Enlarge image

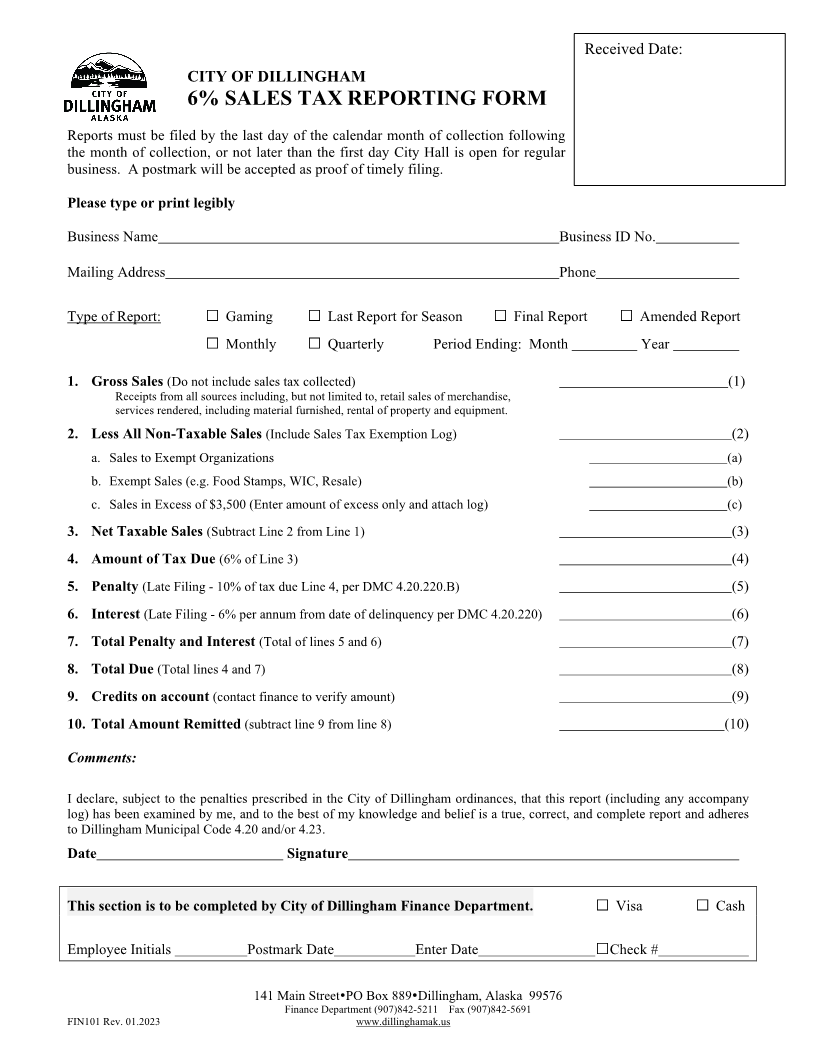

Received Date:

CITY OF DILLINGHAM

6% SALES TAX REPORTING FORM

Reports must be filed by the last day of the calendar month of collection following

the month of collection, or not later than the first day City Hall is open for regular

business. A postmark will be accepted as proof of timely filing.

Please type or print legibly

Business Name Business ID No.

Mailing Address Phone

Type of Report: □ Gaming □ Last Report for Season □ Final Report □ Amended Report

□ Monthly □ Quarterly Period Ending: Month Year

1. Gross Sales (Do not include sales tax collected) (1)

Receipts from all sources including, but not limited to, retail sales of merchandise,

services rendered, including material furnished, rental of property and equipment.

2. Less All Non-Taxable Sales (Include Sales Tax Exemption Log) (2)

a. Sales to Exempt Organizations (a)

b. Exempt Sales (e.g. Food Stamps, WIC, Resale) (b)

c. Sales in Excess of $3,500 (Enter amount of excess only and attach log) (c)

3. Net Taxable Sales (Subtract Line 2 from Line 1) (3)

4. Amount of Tax Due (6% of Line 3) (4)

5. Penalty (Late Filing - 10% of tax due Line 4, per DMC 4.20.220.B) (5)

6. Interest (Late Filing - 6% per annum from date of delinquency per DMC 4.20.220) (6)

7. Total Penalty and Interest (Total of lines 5 and 6) (7)

8. Total Due (Total lines 4 and 7) (8)

9. Credits on account (contact finance to verify amount) (9)

10. Total Amount Remitted (subtract line 9 from line 8) (10)

Comments:

I declare, subject to the penalties prescribed in the City of Dillingham ordinances, that this report (including any accompany

log) has been examined by me, and to the best of my knowledge and belief is a true, correct, and complete report and adheres

to Dillingham Municipal Code 4.20 and/or 4.23.

Date Signature

This section is to be completed by City of Dillingham Finance Department. □ Visa □ Cash

Employee Initials Postmark Date Enter Date □Check #

141 Main Street PO Box 889Dillingham, Alaska 99576

Finance Department (907)842-5211 Fax (907)842-5691

FIN101 Rev. 01.2023 www.dillinghamak.us