Enlarge image

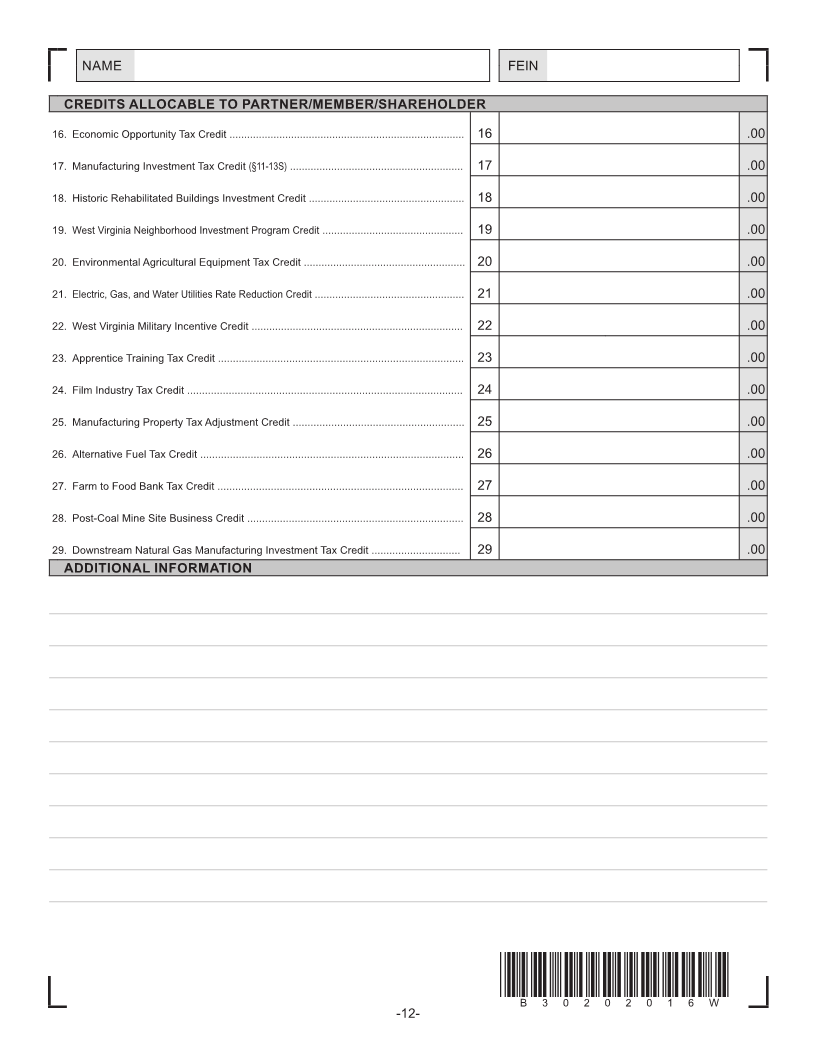

Schedule of WV Partner/Shareholder/Member/Benefi ciary Information

K-1C FROM SP

REV 7-20 for Corporations Subject to Corporate Income Tax

2020

TAXABLE YEAR OF ORGANIZATION

BEGINNING ENDING

MM/DD/YYYY MM/DD/YYYY

ORGANIZATION NAME (please type or print) NAME OF PARTNER/SHAREHOLDER/MEMBER/BENEFICIARY

STREET or POST OFFICE BOX STREET or POST OFFICE BOX

CITY STATE ZIP CITY STATE ZIP

WV IDENTIFICATION NUMBER FEIN FEIN WV IDENTIFICATION NUMBER

CHECK 1. Income subject to withholding for nonresident as reported on

ONE: S Corporation organization’s S Corporation, Partnership or Fiduciary Return $ .00

2. Amount of West Virginia income tax withheld (see instructions)

Limited Liability Company $ .00

PERCENTAGE OF OWNERSHIP

Partnership Fiduciary %

INCOME

1. Distributive pro rata share of income allocable to West Virginia........................................... 1 .00

ADDITIONS

2. Interest or dividend income on federal obligations which is exempt from federal tax but

subject to state tax............................................................................................................ 2 .00

3. Interest or dividend income on state and local bonds other than bonds from West Virginia

sources.............................................................................................................................. 3 .00

4. Interest on money borrowed to purchase bonds earning income exempt from West

Virginia tax......................................................................................................................... 4 .00

5. Any amount not included in federal income that was an eligible contribution for the

Neighborhood Investment Program Tax Credit................................................................. 5 .00

6. Other Income deducted from federal adjusted gross income but subject to state tax...... 6 .00

7. Federal depreciation/amortization for WV water/air pollution control facilities ................... 7 .00

8. Unrelated business taxable income of a corporation exempt from federal tax................... 8 .00

9. Add back expenses for certain REIT’s and RIC’s.............................................................. 9 .00

SUBTRACTIONS

10. Interest or dividends received on United States or West Virginia obligations included in

federal adjusted gross income but exempt from state tax................................................. 10 .00

11. Refunds of state and local income taxes received and reported as income to the IRS.... 11 .00

12. Other income included into federal adjusted gross income but excluded from state

income tax......................................................................................................................... 12 .00

13. Salary expense not allowed on federal return due to claiming the federal jobs credit........ 13 .00

14. Cost of WV water/air pollution control facilities................................................................. 14 .00

15.Allowance for governmental

obligations/obligations secured 15 .00

by residential property

*B30202015W*

B 3 0 2 0 2 0 1 5 W

-11-