Enlarge image

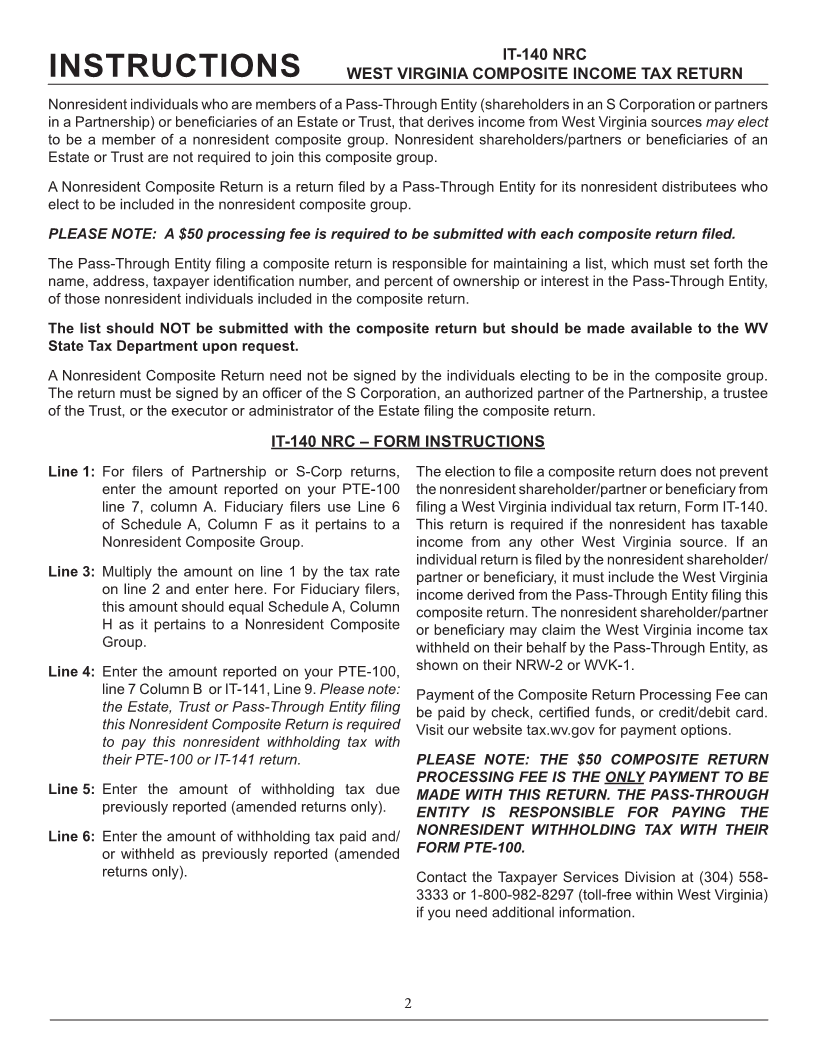

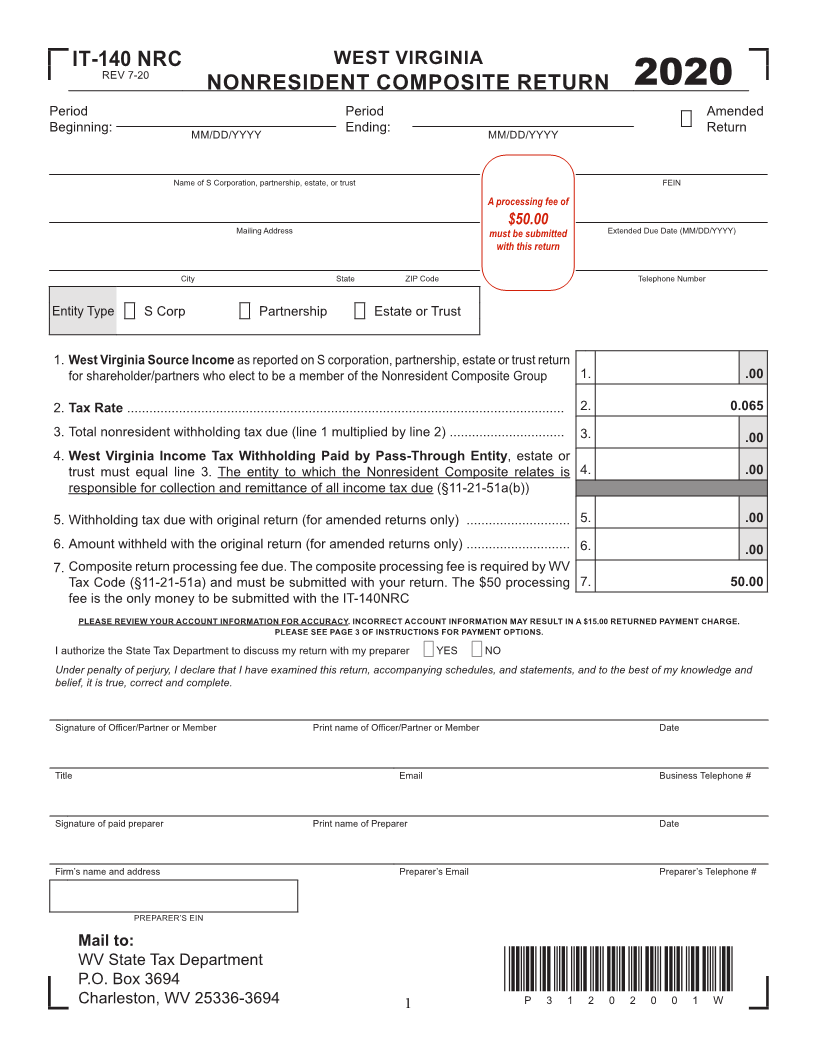

IT-140 NRC WEST VIRGINIA

REV 7-20

NONRESIDENT COMPOSITE RETURN 2020

Period Period Amended

Beginning: MM/DD/YYYY Ending: MM/DD/YYYY Return

Name of S Corporation, partnership, estate, or trust FEIN

A processing fee of

$50.00

Mailing Address must be submitted Extended Due Date (MM/DD/YYYY)

with this return

City State ZIP Code Telephone Number

Entity Type S Corp Partnership Estate or Trust

1. West Virginia Source Income as reported on S corporation, partnership, estate or trust return

for shareholder/partners who elect to be a member of the Nonresident Composite Group 1. .00

2. Tax Rate ...................................................................................................................... 2. 0.065

3. Total nonresident withholding tax due (line 1 multiplied by line 2) ............................... 3. .00

4. West Virginia Income Tax Withholding Paid by Pass-Through Entity, estate or

trust must equal line 3. The entity to which the Nonresident Composite relates is 4. .00

responsible for collection and remittance of all income tax due (§11-21-51a(b))

5. Withholding tax due with original return (for amended returns only) ............................ 5. .00

6. Amount withheld with the original return (for amended returns only) ............................ 6. .00

7. Composite return processing fee due. The composite processing fee is required by WV

Tax Code (§11-21-51a) and must be submitted with your return. The $50 processing 7. 50.00

fee is the only money to be submitted with the IT-140NRC

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

PLEASE SEE PAGE 3 OF INSTRUCTIONS FOR PAYMENT OPTIONS.

I authorize the State Tax Department to discuss my return with my preparer YES NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and

belief, it is true, correct and complete.

Signature of O fficer/Partner or Member Print name of O fficer/Partner or Member Date

Title Email Business Telephone #

Signature of paid preparer Print name of Preparer Date

Firm’s name and address Preparer’s Email Preparer’s Telephone #

PREPARER’S EIN

Mail to:

WV State Tax Department

P.O. Box 3694 *P31202001W*

Charleston, WV 25336-3694 1 P 3 1 2 0 2 0 0 1 W