Enlarge image

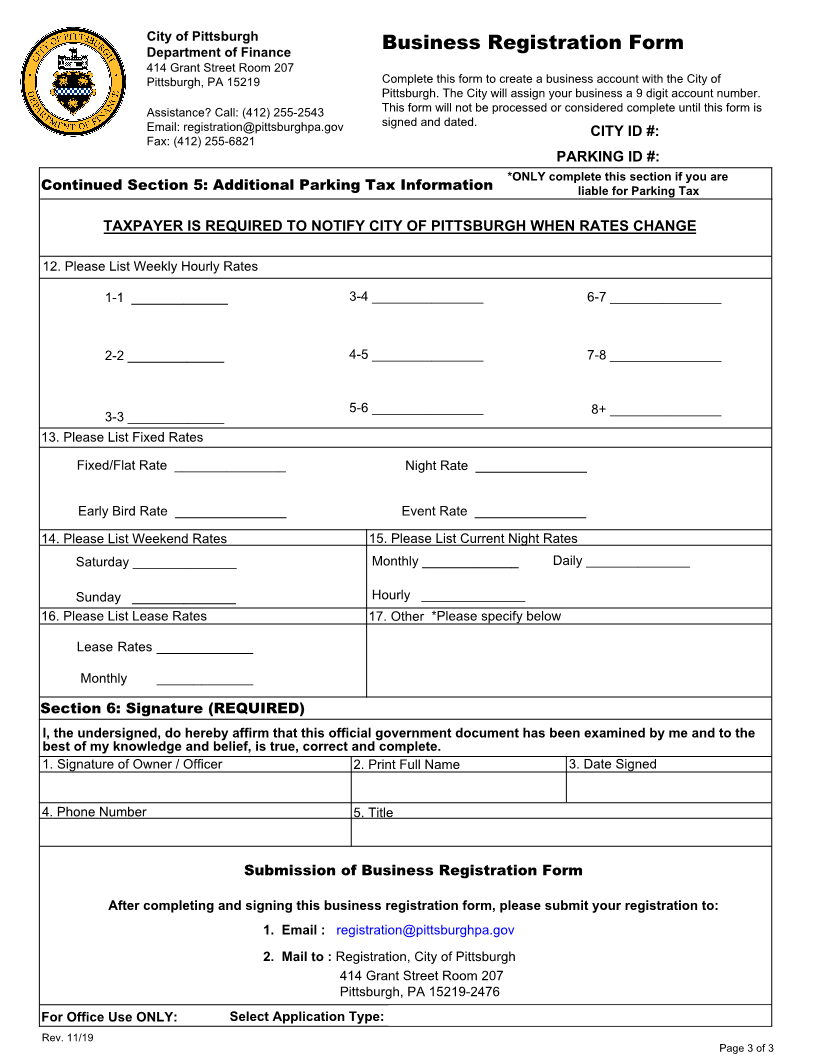

City of Pittsburgh

Department of Finance Business Registration Form

414 Grant Street Room 207

Pittsburgh, PA 15219 Complete this form to create a business account with the City of

Pittsburgh. The City will assign your business a nine digit account

Assistance? Call: 412 255-2543( ) number. This form will not be processed or considered complete until

Email: registration@pittsburghpa.gov this form is signed and dated.

Fax: 412 255-6821 ( ) CITY ID #:

PARKING ID #:

Section 1: Reason For Submitting Form

New Business

Change in Business Structure or Business Name - *Change in Business Status Form must be completed by the previous owner(s) and

attached.

Purchased Existing Business

Other - Please describe reason for submitting form ______________________________________________________

_______________________________________________________________________________________________

Section 2: Business Information

1. Federal Identification Number* ______________________ 2. Social Security Number* _______________________ _

*Provide IRS 9 digit number assigned to your business & IRS EIN documentation *Enter Owner ,Primary Officer or Partner's SSN

3. Full Legal Name of Business (name associated with IRS FEIN) : __________________________________________________

4. Trade Name (doing business as), if any: _______________________________________________________________

5.Indicate Type of Business Structure: (For Non-Profit selections IRS determination, letter must be included)

Sole Proprietor Limited Liability Company (LLC) Non-Profit * (provide IRS documentation)

Partnership One Member Only Charitable Non-Profit *(provide IRS documentation)

General Partnership

Two or More Members Association

Limited Liability Partnership (LLP)

Limited Partnership (LP) Cooperative Other - Specify Below

S Corporation Estate or Trust

C Corporation Joint Venture

6. Business Start Date ___________________ 7. First Day of Business Activities in Pittsburgh _________________

8. Enter the six-digit NAICS code(s) that best describes your business activities (enter at least one) __________________

If you do not know your NAICS code, go to https://www.naics.com/search/ to search.

9. Describe your business activities below, including the type of industry - manufacturing, services, retail or wholesale

trade, etc. Also describe the nature of business being done in the City of Pittsburgh. List additional NAICS codes here:

Section 3: Business Address and Contact Information

1. Pittsburgh Business Location and/or Home Based Employee Address - If there is more than one address,please attach on a separate sheet

Street Address City State Zip Code

2. Mailing Address -All correspondence is sent to this address. If you would like your CPA/accountant to receive your tax forms please list address on separate sheet .

Street Address City State Zip Code

3. Business Phone Number 4. Fax Number 5. Email Address

6. List INDIVIDUALS who are owners, officers, and members. (REQUIRED) Note: . Partnerships, LLPs and multi-member

LLCs must have at least 2 owners/officers/individuals listed. Attach a separate sheet if necessary.

6A. Name (last name, first name, middle initial) Phone Number Social Security Number

Address (street, city,state, zip code) Title

6B. Name (last name, first name, middle initial) Phone Number Social Security Number

Address (street, city,state, zip code) Title

Rev. 11/19

Continue to Section 4 on Page 2 Page 1 of 3