Enlarge image

2020 W ൾඌඍ Vංඋංඇංൺ Personal Income Tax Forms & Instructions 2020 PERSONAL INCOME TAX IS DUE APRIL 15, 2021 WEST VIRGINIA STATE TAX DEPARTMENT

Enlarge image | 2020 W ൾඌඍ Vංඋංඇංൺ Personal Income Tax Forms & Instructions 2020 PERSONAL INCOME TAX IS DUE APRIL 15, 2021 WEST VIRGINIA STATE TAX DEPARTMENT |

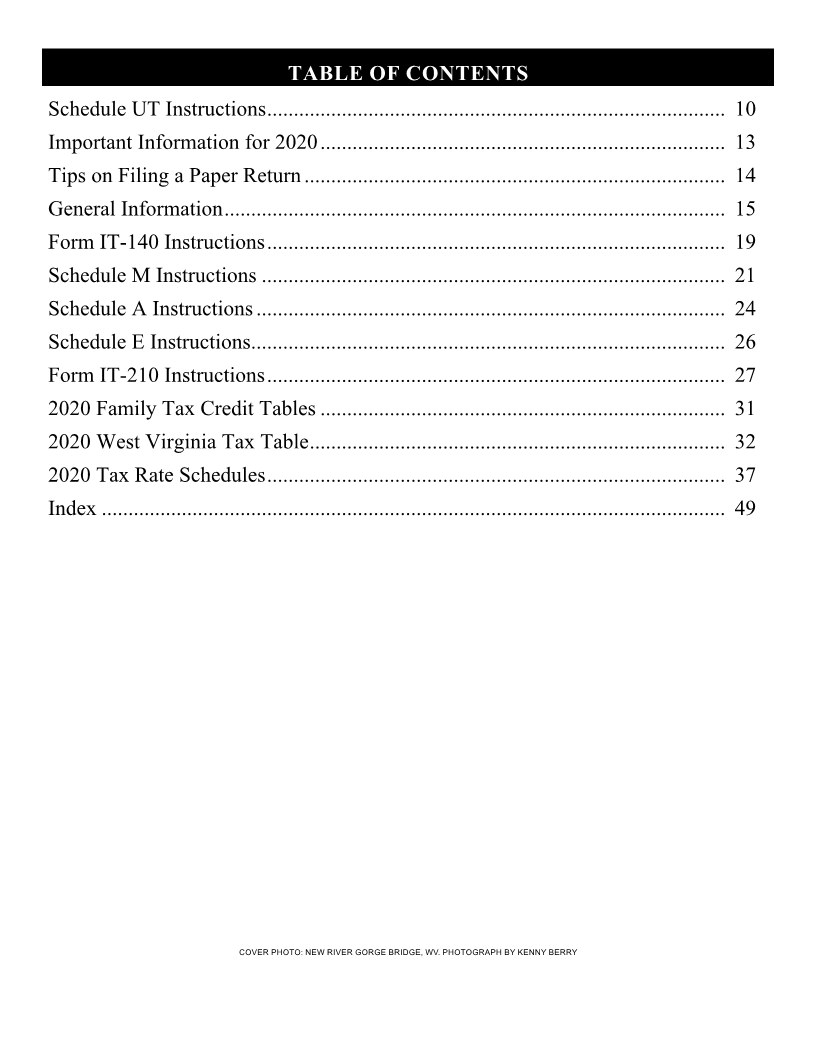

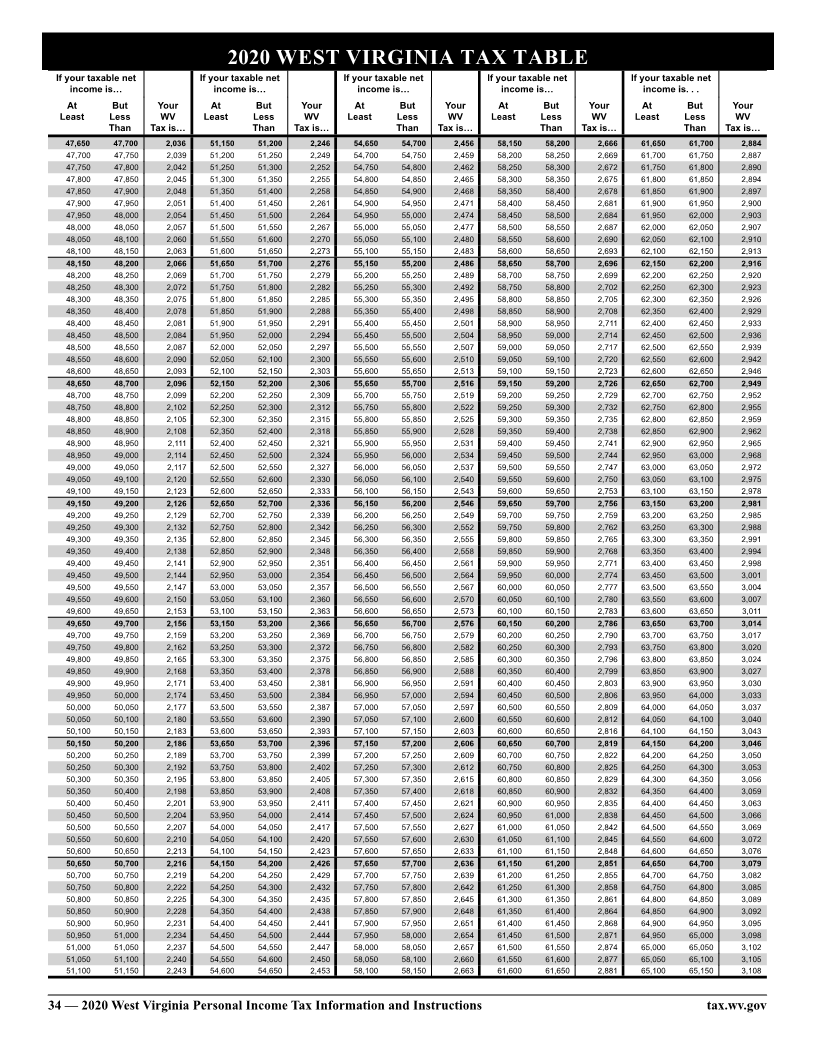

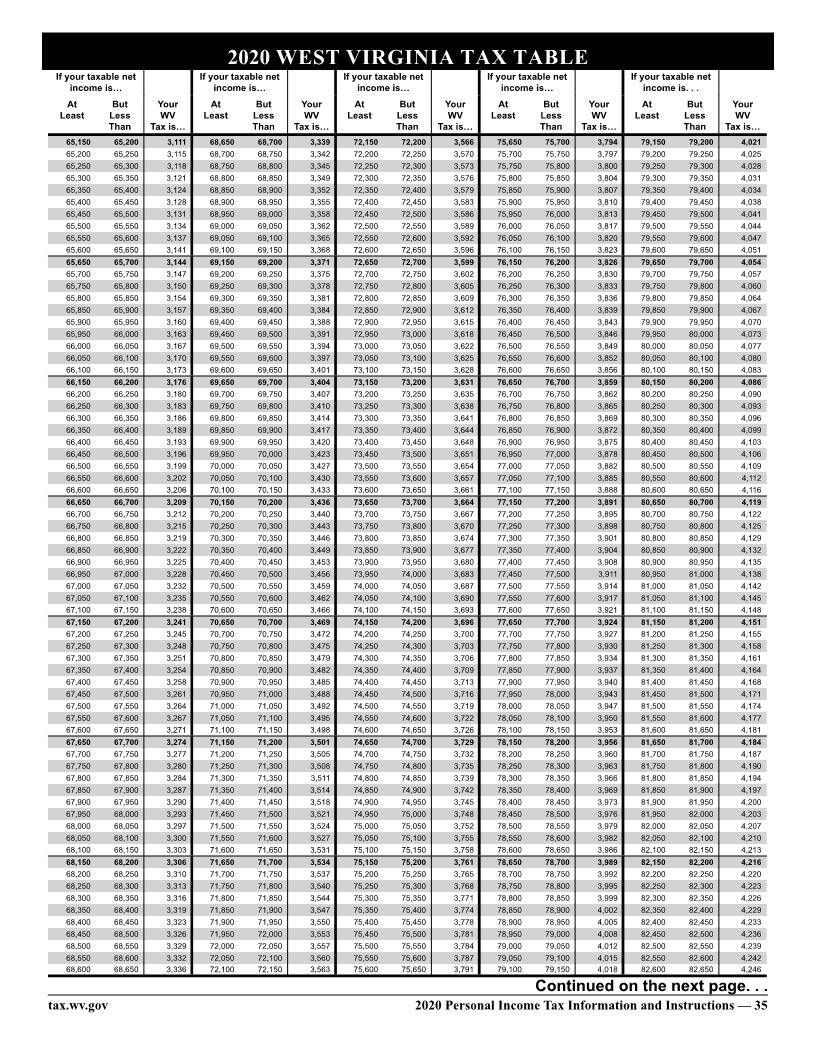

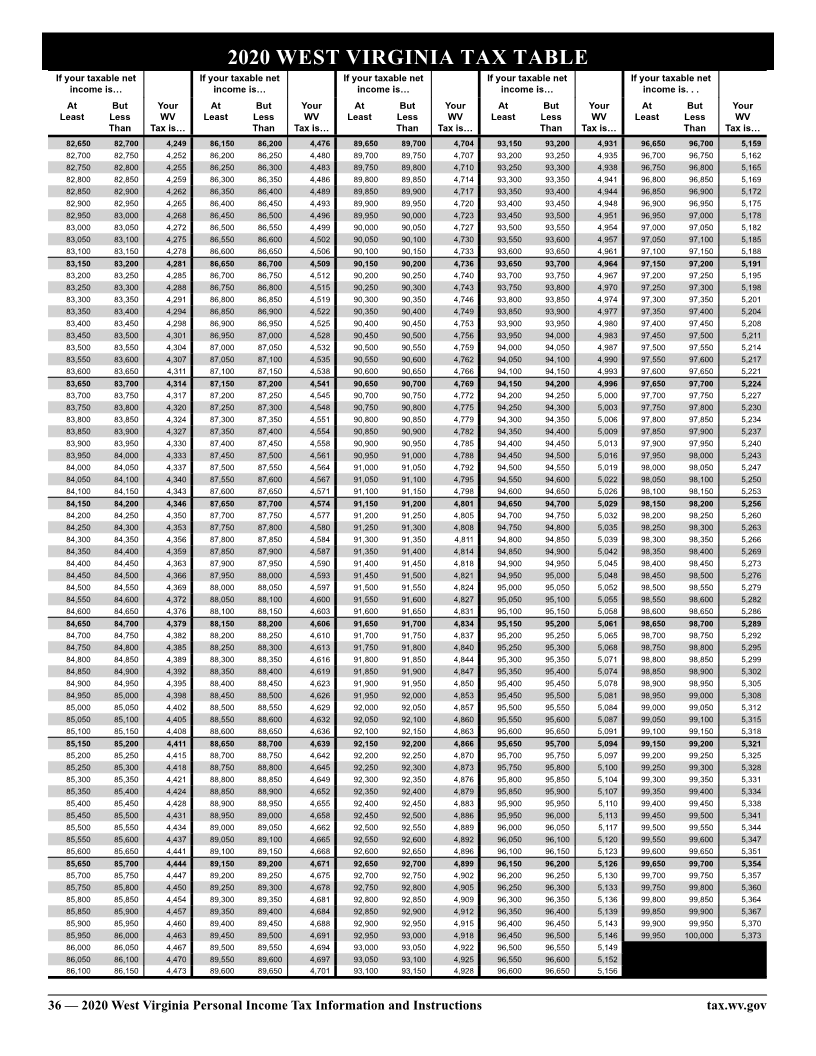

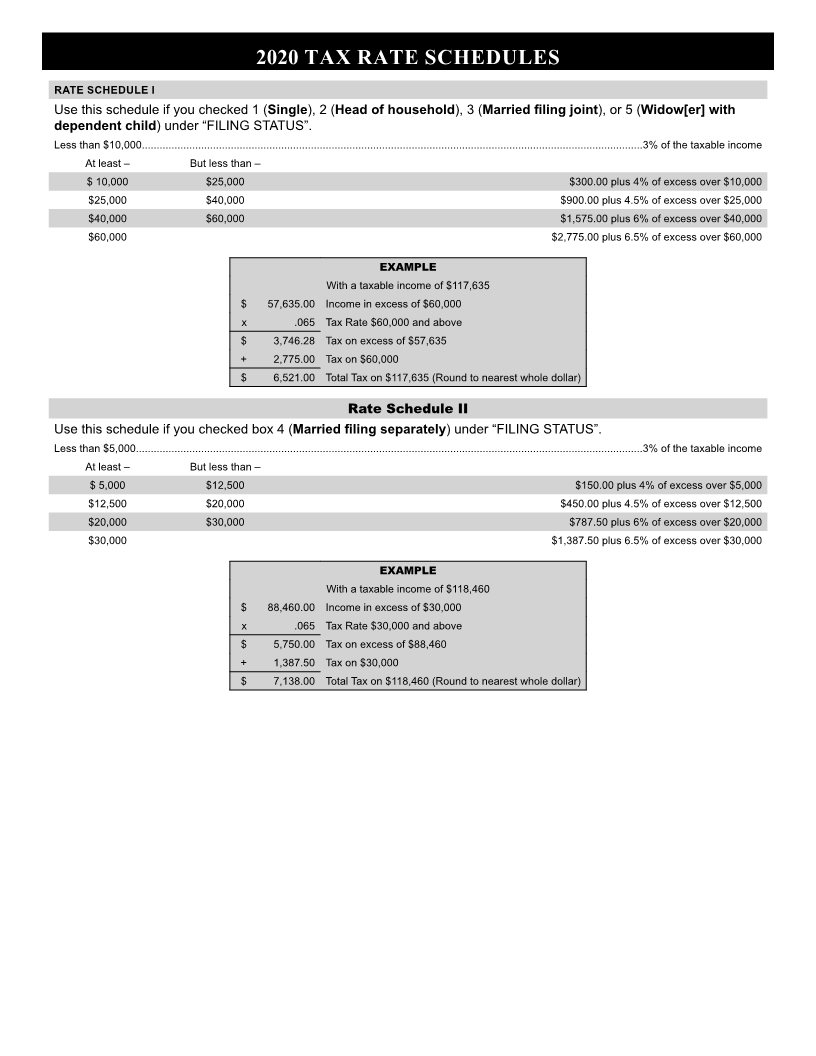

Enlarge image | TABLE OF CONTENTS Schedule UT Instructions ...................................................................................... 10 Important Information for 2020 ............................................................................ 13 Tips on Filing a Paper Return ............................................................................... 14 General Information .............................................................................................. 15 Form IT-140 Instructions ...................................................................................... 19 Schedule M Instructions ....................................................................................... 21 Schedule A Instructions ........................................................................................ 24 Schedule E Instructions ......................................................................................... 26 Form IT-210 Instructions ...................................................................................... 27 2020 Family Tax Credit Tables ............................................................................ 31 2020 West Virginia Tax Table .............................................................................. 32 2020 Tax Rate Schedules ...................................................................................... 37 Index ..................................................................................................................... 49 COVER PHOTO: NEW RIVER GORGE BRIDGE, WV. PHOTOGRAPH BY KENNY BERRY |

