Enlarge image

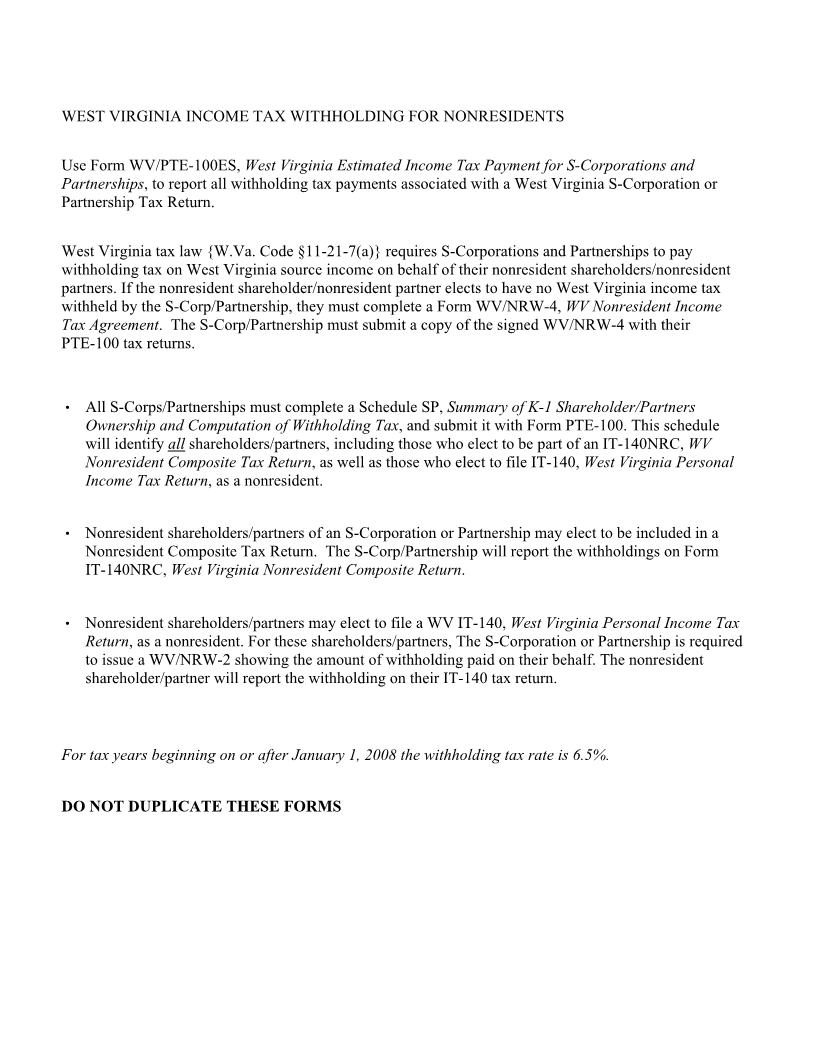

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 11751

Charleston, WV 25339-1751

_____________________________________________________________

NameTEST CORPORATION 1 Letter Id: L1924415488

1001_____________________________________________________________ LEE ST E Issued: 10/23/2018

AddressCHARLESTON WV 25301-1725 Account #: 2270-2288

_____________________________________________________________ Period: 12/31/2019

City State Zip

WEST VIRGINIA ESTIMATED

INCOME TAX PAYMENT FOR S CORPORATIONS AND PARTNERSHIPS

WV/PTE-100ES

rtL067 v.5

Account ID: Taxable Year End: Payment Due Date:

TYPE OF PARTNERSHIP FILING S CORPORATION FILING

ORGANIZATION: FORM WV/PTE-100 FORM WV/PTE-100

(CHECK ONLY ONE)

Nonresident Withholding Tax Payment.

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 11751 , Charleston, WV 25339-1751

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

B 5 5 2 0 1 8 0 1 W