Enlarge image

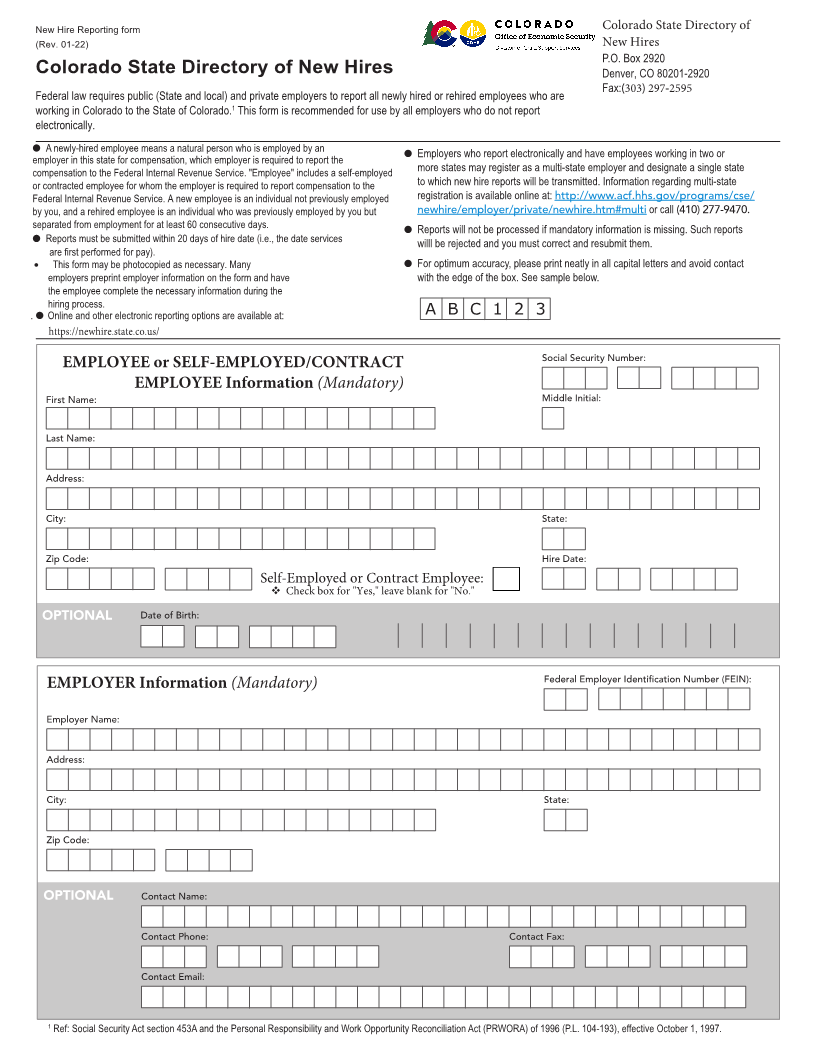

New Hire Reporting form Colorado State Directory of

(Rev. 01-22 ) New Hires

P.O. Box 2920

Colorado State Directory of New Hires Denver CO, 80201 2920-

Fax:(303 297 2595) -

Federal law requires public (State and local) and private employers to report all newly hired or rehired employees who are

working in Colorado to the State of Colorado.1This form is recommended for use by all employers who do not report

electronically.

OO A newly-hired employeemeans a natural person who employedis by an OO Employers who report electronically and have employees working in two or

employer in statethis for compensation, employerwhich requiredis to report the

compensation to the Federal Internal Revenue Service. "Employee" includes a self-employed more states may register as a multi-state employer and designate a single state

or contracted employee for whom the employer is required to report compensation to the to which new hire reports will be transmitted. Information regarding multi-state

Federal Internal Revenue Service. newA employee is an individual not previously employed registration is available online at: http://www.acf.hhs.gov/programs/cse/

by you, and a rehired employee is an individual who was previously employed by you but newhire/employer/private/newhire.htm#multi or call (410) 277-9470.

separated from employment for at least 60 consecutive days. OO Reports will not be processed if mandatory information is missing. Such reports

OO Reports must be submitted within 20 days of hire date (i.e., the date services willl be rejected and you must correct and resubmit them.

areif rst performed for pay).

• This form may be photocopied as necessary. Many OO For optimum accuracy, please print neatly in all capital letters and avoid contact

employers preprint employer information on the form and have with the edge of the box. See sample below.

the employee complete the necessary information during the

hiring process.

. OO Online and other electronic reporting options are available at: A B C 1 2 3

https://newhire.state.co.us/

Social Security Number:

EMPLOYEE or SELF-EMPLOYED/CONTRACT

EMPLOYEE Information (Mandatory)

First Name: Middle Initial:

Last Name:

Address:

City: State:

Zip Code: Hire Date:

Self-Employed or Contract Employee:

Check box for "Yes," leave blank for "No."

OPTIONAL Date of Birth:

Federal Employer Identification Number (FEIN):

EMPLOYER Information (Mandatory)

Employer Name:

Address:

City: State:

Zip Code:

OPTIONAL Contact Name:

Contact Phone: Contact Fax:

Contact Email:

1 Ref: Social Security Act section 453A and the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 (P.L. 104-193), effective October 1, 1997.