Enlarge image

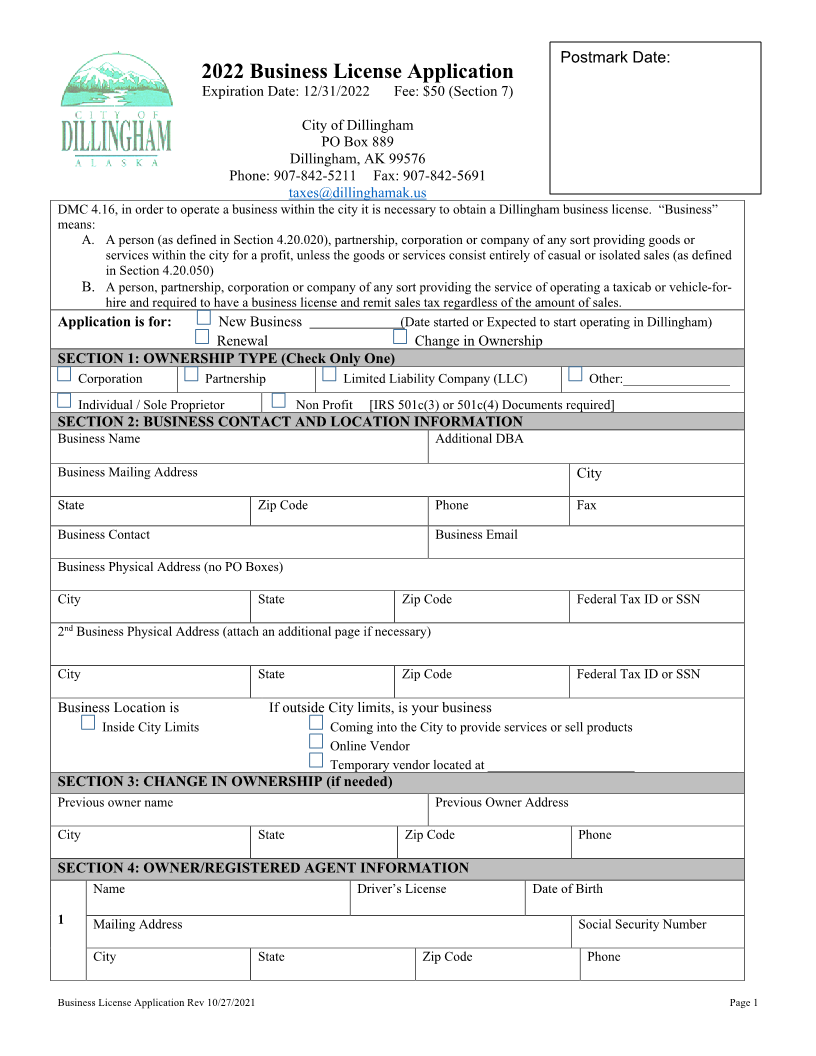

Postmark Date:

2022 Business License Application

Expiration Date: 12/31/2022 Fee: $50 (Section 7)

City of Dillingham

PO Box 889

Dillingham, AK 99576

Phone: 907-842-5211 Fax: 907-842-5691

taxes@dillinghamak.us

DMC 4.16, in order to operate a business within the city it is necessary to obtain a Dillingham business license. “Business”

means:

A. A person (as defined in Section 4.20.020), partnership, corporation or company of any sort providing goods or

services within the city for a profit, unless the goods or services consist entirely of casual or isolated sales (as defined

in Section 4.20.050)

B. A person, partnership, corporation or company of any sort providing the service of operating a taxicab or vehicle-for-

hire and required to have a business license and remit sales tax regardless of the amount of sales.