Enlarge image |

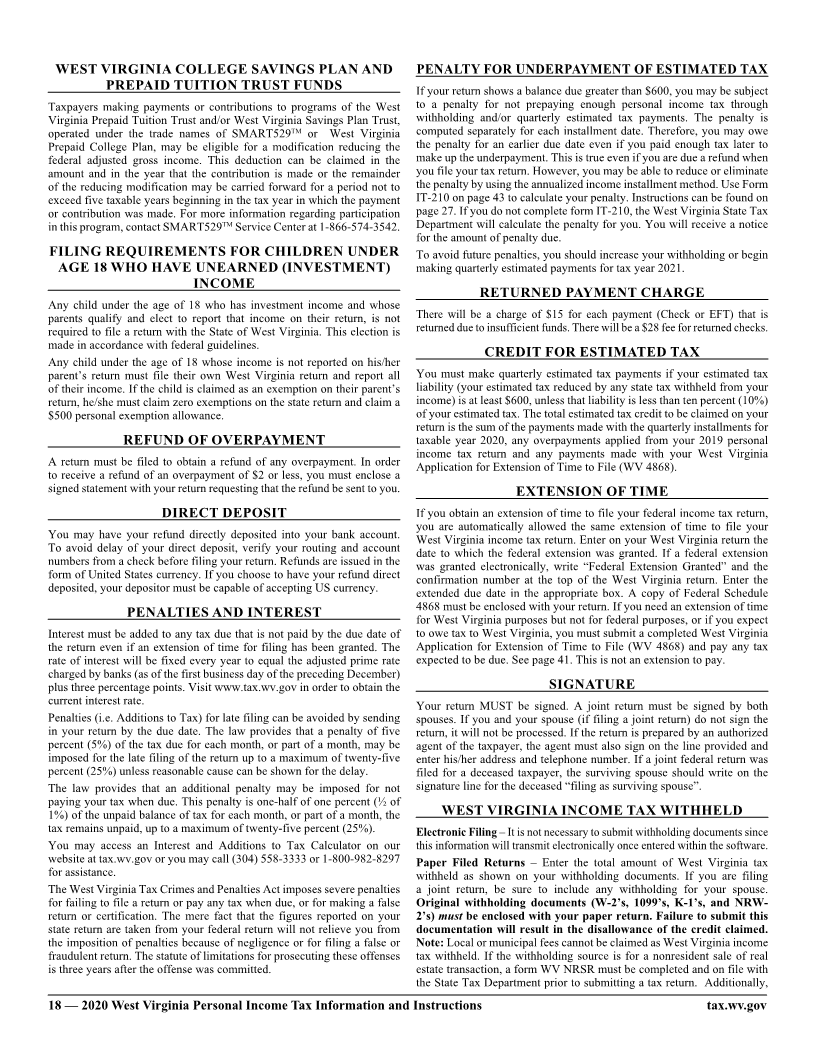

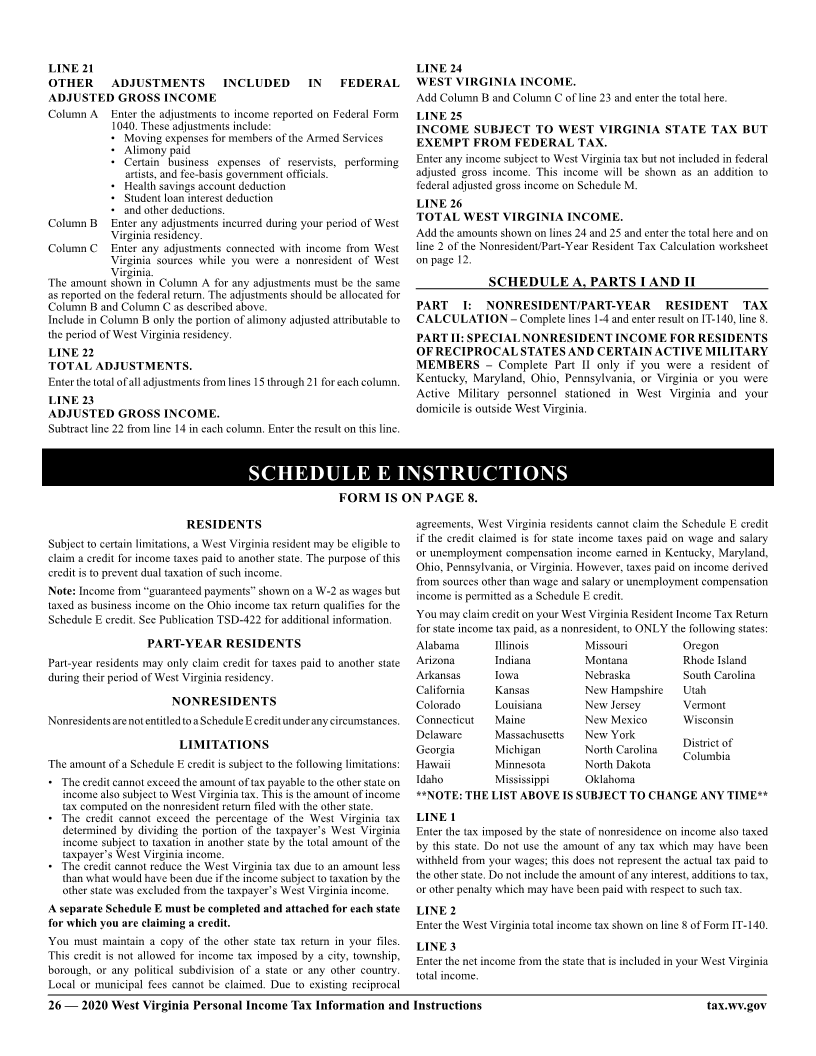

IT-140

REV 7-20 W West Virginia Personal Income Tax Return

2020

SOCIAL Deceased *SPOUSE’S Deceased

SECURITY SOCIAL SECURITY

NUMBER Date of Death: NUMBER Date of Death:

YOUR

LAST NAME SUFFIX FIRST MI

NAME

SPOUSE’S

SPOUSE’S SUFFIX FIRST MI

LAST NAME NAME

FIRST LINE OF SECOND LINE

ADDRESS OF ADDRESS

CITY STATE ZIP CODE

TELEPHONE EMAIL EXTENDED DUE DATE

NUMBER MM/DD/YYYY

Amended Check before 4/15/21 if you wish to stop the original debit Nonresident Nonresident/ Form WV-8379 filed as

return (amended return only) Special Part-Year Resident an injured spouse

FILING Exemptions (If someone can claim you as a dependent, leave box (a) blank.) Enter “1” in boxes a Yourself (a)

and b if they apply { Spouse (b)

STATUS c. List your dependents. If more than five dependents, continue on Schedule DP on page 40.

(Check One) First name Last name Social Security Date of Birth

Number (MM DD YYYY)

1 Single

2 Head of Household

3 Married, Filing Joint

4 Married, Filing

Separate

*Enter spouse’s SS# and

name in the boxes above

d. Additional exemption if surviving spouse (see page 17) Enter total number of dependents (c)

5 Widow(er) with Enter decedents SSN: ______________________ Year Spouse Died: _____________________ (d)

dependent child e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. (e)

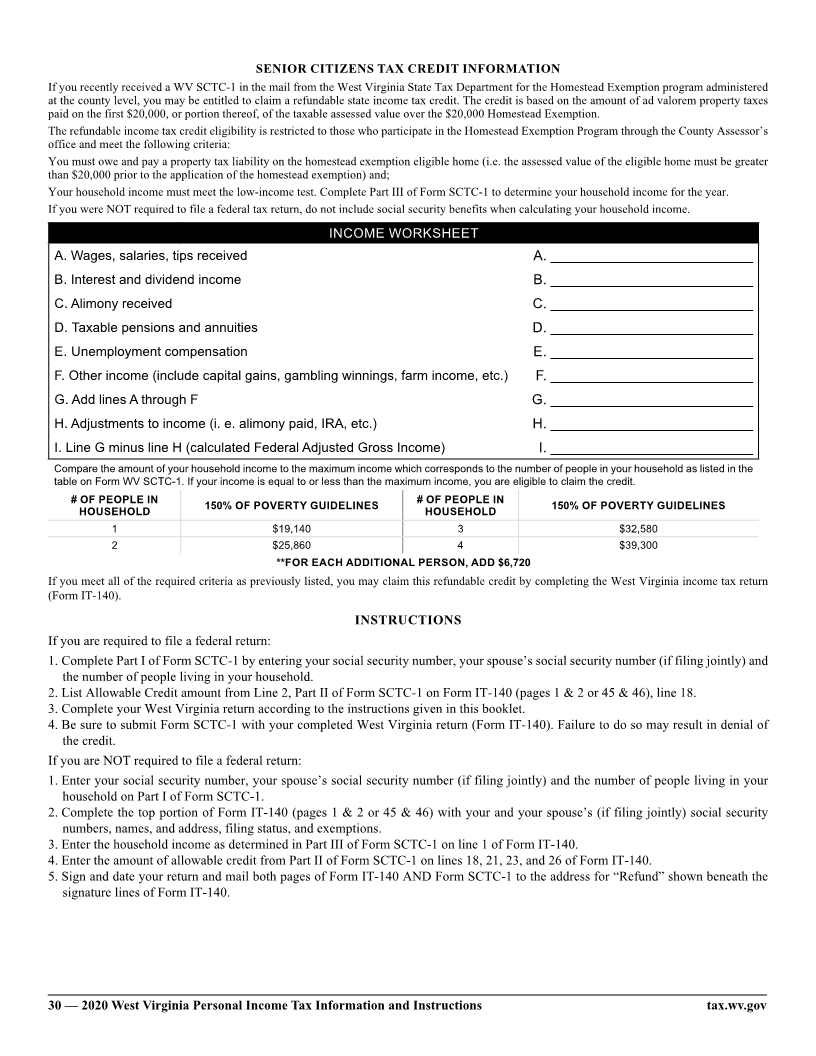

1. Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule SCTC-1 1 .00

2. Additions to income (line 55 of Schedule M)............................................................................................. 2 .00

3. Subtractions from income (line 48 of Schedule M).................................................................................... 3 .00

4. West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)...................................................... 4 .00

5. Low-Income Earned Income Exclusion (see worksheet on page 23)........................................................ 5 .00

6. Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 ........................................ 6 .00

