Enlarge image

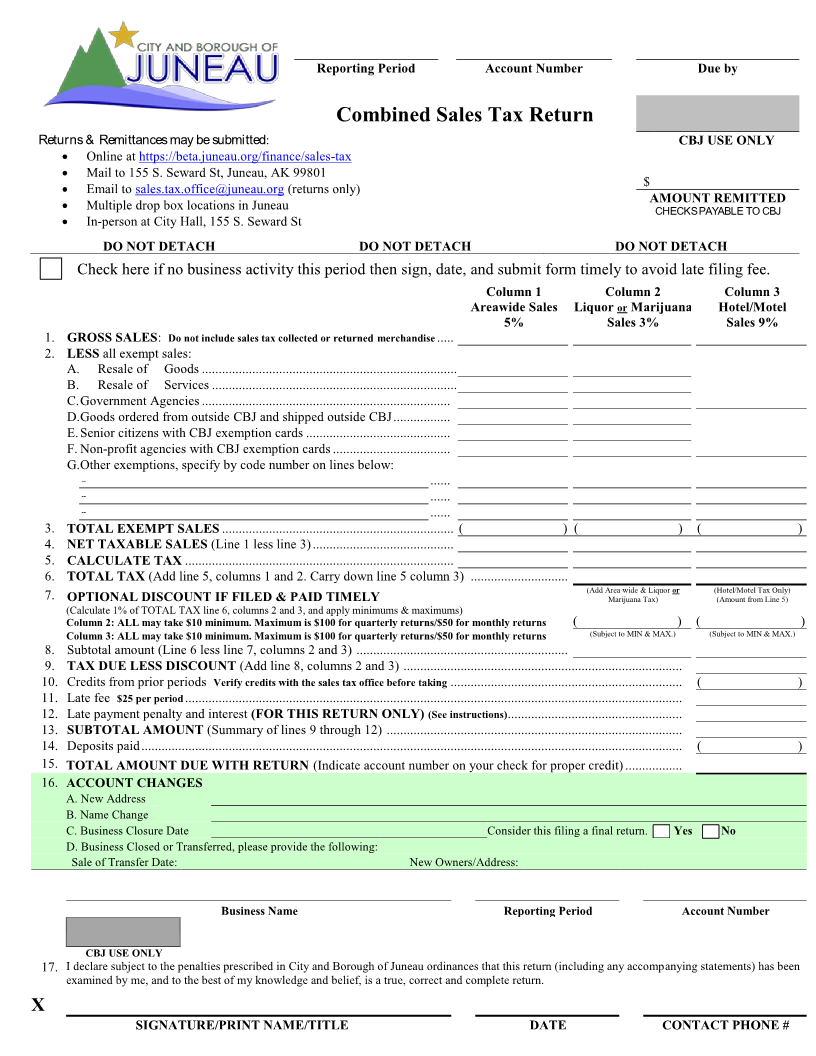

Reporting Period Account Number Due by

Combined Sales Tax Return

Returns & Remittances may be submitted: CBJ USE ONLY

Online at https://beta.juneau.org/finance/sales-tax

Mail to 155 S. Seward St, Juneau, AK 99801

$

Email to sales.tax.office@juneau.org (returns only)

AMOUNT REMITTED

Multiple drop box locations in Juneau CHECKS PAYABLE TO CBJ

In-person at City Hall, 155 S. Seward St

DO NOT DETACH DO NOT DETACH DO NOT DETACH

Check here if no business activity this period then sign, date, and submit form timely to avoid late filing fee.

Column 1 Column 2 Column 3

Areawide Sales Liquor Marijuanaor Hotel/Motel

5% Sales 3% Sales 9%

1. GROSS SALES : Do not include sales tax collected or returned merchandise .....

2. LESS all exempt sales:

A. Resale of Goods ............................................................................

B. Resale of Services .........................................................................

C. Government Agencies ..........................................................................

D. Goods ordered from outside CBJ and shipped outside CBJ .................

E. Senior citizens with CBJ exemption cards ...........................................

F. Non-profit agencies with CBJ exemption cards ...................................

G. Other exemptions, specify by code number on lines below:

-- ......

-- ......

-- ......

3. TOTAL EXEMPT SALES ..................................................................... ( ) ( ) ( )

4. NET TAXABLE SALES (Line 1 less line 3) ..........................................

5. CALCULATE TAX ................................................................................

6. TOTAL TAX (Add line 5, columns 1 and 2. Carry down line 5 column 3) .............................

(Add Area wide & Liquor or (Hotel/Motel Tax Only)

7. OPTIONAL DISCOUNT IF FILED & PAID TIMELY Marijuana Tax) (Amount from Line 5)

(Calculate 1% of TOTAL TAX line 6, columns 2 and 3, and apply minimums & maximums)

Column 2: ALL may take $10 minimum. Maximum is $100 for quarterly returns/$50 for monthly returns ( ) ( )

Column 3: ALL may take $10 minimum. Maximum is $100 for quarterly returns/$50 for monthly returns (Subject to MIN & MAX.) (Subject to MIN & MAX.)

8. Subtotal amount (Line 6 less line 7, columns 2 and 3) ...............................................................

9. TAX DUE LESS DISCOUNT (Add line 8, columns 2 and 3) ...................................................................................

10. Credits from prior periods Verify credits with the sales tax office before taking ..................................................................... ( )

11. Late fee $25 per period ....................................................................................................................................................

12. Late payment penalty and interest (FOR THIS RETURN ONLY) (See instructions) ....................................................

13. SUBTOTAL AMOUNT (Summary of lines 9 through 12) ........................................................................................

14. Deposits paid ................................................................................................................................................................. ( )

15. TOTAL AMOUNT DUE WITH RETURN (Indicate account number on your check for proper credit) .................

16. ACCOUNT CHANGES

A. New Address

B. Name Change

C. Business Closure Date Consider this filing a final return. Yes No

D. Business Closed or Transferred, please provide the following:

Sale of Transfer Date: New Owners/Address:

Business Name Reporting Period Account Number

CBJ USE ONLY

17. I declare subject to the penalties prescribed in City and Borough of Juneau ordinances that this return (including any accompanying statements) has been

examined by me, and to the best of my knowledge and belief, is a true, correct and complete return.

X

SIGNATURE/PRINT NAME/TITLE DATE CONTACT PHONE #