Enlarge image

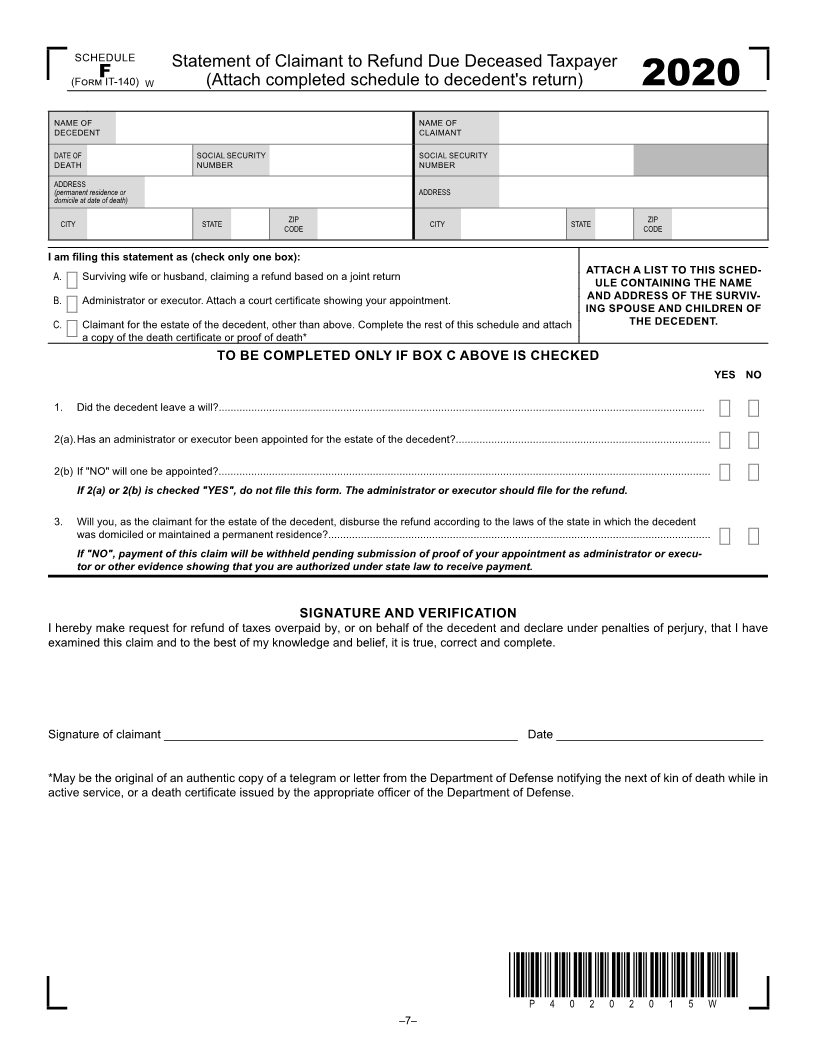

SCHEDULE

Statement of Claimant to Refund Due Deceased Taxpayer

(F IT-140)F W (Attach completed schedule to decedent's return)

2020

NAME OF NAME OF

DECEDENT CLAIMANT

DATE OF SOCIAL SECURITY SOCIAL SECURITY

DEATH NUMBER NUMBER

ADDRESS

(permanent residence or ADDRESS

domicile at date of death)

CITY STATE ZIP CITY STATE ZIP

CODE CODE

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME

B. Administrator or executor. Attach a court certificate showing your appointment. AND ADDRESS OF THE SURVIV-

ING SPOUSE AND CHILDREN OF

C. Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach THE DECEDENT.

a copy of the death certificate or proof of death*

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3. Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu-

tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have

examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in

active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202015W*

P 4 0 2 0 2 0 1 5 W

–7–