- 6 -

Enlarge image

|

Instructions for Form 10

Who Must File. Every retailer must file a Form 10. Retailers include remote Line 1. Enter the total dollar amount of ALL Nebraska sales, leases, rentals,

sellers and Multivendor Marketplace Platforms (MMPs) with more than and services made or facilitated by your business or by an MMP on your

$100,000 of gross sales or 200 or more transactions in Nebraska. All retailers behalf. Enter both taxable and exempt sales. Line 1 does not include the

must hold a Nebraska Sales Tax Permit. amount of sales tax collected.

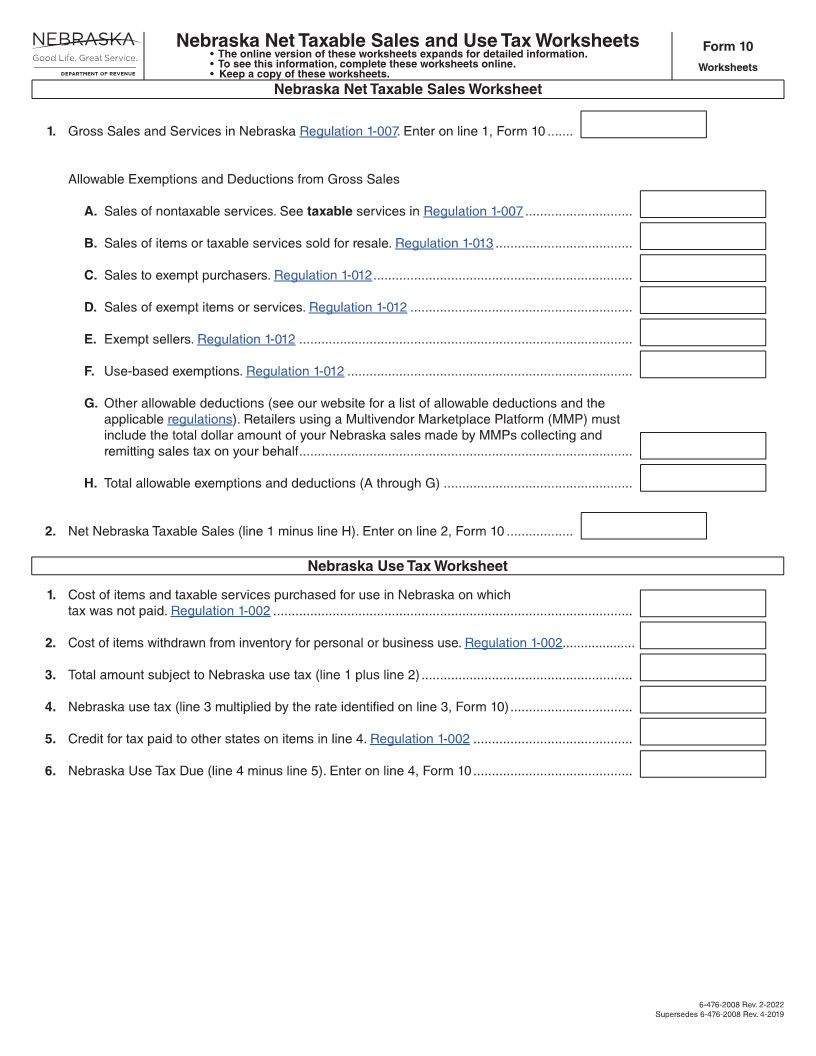

How to Obtain a Permit. You must complete a Nebraska Tax Application, Line 2. Complete the Nebraska Net Taxable Sales and Use Tax Worksheets

Form 20, to apply for a sales tax permit. After the application has been for allowable exemptions or deductions, including the MMP deduction. Enter

processed, you will receive your Nebraska sales tax ID number printed on the Nebraska net taxable sales rounded to the nearest whole dollar. Retailers

the permit. making sales through MMPs refer to the MMP Users Only instructions below.

