Enlarge image

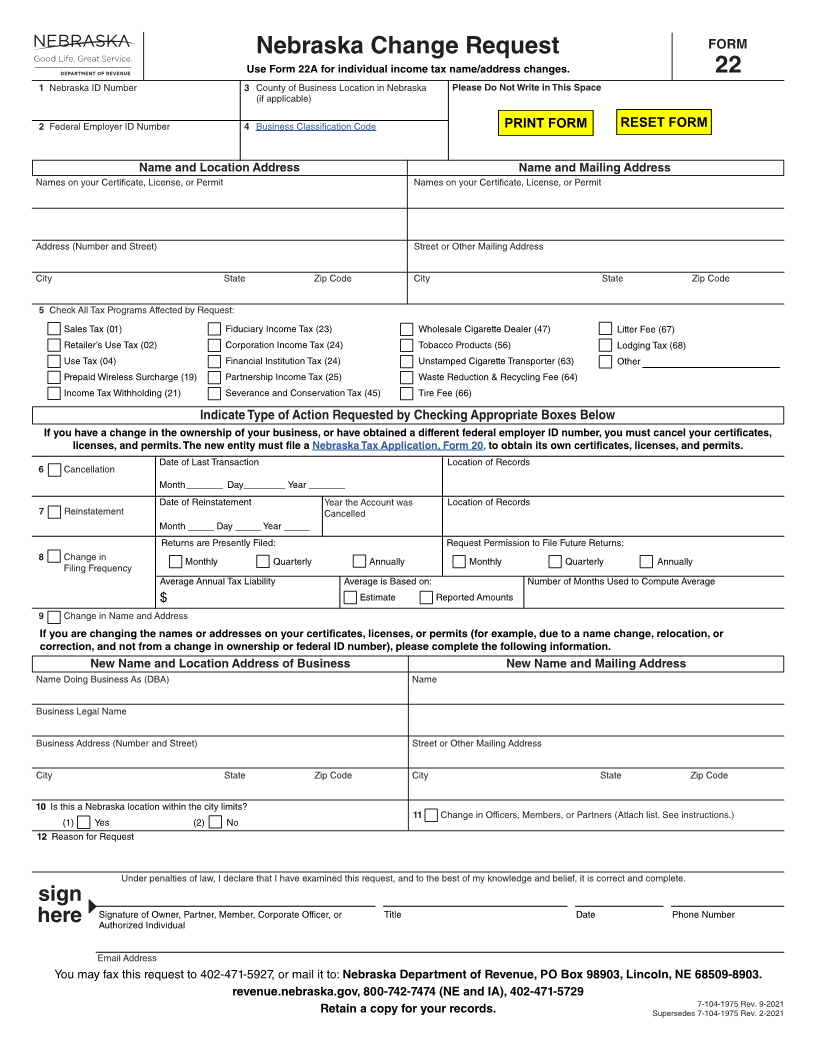

FORM

Nebraska Change Request

Use Form 22A for individual income tax name/address changes. 22

1 Nebraska ID Number 3 County of Business Location in Nebraska Please Do Not Write in This Space

(if applicable)

2 Federal Employer ID Number 4 Business Classification Code PRINT FORM RESET FORM

Name and Location Address Name and Mailing Address

Names on your Certificate, License, or Permit Names on your Certificate, License, or Permit

Address (Number and Street) Street or Other Mailing Address

City State Zip Code City State Zip Code

5 Check All Tax Programs Affected by Request:

Sales Tax (01) Fiduciary Income Tax (23) Wholesale Cigarette Dealer (47) Litter Fee (67)

Retailer’s Use Tax (02) Corporation Income Tax (24) Tobacco Products (56) Lodging Tax (68)

Use Tax (04) Financial Institution Tax (24) Unstamped Cigarette Transporter (63) Other

Prepaid Wireless Surcharge (19) Partnership Income Tax (25) Waste Reduction & Recycling Fee (64)

Income Tax Withholding (21) Severance and Conservation Tax (45) Tire Fee (66)

Indicate Type of Action Requested by Checking Appropriate Boxes Below

If you have a change in the ownership of your business, or have obtained a different federal employer ID number, you must cancel your certificates,

licenses, and permits. The new entity must file a Nebraska Tax Application, Form 20, to obtain its own certificates, licenses, and permits.

Date of Last Transaction Location of Records

6 Cancellation

Month _______ Day ________ Year _______

Date of Reinstatement Year the Account was Location of Records

7 Reinstatement Cancelled

Month _____ Day _____ Year _____

Returns are Presently Filed: Request Permission to File Future Returns:

8 Change in Monthly Quarterly Annually Monthly Quarterly Annually

Filing Frequency

Average Annual Tax Liability Average is Based on: Number of Months Used to Compute Average

$ Estimate Reported Amounts

9 Change in Name and Address

If you are changing the names or addresses on your certificates, licenses, or permits (for example, due to a name change, relocation, or

correction, and not from a change in ownership or federal ID number), please complete the following information.

New Name and Location Address of Business New Name and Mailing Address

Name Doing Business As (DBA) Name

Business Legal Name

Business Address (Number and Street) Street or Other Mailing Address

City State Zip Code City State Zip Code

10 Is this a Nebraska location within the city limits?

11 Change in Officers, Members, or Partners (Attach list. See instructions.)

(1) Yes (2) No

12 Reason for Request

Under penalties of law, I declare that I have examined this request, and to the best of my knowledge and belief, it is correct and complete.

sign

Signature of Owner, Partner, Member, Corporate Officer, or Title Date Phone Number

here Authorized Individual

Email Address

You may fax this request to 402-471-5927, or mail it to: Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

7-104-1975 Rev. 9-2021

Retain a copy for your records. Supersedes 7-104-1975 Rev. 2-2021