Enlarge image

West Virginia

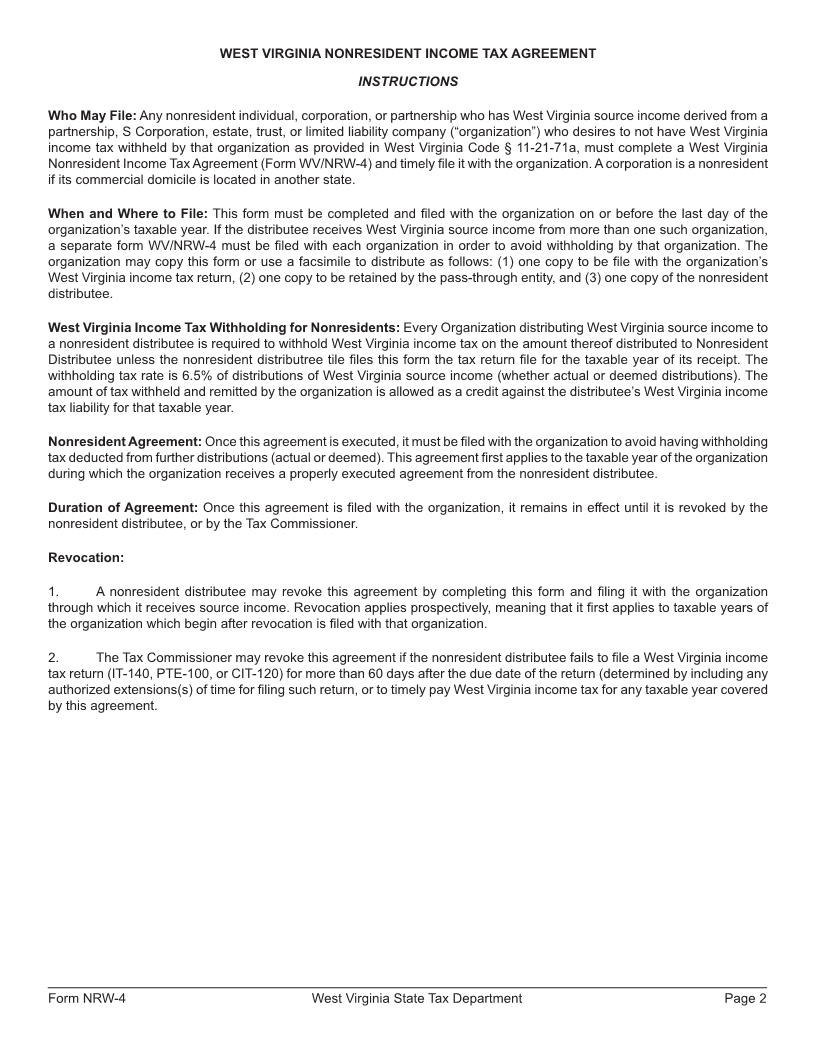

West Virginia Nonresident Income Tax Agreement

NRW-4 State Tax

REV. 02/2021 Read Instructions on Reverse Side Department

Part I

ORGANIZATION NAME AND MAILING ADDRESS NONRESIDENT NAME AND MAILING ADDRESS

Name (please type or print) Name (please type or print)

Post O ffice or Street Address Post O ffice or Street Address

City/Town State Zip Code City/Town State Zip Code

West Virginia Federal Social Security Number or Federal Spouse’s

Identi fication Number Identi fication Number Identi fication Number Social Security Number

Type of Organization: (check only one) Type of Nonresident:

Partnership S Corporation Estate Individual Corporation Partnership

Trust Limited Liability Company Nonresident’s Taxable Year:

Taxable Year of Organiation: Calender Year

Calender Year Fiscal Year Ending ________________________________________

Fiscal Year Ending ____________________________ State of Residence or Commercial Domicile:_______________________

State of Commercial Domicile: ______________________

Internal Revenue Service center where organization’s federal return Internal Revenue Service center where nonresident’s federal return is

is filed: fi led:

City____________________________________ State______________ City____________________________________ State_______________

Part II

I declare that the above-named Distributee is a nonresident of West Virginia and that the nonresident Distributee hereby agrees to timely le Westfi

Virginia Income Tax Returns (Form IT-140, CIT-120, or PTE-100) and pay any income tax due; that the Distributee will include in that return the portion

of the above-named Organization’s West Virginia income or gain attributable to the nonresident Distributee’s interest in such Organization for the

taxable year of the Distributee during which this Form is ledfiwith the Organization and for each succeeding taxable year for which the Distributee

receives actual or deemed distributions of West Virginia source income or gain; and that this Agreement remains in e ffect until it is revoked by either the

Distributee or the Tax Commissioner.

SIGN

HERE

(Signature of Nonresident Partner, Shareholder, or Bene ficiary, or of an Authorized Corporate O fficer)

(Print Name Signed Above

(Mailing Address if Di fferent from above) (Date)

Part III

NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT

WARNING: COMPLETE ONLY IF REVOKING AGREEMENT

Notice is hereby given that the West Virginia Nonresident Income Tax Agreement (Form WV/NRW-4) previously executed by or on behalf of the

above-named Nonresident is revoked for taxable years of the above-name Organization (Pass-through entity) that begins after today’s date.

SIGN

HERE

(Signature of Nonresident Partner, Shareholder, or Bene ficiary, or of an Authorized Corporate O fficer)

(Print Named Signed Above)

(Mailing Address if Di fferent from Above) (Date)

Form NRW-4 West Virginia State Tax Department Page 1