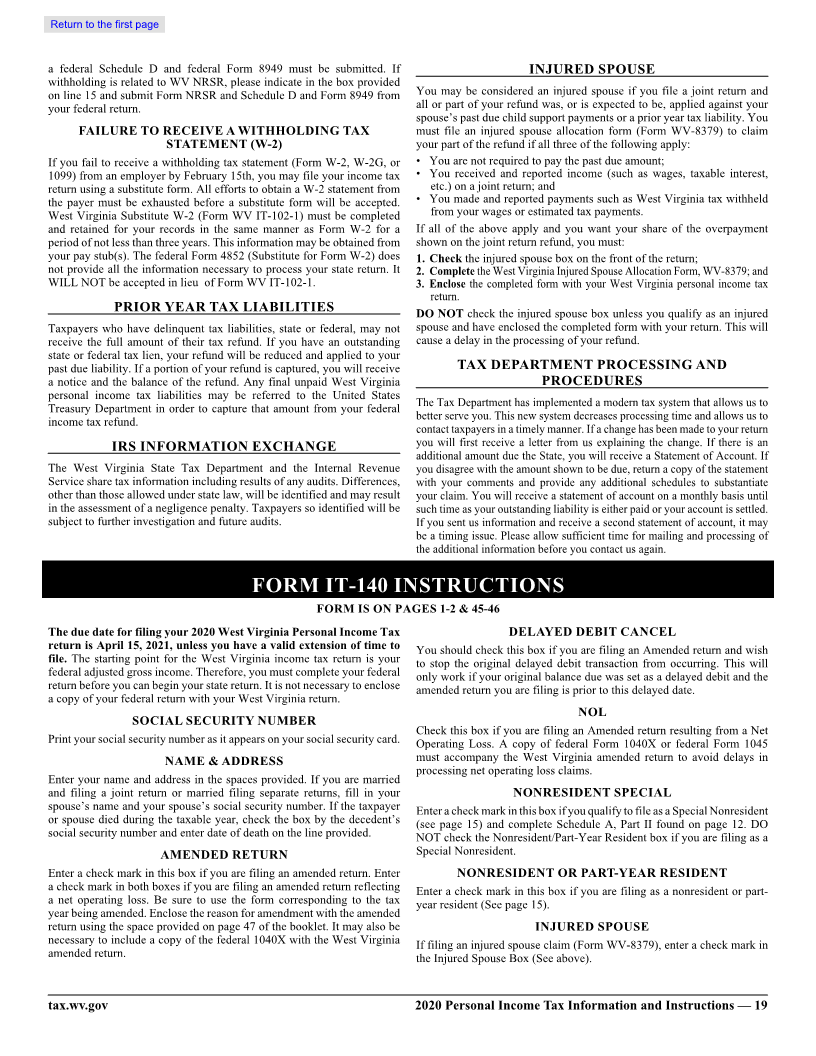

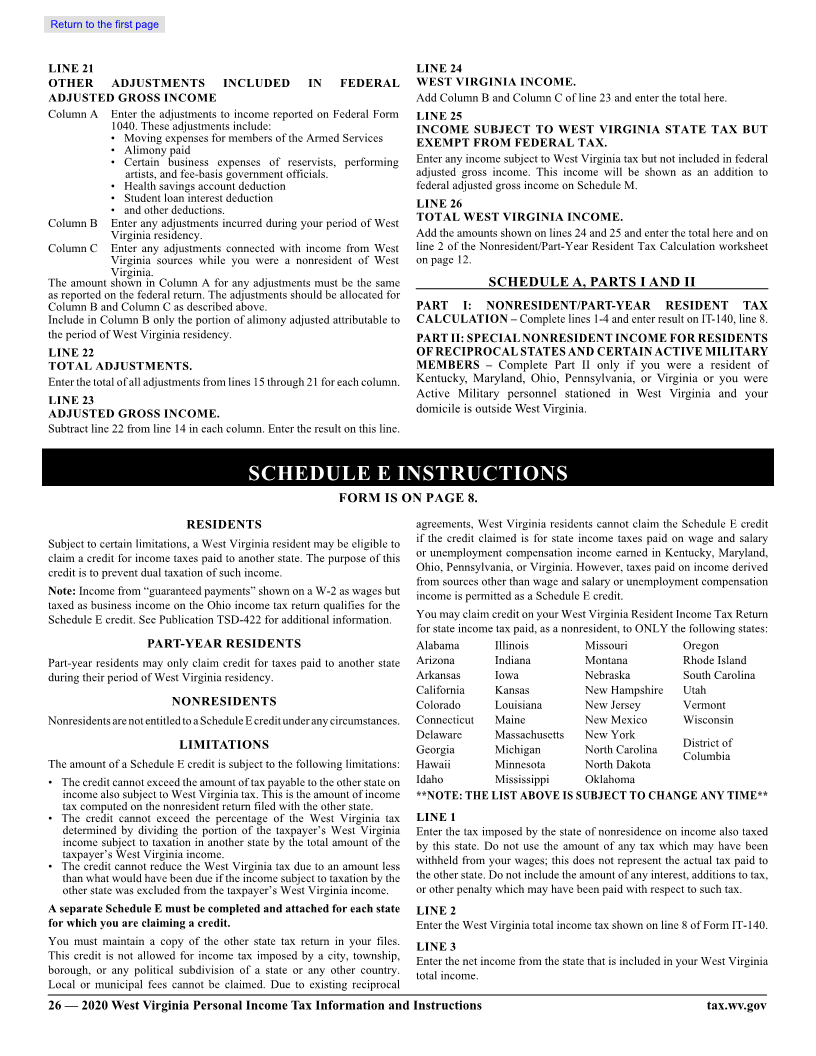

Enlarge image

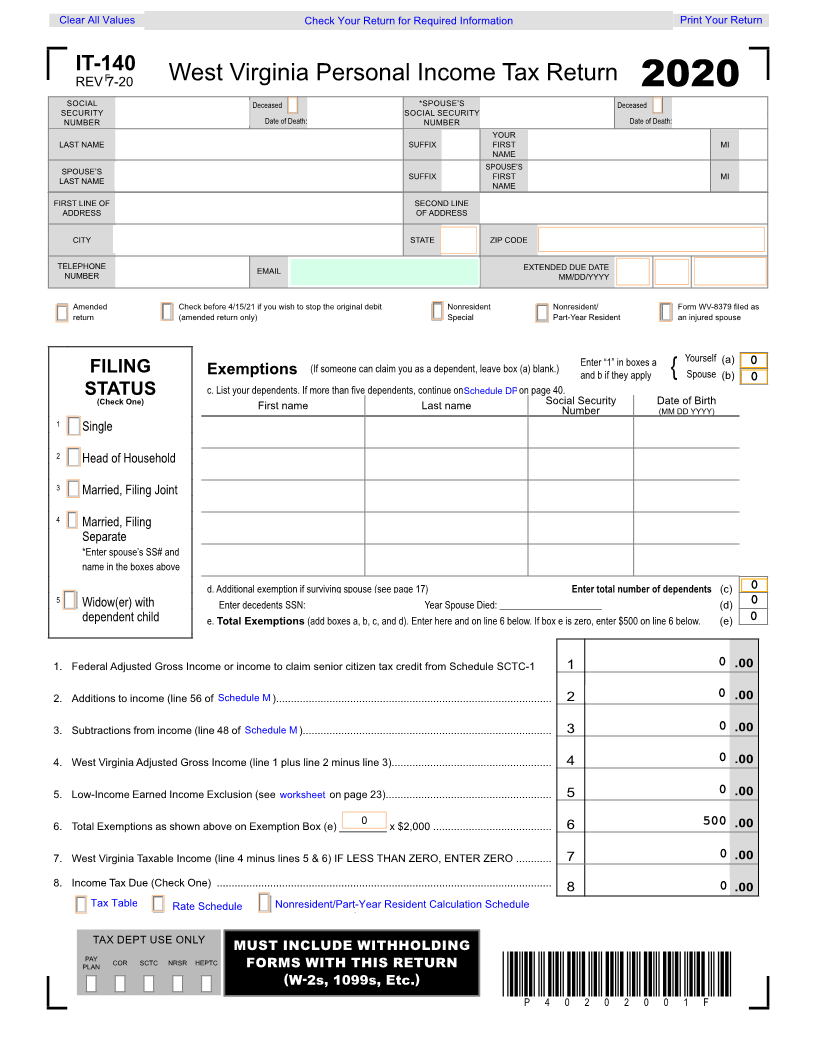

Clear All Values Check Your Return for Required Information Print Your Return

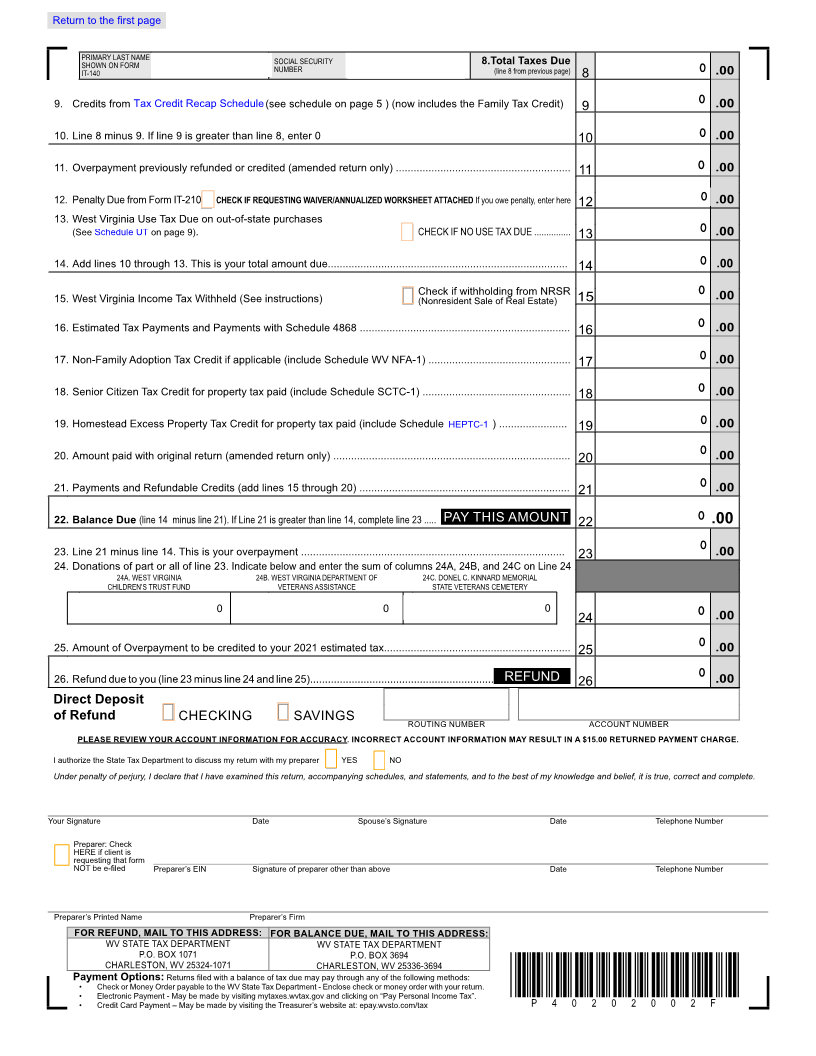

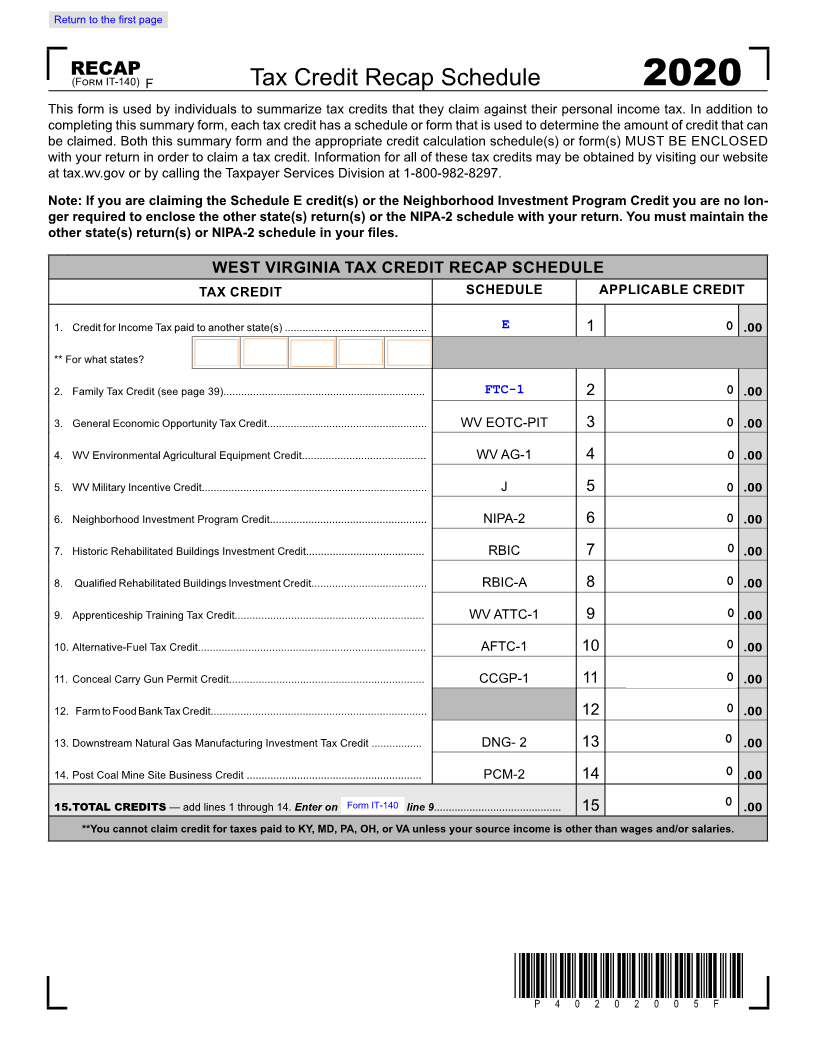

IT-140