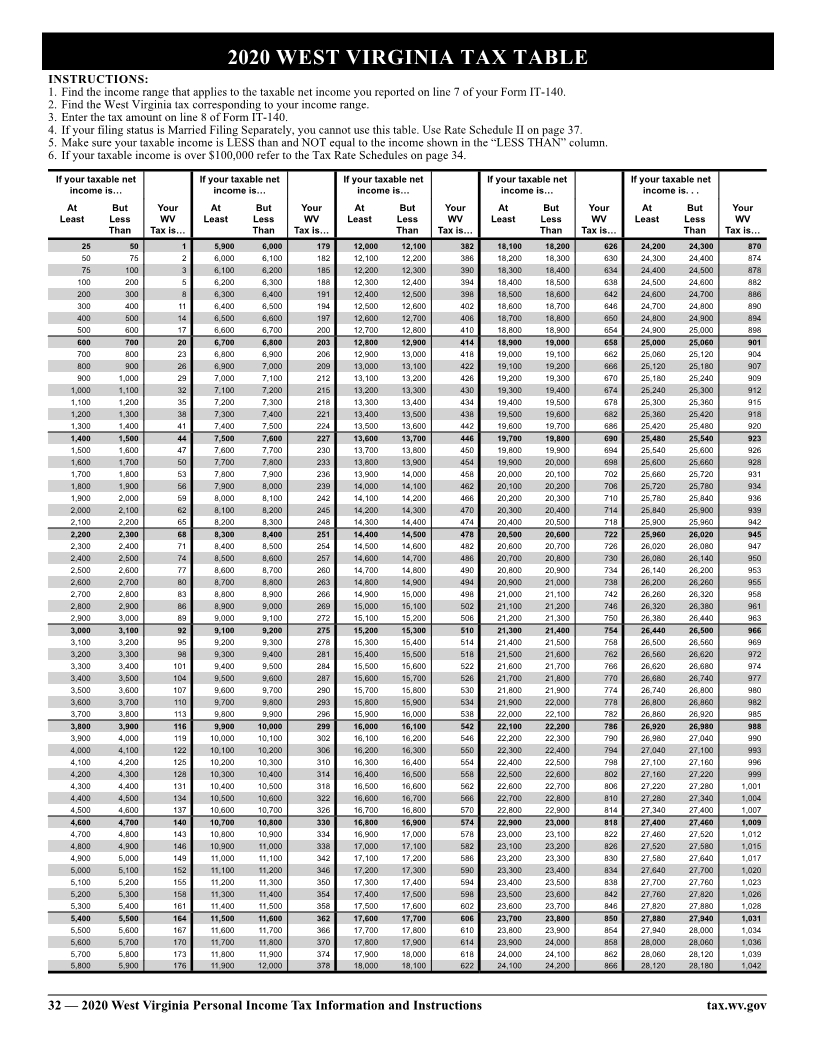

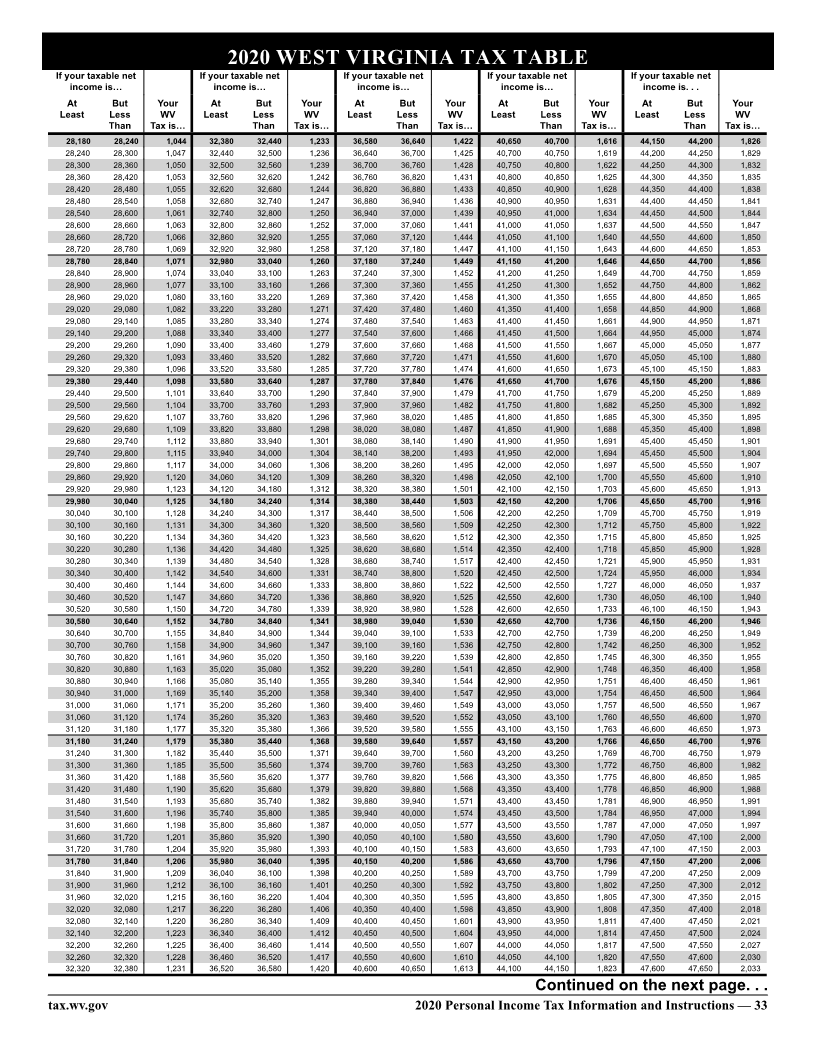

7. West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............ 7 .00

8. Income Tax Due (Check One) ................................................................................................................. 8 .00

Tax Table Rate Schedule Nonresident/Part-year resident calculation schedule

TAX DEPT USE ONLY

MUST INCLUDE WITHHOLDING

PLAN

PAY COR SCTC NRSR HEPTC FORMS WITH THIS RETURN

(W-2s, 1099s, Etc.)

*P40202001W*

P 4 0 2 0 2 0 0 1 W

–1–

|

Enlarge image |

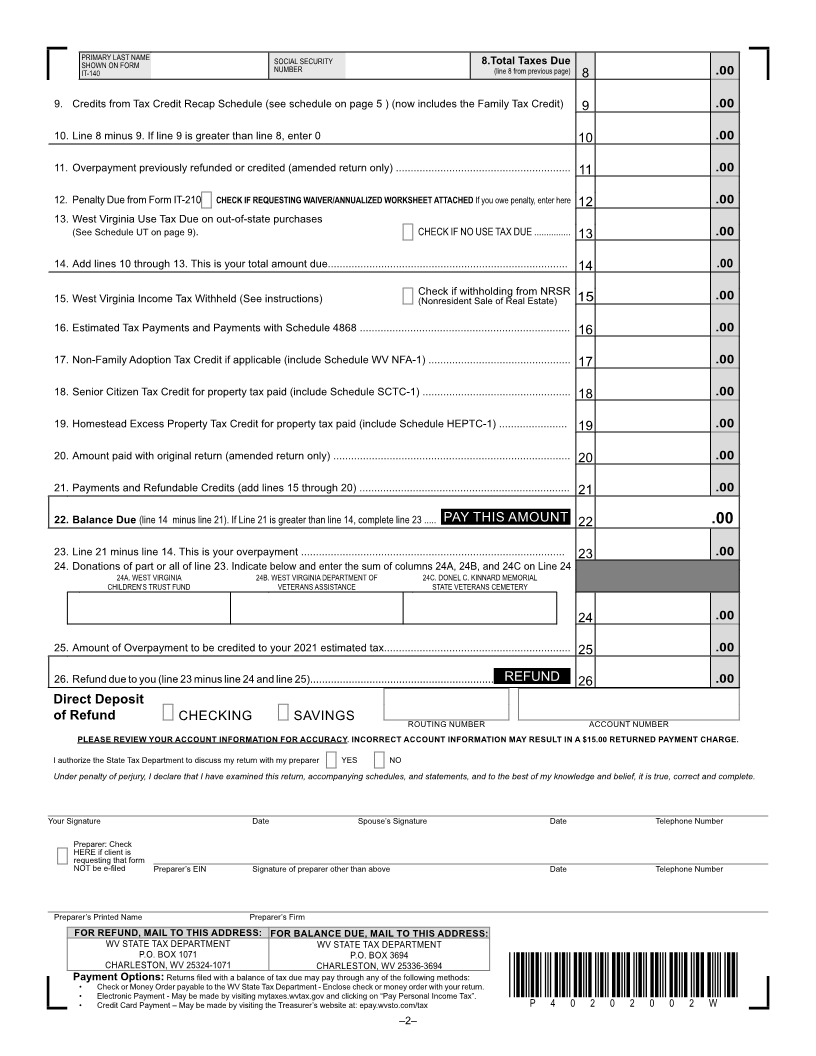

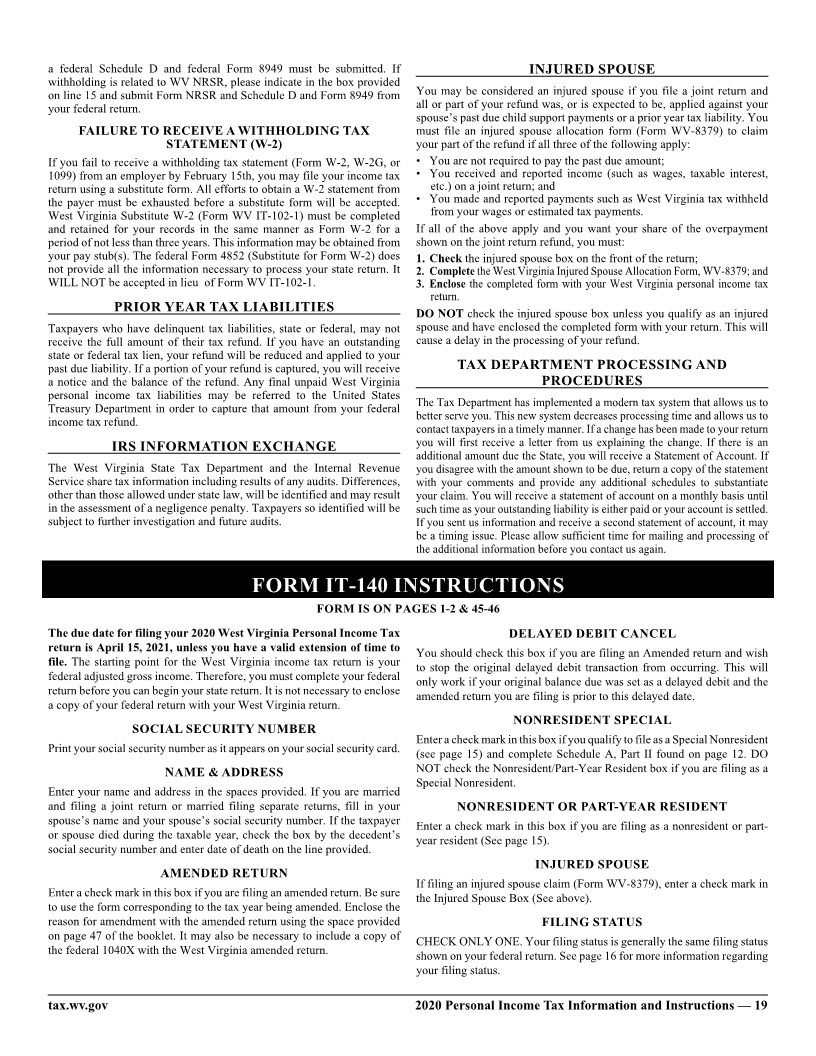

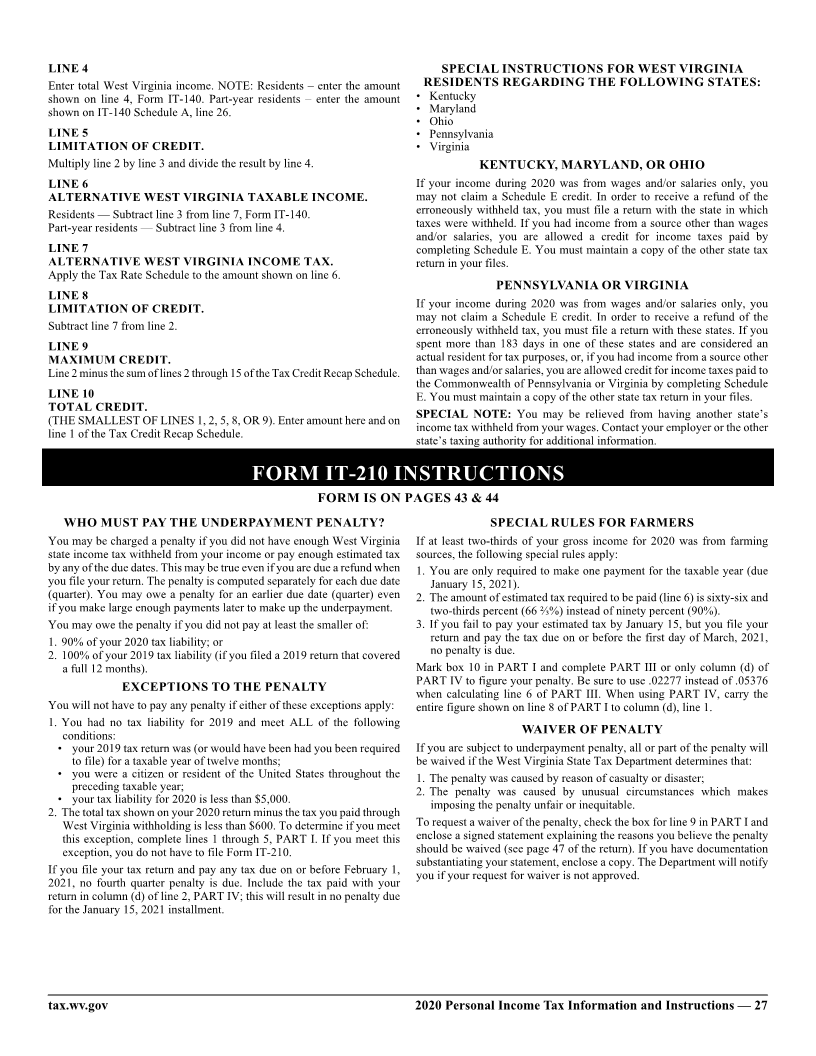

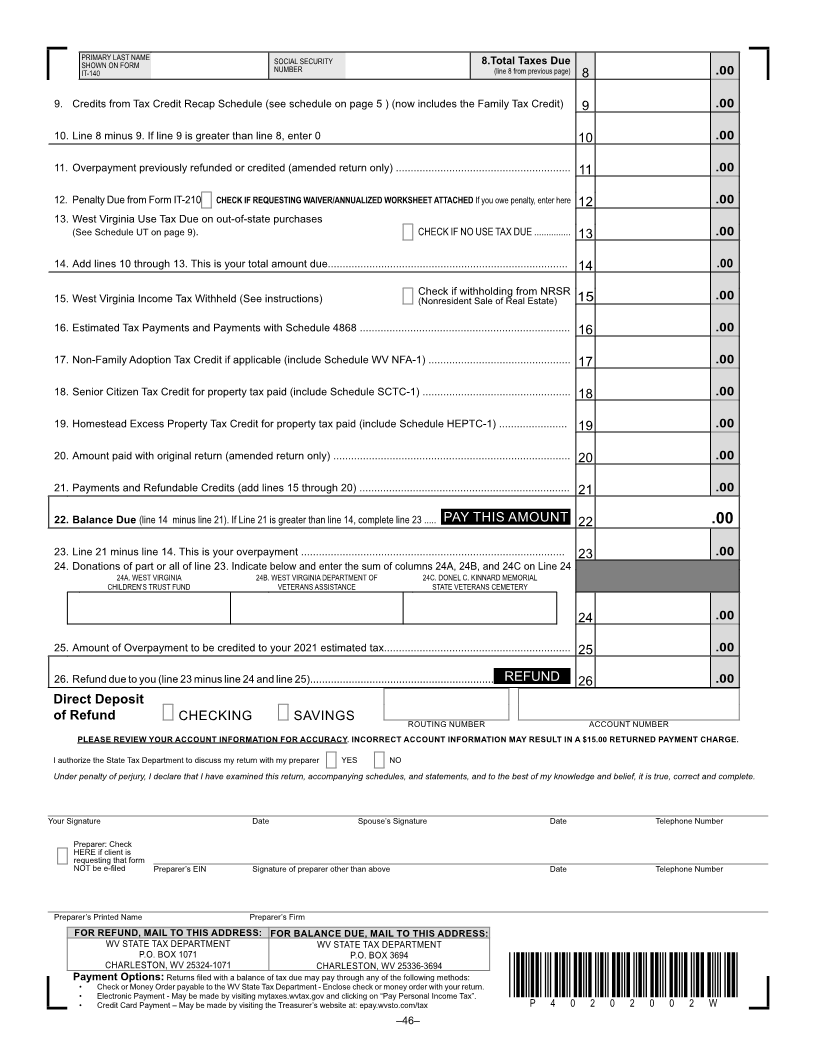

PRIMARY LAST NAME SOCIAL SECURITY 8.Total Taxes Due

SHOWN ON FORM NUMBER (line 8 from previous page) 8 .00

IT-140

9. Credits from Tax Credit Recap Schedule (see schedule on page 5 ) (now includes the Family Tax Credit) 9 .00

10. Line 8 minus 9. If line 9 is greater than line 8, enter 0 10 .00

11. Overpayment previously refunded or credited (amended return only) ........................................................... 11 .00

