Enlarge image

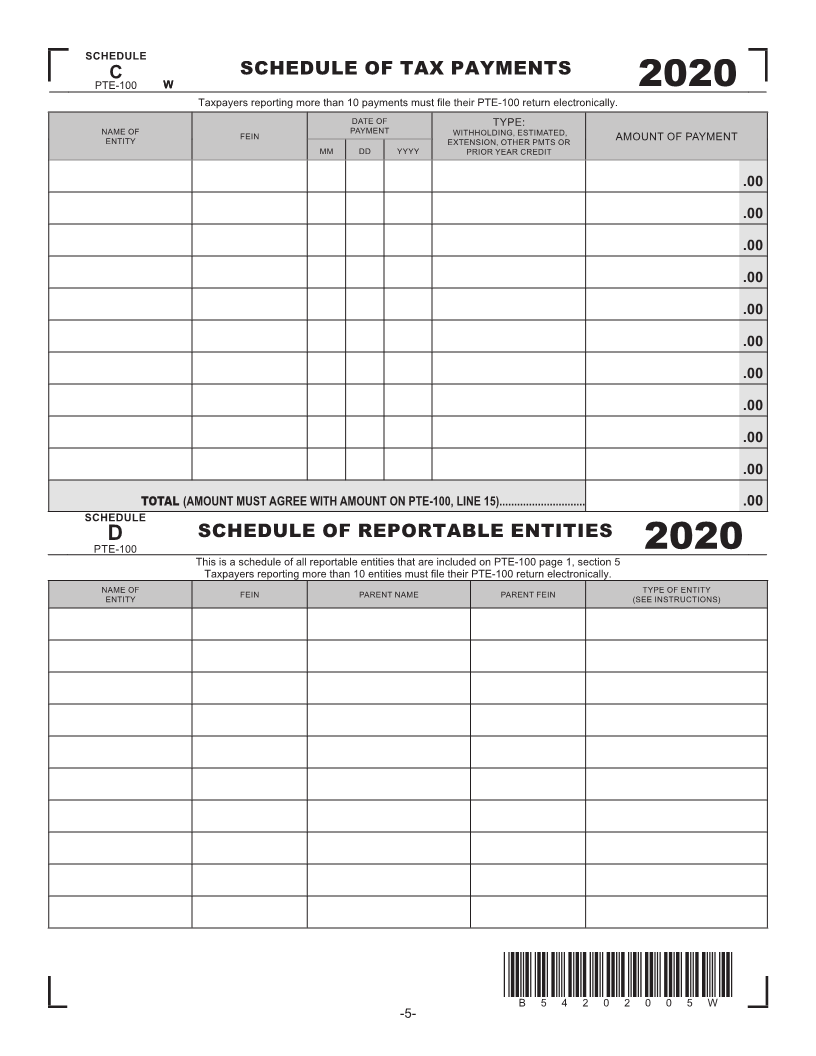

SCHEDULE

C SCHEDULE OF TAX PAYMENTS

PTE-100 W W 2020

Taxpayers reporting more than 10 payments must file their PTE-100 return electronically.

DATE OF TYPE:

NAME OF FEIN PAYMENT WITHHOLDING, ESTIMATED, AMOUNT OF PAYMENT

ENTITY EXTENSION, OTHER PMTS OR

MM DD YYYY PRIOR YEAR CREDIT

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

TOTAL (AMOUNT MUST AGREE WITH AMOUNT ON PTE-100, LINE 15)............................. .00

SCHEDULE

D SCHEDULE OF REPORTABLE ENTITIES

PTE-100 2020

This is a schedule of all reportable entities that are included on PTE-100 page 1, section 5

Taxpayers reporting more than 10 entities must file their PTE-100 return electronically.

NAME OF FEIN PARENT NAME PARENT FEIN TYPE OF ENTITY

ENTITY (SEE INSTRUCTIONS)

*B54202005W*

B 5 4 2 0 2 0 0 5 W

-5-