Enlarge image

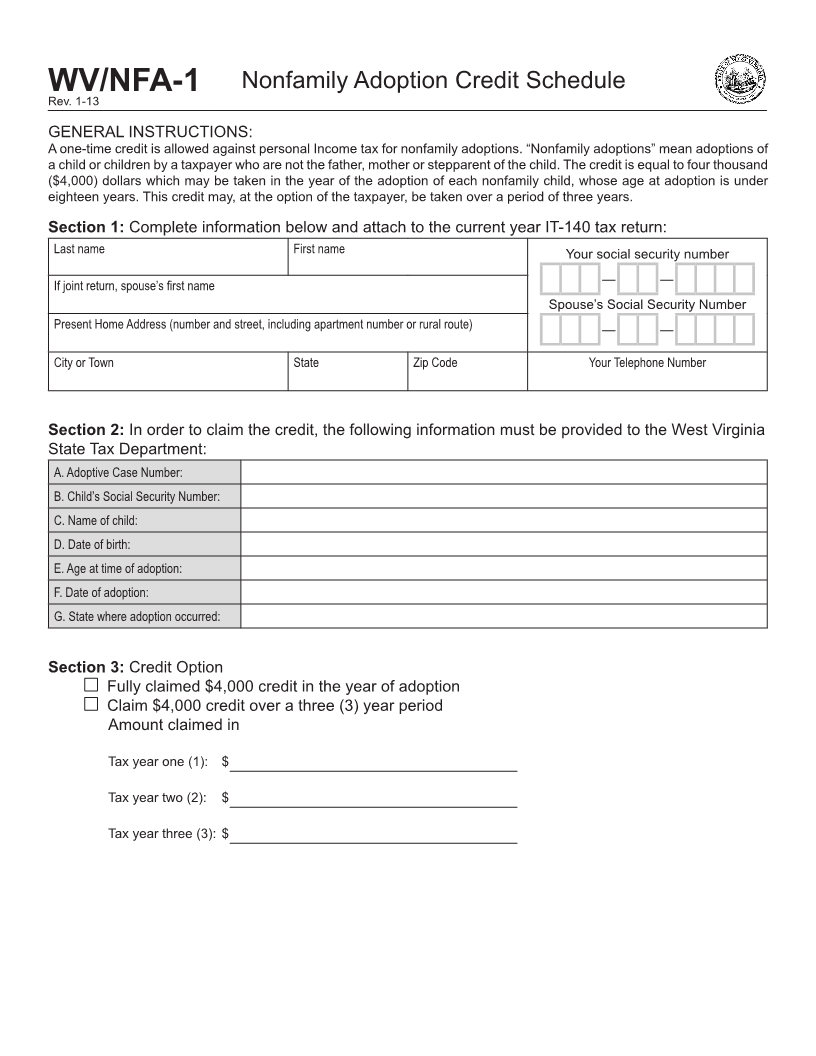

Nonfamily Adoption Credit Schedule

Rev.WV/NFA-11-13

GENERAL INSTRUCTIONS:

A one-time credit is allowed against personal Income tax for nonfamily adoptions. “Nonfamily adoptions” mean adoptions of

a child or children by a taxpayer who are not the father, mother or stepparent of the child. The credit is equal to four thousand

($4,000) dollars which may be taken in the year of the adoption of each nonfamily child, whose age at adoption is under

eighteen years. This credit may, at the option of the taxpayer, be taken over a period of three years.

Section 1: Complete information below and attach to the current year IT-140 tax return:

Last name First name Your social security number

If joint return, spouse’s first name — —

Spouse’s Social Security Number

Present Home Address (number and street, including apartment number or rural route) — —

City or Town State Zip Code Your Telephone Number

Section 2: In order to claim the credit, the following information must be provided to the West Virginia

State Tax Department:

A. Adoptive Case Number:

B. Child’s Social Security Number:

C. Name of child:

D. Date of birth:

E. Age at time of adoption:

F. Date of adoption:

G. State where adoption occurred:

Section 3: Credit Option

Fully claimed $4,000 credit in the year of adoption

Claim $4,000 credit over a three (3) year period

Amount claimed in

Tax year one (1): $

Tax year two (2): $

Tax year three (3): $