12. Penalty Due from Form IT-210 CHECK IF REQUESTING WAIVER/ANNUALIZED WORKSHEET ATTACHED If you owe penalty, enter here 12 .00

13. West Virginia Use Tax Due on out-of-state purchases

(See Schedule UT on page 9). CHECK IF NO USE TAX DUE ............... 13 .00

14. Add lines 10 through 13. This is your total amount due................................................................................. 14 .00

Check if withholding from NRSR

15. West Virginia Income Tax Withheld (See instructions) (Nonresident Sale of Real Estate) 15 .00

16. Estimated Tax Payments and Payments with Schedule 4868 ....................................................................... 16 .00

17. Non-Family Adoption Tax Credit if applicable (include Schedule WV NFA-1) ................................................ 17 .00

18. Senior Citizen Tax Credit for property tax paid (include Schedule SCTC-1) .................................................. 18 .00

19. Homestead Excess Property Tax Credit for property tax paid (include Schedule HEPTC-1) ....................... 19 .00

20. Amount paid with original return (amended return only) ................................................................................ 20 .00

21. Payments and Refundable Credits (add lines 15 through 20) ....................................................................... 21 .00

22. Balance Due (line 14 minus line 21). If Line 21 is greater than line 14, complete line 23 ..... PAY THIS AMOUNT 22 .00

23. Line 21 minus line 14. This is your overpayment ......................................................................................... 23 .00

24. Donations of part or all of line 23. Indicate below and enter the sum of columns 24A, 24B, and 24C on Line 24

24A. WEST VIRGINIA 24B. WEST VIRGINIA DEPARTMENT OF 24C. DONEL C. KINNARD MEMORIAL

CHILDREN’S TRUST FUND VETERANS ASSISTANCE STATE VETERANS CEMETERY

24 .00

25. Amount of Overpayment to be credited to your 2021 estimated tax............................................................... 25 .00

26. Refund due to you (line 23 minus line 24 and line 25).............................................................. REFUND 26 .00

Direct Deposit

of Refund CHECKING SAVINGS ROUTING NUMBER ACCOUNT NUMBER

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Department to discuss my return with my preparer YES NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature Date Spouse’s Signature Date Telephone Number

Preparer: Check

HERE if client is

requesting that form

NOT be e-filed Preparer’s EIN Signature of preparer other than above Date Telephone Number

Preparer’s Printed Name Preparer’s Firm

FOR REFUND, MAIL TO THIS ADDRESS: FOR BALANCE DUE, MAIL TO THIS ADDRESS:

WV STATE TAX DEPARTMENT WV STATE TAX DEPARTMENT

P.O. BOX 1071 P.O. BOX 3694

CHARLESTON, WV 25324-1071 CHARLESTON, WV 25336-3694

Payment Options: Returns filed with a balance of tax due may pay through any of the following methods:

• Check or Money Order payable to the WV State Tax Department - Enclose check or money order with your return. *P40202002W*

• Electronic Payment - May be made by visiting mytaxes.wvtax.gov and clicking on “Pay Personal Income Tax”.

• Credit Card Payment – May be made by visiting the Treasurer’s website at: epay.wvsto.com/tax P 4 0 2 0 2 0 0 2 W

–2–

|

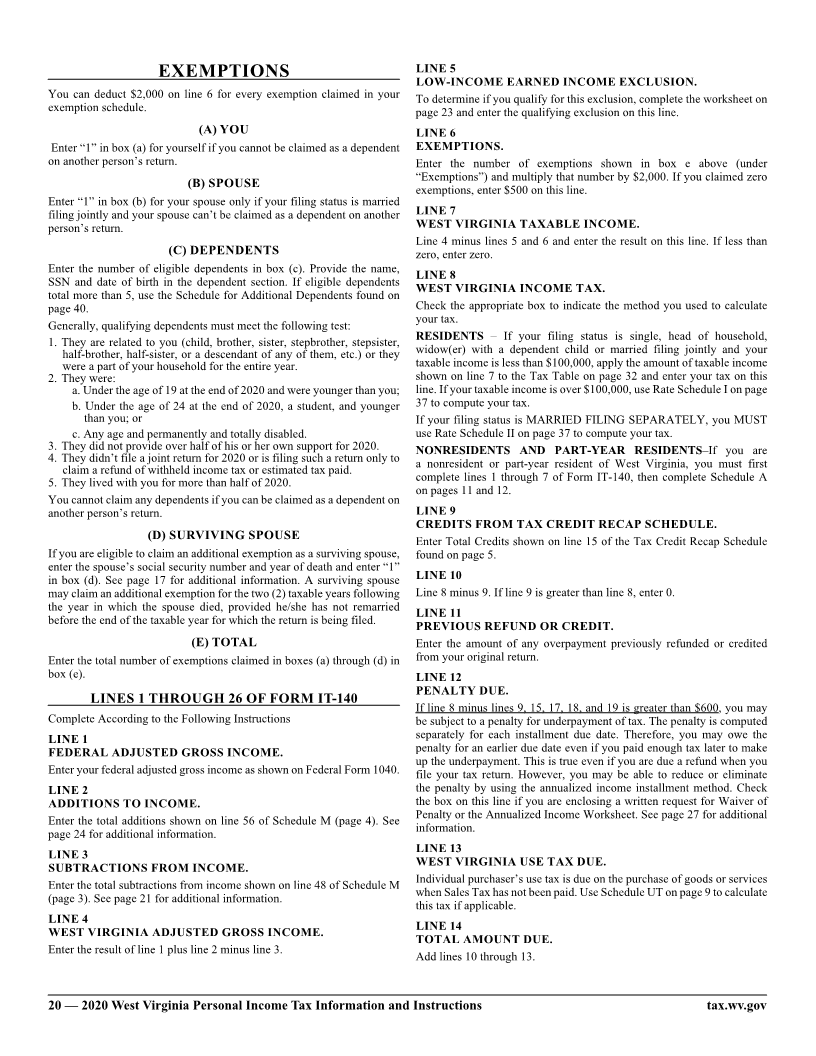

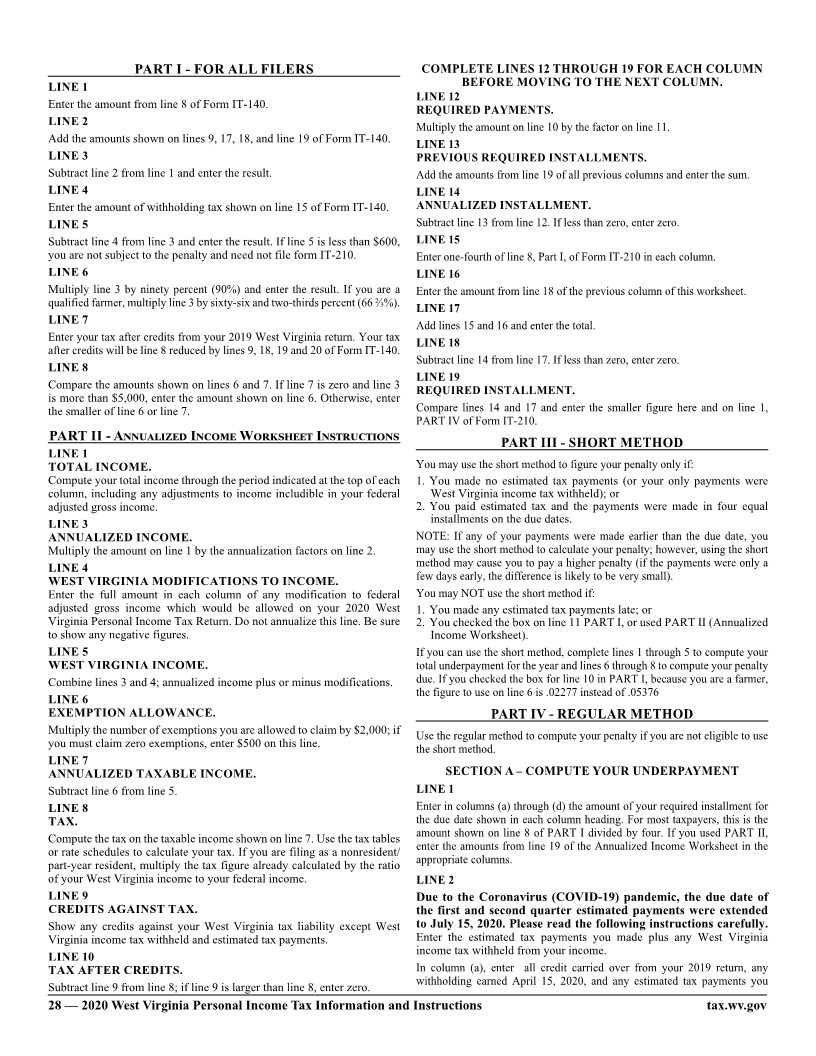

Enlarge image |

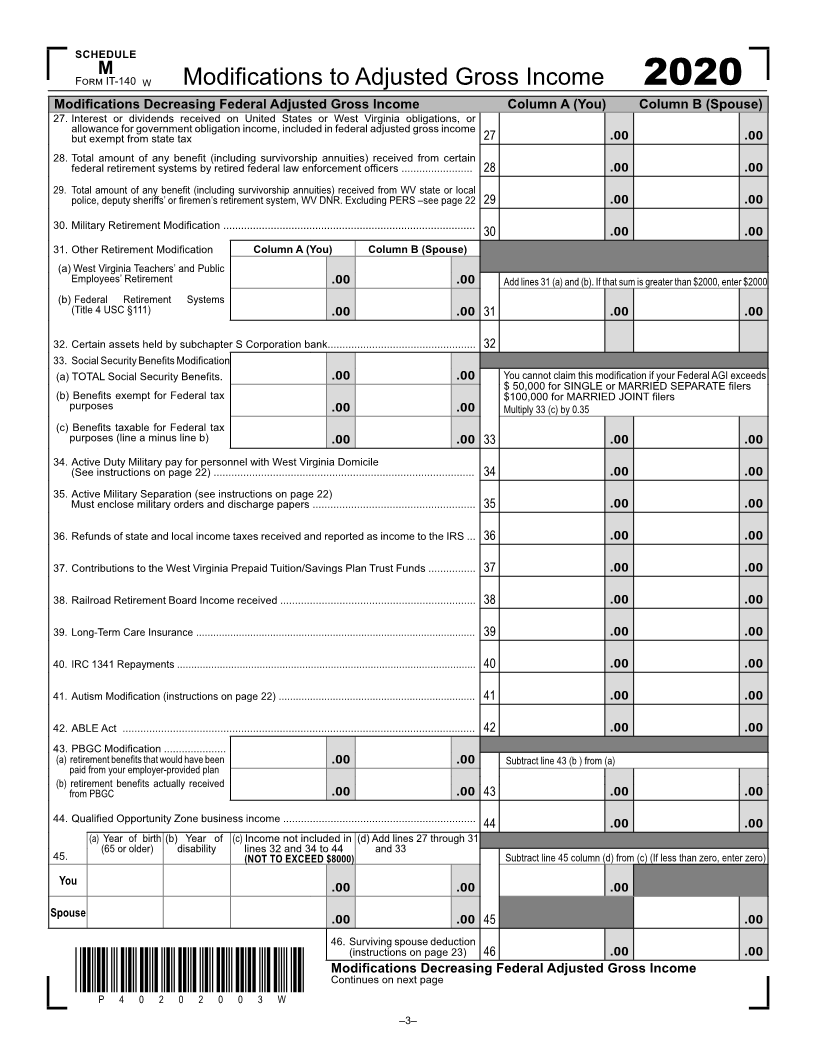

SCHEDULE

M

F IT-140 W Modifications to Adjusted Gross Income 2020

Modi fications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse)

27. Interest or dividends received on United States or West Virginia obligations, or

allowance for government obligation income, included in federal adjusted gross income

but exempt from state tax 27 .00 .00

28. Total amount of any bene tfi(including survivorship annuities) received from certain

federal retirement systems by retired federal law enforcement o fficers ........................ 28 .00 .00

29. Total amount of any benefi t (including survivorship annuities) received from WV state or local

police, deputy sheriff s’ or fi remen’s retirement system, WV DNR. Excluding PERS –see page29 22 .00 .00

30. Military Retirement Modification .....................................................................................

