Enlarge image

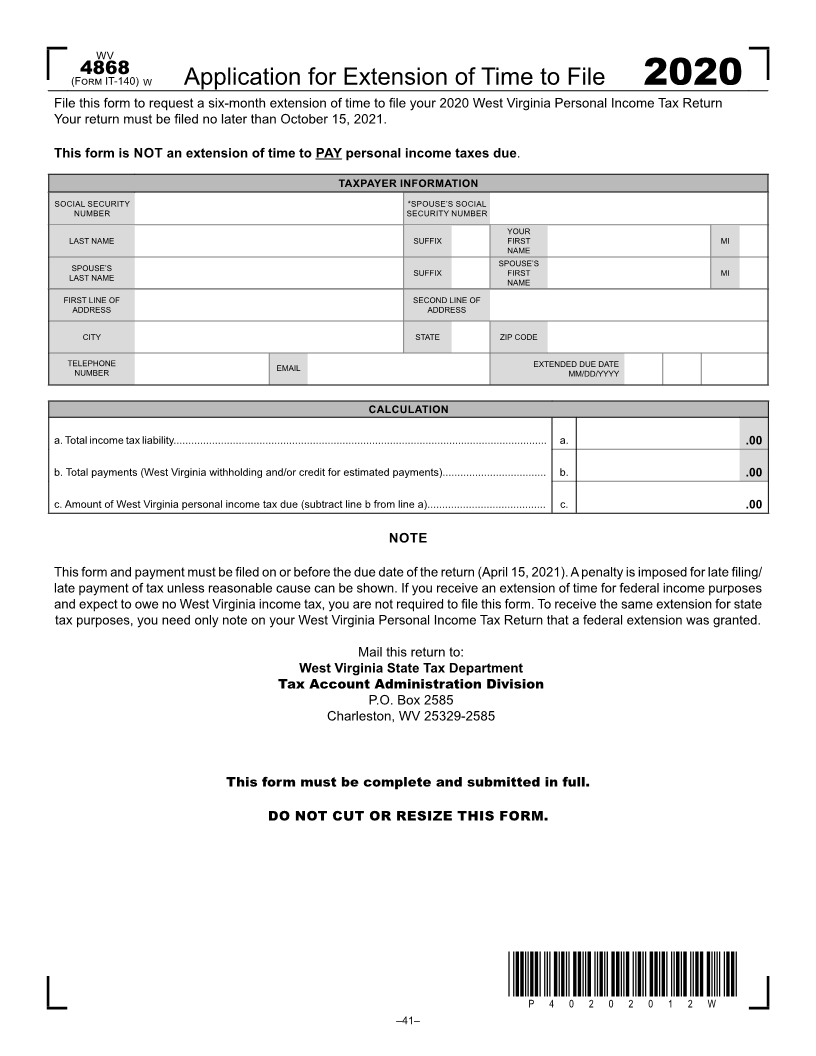

WV

4868

(F IT-140) W Application for Extension of Time to File 2020

File this form to request a six-month extension of time to file your 2020 West Virginia Personal Income Tax Return

Your return must be filed no later than October 15, 2021.

This form is NOT an extension of time to PAY personal income taxes due.

TAXPAYER INFORMATION

SOCIAL SECURITY *SPOUSE’S SOCIAL

NUMBER SECURITY NUMBER

YOUR

LAST NAME SUFFIX FIRST MI

NAME

SPOUSE’S

SPOUSE’S SUFFIX FIRST MI

LAST NAME NAME

FIRST LINE OF SECOND LINE OF

ADDRESS ADDRESS

CITY STATE ZIP CODE

TELEPHONE EMAIL EXTENDED DUE DATE

NUMBER MM/DD/YYYY

CALCULATION

a. Total income tax liability.............................................................................................................................. a. .00

b. Total payments (West Virginia withholding and/or credit for estimated payments)................................... b. .00

c. Amount of West Virginia personal income tax due (subtract line b from line a)........................................ c. .00

NOTE

This form and payment must be fi led on or before the due date of the return (April 15, 2021). A penalty is imposed forfi late ling/

late payment of tax unless reasonable cause can be shown. If you receive an extension of time for federal income purposes

and expect to owe no West Virginia income tax, you are not requiredfito le this form. To receive the same extension for state

tax purposes, you need only note on your West Virginia Personal Income Tax Return that a federal extension was granted.

Mail this return to:

West Virginia State Tax Department

Tax Account Administration Division

P.O. Box 2585

Charleston, WV 25329-2585

This form must be complete and submitted in full.

DO NOT CUT OR RESIZE THIS FORM.

*P40202012W*

P 4 0 2 0 2 0 1 2 W

–41–