REVF7-20 West Virginia Personal Income Tax Return

2020

SOCIAL Deceased *SPOUSE’S Deceased

SECURITY SOCIAL SECURITY

NUMBER Date of Death: NUMBER Date of Death:

YOUR

LAST NAME SUFFIX FIRST MI

NAME

SPOUSE’S

SPOUSE’S SUFFIX FIRST MI

LAST NAME NAME

FIRST LINE OF SECOND LINE

ADDRESS OF ADDRESS

CITY STATE ZIP CODE

TELEPHONE EMAIL EXTENDED DUE DATE

NUMBER MM/DD/YYYY

Amended Check before 4/15/21 if you wish to stop the original debit Nonresident Nonresident/ Form WV-8379 filed as

return (amended return only) Special Part-Year Resident an injured spouse

FILING Exemptions (If someone can claim you as a dependent, leave box (a) blank.) Enter “1” in boxes a Yourself (a)

0

and b if they apply { Spouse (b)

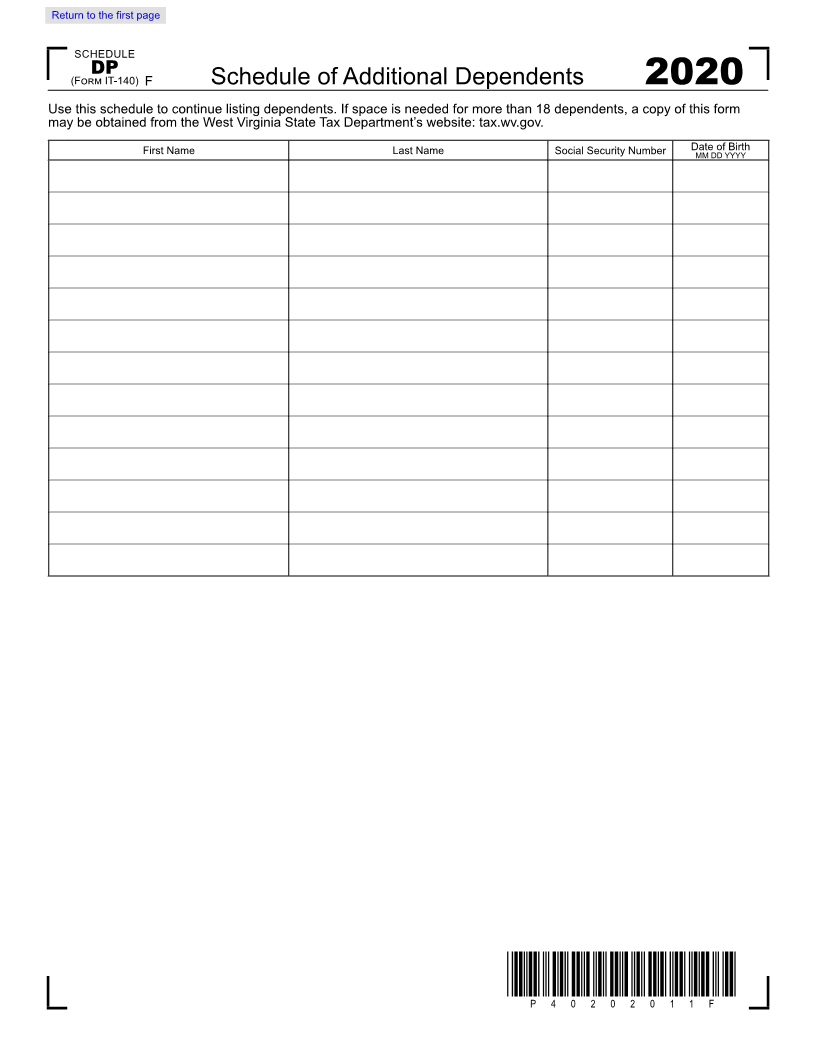

STATUS c. List your dependents. If more than five dependents, continue on Schedule DP on page 40. 0

Schedule DP

(Check One) First name Last name Social Security Date of Birth

Number (MM DD YYYY)