30 .00 .00

31. Other Retirement Modification Column A (You) Column B (Spouse)

(a) West Virginia Teachers’ and Public

Employees’ Retirement .00 .00 Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000

(b) Federal Retirement Systems

(Title 4 USC §111) .00 .00 31 .00 .00

32. Certain assets held by subchapter S Corporation bank.................................................. 32

33. Social Security Benefi ts Modifi cation

(a) TOTAL Social Security Benefits. .00 .00 You cannot claim this modifi cation if your Federal AGI exceeds

$ 50,000 for SINGLE or MARRIED SEPARATE filers

(b) Benefits exempt for Federal tax $100,000 for MARRIED JOINT filers

purposes .00 .00 Multiply 33 (c) by 0.35

(c) Benefits taxable for Federal tax

purposes (line a minus line b) .00 .00 33 .00 .00

34. Active Duty Military pay for personnel with West Virginia Domicile

(See instructions on page 22) ........................................................................................ 34 .00 .00

35. Active Military Separation (see instructions on page 22)

Must enclose military orders and discharge papers ....................................................... 35 .00 .00

36. Refunds of state and local income taxes received and reported as income to the IRS ... 36 .00 .00

37. Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds ................ 37 .00 .00

38. Railroad Retirement Board Income received .................................................................. 38 .00 .00

39. Long-Term Care Insurance .................................................................................................. 39 .00 .00

40. IRC 1341 Repayments ......................................................................................................... 40 .00 .00

41. Autism Modification (instructions on page 22) .....................................................................41 .00 .00

42. ABLE Act ....................................................................................................................... 42 .00 .00

43. PBGC Modification .....................

(a) retirement benefits that would have been .00 .00 Subtract line 43 (b ) from (a)

paid from your employer-provided plan

(b) retirement bene tsfiactually received

from PBGC .00 .00 43 .00 .00

44. Qualified Opportunity Zone business income ................................................................. 44 .00 .00

(a) Year of birth (b) Year of (c) Income not included in (d) Add lines 27 through 31

(65 or older) disability lines 32 and 34 to 44 and 33

45. (NOT TO EXCEED $8000) Subtract line 45 column (d) from (c) (If less than zero, enter zero)

You

.00 .00 .00

Spouse

.00 .00 45 .00

46. Surviving spouse deduction

(instructions on page 23) 46 .00 .00

Modi fications Decreasing Federal Adjusted Gross Income

Continues on next page

*P40202003W*

P 4 0 2 0 2 0 0 3 W

–3–

|

Enlarge image |

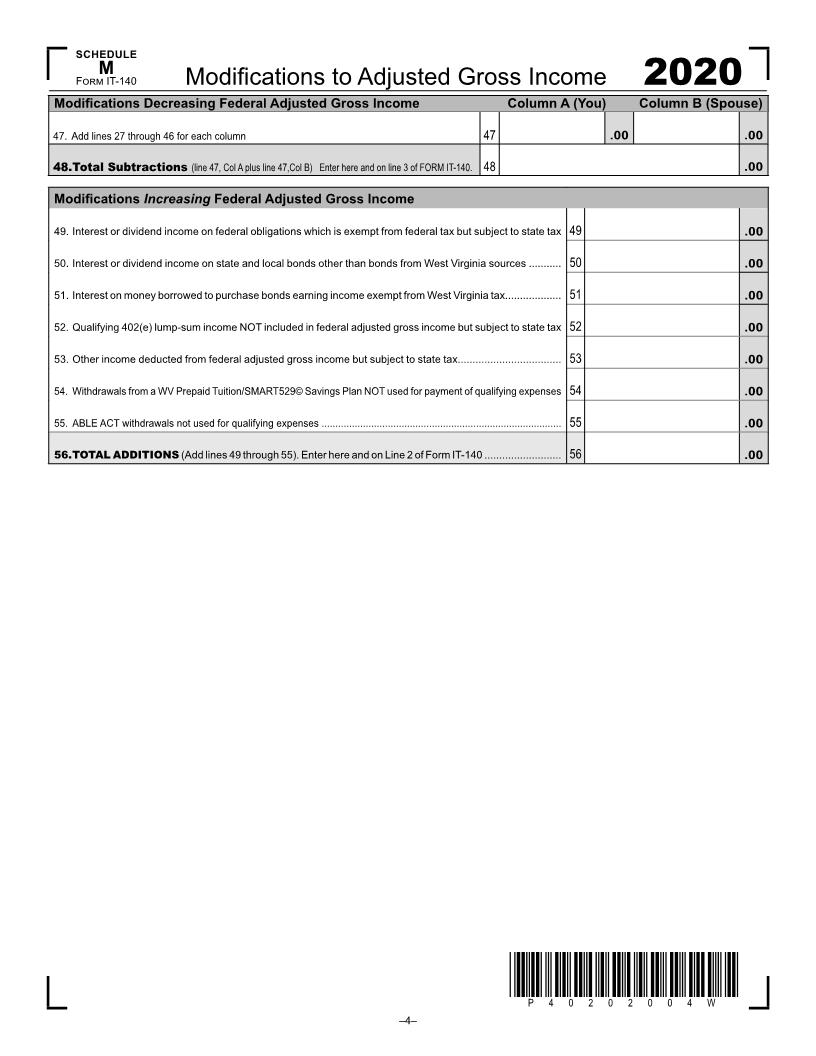

SCHEDULE

M

F IT-140 Modifications to Adjusted Gross Income 2020

Modi fications Decreasing Federal Adjusted Gross Income Column A (You) Column B (Spouse)

47. Add lines 27 through 46 for each column 47 .00 .00

48. Total Subtractions (line 47, Col A plus line 47,Col B) Enter here and on line 3 of FORM IT-140. 48 .00

Modi fications Increasing Federal Adjusted Gross Income

49. Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax 49 .00

50. Interest or dividend income on state and local bonds other than bonds from West Virginia sources ........... 50 .00

51. Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax................... 51 .00

52. Qualifying 402(e) lump-sum income NOT included in federal adjusted gross income but subject to state tax 52 .00

53. Other income deducted from federal adjusted gross income but subject to state tax................................... 53 .00

54. Withdrawals from a WV Prepaid Tuition/SMART529© Savings Plan NOT used for payment of qualifying expenses 54 .00

55. ABLE ACT withdrawals not used for qualifying expenses ....................................................................................... 55 .00

56. TOTAL ADDITIONS (Add lines 49 through 55). Enter here and on Line 2 of Form IT-140 .......................... 56 .00

*P40202004W*

P 4 0 2 0 2 0 0 4 W

–4–

|

Enlarge image |

RECAP

(F IT-140) W Tax Credit Recap Schedule 2020

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to

completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can

be claimed. Both this summary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED

with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website

at tax.wv.gov or by calling the Taxpayer Services Division at 1-800-982-8297.

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no lon-

ger required to enclose the other state(s) return(s) or the NIPA-2 schedule with your return. You must maintain the

other state(s) return(s) or NIPA-2 schedule in your files.

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

TAX CREDIT SCHEDULE APPLICABLE CREDIT

1. Credit for Income Tax paid to another state(s) ................................................ E 1 .00

** For what states?

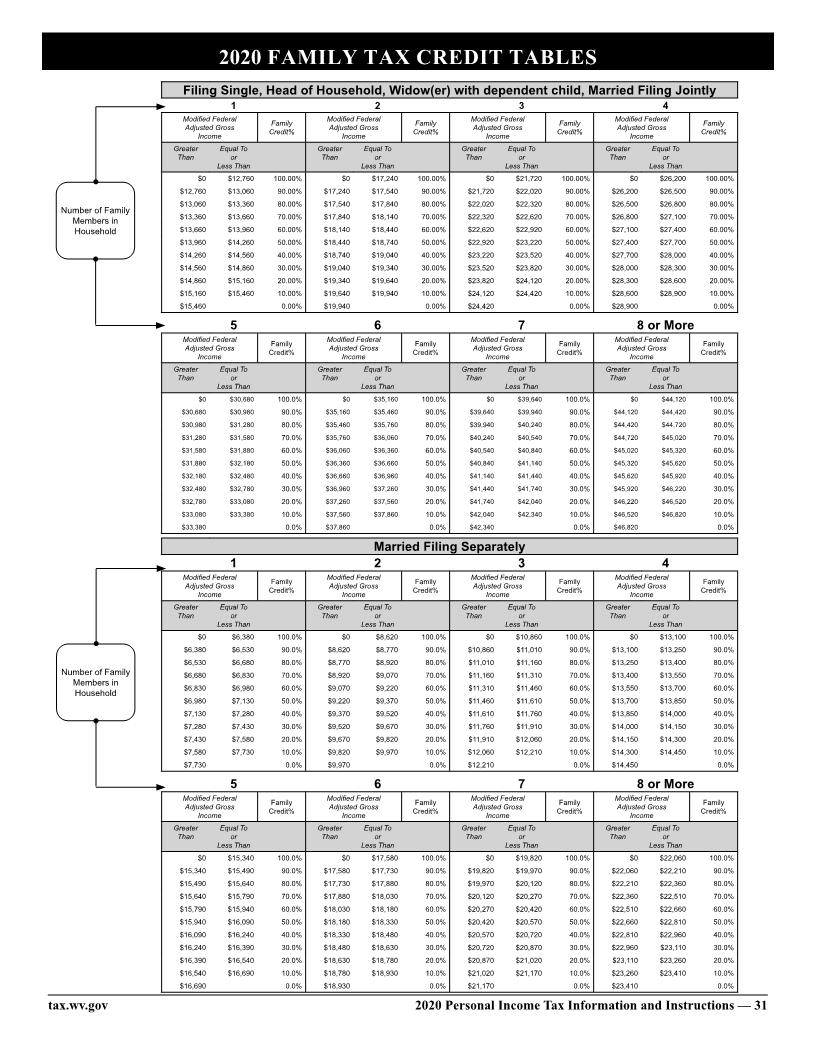

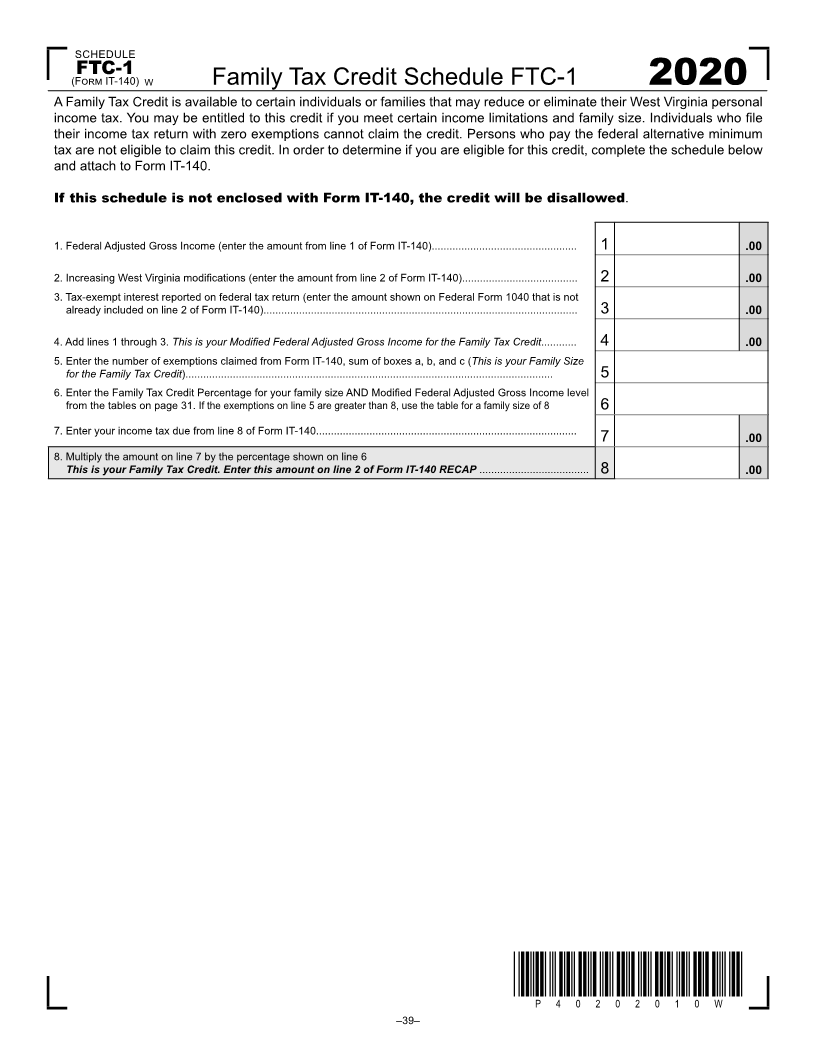

2. Family Tax Credit (see page 39).................................................................... FTC-1 2 .00

3. General Economic Opportunity Tax Credit...................................................... WV EOTC-PIT 3 .00

4. WV Environmental Agricultural Equipment Credit.......................................... WV AG-1 4 .00

5. WV Military Incentive Credit............................................................................ J 5 .00

6. Neighborhood Investment Program Credit..................................................... NIPA-2 6 .00

7. Historic Rehabilitated Buildings Investment Credit........................................ RBIC 7 .00

8. Quali edfi Rehabilitated Buildings Investment Credit....................................... RBIC-A 8 .00

9. Apprenticeship Training Tax Credit................................................................ WV ATTC-1 9 .00

10. Alternative-Fuel Tax Credit............................................................................. AFTC-1 10 .00

11. Conceal Carry Gun Permit Credit.................................................................. CCGP-1 11 .00

12. Farm to Food Bank Tax Credit......................................................................... 12 .00

13. Downstream Natural Gas Manufacturing Investment Tax Credit ................. DNG- 2 13 .00

14. Post Coal Mine Site Business Credit ........................................................... PCM-2 14 .00

15. TOTAL CREDITS — add lines 1 through 14. Enter on Form IT-140, line 9........................................... 15 .00

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202005W*

P 4 0 2 0 2 0 0 5 W

–5–

|

Enlarge image | THIS PAGE INTENTIONALLY LEFT BLANK. –6– |

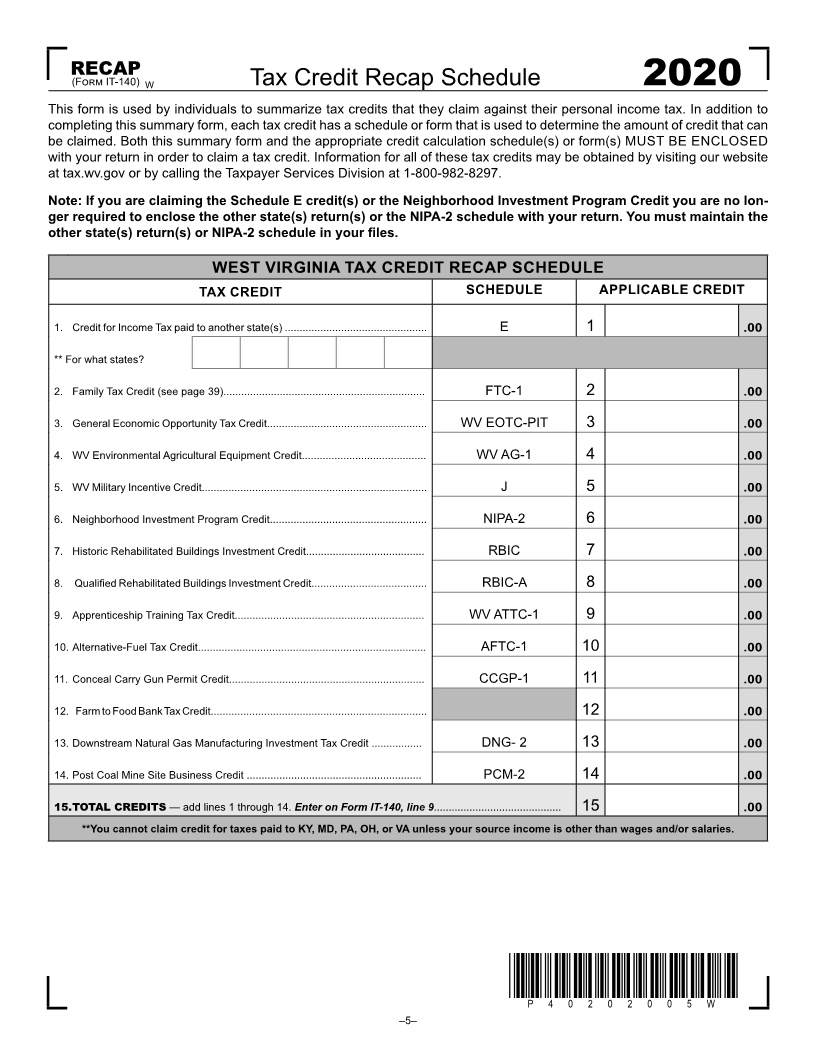

Enlarge image |

SCHEDULE

Statement of Claimant to Refund Due Deceased Taxpayer

(F F IT-140) W (Attach completed schedule to decedent's return)

