Enlarge image

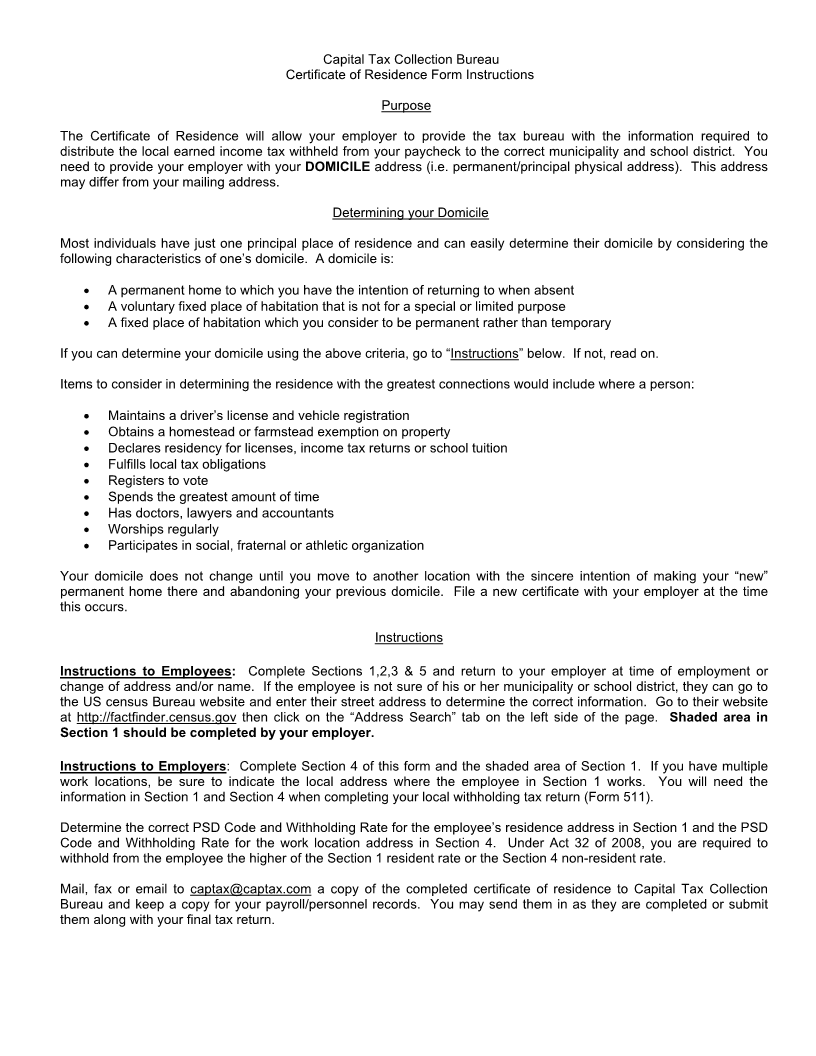

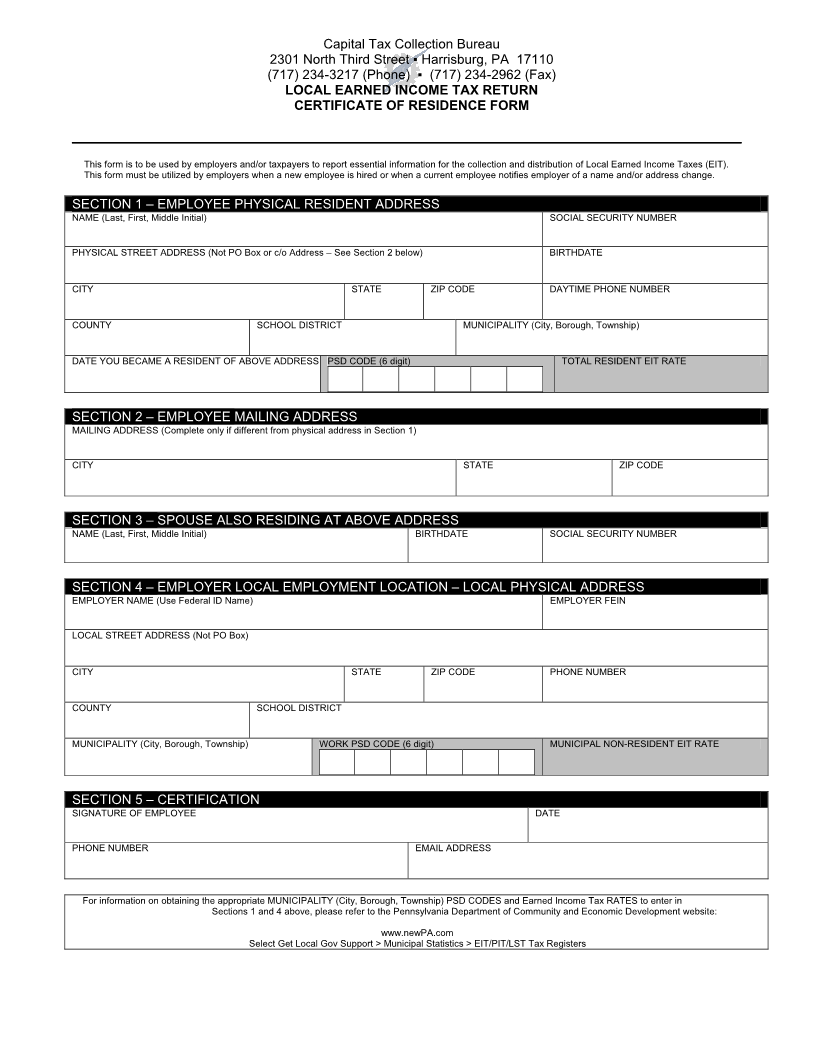

Capital Tax Collection Bureau

2301 North Third Street ▪ Harrisburg, PA 17110

(717) 234-3217 (Phone) ▪ (717) 234-2962 (Fax)

LOCAL EARNED INCOME TAX RETURN

CERTIFICATE OF RESIDENCE FORM

__________________________________________________________________________________________

This form is to be used by employers and/or taxpayers to report essential information for the collection and distribution of Local Earned Income Taxes (EIT).

This form must be utilized by employers when a new employee is hired or when a current employee notifies employer of a name and/or address change.

SECTION 1 – EMPLOYEE PHYSICAL RESIDENT ADDRESS

NAME (Last, First, Middle Initial) SOCIAL SECURITY NUMBER

PHYSICAL STREET ADDRESS (Not PO Box or c/o Address – See Section 2 below) BIRTHDATE

CITY STATE ZIP CODE DAYTIME PHONE NUMBER

COUNTY SCHOOL DISTRICT MUNICIPALITY (City, Borough, Township)

DATE YOU BECAME A RESIDENT OF ABOVE ADDRESS PSD CODE (6 digit) TOTAL RESIDENT EIT RATE