1 Single

2 Head of Household

3 Married, Filing Joint

4 Married, Filing

Separate

*Enter spouse’s SS# and

name in the boxes above

d. Additional exemption if surviving spouse (see page 17) Enter total number of dependents (c) 0

5 Widow(er) with Enter decedents SSN: ______________________ Year Spouse Died: _____________________ (d) 0

dependent child e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. (e) 0

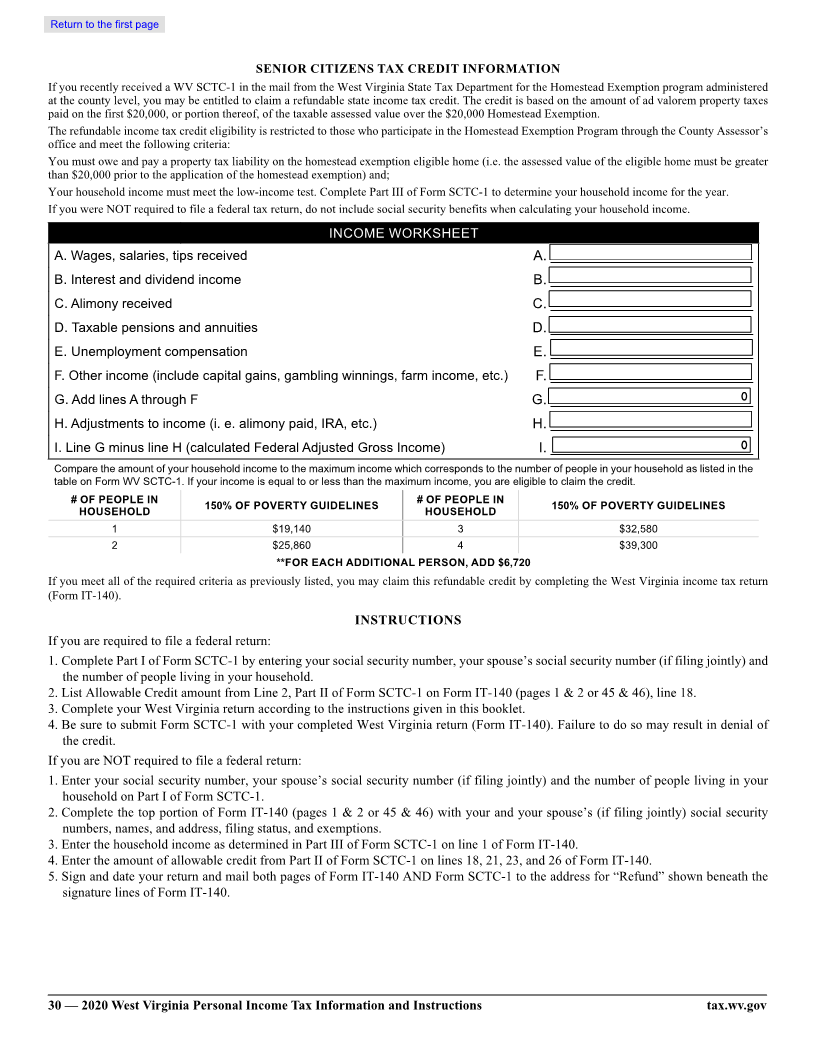

1. Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule SCTC-1 1 0 .00

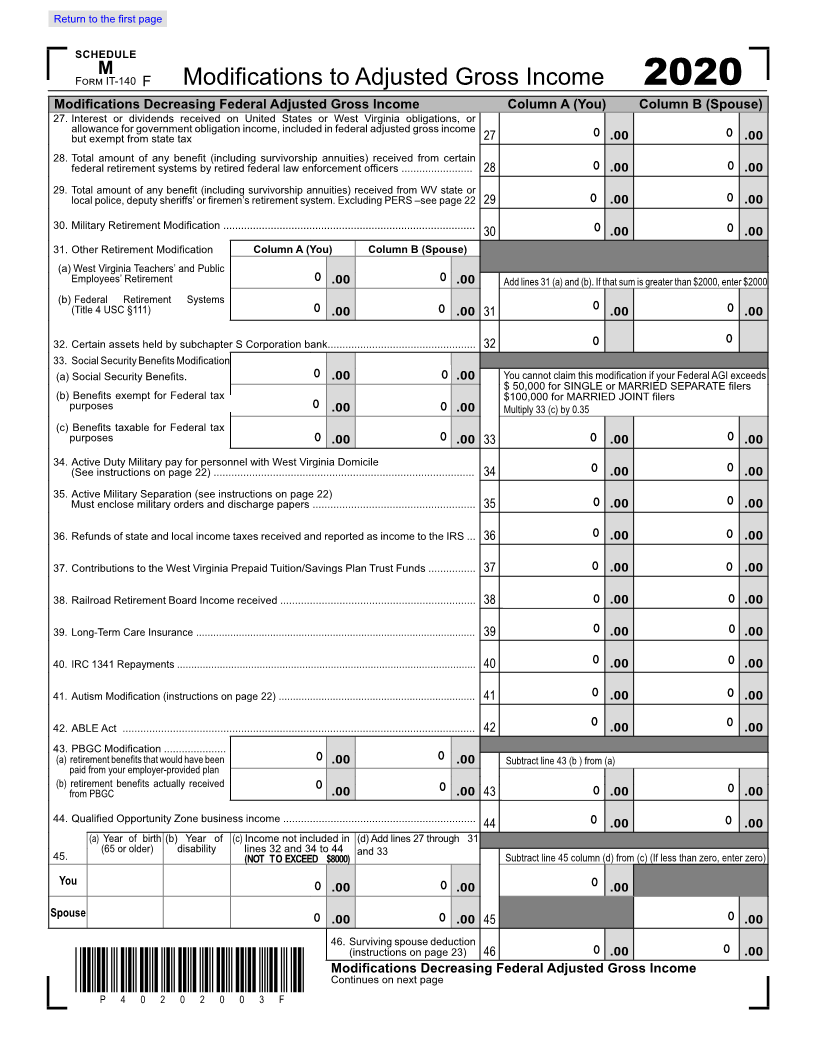