2020

NAME OF NAME OF

DECEDENT CLAIMANT

DATE OF SOCIAL SECURITY SOCIAL SECURITY

DEATH NUMBER NUMBER

ADDRESS

(permanent residence or ADDRESS

domicile at date of death)

CITY STATE ZIP CITY STATE ZIP

CODE CODE

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME

B. Administrator or executor. Attach a court certificate showing your appointment. AND ADDRESS OF THE SURVIV-

ING SPOUSE AND CHILDREN OF

C. Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach THE DECEDENT.

a copy of the death certificate or proof of death*

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3. Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu-

tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have

examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in

active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202015W*

P 4 0 2 0 2 0 1 5 W

–7–

|

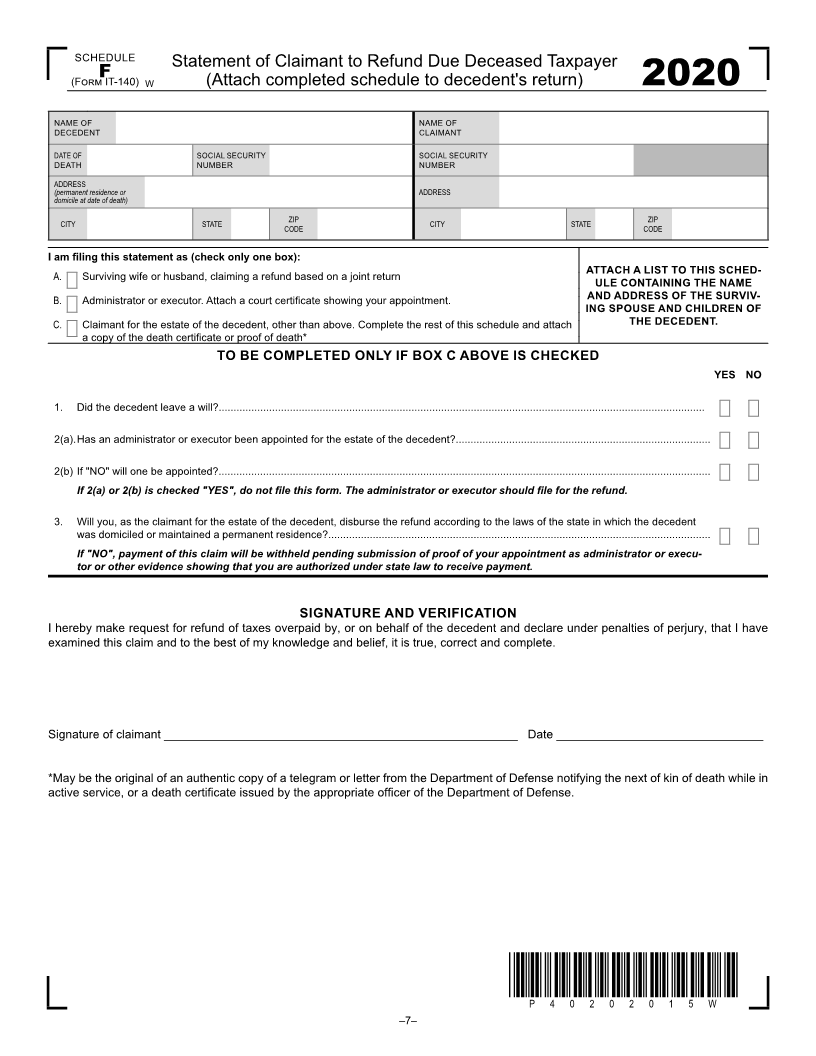

Enlarge image |

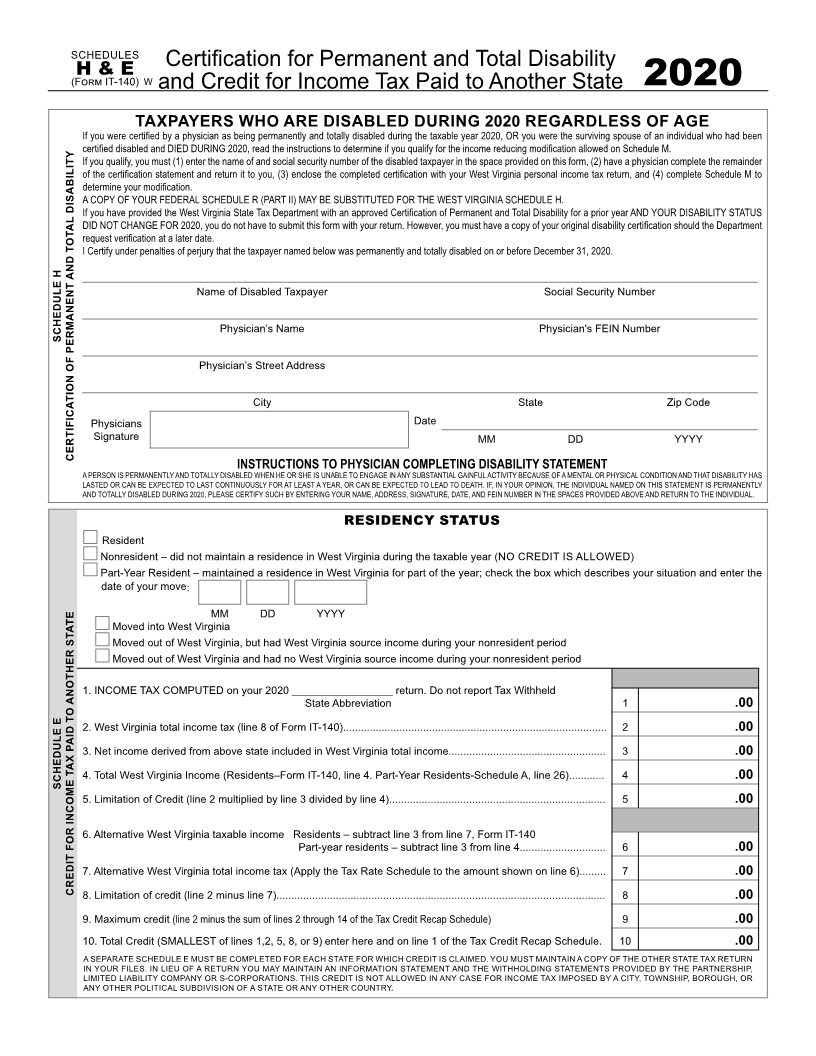

SCHEDULES

Certification for Permanent and Total Disability

H & E W

(F IT-140) and Credit for Income Tax Paid to Another State 2020

TAXPAYERS WHO ARE DISABLED DURING 2020 REGARDLESS OF AGE

If you were certified by a physician as being permanently and totally disabled during the taxable year 2020, OR you were the surviving spouse of an individual who had been

certified disabled and DIED DURING 2020, read the instructions to determine if you qualify for the income reducing modification allowed on Schedule M.

If you qualify, you must (1) enter the name of and social security number of the disabled taxpayer in the space provided on this form, (2) have a physician complete the remainder

of the certification statement and return it to you, (3) enclose the completed certi cationfiwith your West Virginia personal income tax return, and (4) complete Schedule M to

determine your modification.

A COPY OF YOUR FEDERAL SCHEDULE R (PART II) MAY BE SUBSTITUTED FOR THE WEST VIRGINIA SCHEDULE H.

If you have provided the West Virginia State Tax Department with an approved Certification of Permanent and Total Disability for a prior year AND YOUR DISABILITY STATUS

DID NOT CHANGE FOR 2020, you do not have to submit this form with your return. However, you must have a copy of your original disability certification should the Department

request verification at a later date.

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2020.

Name of Disabled Taxpayer Social Security Number

Physician’s Name Physician's FEIN Number

SCHEDULE H

Physician’s Street Address

City State Zip Code

Physicians Date

Signature MM DD YYYY

CERTIFICATION OF PERMANENT AND TOTAL DISABILITY

INSTRUCTIONS TO PHYSICIAN COMPLETING DISABILITY STATEMENT

A PERSON IS PERMANENTLY AND TOTALLY DISABLED WHEN HE OR SHE IS UNABLE TO ENGAGE IN ANY SUBSTANTIAL GAINFUL ACTIVITY BECAUSE OF A MENTAL OR PHYSICAL CONDITION AND THAT DISABILITY HAS

LASTED OR CAN BE EXPECTED TO LAST CONTINUOUSLY FOR AT LEAST A YEAR, OR CAN BE EXPECTED TO LEAD TO DEATH. IF, IN YOUR OPINION, THE INDIVIDUAL NAMED ON THIS STATEMENT IS PERMANENTLY

AND TOTALLY DISABLED DURING 2020, PLEASE CERTIFY SUCH BY ENTERING YOUR NAME, ADDRESS, SIGNATURE, DATE, AND FEIN NUMBER IN THE SPACES PROVIDED ABOVE AND RETURN TO THE INDIVIDUAL.

RESIDENCY STATUS

Resident

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

Part-Year Resident – maintained a residence in West Virginia for part of the year; check the box which describes your situation and enter the

date of your move:

MM DD YYYY

Moved into West Virginia

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

1. INCOME TAX COMPUTED on your 2020 _________________ return. Do not report Tax Withheld

State Abbreviation 1 .00

2. West Virginia total income tax (line 8 of Form IT-140)......................................................................................... 2 .00

3. Net income derived from above state included in West Virginia total income..................................................... 3 .00

4. Total West Virginia Income (Residents–Form IT-140, line 4. Part-Year Residents-Schedule A, line 26)............ 4 .00

SCHEDULE E

5. Limitation of Credit (line 2 multiplied by line 3 divided by line 4)......................................................................... 5 .00

6. Alternative West Virginia taxable income Residents – subtract line 3 from line 7, Form IT-140

Part-year residents – subtract line 3 from line 4............................. 6 .00

7. Alternative West Virginia total income tax (Apply the Tax Rate Schedule to the amount shown on line 6)......... 7 .00

CREDIT FOR INCOME TAX PAID TO ANOTHER STATE 8. Limitation of credit (line 2 minus line 7)............................................................................................................... 8 .00

9. Maximum credit (line 2 minus the sum of lines 2 through 14 of the Tax Credit Recap Schedule) 9 .00

10. Total Credit (SMALLEST of lines 1,2, 5, 8, or 9)enter here and on line 1 of the Tax Credit Recap Schedule.10 .00

A SEPARATE SCHEDULE E MUST BE COMPLETED FOR EACH STATE FOR WHICH CREDIT IS CLAIMED. YOU MUST MAINTAIN A COPY OF THE OTHER STATE TAX RETURN

IN YOUR FILES. IN LIEU OF A RETURN YOU MAY MAINTAIN AN INFORMATION STATEMENT AND THE WITHHOLDING STATEMENTS PROVIDED BY THE PARTNERSHIP,

LIMITED LIABILITY COMPANY OR S-CORPORATIONS. THIS CREDIT IS NOT ALLOWED IN ANY CASE FOR INCOME TAX IMPOSED BY A CITY, TOWNSHIP, BOROUGH, OR

ANY OTHER POLITICAL SUBDIVISION OF A STATE OR ANY OTHER COUNTRY.

|

Enlarge image |

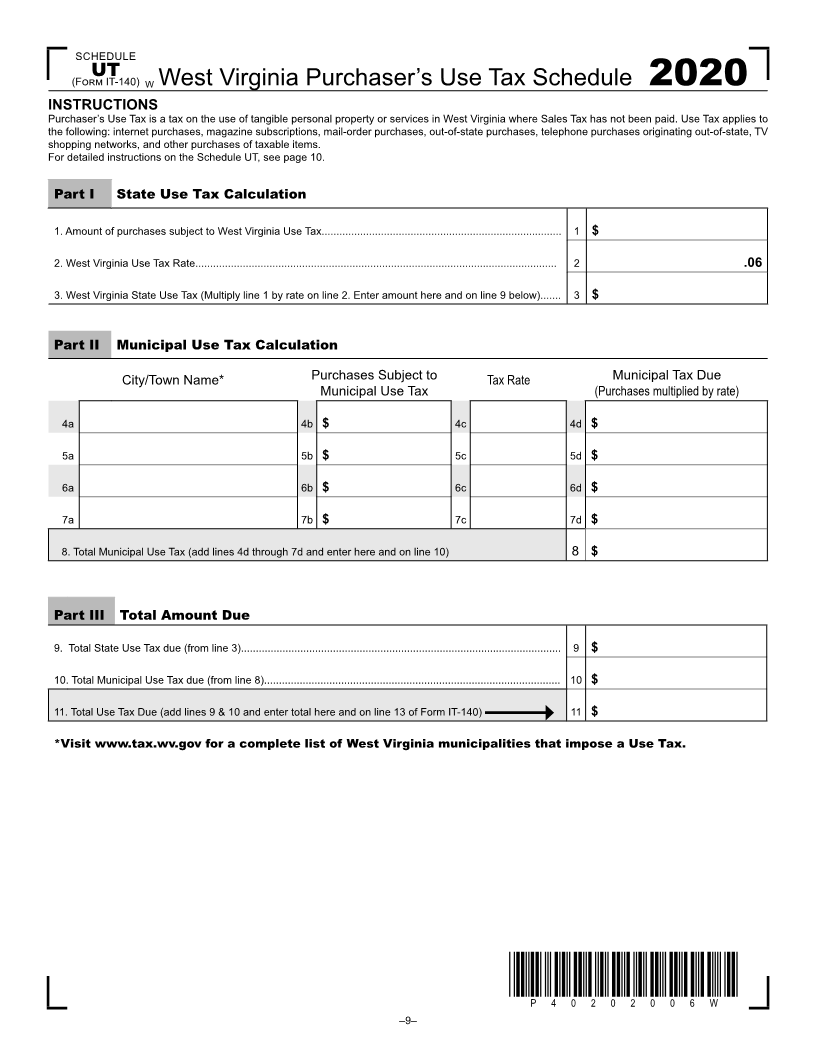

SCHEDULE

UT

(F IT-140) W West Virginia Purchaser’s Use Tax Schedule 2020

INSTRUCTIONS

Purchaser’s Use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not been paid. Use Tax applies to

the following: internet purchases, magazine subscriptions, mail-order purchases, out-of-state purchases, telephone purchases originating out-of-state, TV

shopping networks, and other purchases of taxable items.

