Enlarge image

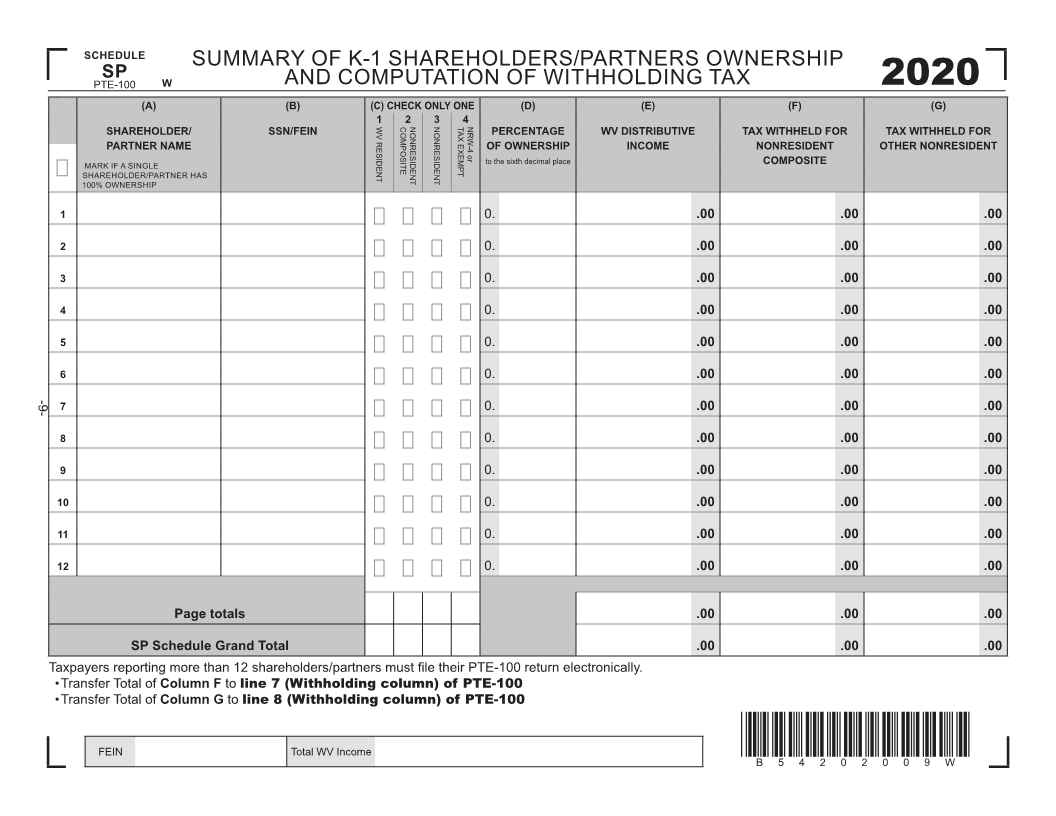

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

W

(G) 9

0

2020 TAX WITHHELD FOR OTHER NONRESIDENT 0

2

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 0

2

4

(F)

5

COMPOSITE

NONRESIDENT B

TAX WITHHELD FOR *B54202009W*

.00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

(E)

INCOME

WV DISTRIBUTIVE

(D)

PERCENTAGE OF OWNERSHIP to the sixth decimal place 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0.

4 NRW-4 or

TAX EXEMPT

3 NONRESIDENT

fi

2 NONRESIDENT

COMPOSITE

(C)CHECK ONLY ONE 1 WV RESIDENT

AND COMPUTATION OF WITHHOLDING TAX (B) Total WV Income

SSN/FEIN

line 7 (Withholding column) of PTE-100 line 8 (Withholding column) of PTE-100

to to

SUMMARY OF K-1 SHAREHOLDERS/PARTNERS OWNERSHIP

Page totals

W Column F Column G

(A)

SP Schedule Grand Total

SP SHAREHOLDER/ PARTNER NAME

PTE-100 FEIN

SCHEDULE MARK IF A SINGLE SHAREHOLDER/PARTNER HAS 100% OWNERSHIP

1 2 3 4 5 6 7 8 9 10 11 12 • Transfer Total of • Transfer Total of

Taxpayers reporting more than 12 shareholders/partners must le their PTE-100 return electronically.

-9-