Application is for: New Business (Date started or Expected to start operating in Dillingham)

Renewal Change in Ownership

SECTION 1: OWNERSHIP TYPE (Check Only One)

Corporation Partnership Limited Liability Company (LLC) Other:________________

Individual / Sole Proprietor Non Profit [IRS 501c(3) or 501c(4) Documents required]

SECTION 2: BUSINESS CONTACT AND LOCATION INFORMATION

Business Name Additional DBA

Business Mailing Address City

State Zip Code Phone Fax

Business Contact Business Email

Business Physical Address (no PO Boxes)

City State Zip Code Federal Tax ID or SSN

2 Businessnd Physical Address (attach an additional page if necessary)

City State Zip Code Federal Tax ID or SSN

Business Location is If outside City limits, is your business

Inside City Limits Coming into the City to provide services or sell products

Online Vendor

Temporary vendor located at ______________________

SECTION 3: CHANGE IN OWNERSHIP (if needed)

Previous owner name Previous Owner Address

City State Zip Code Phone

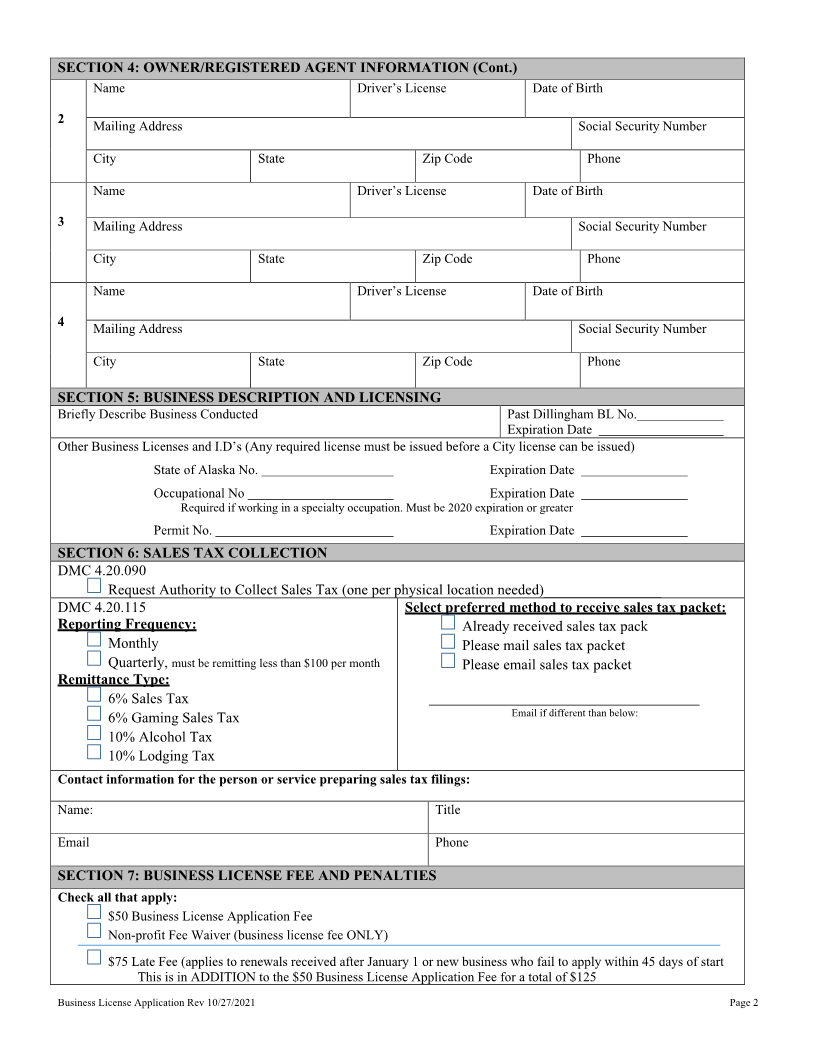

SECTION 4: OWNER/REGISTERED AGENT INFORMATION

Name Driver’s License Date of Birth

1 Mailing Address Social Security Number

City State Zip Code Phone

Business License Application Rev 10/27/2021 Page 1