For detailed instructions on the Schedule UT, see page 10.

Part I State Use Tax Calculation

1. Amount of purchases subject to West Virginia Use Tax................................................................................. 1 $

2. West Virginia Use Tax Rate.......................................................................................................................... 2 .06

3. West Virginia State Use Tax (Multiply line 1 by rate on line 2. Enter amount here and on line 9 below)....... 3 $

Part II Municipal Use Tax Calculation

City/Town Name* Purchases Subject to Tax Rate Municipal Tax Due

Municipal Use Tax (Purchases multiplied by rate)

4a 4b $ 4c 4d $

5a 5b $ 5c 5d $

6a 6b $ 6c 6d $

7a 7b $ 7c 7d $

8. Total Municipal Use Tax (add lines 4d through 7d and enter here and on line 10) 8 $

Part III Total Amount Due

9. Total State Use Tax due (from line 3)............................................................................................................ 9 $

10. Total Municipal Use Tax due (from line 8).................................................................................................... 10 $

11. Total Use Tax Due (add lines 9 & 10 and enter total here and on line 13 of Form IT-140) 11 $

*Visit www.tax.wv.gov for a complete list of West Virginia municipalities that impose a Use Tax.

*P40202006W*

P 4 0 2 0 2 0 0 6 W

–9–

|

Enlarge image |

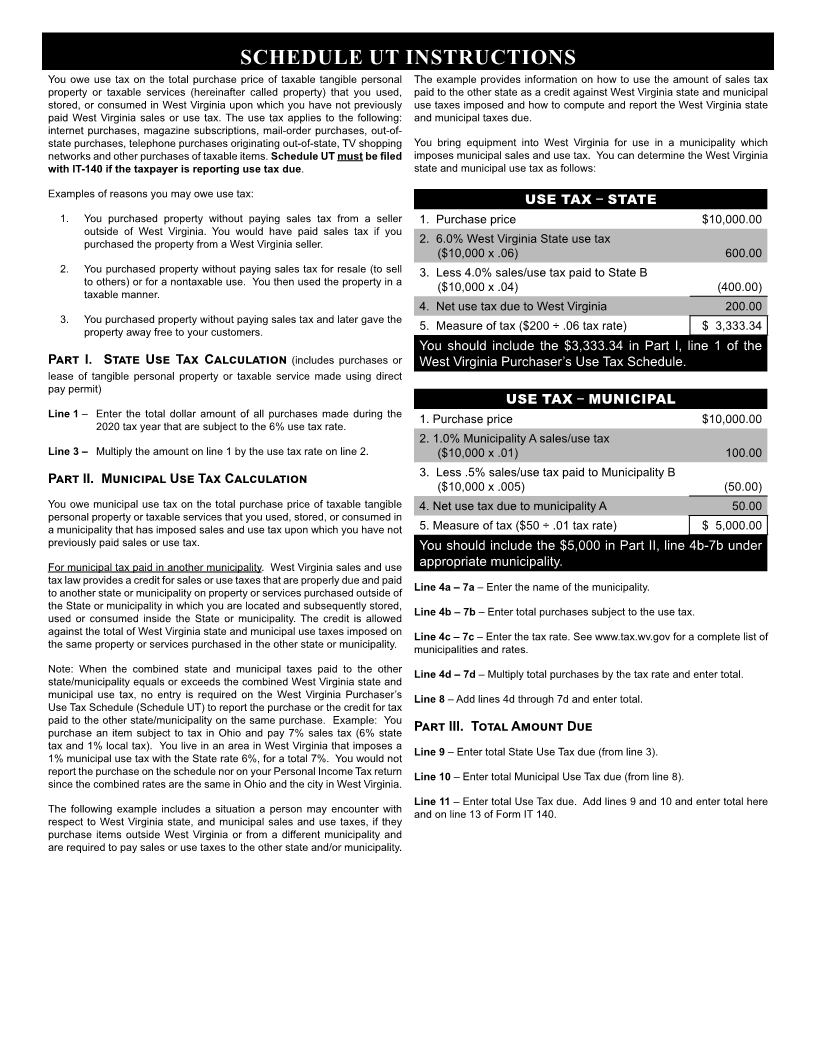

SCHEDULE UT INSTRUCTIONS

You owe use tax on the total purchase price of taxable tangible personal The example provides information on how to use the amount of sales tax

property or taxable services (hereinafter called property) that you used, paid to the other state as a credit against West Virginia state and municipal

stored, or consumed in West Virginia upon which you have not previously use taxes imposed and how to compute and report the West Virginia state

paid West Virginia sales or use tax. The use tax applies to the following: and municipal taxes due.

internet purchases, magazine subscriptions, mail-order purchases, out-of-

state purchases, telephone purchases originating out-of-state, TV shopping You bring equipment into West Virginia for use in a municipality which

networks and other purchases of taxable items.Schedule UT must be filed imposes municipal sales and use tax. You can determine the West Virginia

with IT-140 if the taxpayer is reporting use tax due. state and municipal use tax as follows:

Examples of reasons you may owe use tax:

USE TAX – STATE

1. You purchased property without paying sales tax from a seller 1. Purchase price $10,000.00

outside of West Virginia. You would have paid sales tax if you

purchased the property from a West Virginia seller. 2. 6.0% West Virginia State use tax

($10,000 x .06) 600.00

2. You purchased property without paying sales tax for resale (to sell 3. Less 4.0% sales/use tax paid to State B

to others) or for a nontaxable use. You then used the property in a ($10,000 x .04) (400.00)

taxable manner.

4. Net use tax due to West Virginia 200.00

3. You purchased property without paying sales tax and later gave the

property away free to your customers. 5. Measure of tax ($200 ÷ .06 tax rate) $ 3,333.34

You should include the $3,333.34 in Part I, line 1 of the

Pඉකග I. S ගඉගඍ U ඛඍ ඉචT C ඉඔඋඝඔඉගඑඖ (includes purchases or West Virginia Purchaser’s Use Tax Schedule.

lease of tangible personal property or taxable service made using direct

pay permit)

USE TAX – MUNICIPAL

Line 1 – Enter the total dollar amount of all purchases made during the 1. Purchase price $10,000.00

2020 tax year that are subject to the 6% use tax rate.

2. 1.0% Municipality A sales/use tax

Line 3 – Multiply the amount on line 1 by the use tax rate on line 2. ($10,000 x .01) 100.00

3. Less .5% sales/use tax paid to Municipality B

Pඉකග II. Mඝඖඑඋඑඉඔ ඛඍ ඉච ඉඔඋඝඔඉගඑඖ U T C

($10,000 x .005) (50.00)

You owe municipal use tax on the total purchase price of taxable tangible 4. Net use tax due to municipality A 50.00

personal property or taxable services that you used, stored, or consumed in

a municipality that has imposed sales and use tax upon which you have not 5. Measure of tax ($50 ÷ .01 tax rate) $ 5,000.00

previously paid sales or use tax. You should include the $5,000 in Part II, line 4b-7b under

For municipal tax paid in another municipality. West Virginia sales and use appropriate municipality.

tax law provides a credit for sales or use taxes that are properly due and paid

to another state or municipality on property or services purchased outside of Line 4a – 7a – Enter the name of the municipality.

the State or municipality in which you are located and subsequently stored, Line 4b – 7b – Enter total purchases subject to the use tax.

used or consumed inside the State or municipality. The credit is allowed

against the total of West Virginia state and municipal use taxes imposed on Line 4c – 7c – Enter the tax rate. See www.tax.wv.gov for a complete list of

the same property or services purchased in the other state or municipality. municipalities and rates.

Note: When the combined state and municipal taxes paid to the other Line 4d – 7d – Multiply total purchases by the tax rate and enter total.

state/municipality equals or exceeds the combined West Virginia state and

municipal use tax, no entry is required on the West Virginia Purchaser’s Line 8 – Add lines 4d through 7d and enter total.

Use Tax Schedule (Schedule UT) to report the purchase or the credit for tax

paid to the other state/municipality on the same purchase. Example: You

purchase an item subject to tax in Ohio and pay 7% sales tax (6% state Pඉකග III. Tගඉඔ ඕඝඖග ඝඍ A D

tax and 1% local tax). You live in an area in West Virginia that imposes a Line 9 – Enter total State Use Tax due (from line 3).

1% municipal use tax with the State rate 6%, for a total 7%. You would not

report the purchase on the schedule nor on your Personal Income Tax return Line 10 – Enter total Municipal Use Tax due (from line 8).

since the combined rates are the same in Ohio and the city in West Virginia.

Line 11 – Enter total Use Tax due. Add lines 9 and 10 and enter total here

The following example includes a situation a person may encounter with and on line 13 of Form IT 140.

respect to West Virginia state, and municipal sales and use taxes, if they

purchase items outside West Virginia or from a di erentff municipality and

are required to pay sales or use taxes to the other state and/or municipality.

|

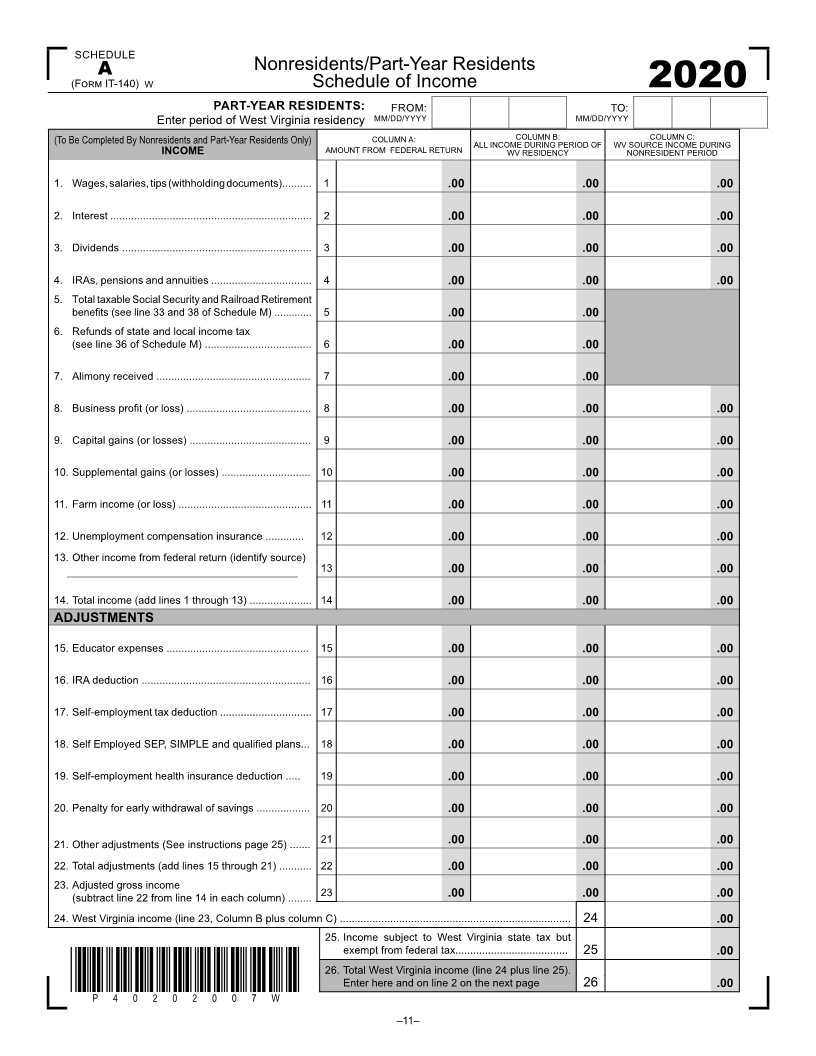

Enlarge image |

SCHEDULE

A Nonresidents/Part-Year Residents

(F IT-140) W Schedule of Income

2020

PART-YEAR RESIDENTS: FROM: TO:

Enter period of West Virginia residency MM/DD/YYYY MM/DD/YYYY

(To Be Completed By Nonresidents and Part-Year Residents Only) COLUMN A: COLUMN B: COLUMN C:

INCOME AMOUNT FROM FEDERAL RETURN ALL INCOME DURING PERIOD OF WV SOURCE INCOME DURING

WV RESIDENCY NONRESIDENT PERIOD

1. Wages, salaries, tips (withholding documents).......... 1 .00 .00 .00

2. Interest .................................................................... 2 .00 .00 .00

3. Dividends ................................................................ 3 .00 .00 .00

4. IRAs, pensions and annuities .................................. 4 .00 .00 .00

5. Total taxable Social Security and Railroad Retirement

benefits (see line 33 and 38 of Schedule M) ............. 5 .00 .00

6. Refunds of state and local income tax

(see line 36 of Schedule M) .................................... 6 .00 .00

7. Alimony received .................................................... 7 .00 .00

8. Business pro tfi(or loss) .......................................... 8 .00 .00 .00

9. Capital gains (or losses) ......................................... 9 .00 .00 .00

10. Supplemental gains (or losses) .............................. 10 .00 .00 .00

11. Farm income (or loss) ............................................. 11 .00 .00 .00

12. Unemployment compensation insurance ............. 12 .00 .00 .00

13. Other income from federal return (identify source)

13 .00 .00 .00

14. Total income (add lines 1 through 13) ..................... 14 .00 .00 .00

ADJUSTMENTS

15. Educator expenses ................................................ 15 .00 .00 .00

16. IRA deduction ......................................................... 16 .00 .00 .00

17. Self-employment tax deduction ............................... 17 .00 .00 .00

18. Self Employed SEP, SIMPLE and qualified plans... 18 .00 .00 .00

19. Self-employment health insurance deduction ..... 19 .00 .00 .00

20. Penalty for early withdrawal of savings .................. 20 .00 .00 .00

21. Other adjustments (See instructions page 25) ....... 21 .00 .00 .00

22. Total adjustments (add lines 15 through 21) ........... 22 .00 .00 .00

23. Adjusted gross income

(subtract line 22 from line 14 in each column) ........ 23 .00 .00 .00

24. West Virginia income (line 23, Column B plus column C) .............................................................................. 24 .00

