Enlarge image

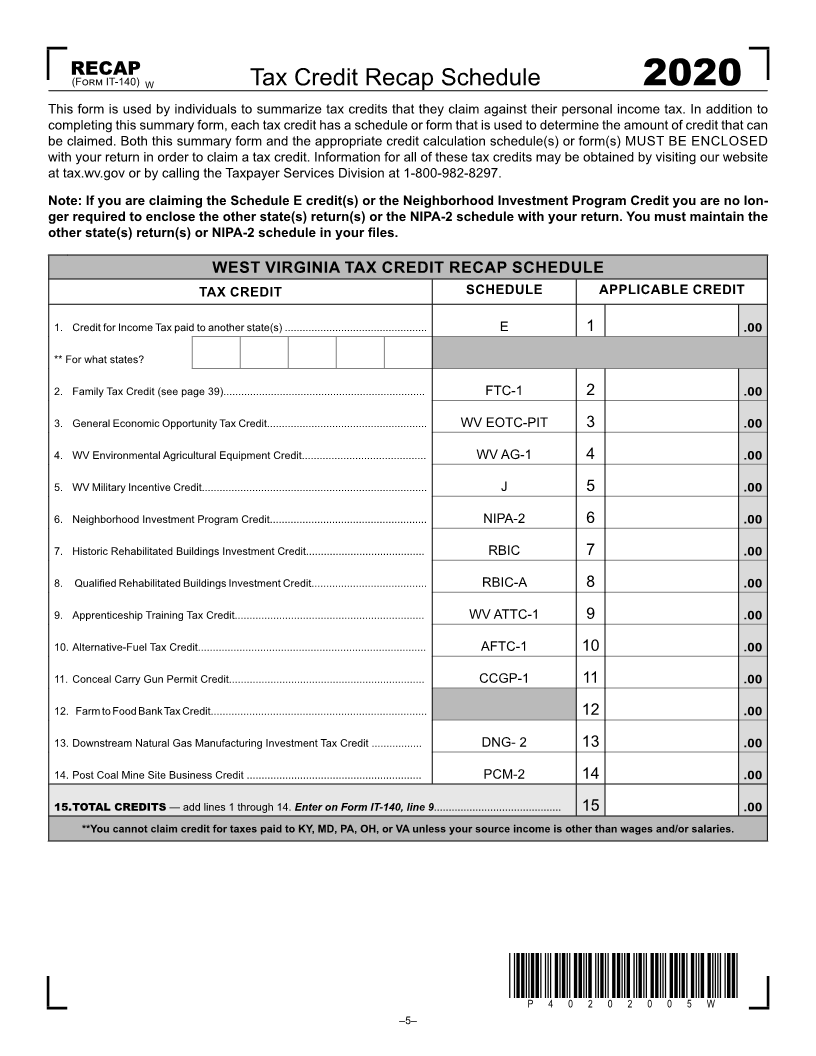

RECAP

(F IT-140) W Tax Credit Recap Schedule 2020

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to

completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can

be claimed. Both this summary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED

with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website

at tax.wv.gov or by calling the Taxpayer Services Division at 1-800-982-8297.

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no lon-

ger required to enclose the other state(s) return(s) or the NIPA-2 schedule with your return. You must maintain the

other state(s) return(s) or NIPA-2 schedule in your files.

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

TAX CREDIT SCHEDULE APPLICABLE CREDIT

1. Credit for Income Tax paid to another state(s) ................................................ E 1 .00

** For what states?

2. Family Tax Credit (see page 39).................................................................... FTC-1 2 .00

3. General Economic Opportunity Tax Credit...................................................... WV EOTC-PIT 3 .00

4. WV Environmental Agricultural Equipment Credit.......................................... WV AG-1 4 .00

5. WV Military Incentive Credit............................................................................ J 5 .00

6. Neighborhood Investment Program Credit..................................................... NIPA-2 6 .00

7. Historic Rehabilitated Buildings Investment Credit........................................ RBIC 7 .00

8. Quali edfi Rehabilitated Buildings Investment Credit....................................... RBIC-A 8 .00

9. Apprenticeship Training Tax Credit................................................................ WV ATTC-1 9 .00

10. Alternative-Fuel Tax Credit............................................................................. AFTC-1 10 .00

11. Conceal Carry Gun Permit Credit.................................................................. CCGP-1 11 .00

12. Farm to Food Bank Tax Credit......................................................................... 12 .00

13. Downstream Natural Gas Manufacturing Investment Tax Credit ................. DNG- 2 13 .00

14. Post Coal Mine Site Business Credit ........................................................... PCM-2 14 .00

15. TOTAL CREDITS — add lines 1 through 14. Enter on Form IT-140, line 9........................................... 15 .00

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202005W*

P 4 0 2 0 2 0 0 5 W

–5–