When and Where to File. This return and payment are due the 20th of Lines 4 and 5. Transactions Subject to Use Tax. Use tax is due on

the month following the tax period covered by the return. Paper returns all taxable purchases when Nebraska and any applicable local sales tax is not

must be mailed to the Nebraska Department of Revenue, PO Box 98923, paid. Use tax is due on your cost of these items or taxable services. Examples

Lincoln, NE 68509-8923. Retain a copy of this return and all schedules and include, but are not limited to:

worksheets for your records. Purchases of uniforms, magazines, computers, software; or

Electronic Filing (e-filing). All retailers may e-file Form 10 using NebFile Purchases of taxable services such as repair or installation labor on

for Business. Retailers approved to file a combined return or required to tangible personal property, pest control, building cleaning, or motor

pay electronically, must e-file Form 10. If you have questions about e-filing vehicle towing;

or payment options, visit the Department of Revenue (DOR) website Purchases of property from outside Nebraska, brought to Nebraska for

revenue.nebraska.gov. use or storage; and

Preidentified Return. Retailers will be mailed a preidentified paper return Items withdrawn from inventory for use or donation.

if they did not e-file a Form 10 previously and are not required to pay Line 6. Enter the total local sales tax from the Schedule I.

electronically. This return should only be used by the retailer whose name is

printed on it. If you have not received your preidentified return for the tax Line 8. The retailer is allowed to retain a fee for collecting the Nebraska

period, you may print a Form 10 from DOR’s website. Complete the Nebraska and local sales tax.

ID number, tax period, name, and address information. Line 12. A balance due resulting from a partial payment, mathematical or

Name and Address Changes. If the business name has changed and it is clerical errors, penalty, or interest relating to prior returns is entered on this

a name change only (for example, if the ownership or federal ID number has line. The amount of interest includes interest on unpaid tax through the due

not changed), mark through the previous name and plainly print the new date of this return. If the amount due is paid before the due date, interest will

name and write “name change only.” If you e-file, name changes should be be recomputed and a credit will be on your next return. If you have already

made on a Nebraska Change Request, Form 22. paid the amount on this line with a previous remittance, please disregard it.

If there is a change or correction in the name or address, mark through the A credit is indicated by the word “subtract” and can be subtracted from the

incorrect information and plainly print the correct information. If this is the amount due on line 11. However, if your records do not support this credit,

result of a relocation of your business, indicate this by writing “relocated” please contact DOR.

next to the change made. If you are e-filing, you may make an address change Line 13. All taxpayers are encouraged to make payments electronically.

during filing; however, name changes must be done by filing a Form 22. See Do not send a paper check if you are mandated to pay electronically.

previous paragraph for name change information. Reminder: A sales tax Electronic payments may be made using DOR’s free e-pay program (EFT

permit is required for each location. If an additional location is opened, you Debit), by ACH Credit, credit card, or by phone. Refer to DOR’s website

must apply for another sales tax permit by filing a Form 20. for payment options.

Ownership Changes. A change in ownership, or type of ownership Signatures. This return must be signed by the taxpayer, partner, officer, or

(individual to a partnership, partnership to a corporation, etc.) requires member. Include a daytime phone number and email address in case DOR

you to cancel your permit and obtain a new permit for the new business. To needs to contact you about your account.

cancel the old permit, check the box in the upper left corner of the Form 10. Email. By entering an email address, the taxpayer acknowledges that

The new owners must complete a Form 20 to obtain their own sales tax DOR may contact the taxpayer by email. The taxpayer accepts any risk to

permit. The new owners of the business should not use the previous owner’s confidentiality associated with this method of communication. DOR will

preidentified sales and use tax return. send all confidential information by secure mail or the State of Nebraska’s

Credit Returns. If line 11 is a credit amount, documentation must be sent file share system. If you do not wish to be contacted by email, write “Opt

with the return to support the credit. This documentation must include a Out” on the line labeled “email address.”

