Enlarge image

DR 0021W (08/20/20)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

*DO=NOT=SEND* Tax.Colorado.gov

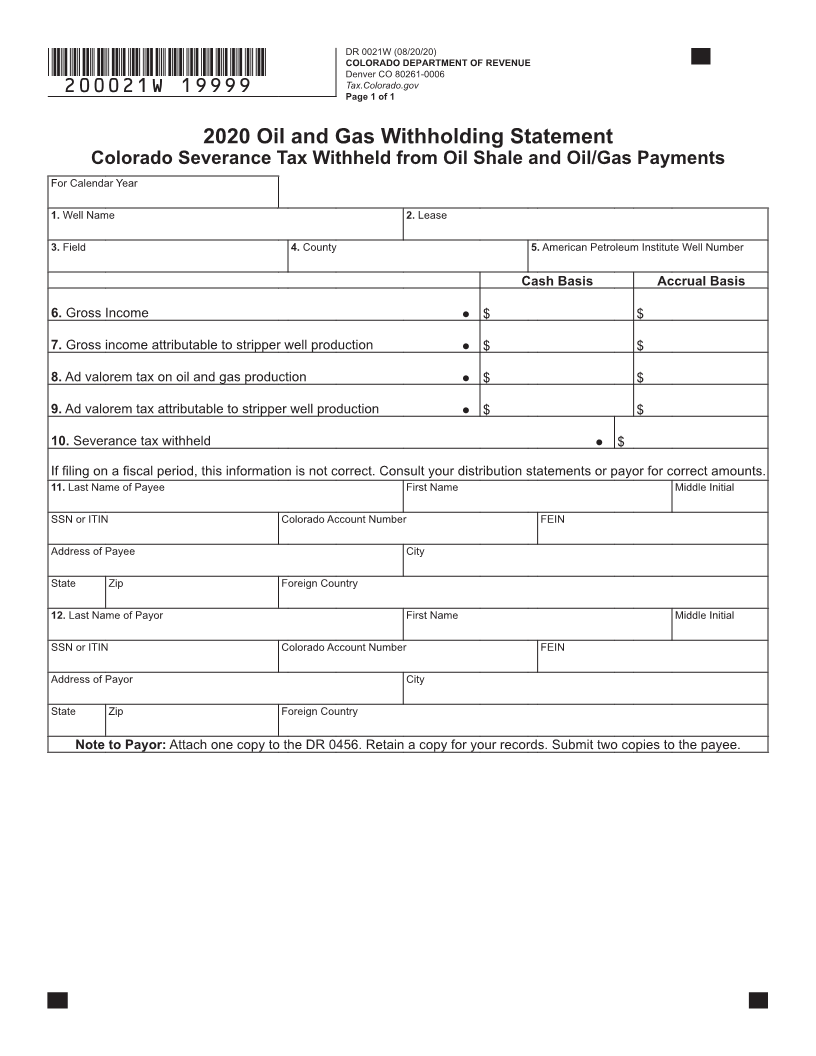

Instructions for Producers and First Purchasers

Preparing DR 0021W for Severance Taxpayers

See form on Page 2

Box 1–5 Enter the information requested. Line 8 Enter the amount of ad valorem tax on both cash

Line 6 Enter the total gross income (before 1% withholding, and accrual basis. For cash basis, report only ad

ad valorem, etc.,) made to the interest owner on both actually paid to the county assessors

valorem taxes

during the year. For accrual basis, report the

a cash basis and accrual basis. For cash basis, actual

report all payments made during the year even if ad valorem tax amount assessed at the mill levy

they are for prior period production or are take or date (usually in November or December) within the

year.

pay payments for future production. For accrual

basis, report payments on all production during the Line 9 Enter that amount of ad valorem tax for both the

calendar year, even if they are not disbursed to the cash and accrual basis that related to oil and gas

interest owner within the year. production from a stripper well.

Line 7 Enter that portion of payments, on both the cash Line 10 Enter amount of severance tax actually withheld and

and accrual basis, that are from tax-exempt oil remitted to Colorado Department of Revenue for the

and gas production from a stripper well. calendar year.

Box 11 Enter information as required.

and 12

This form may be reproduced in this format in a manner compatible with computer generation.

Instructions for Recipients of DR 0021W

Any producer, working, royalty or other interest owner of oil You must attach one copy of this form to your “Colorado

and gas produced in Colorado is required to pay severance Severance Tax Return” (DR 0021) in order to claim credits.

tax. Every producer or first purchaser is required to If you need additional information about severance tax, see

withhold 1% of the gross income paid to every owner, and publication FYI General 4, "Severance Tax Information for

to supply an Oil and Gas Withholding Statement by March Owners of any Interest in any Oil and Gas Produced in

1 of each year. Colorado," on our Web site Tax.Colorado.gov

This Oil and Gas Withholding Statement form lists your

gross income from the property indicated and the amount

the producer or first purchaser has withheld. It also lists

your share of any ad valorem taxes paid.