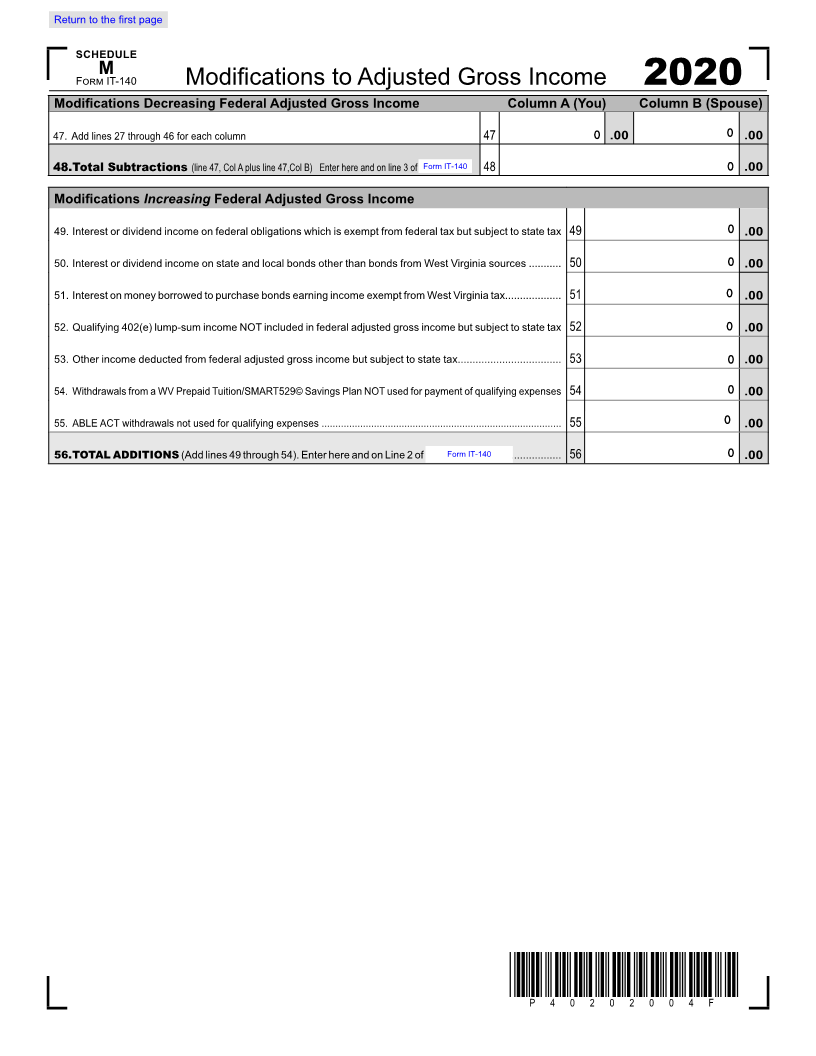

2. Additions to income (line 5 6of ScheduleScheduleM).............................................................................................M 2 0 .00

3. Subtractions from income (line 48 of ScheduleSchedule MM).................................................................................... 3 0.00

4. West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)...................................................... 4 0 .00

5. Low-Income Earned Income Exclusion (see worksheetworksheeton page 23)........................................................ 5 0.00

