- 6 -

Enlarge image

|

Col.D IfthebeneficiaryisanonresidentofWestVirginiaandtheEstateorTrustwillsatisfythewithholdingrequirementsbutthe

beneficiarywillbefilinganonresidentIT 140toreporttheincome,checkthiscolumn.YoumustcompletecolumnsD,F,and ‐

H.AWVNRW 2,tobefiledassupportingdocumentationforthenonresidentIT140,mustbeprovidedtoallnonresident‐ ‐

beneficiariesmakingthiselection.

Col.E Check this column if you have received or previously had on file, a completed Form WV NRW 4 from this non‐ resident ‐

beneficiary.DonotcompletecolumnsFthroughHifyoucheckedcolumnE.

Col.F EntertheamountofWestVirginiasourceincomeallocatedtothisnon residentbeneficiary. ‐

Col.H MultiplythedollaramountincolumnFbythetaxrateincolumnGandentertheresultincolumnH.

Line6 TotalcolumnsFandH :IfyouhaveattachedadditionalcopiesofScheduleSB,enterthegrandtotalofthecolumnsfromall

thecopiesofScheduleSBonthefirstScheduleSBandlabelthefiguresas“grandtotal”.Transfertheappropriatecolumn

totalstothefrontofthereturn.

SCHEDULEB:WESTVIRGINIAFIDUCIARYMODIFICATIONS

The income of the estate, trust, or QFT for federal tax purposes may be subject to a fiduciary modification for West Virginia tax

purposes.SomeofthesemodificationsincreaseandothersdecreaseincomeforWestVirginiataxpurposes.Thenetmodificationmay

be a plus or a minus figure. In column I, enter the total amount of all additions and subtractions. On line 12, column I, enter the

difference between the additions and subtractions. If this is a complex trust or estate, or a simple trust having taxable income,

completecolumnIIbyenteringthatshareofthemodificationwhichisallocabletotheestate,trust,orQFT.ElectingSmallBusiness

Trusts(ESBT) IncomefromanESBTnotshowninfederaltaxableincomeshouldbereportedonLine5,ElectingSmallBusinessTrust ‐

Additions. Losses from an ESBT not shown in federal taxable income should be reported on Line 10, Electing Small Business Trust

Subtractions.