letter of explanation, invoices, or credit memos issued to customers. When If the taxpayer authorizes another person to sign this return, there must be a

e-filing, complete the explanation box with information on the credit. You will power of attorney on file with DOR. Any person who is paid for preparing a

be contacted if additional documentation is required. If a credit is shown on taxpayer’s return must also sign the return as preparer. E-filers are required

line 11, it may be applied to a balance shown on line 12, if any, or used on to identify the person completing the return during the filing process.

future returns. If the credit cannot be used in a reasonable amount of time, Nebraska Schedule I

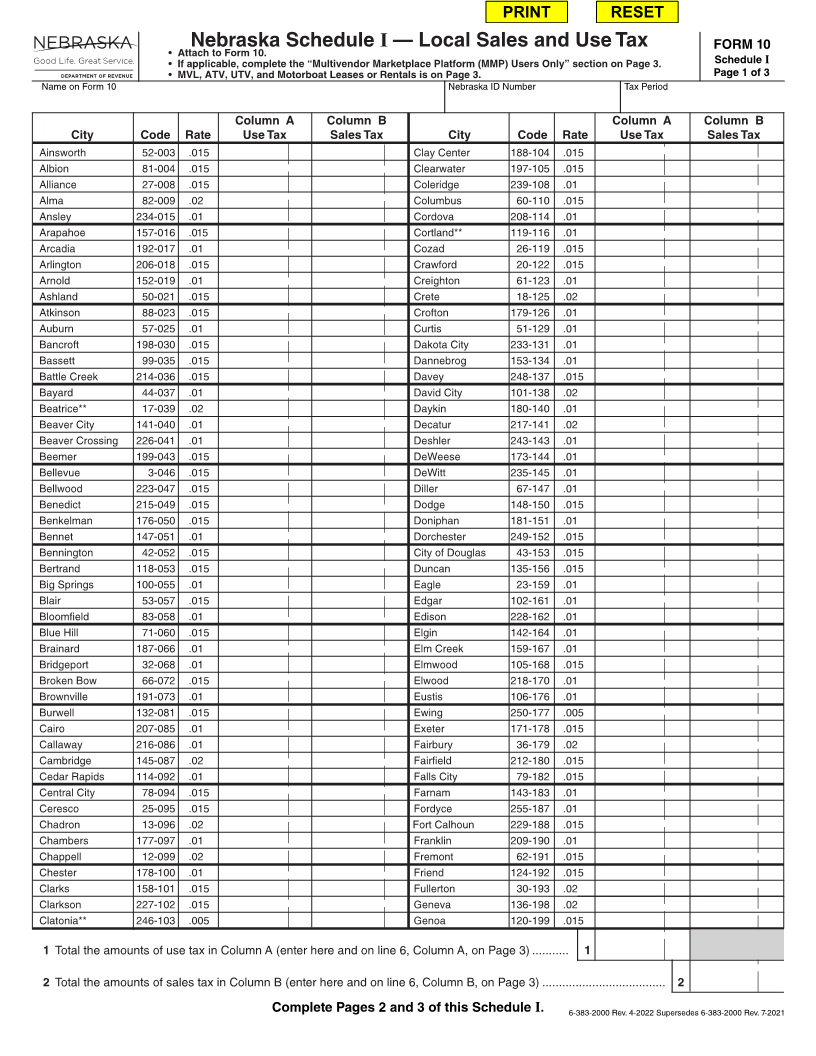

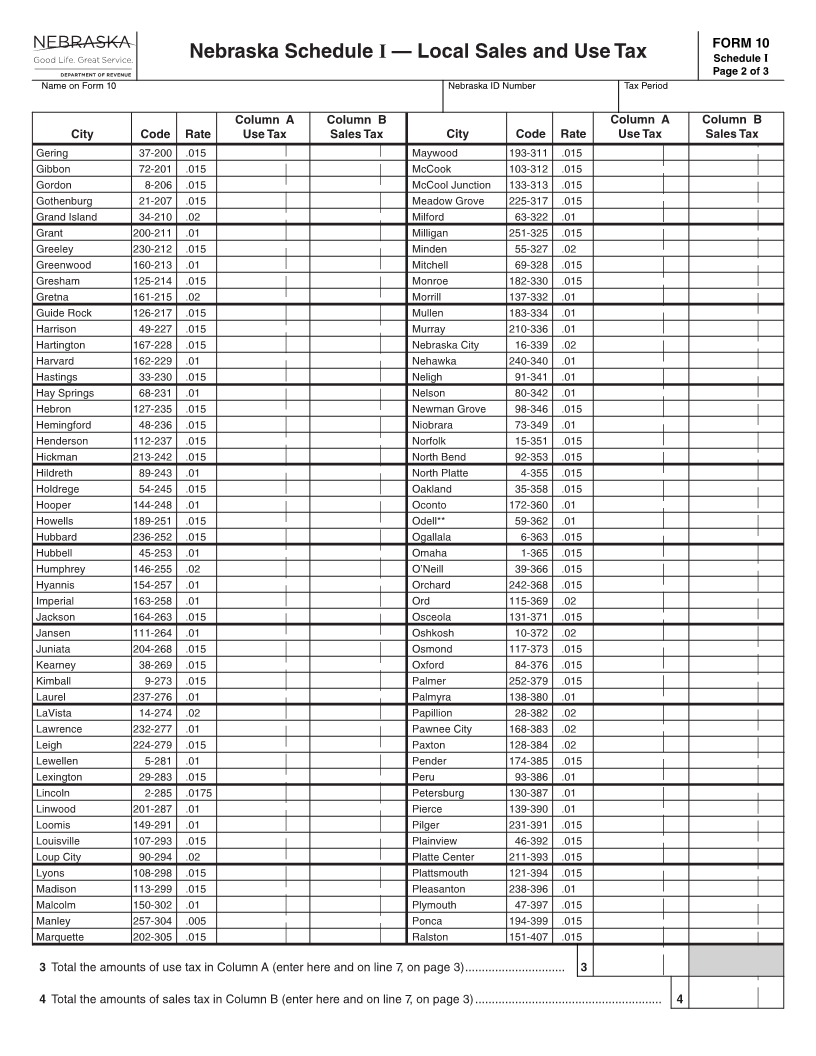

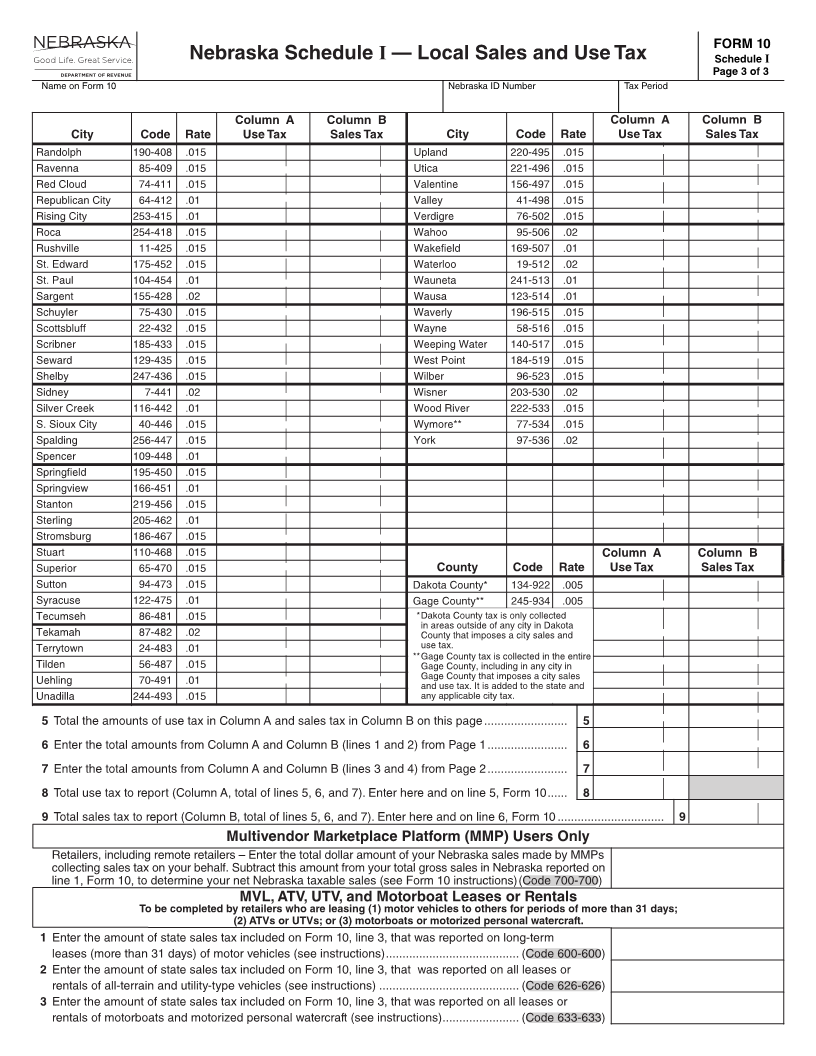

a Claim for Refund of Sales and Use Tax, Form 7, may be filed. The statute The Schedule I displays any city or county that has been reported in the last

of limitations for filing the Form 7 is three years from the due date following 12 months. Enter the local sales and use tax due for each city and county.

the end of the period for which the credit was created. Retailers that make sales using an MMP should enter the result of the total

