Enlarge image

West Virginia

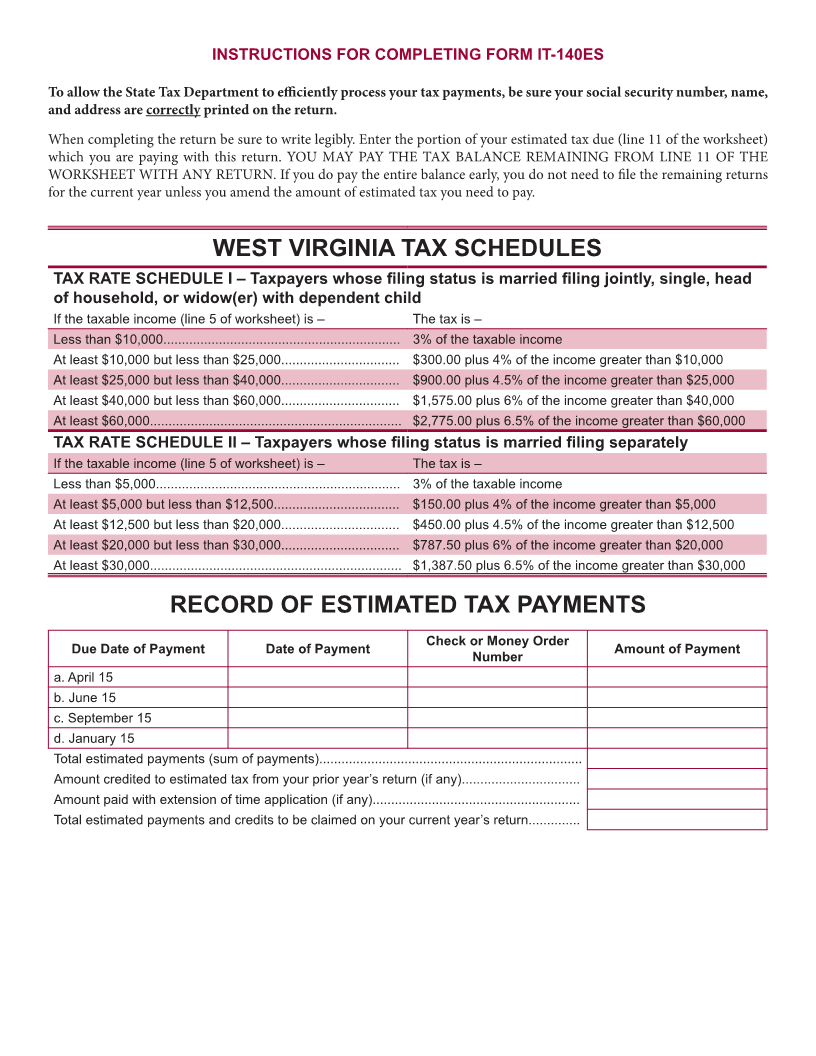

InstructIons for M akIng EstIMatEd t ax P ayMEnts

What is estimated tax? Estimated tax is the income tax you Commissioner at six month intervals, but cannot be less

expect to owe, less the amount of any income tax credits than eight percent (8%).

you expect to receive. Income tax withheld from any of

your income is treated as an estimated tax payment for the What are the exceptions to the penalty? Under certain

purpose of determining your estimated tax. Therefore, your criteria, you may not be subject to the penalty for

estimated tax is your expected income tax for the year less underpayment of estimated tax. The exceptions are:

the sum of the following credits which you expect to have, 1. If your estimated tax liability is less than $600; in

such as: Family Tax Credit, Credit for Income Tax Paid other words, if your estimated tax reduced by your tax

to Another State, or Senior Citizens Credit for Property withheld is less than $600, no penalty will be imposed.

Taxes Paid. Refer to Publication TSD-110 for additional tax

credits. This Publication is available on our web site www. 2. If you prepay, through tax withholding and estimated

wvtax.gov or by calling our Taxpayer Services Division at tax payments, one hundred percent of the tax shown

(304) 558-3333 or 1-800-982-8297 on normal business days on your return for the preceding year. This exception is

between 8:00 a.m. and 5:00 p.m. determined on an installment by installment basis. For

example, a taxpayer must prepay twenty-five percent

Who must make estimated tax payments? You must make (100% times one-fourth) of the prior year tax by the first

quarterly estimated tax payments if your estimated tax quarterly installment due date to meet the exception for

liability (your estimated tax reduced by any state tax withheld that quarter; making a lump sum payment later in the

from your income) is at least $600, unless that liability is year will not eliminate the penalty due for that quarter.

less than ten percent of your estimated tax. Taxpayers who

are required to make estimated tax payments but wait until 3. If you prepay, through tax withholding and estimated

late in the tax year to make a lump sum payment will be tax payments, the portion of the tax which would be

penalized for not making the earlier required payments. due if you annualized the income earned so far this year.

This exception is also determined on an installment by

NOTE: If your estimated tax liability is more than $600 and installment basis. Many taxpayers who have varying

your primary income source is wage and salary income, you levels of income throughout the year will qualify for this

may want to adjust your withholding. File a new Form IT- exception for some quarters in which their income is

104 (Employee Withholding Exemption Certificate) with low.

your employer to adjust the state tax withheld from your

income. 4. If you had no West Virginia tax liability for the preceding

year, no penalty will be imposed if (a) the preceding tax

How much estimated tax must I pay? Use the Estimated Tax year was a twelve month period, (b) you were a citizen or

Worksheet on page 3 to calculate your estimated tax liability. resident of the United States throughout the preceding

The amount shown on line 11 is the minimum amount tax year, and (c) your current year liability is less than

required to be paid as estimated tax payments throughout $5,000.

the year.

When are my estimated payments due? Current year

What if I don’t pay enough estimated tax? If you have not quarterly installments are typically due April 15, June 15,

prepaid at least ninety percent (90%) of your estimated tax and September 15 with the fourth quarter due January 15 of

by the appropriate due dates, a penalty will be added to your the following year. If the due date falls on Saturday, Sunday,

tax liability unless you qualify for one of the exceptions. or a legal holiday, the payment is due the next business day.

The penalty is calculated using Form IT-210 (Underpayment A payment placed in the mail, postmarked on or before the

of Estimated Tax by Individuals) and is equal to the amount due date, is considered timely paid.

determined by applying the current interest rate for tax What is the minimum amount required to be paid with

underpayments to the underpayment for the period of each voucher? The minimum payment required with each

time the underpayment exists. The annual interest rate voucher is determined by dividing the amount remaining

for tax underpayments is determined by the State Tax

IT-140 ESI irginia State Tax Department Page 1

Rev. 3/13