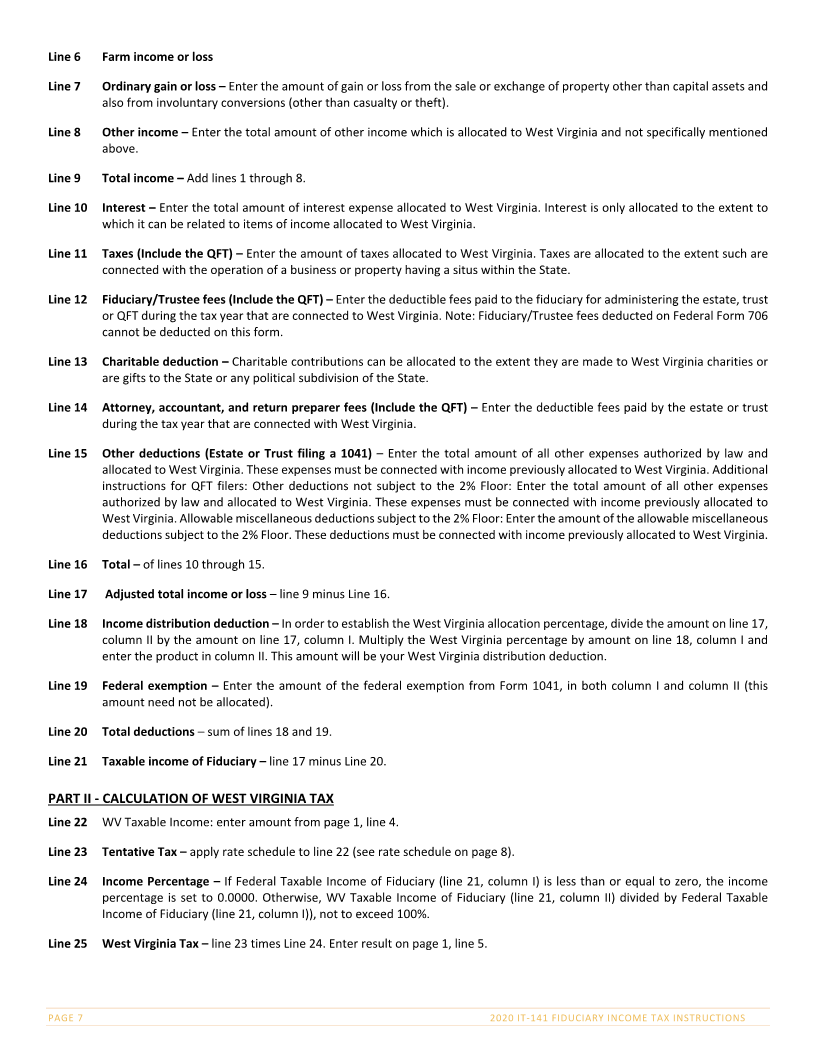

SCHEDULENR

ScheduleNRmustbecompletedforallnon residentestatesandtrusts,includingtheQualifiedFuneralTrust(QFT)havingitemsof‐

income,gainordeductionderivedfromWestVirginiasources.ScheduleNRisdesignedtoconformtothefederalfiduciaryorQFT

return. Column I must be completed regardless of the source of income, gain or deduction. These figures are taken directly from

Federal Form1041 or 1041 QFT.‐ In column II, enter theamount which is attributable to or connected with West Virginia sources.

BecauseoftheconformityofallamountsincolumnIofScheduleNRtothefederalreturn,theinstructionsforthefederalreturnare

equallyapplicablehere.TheinstructionsbelowrelateonlytocolumnII,tobeusedbynon residentestatesandtrusts,includingthe ‐

QFT,forallocationofincomeanddeductionstoWestVirginiaandfordeterminingtheWestVirginiaincomedistributiondeduction

andWestVirginiataxableincome.Pleasenotethatinthecaseofatrust,thefederalincomeusedinthecalculationoftheincome

percentage(Line24)mustbeincreasedbytheamountofanygain,reducedbyanydeductions,uponwhichtaxisimposedunder§

644oftheInternalRevenueCode.

INSTRUCTIONSFORCOLUMNII

EnterthatamountwhichisattributabletoWestVirginiaonly

Lines1and2Interestanddividends(IncludetheQFT) –InterestanddividendsshouldbeallocatedtoWestVirginiaonlytotheextent

thatsuchincomeisfrompropertyemployedinabusiness,trade,professionoroccupationcarriedoninthisState.

Line3 Businessincomeorloss –Entertheamountofgrossprofitorlossfromanytrade,businessorprofessioncarriedonwithin

WestVirginia.IfseparateaccountingisnotmaintainedfortheWestVirginiabusiness,incomederivedfrombusinesscarried

onbothwithinandoutsideoftheStatemustbeallocatedbyafairandequitablemethod;andsuchmethodofallocation

mustbeexplainedbyaseparatestatementattachedtothereturn.

Line4 Capitalgainorloss(IncludetheQFT)– Capitalgainorloss:Enterthenetamountofgainsorlossesfromcapitalassets.The

netgainsorlossesallocabletoWestVirginiaarethosefromthesaleorexchangeofpropertyhavingasituswithintheState.

Line5 Rents,royalties,partnerships,otherestatesandtrusts– Entertheamountofgrossrentsandroyaltiesreceivedfromreal

ortangiblepersonalpropertyhavingasitusinWestVirginia.Also,entertheamountofincomefrompartnershipsandother

fiduciaries.Thiswouldbetheproportionateshareofincomefromaresidentpartnership,estateortrust,orfromtheWest

Virginiaportionofanon residentpartnership,estateortrust.‐

PAGE6 2020IT ‐ 141FIDUCIARYINCOMETAXINSTRUCTIONS

|