Amended Returns. An amended Form 10, available on DOR’s website, city or county sales tax due by the retailer and the MMP less the city or county

may only be filed by paper. Mandated retailers must pay all balance dues sales tax remitted by the MMP on the retailer’s behalf. A city or county may

electronically. If you e-file, you can make changes to your filed return any be added by writing the information in the blank boxes on Schedule I. You

time on or before the return’s due date. This feature is for current tax period can find listings of the city and county taxing jurisdictions and the sales tax

returns only. rates on DOR’s website.

Penalty and Interest. If a return is not filed and/or is not paid by the due date, a Line 1, Local Use Tax. Total the amounts reported in the use tax column

penalty may be assessed in the amount of 10% of the tax due or $25, whichever and enter the total from Nebraska Schedule I, on line 5, Form 10.

is greater. Interest on the unpaid tax will be assessed at the rate printed on Line 2, Local Sales Tax. Total the amounts reported in the sales tax column

line 12 from the due date until payment is received. and enter the total from Nebraska Schedule I, on line 6, Form 10.

Retention of Records. Records to substantiate this return must be kept Multivendor Marketplace Platform (MMP) Users Only

and be available to DOR for a period of at least three years following the Retailers making sales into Nebraska using an MMP must enter the dollar

date of filing the return. amount of Nebraska sales remitted by MMPs that are collecting Nebraska

Additional information regarding sales and use taxes may be found in the sales tax on your behalf. Retain documentation from your MMPs that

“Information Guides” section of DOR’s website. substantiates this amount.

Specific Instructions MVL, ATV, UTV, and Motorboat Leases or Rentals

Retailers must report the tax due for each type of tax. If no sales or use tax Enter the portion of the state sales tax (reported on Form 10, line 3) that is

is due, the retailer must indicate it by entering a zero, N/A, drawing a line, from all leases or rentals of: (1) automobiles, trucks, trailers, semitrailers,

writing a word, or statement on the appropriate line. Failure to do so extends and truck tractors for periods of more than 31 days that are not classified

the statute of limitations to six years for audit purposes. as transportation equipment, see the Nebraska Sales Tax on Leased Motor

Vehicles Information Guide; (2) all-terrain and utility-type vehicles; or (3)

Complete the Nebraska Net Taxable Sales and Use Tax Worksheets to assist motorboats and motorized personal watercraft (for example, jet skis or

with the Form 10. wave runners).

|