Enlarge image

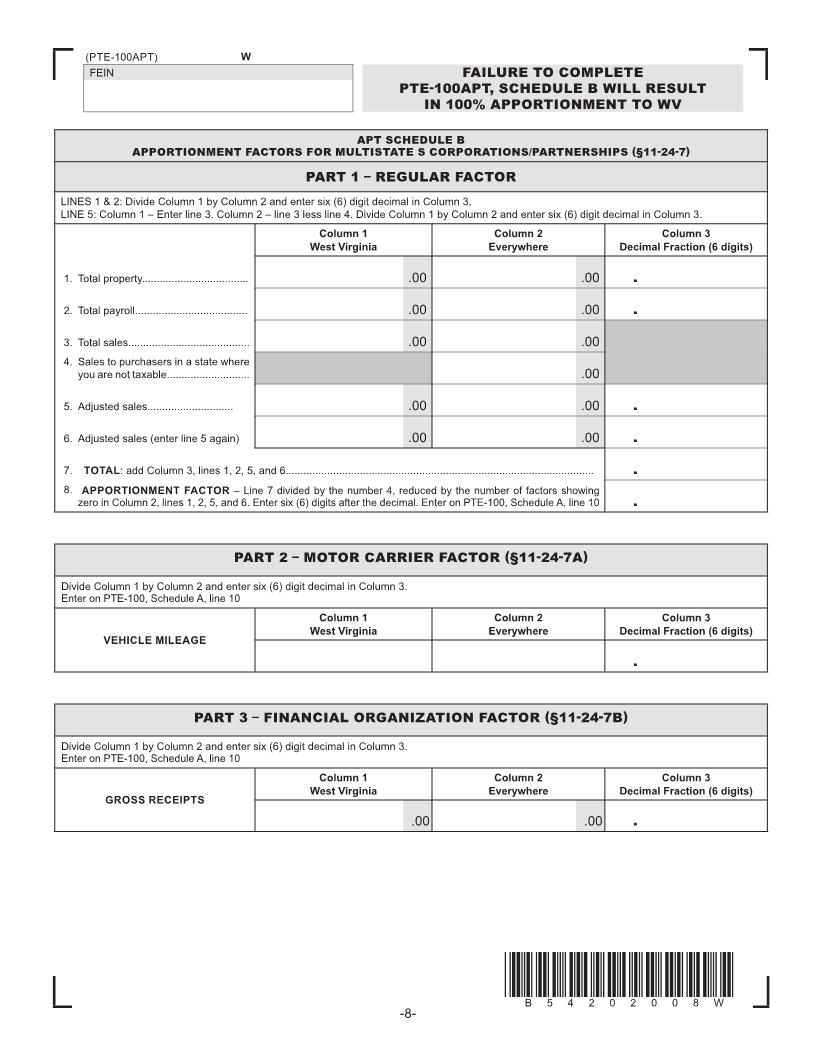

(PTE-100APT) W

FEIN FAILURE TO COMPLETE

PTE-100APT, SCHEDULE B WILL RESULT

IN 100% APPORTIONMENT TO WV

APT SCHEDULE B

APPORTIONMENT FACTORS FOR MULTISTATE S CORPORATIONS/PARTNERSHIPS (§11-24-7)

PART 1 – REGULAR FACTOR

LINES 1 & 2: Divide Column 1 by Column 2 and enter six (6) digit decimal in Column 3.

LINE 5: Column 1 – Enter line 3. Column 2 – line 3 less line 4. Divide Column 1 by Column 2 and enter six (6) digit decimal in Column 3.

Column 1 Column 2 Column 3

West Virginia Everywhere Decimal Fraction (6 digits)

1. Total property.................................... .00 .00 .

2. Total payroll...................................... .00 .00 .

3. Total sales......................................... .00 .00

4. Sales to purchasers in a state where

you are not taxable............................ .00

5. Adjusted sales............................. .00 .00 .

6. Adjusted sales (enter line 5 again) .00 .00 .

7. TOTAL: add Column 3, lines 1, 2, 5, and 6........................................................................................................ .

8. APPORTIONMENT FACTOR – Line 7 divided by the number 4, reduced by the number of factors showing

zero in Column 2, lines 1, 2, 5, and 6. Enter six (6) digits after the decimal. Enter on PTE-100, Schedule A, line 10 .

PART 2 – MOTOR CARRIER FACTOR (§11-24-7A)

Divide Column 1 by Column 2 and enter six (6) digit decimal in Column 3.

Enter on PTE-100, Schedule A, line 10

Column 1 Column 2 Column 3

West Virginia Everywhere Decimal Fraction (6 digits)

VEHICLE MILEAGE

.

PART 3 – FINANCIAL ORGANIZATION FACTOR (§11-24-7B)

Divide Column 1 by Column 2 and enter six (6) digit decimal in Column 3.

Enter on PTE-100, Schedule A, line 10

Column 1 Column 2 Column 3

West Virginia Everywhere Decimal Fraction (6 digits)

GROSS RECEIPTS

.00 .00 .

*B54202008W*

B 5 4 2 0 2 0 0 8 W

-8-