SECTION 2 – EMPLOYEE MAILING ADDRESS

MAILING ADDRESS (Complete only if different from physical address in Section 1)

CITY STATE ZIP CODE

SECTION 3 – SPOUSE ALSO RESIDING AT ABOVE ADDRESS

NAME (Last, First, Middle Initial) BIRTHDATE SOCIAL SECURITY NUMBER

SECTION 4 – EMPLOYER LOCAL EMPLOYMENT LOCATION – LOCAL PHYSICAL ADDRESS

EMPLOYER NAME (Use Federal ID Name) EMPLOYER FEIN

LOCAL STREET ADDRESS (Not PO Box)

CITY STATE ZIP CODE PHONE NUMBER

COUNTY SCHOOL DISTRICT

MUNICIPALITY (City, Borough, Township) WORK PSD CODE (6 digit) MUNICIPAL NON-RESIDENT EIT RATE

SECTION 5 – CERTIFICATION

SIGNATURE OF EMPLOYEE DATE

PHONE NUMBER EMAIL ADDRESS

For information on obtaining the appropriate MUNICIPALITY (City, Borough, Township) PSD CODES and Earned Income Tax RATES to enter in

Sections 1 and 4 above, please refer to the Pennsylvania Department of Community and Economic Development website:

www.newPA.com

Select Get Local Gov Support > Municipal Statistics > EIT/PIT/LST Tax Registers