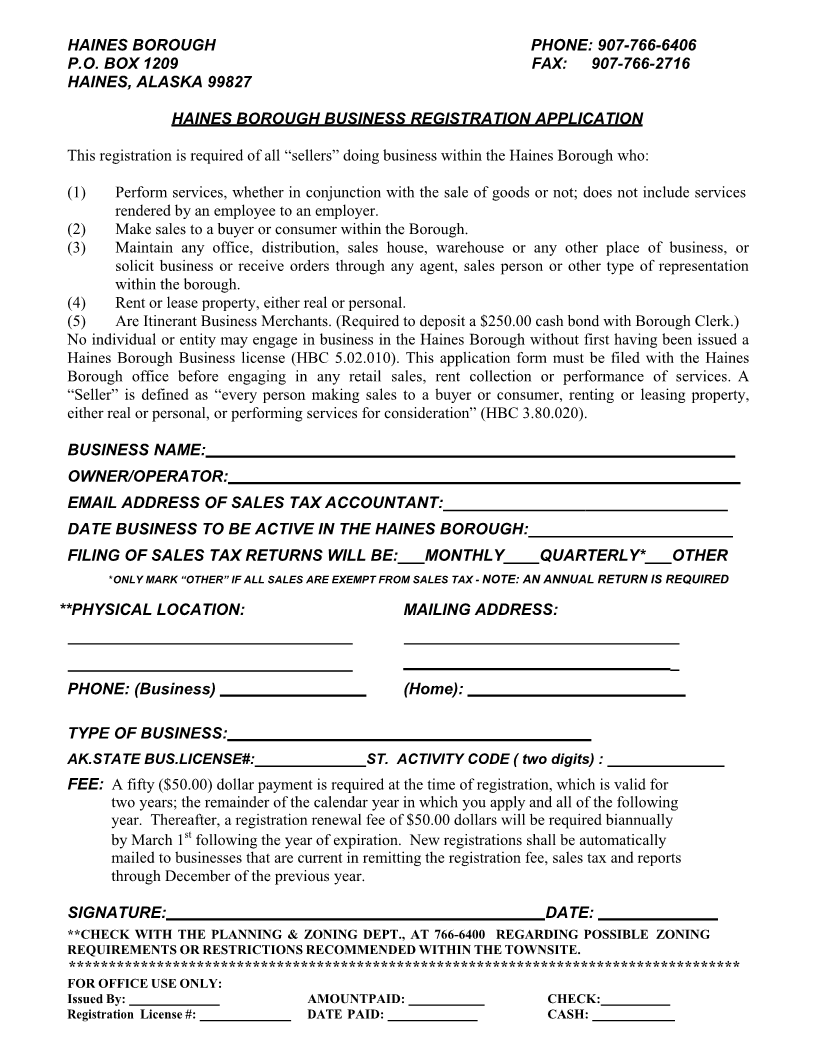

HAINES BOROUGH PHONE: 907-766-6406

P.O. BOX 1209 FAX: 907-766-2716

HAINES, ALASKA 99827

HAINES BOROUGH BUSINESS REGISTRATION APPLICATION

This registration is required of all “sellers” doing business within the Haines Borough who:

(1) Perform services, whether in conjunction with the sale of goods or not; does not include services

rendered by an employee to an employer.

(2) Make sales to a buyer or consumer within the Borough.

(3) Maintain any office, distribution, sales house, warehouse or any other place of business, or

solicit business or receive orders through any agent, sales person or other type of representation

within the borough.

(4) Rent or lease property, either real or personal.

(5) Are Itinerant Business Merchants. (Required to deposit a $250.00 cash bond with Borough Clerk.)

No individual or entity may engage in business in the Haines Borough without first having been issued a

Haines Borough Business license (HBC 5.02.010). This application form must be filed with the Haines

Borough office before engaging in any retail sales, rent collection or performance of services. A

“Seller” is defined as “every person making sales to a buyer or consumer, renting or leasing property,

either real or personal, or performing services for consideration” (HBC 3.80.020).

BUSINESS NAME:

OWNER/OPERATOR:

EMAIL ADDRESS OF SALES TAX ACCOUNTANT:________________________________

DATE BUSINESS TO BE ACTIVE IN THE HAINES BOROUGH:_______________________

FILING OF SALES TAX RETURNS WILL BE:___MONTHLY____QUARTERLY*___OTHER

*ONLY MARK “OTHER” IF ALL SALES ARE EXEMPT FROM SALES TAX - NOTE: AN ANNUAL RETURN IS REQUIRED

**PHYSICAL LOCATION: MAILING ADDRESS:

_

PHONE: (Business) (Home):

TYPE OF BUSINESS:

AK.STATE BUS.LICENSE#: ST. ACTIVITY CODE ( two digits) :

FEE: A fifty ($50.00) dollar payment is required at the time of registration, which is valid for

two years; the remainder of the calendar year in which you apply and all of the following

year. Thereafter, a registration renewal fee of $50.00 dollars will be required biannually

st

by March 1 following the year of expiration. New registrations shall be automatically

mailed to businesses that are current in remitting the registration fee, sales tax and reports

through December of the previous year.

SIGNATURE: DATE:

**CHECK WITH THE PLANNING & ZONING DEPT., AT 766-6400 REGARDING POSSIBLE ZONING

REQUIREMENTS OR RESTRICTIONS RECOMMENDED WITHIN THE TOWNSITE.

************************************************************************************

FOR OFFICE USE ONLY:

Issued By: AMOUNTPAID: CHECK:

Registration License #: DATE PAID: CASH: