Enlarge image

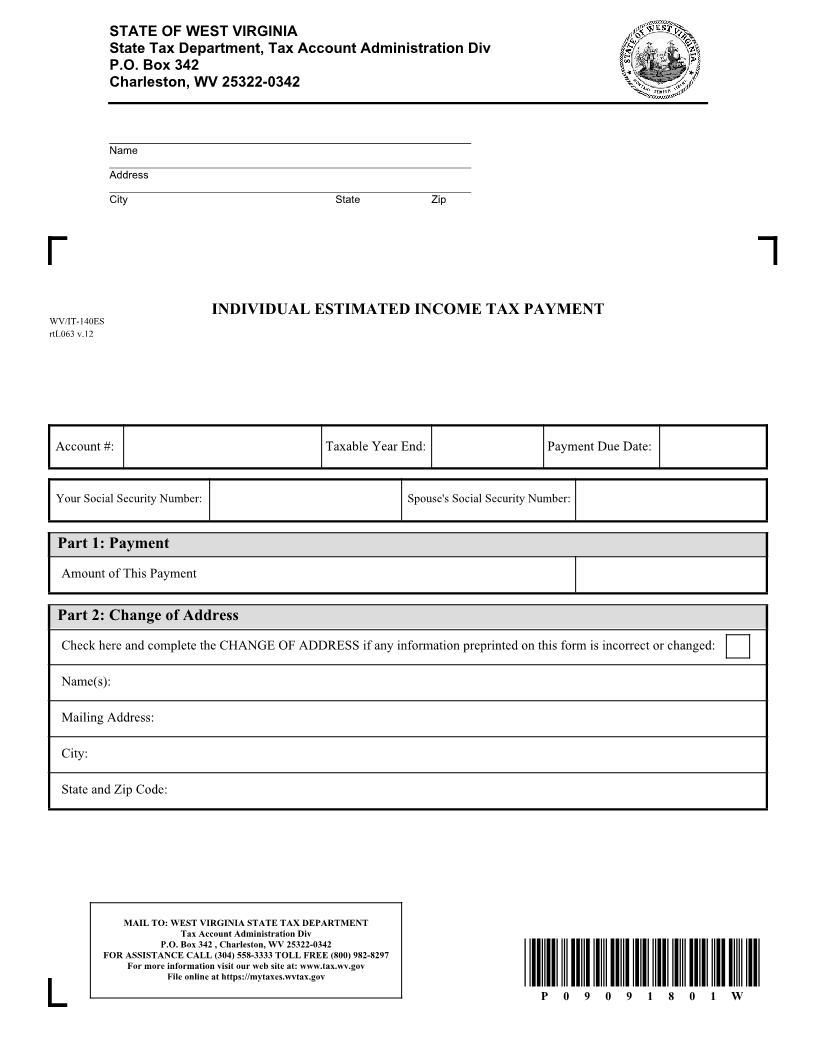

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV 25322-0342

_____________________________________________________________

NameDONNA J. AAROE Letter Id: L0045367296

17_____________________________________________________________ CLUB HOUSE DR Issued: 02/01/2019

AddressEVANS WV 25241-9402 Account #: 2094-9145

_____________________________________________________________ Period: 12/31/2018

City State Zip

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

WV/IT-140ES

rtL063 v.12

Account #: Taxable Year End: Payment Due Date:

Your Social Security Number: Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV 25322-0342

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W