6. Total Exemptions as shown above on Exemption Box (e) ________0 x $2,000 ........................................ 6 500.00

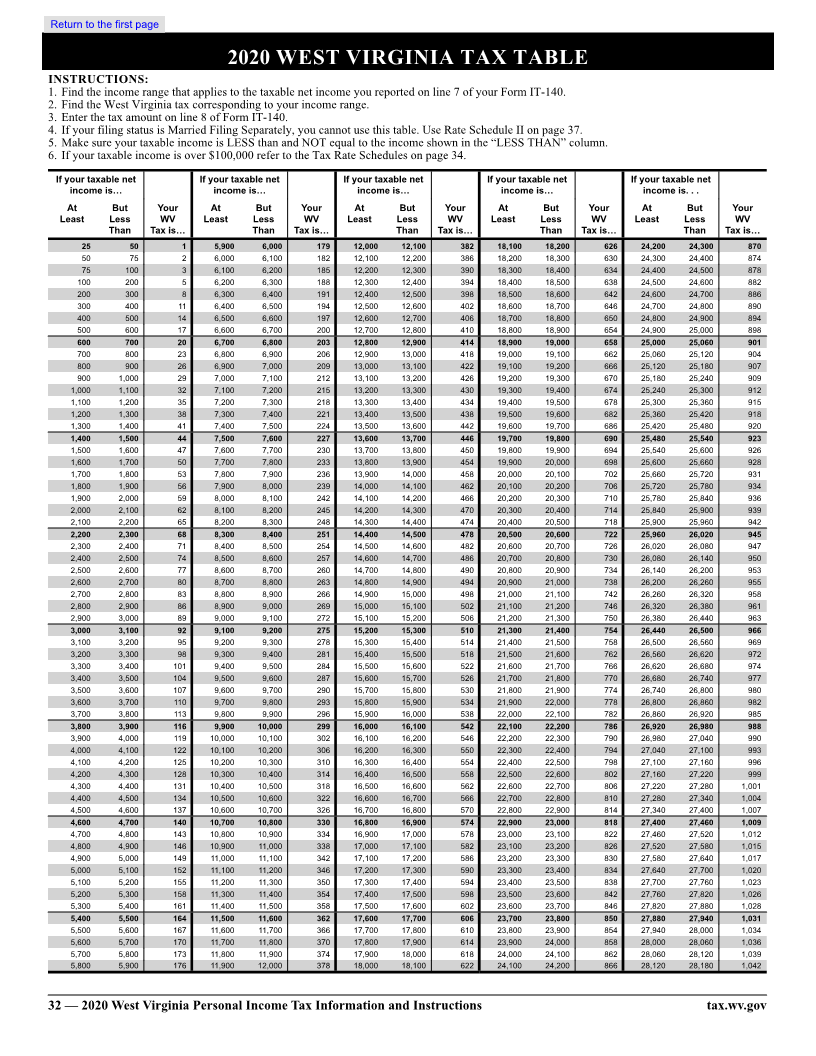

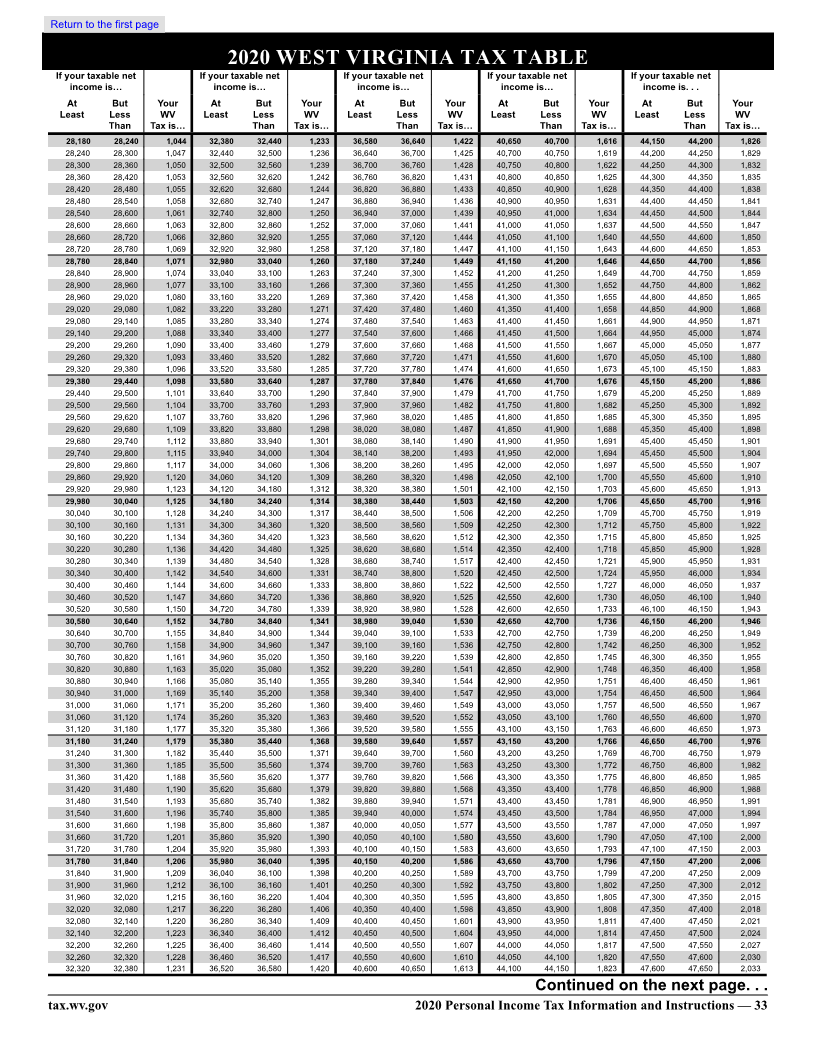

7. West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............ 7 0 .00

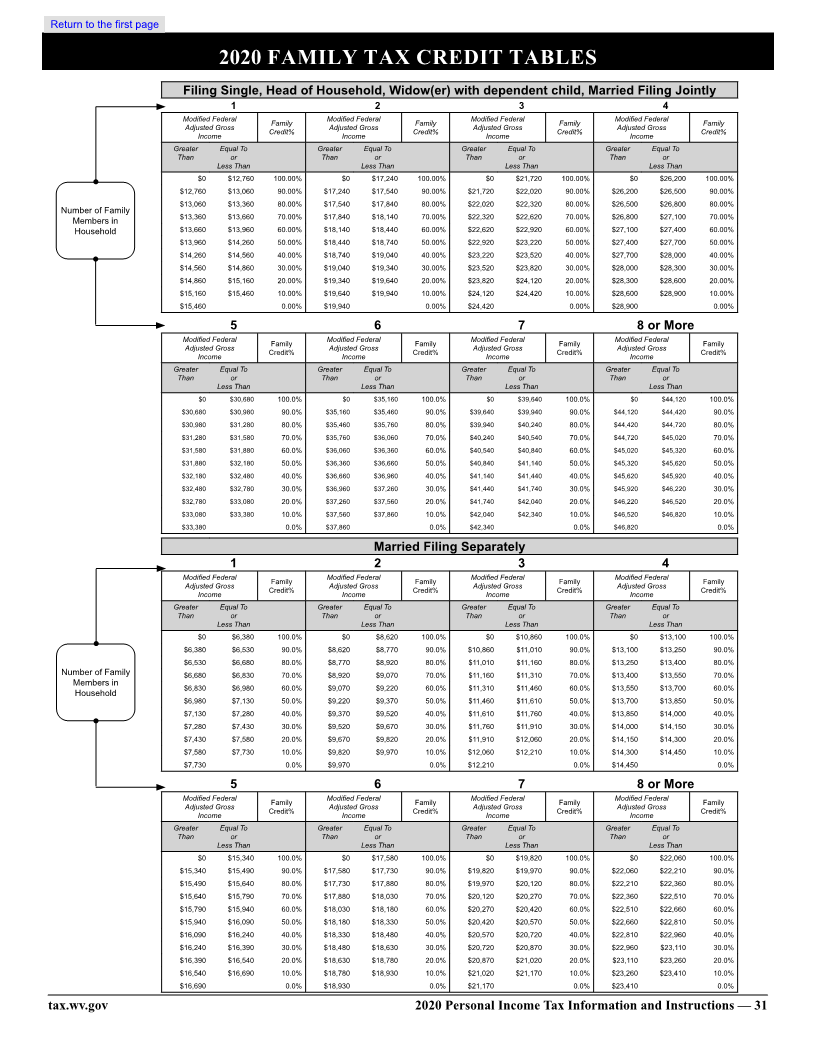

8. Income Tax Due (Check One) ................................................................................................................. 8 0 .00

TaxTax TableTable RateRateScheduleSchedule Nonresident/Part-YearNonresident/Part-year residentResidentcalculationCalculationscheduleSchedule

TAX DEPT USE ONLY

MUST INCLUDE WITHHOLDING

PLAN

PAY COR SCTC NRSR HEPTC FORMS WITH THIS RETURN

(W-2s, 1099s, Etc.)

*P40202001F*

P 4 0 2 0 2 0 0 1 F