Enlarge image

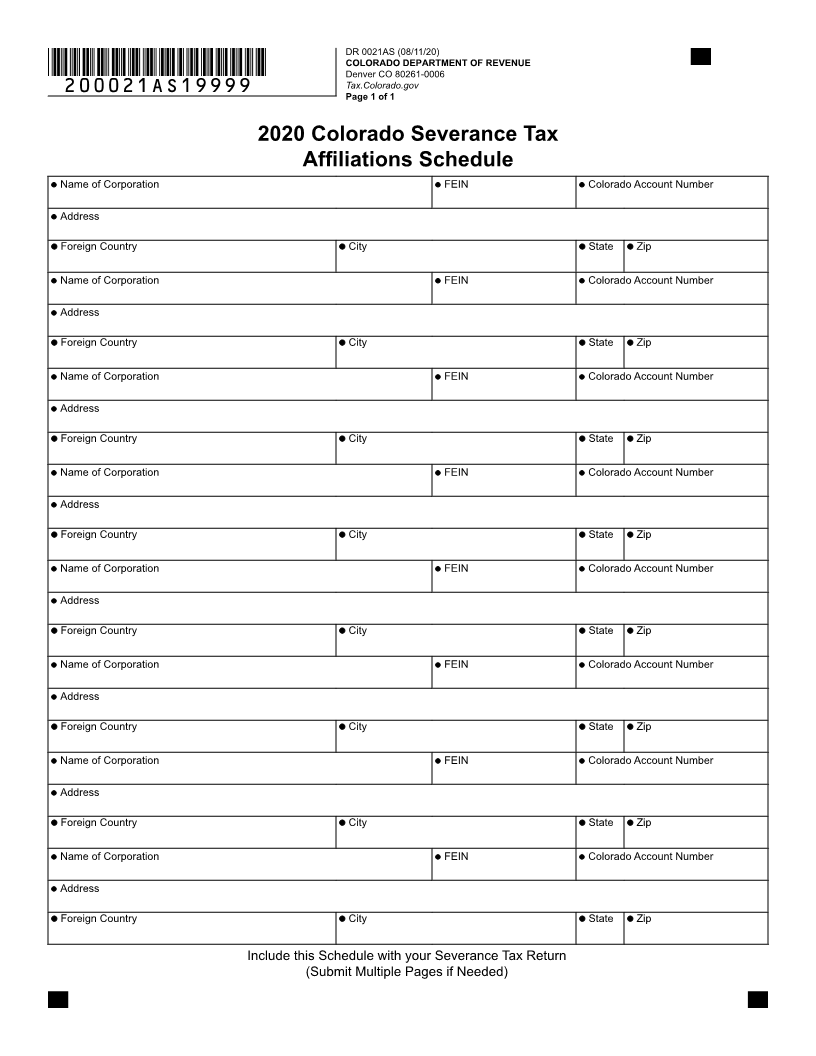

DR 0021AS (08/11/20)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

*DO=NOT=SEND* Tax.Colorado.gov

Colorado Severance Tax Affiliations Schedule Instructions

(see page 2 for form)

For Colorado severance tax purposes, persons A controlled group of corporations is any parent-

who are members of the same controlled group of subsidiary or brother-sister group of related

corporations are treated as one taxpayer. corporations where 50% or more of the beneficial

interests in such corporations is owned by the

The term “controlled group of corporations” has the

same or related persons taking into account only

meaning defined by Section 613A of the Internal

persons who own at least 5% of the beneficial

Revenue Code of 1986.

interest.

Additional forms and information are available at

Tax.Colorado.gov or by calling 303-238-SERV(7378).