Enlarge image

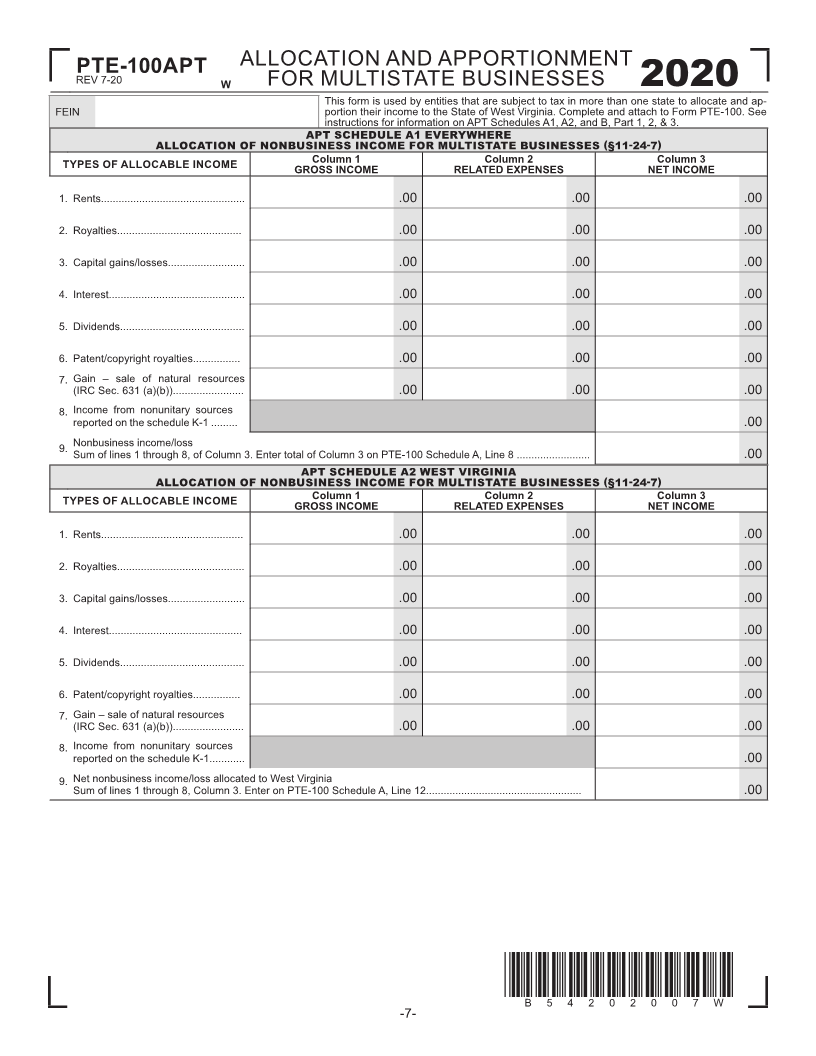

ALLOCATION AND APPORTIONMENT

PTE-100APT

REV 7-20 W FOR MULTISTATE BUSINESSES

2020

This form is used by entities that are subject to tax in more than one state to allocate and ap-

FEIN portion their income to the State of West Virginia. Complete and attach to Form PTE-100. See

instructions for information on APT Schedules A1, A2, and B, Part 1, 2, & 3.

APT SCHEDULE A1 EVERYWHERE

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES (§11-24-7)

TYPES OF ALLOCABLE INCOME Column 1 Column 2 Column 3

GROSS INCOME RELATED EXPENSES NET INCOME

1. Rents................................................. .00 .00 .00

2. Royalties.......................................... .00 .00 .00

3. Capital gains/losses.......................... .00 .00 .00

4. Interest.............................................. .00 .00 .00

5. Dividends.......................................... .00 .00 .00

6. Patent/copyright royalties................ .00 .00 .00

7. Gain – sale of natural resources

(IRC Sec. 631 (a)(b))........................ .00 .00 .00

8. Income from nonunitary sources

reported on the schedule K-1 ......... .00

9. Nonbusiness income/loss

Sum of lines 1 through 8, of Column 3. Enter total of Column 3 on PTE-100 Schedule A, Line 8 ......................... .00

APT SCHEDULE A2 WEST VIRGINIA

ALLOCATION OF NONBUSINESS INCOME FOR MULTISTATE BUSINESSES (§11-24-7)

TYPES OF ALLOCABLE INCOME Column 1 Column 2 Column 3

GROSS INCOME RELATED EXPENSES NET INCOME

1. Rents................................................ .00 .00 .00

2. Royalties........................................... .00 .00 .00

3. Capital gains/losses.......................... .00 .00 .00

4. Interest............................................. .00 .00 .00

5. Dividends.......................................... .00 .00 .00

6. Patent/copyright royalties................ .00 .00 .00

7. Gain – sale of natural resources

(IRC Sec. 631 (a)(b))........................ .00 .00 .00

8. Income from nonunitary sources

reported on the schedule K-1............ .00

9. Net nonbusiness income/loss allocated to West Virginia

Sum of lines 1 through 8, Column 3. Enter on PTE-100 Schedule A, Line 12..................................................... .00

*B54202007W*

B 5 4 2 0 2 0 0 7 W

-7-