Enlarge image

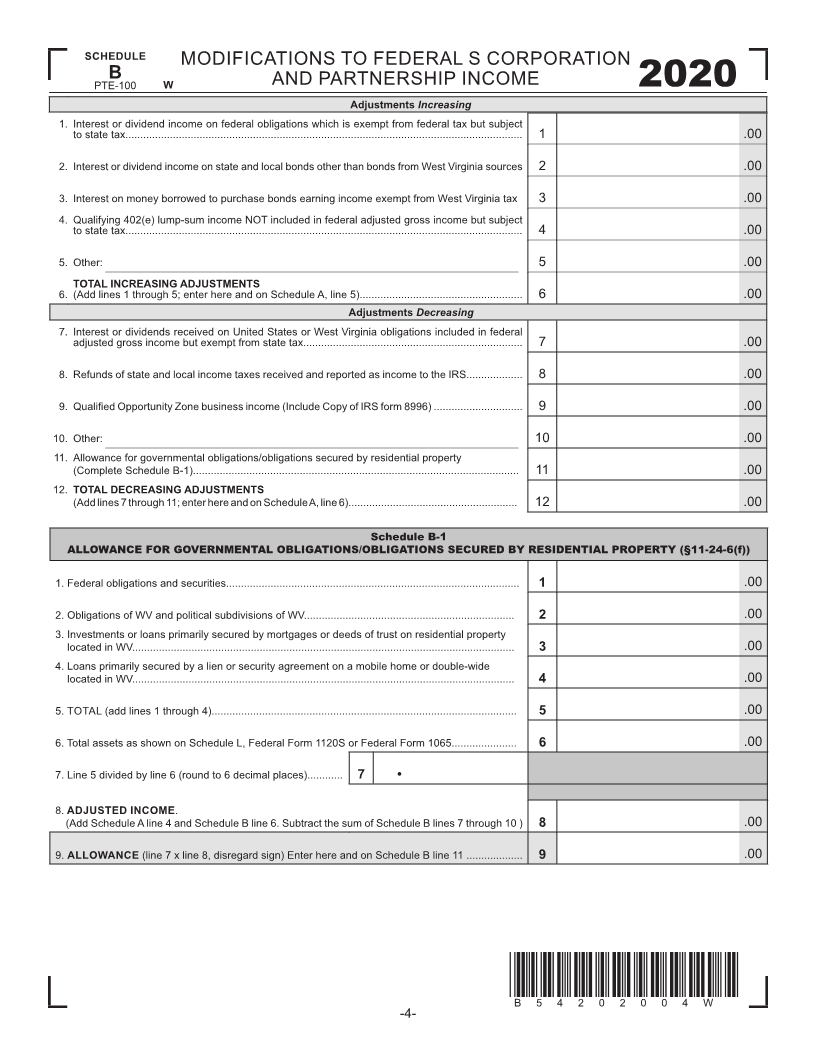

SCHEDULE MODIFICATIONS TO FEDERAL S CORPORATION

B AND PARTNERSHIP INCOME

PTE-100 W

2020

Adjustments Increasing

1. Interest or dividend income on federal obligations which is exempt from federal tax but subject

to state tax...................................................................................................................................... 1 .00

2. Interest or dividend income on state and local bonds other than bonds from West Virginia sources 2 .00

3. Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax 3 .00

4. Qualifying 402(e) lump-sum income NOT included in federal adjusted gross income but subject

to state tax...................................................................................................................................... 4 .00

5. Other: 5 .00

TOTAL INCREASING ADJUSTMENTS

6. (Add lines 1 through 5; enter here and on Schedule A, line 5)....................................................... 6 .00

Adjustments Decreasing

7. Interest or dividends received on United States or West Virginia obligations included in federal

adjusted gross income but exempt from state tax.......................................................................... 7 .00

8. Refunds of state and local income taxes received and reported as income to the IRS................... 8 .00

9. Qualified Opportunity Zone business income (Include Copy of IRS form 8996) .............................. 9 .00

10. Other: 10 .00

11. Allowance for governmental obligations/obligations secured by residential property

(Complete Schedule B-1).............................................................................................................. 11 .00

12. TOTAL DECREASING ADJUSTMENTS

(Add lines 7 through 11; enter here and on Schedule A, line 6)......................................................... 12 .00

Schedule B-1

ALLOWANCE FOR GOVERNMENTAL OBLIGATIONS/OBLIGATIONS SECURED BY RESIDENTIAL PROPERTY (§11-24-6(f))

1. Federal obligations and securities................................................................................................... 1 .00

2. Obligations of WV and political subdivisions of WV....................................................................... 2 .00

3.Investments or loans primarily secured by mortgages or deeds of trust on residential property

located in WV................................................................................................................................. 3 .00

4.Loans primarily secured by a lien or security agreement on a mobile home or double-wide

located in WV................................................................................................................................. 4 .00

5. TOTAL (add lines 1 through 4)....................................................................................................... 5 .00

6. Total assets as shown on Schedule L, Federal Form 1120S or Federal Form 1065...................... 6 .00

7. Line 5 divided by line 6 (round to 6 decimal places)............ 7 •

8. ADJUSTED INCOME.

(Add Schedule A line 4 and Schedule B line 6. Subtract the sum of Schedule B lines 7 through 10 ) 8 .00

9. ALLOWANCE (line 7 x line 8, disregard sign) Enter here and on Schedule B line 11 ................... 9 .00

*B54202004W*

B 5 4 2 0 2 0 0 4 W

-4-