25. Income subject to West Virginia state tax but

exempt from federal tax...................................... 25 .00

26. Total West Virginia income (line 24 plus line 25).

*P40201907W* Enter here and on line 2 on the next page 26 .00

P 4 0 2 0 2 0 0 7 W

–11–

|

Enlarge image |

SCHEDULE

A Nonresidents/Part-Year Residents

(F IT-140) W Schedule of Income

2020

SCHEDULE A (CONTINUED)

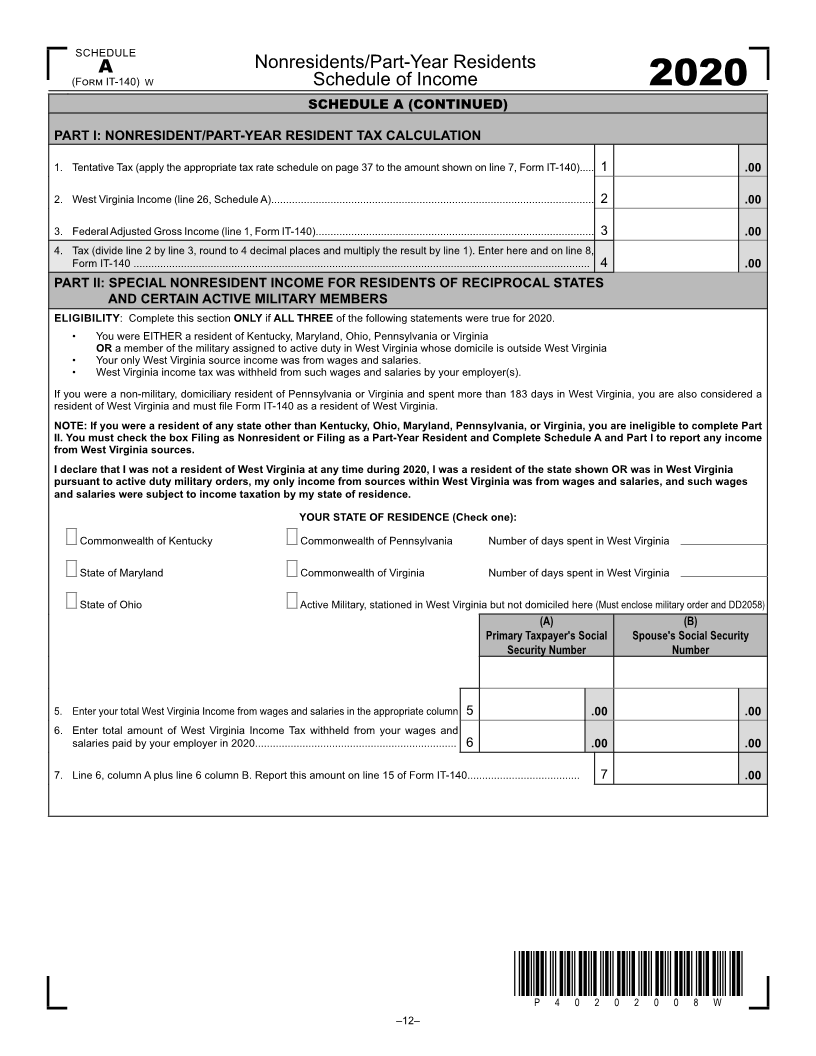

PART I: NONRESIDENT/PART-YEAR RESIDENT TAX CALCULATION

1. Tentative Tax (apply the appropriate tax rate schedule on page 37 to the amount shown on line 7, Form IT-140)..... 1 .00

2. West Virginia Income (line 26, Schedule A)............................................................................................................. 2 .00

3. Federal Adjusted Gross Income (line 1, Form IT-140).............................................................................................. 3 .00

4. Tax (divide line 2 by line 3, round to 4 decimal places and multiply the result by line 1). Enter here and on line 8,

Form IT-140 .......................................................................................................................................................... 4 .00

PART II: SPECIAL NONRESIDENT INCOME FOR RESIDENTS OF RECIPROCAL STATES

AND CERTAIN ACTIVE MILITARY MEMBERS

ELIGIBILITY: Complete this section ONLY if ALL THREE of the following statements were true for 2020.

• You were EITHER a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia

OR a member of the military assigned to active duty in West Virginia whose domicile is outside West Virginia

• Your only West Virginia source income was from wages and salaries.

• West Virginia income tax was withheld from such wages and salaries by your employer(s).

If you were a non-military, domiciliary resident of Pennsylvania or Virginia and spent more than 183 days in West Virginia, you are also considered a

resident of West Virginia and must file Form IT-140 as a resident of West Virginia.

NOTE: If you were a resident of any state other than Kentucky, Ohio, Maryland, Pennsylvania, or Virginia, you are ineligible to complete Part

II. You must check the box Filing as Nonresident or Filing as a Part-Year Resident and Complete Schedule A and Part I to report any income

from West Virginia sources.

I declare that I was not a resident of West Virginia at any time during 2020, I was a resident of the state shown OR was in West Virginia

pursuant to active duty military orders, my only income from sources within West Virginia was from wages and salaries, and such wages

and salaries were subject to income taxation by my state of residence.

YOUR STATE OF RESIDENCE (Check one):

Commonwealth of Kentucky Commonwealth of Pennsylvania Number of days spent in West Virginia

State of Maryland Commonwealth of Virginia Number of days spent in West Virginia

State of Ohio Active Military, stationed in West Virginia but not domiciled here (Must enclose military order and DD2058)

(A) (B)

Primary Taxpayer's Social Spouse's Social Security

Security Number Number

5. Enter your total West Virginia Income from wages and salaries in the appropriate column 5 .00 .00

6. Enter total amount of West Virginia Income Tax withheld from your wages and

salaries paid by your employer in 2020.................................................................... 6 .00 .00

7. Line 6, column A plus line 6 column B. Report this amount on line 15 of Form IT-140...................................... 7 .00

*P40202008W*

P 4 0 2 0 2 0 0 8 W

–12–

|

Enlarge image |

IMPORTANT INFORMATION FOR 2020

• You are required to submit your original withholding documents, such as W-2’s, 1099’s, K-1’s, and NRW-2’s. Failure to submit

this documentation will result in the disallowance of the withholding amount claimed.

• Additional municipalities are now subject to the Municipal Use Tax. Visit www.tax.wv.gov for a complete list of West Virginia

municipalities that impose a Use tax.

• You can now interact with us online at mytaxes.wvtax.gov. Services offered include bill pay and secure communication about your

return. Before you call, please use our MyTaxes portal. At this time, we do not offer online filing through that portal. Online filing

options are available on our website.

RETURNED PAYMENT CHARGE

The Tax Department will recover a $15.00 fee associated with returned bank transactions. These bank transactions include but are not

limited to the following:

• Direct Debit (payment) transactions returned for insufficient funds.

• Stopped payments.

• Bank refusal to authorize payment for any reason.

• Direct Deposit of refunds to closed accounts.

• Direct Deposit of refunds to accounts containing inaccurate or illegible account information.

• Checks returned for insufficient funds will incur a $28.00 fee.

The fee charged for returned or rejected payments will be to recover only the amount charged to the State Tax Department by the

financial institutions.

Important: There are steps that can be taken to minimize the likelihood of a rejected financial transaction occurring:

• Be sure that you are using the most current bank routing and account information.

• If you have your tax return professionally prepared, the financial information used from a prior year return often carries over to the

current return as a step saver. It is important that you verify this information with your tax preparer by reviewing the bank routing and

account information from a current check. This will ensure the information is accurate and current in the event that a bank account

previously used was closed or changed either by you or the financial institution.

• If you prepare your tax return at home using tax preparation software, the financial information used from a prior year return often

carries over to the current return as a step saver. It is important that you verify this information by reviewing the bank routing and

account information from a current check. This will ensure the information is accurate and current in the event that a bank account

previously used was closed or changed either by you or the financial institution.

• If you prepare your tax return by hand using a paper return form, be sure that all numbers entered when requesting a direct deposit of

refund are clear and legible.

• If making a payment using MyTaxes, be sure that the bank routing and account numbers being used are current.

• If scheduling a delayed debit payment for an electronic return filed prior to the due date, make sure that the bank routing and account

numbers being used will be active on the scheduled date.

• Be sure that funds are available in your bank account to cover the payment when checks or delayed debit payments are presented for

payment.

tax.wv.gov 2020 Personal Income Tax Information and Instructions — 13

|

Enlarge image |

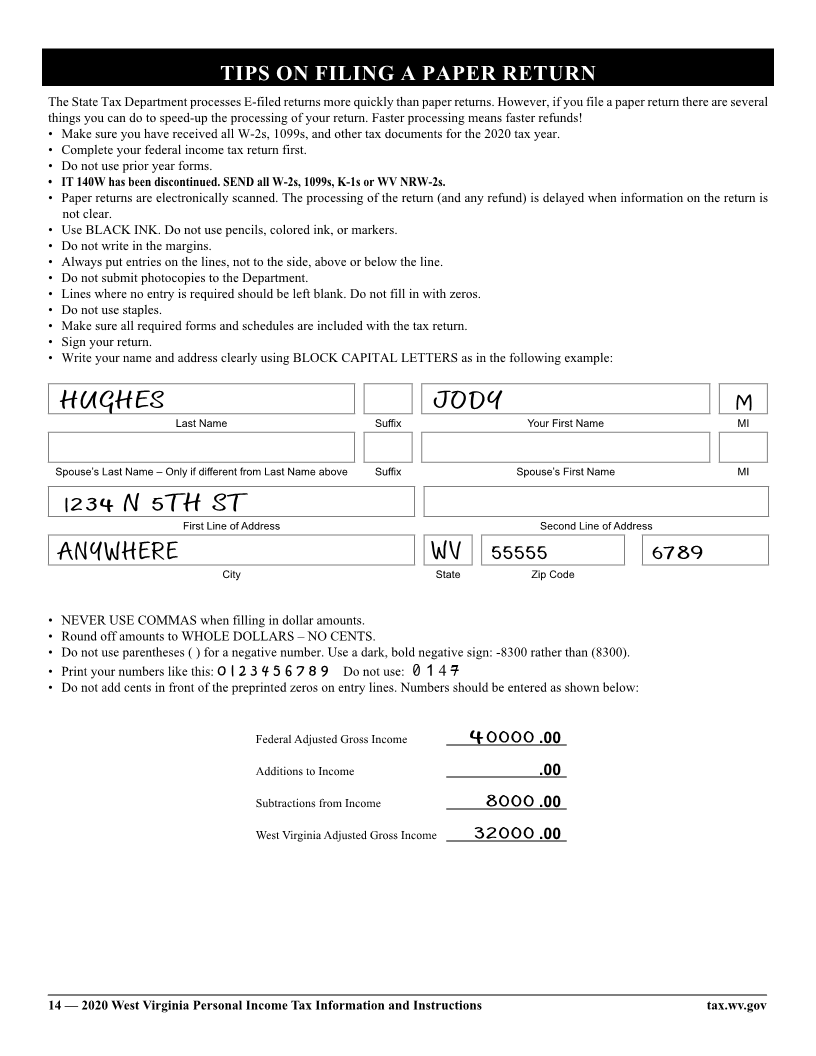

TIPS ON FILING A PAPER RETURN

The State Tax Department processes E-filed returns more quickly than paper returns. However, if you file a paper return there are several

things you can do to speed-up the processing of your return. Faster processing means faster refunds!

• Make sure you have received all W-2s, 1099s, and other tax documents for the 2020 tax year.

• Complete your federal income tax return first.

• Do not use prior year forms.

• IT 140W has been discontinued. SEND all W-2s, 1099s, K-1s or WV NRW-2s.

• Paper returns are electronically scanned. The processing of the return (and any refund) is delayed when information on the return is

not clear.

• Use BLACK INK. Do not use pencils, colored ink, or markers.

• Do not write in the margins.

• Always put entries on the lines, not to the side, above or below the line.

• Do not submit photocopies to the Department.

• Lines where no entry is required should be left blank. Do not fill in with zeros.

• Do not use staples.

• Make sure all required forms and schedules are included with the tax return.

• Sign your return.

• Write your name and address clearly using BLOCK CAPITAL LETTERS as in the following example:

HUGHES JODY M

Last Name Su ffix Your First Name MI

Spouse’s Last Name – Only if different from Last Name aboveSu ffix Spouse’s First Name MI

2 N 5TH STl 34

First Line of Address Second Line of Address

ANYWHERE WV 55555 6789

City State Zip Code

• NEVER USE COMMAS when filling in dollar amounts.

• Round off amounts to WHOLE DOLLARS – NO CENTS.

• Do not use parentheses ( ) for a negative number. Use a dark, bold negative sign: -8300 rather than (8300).

• Print your numbers like this: 0 l 2 3 4 5 6 7 8 9 Do not use: 0 1 4 7

• Do not add cents in front of the preprinted zeros on entry lines. Numbers should be entered as shown below:

Federal Adjusted Gross Income 4 0000.00

Additions to Income .00

Subtractions from Income 8000.00

West Virginia Adjusted Gross Income 32000.00

14 — 2020 West Virginia Personal Income Tax Information and Instructions tax.wv.gov

|

Enlarge image |

GENERAL INFORMATION

WHO MUST FILE If a separate individual return is filed, the nonresident must include the

West Virginia income derived from the pass-through entity filing the

You must file a West Virginia income tax return if: composite return. Credit may be claimed for the share of West Virginia

• You were a resident of West Virginia for the entire taxable year. income tax remitted with the composite return.

• You were a resident of West Virginia for a part of the taxable year This form is available on our website at tax.wv.gov.

(Part-Year Resident).

• You were not a resident of West Virginia at any time during 2020, AMENDED RETURN

but your federal adjusted gross income includes income from West

Virginia sources (nonresident). Use the version of Form IT-140 that corresponds to the tax year to be

You are required to file a West Virginia return even though you may not amended and check the “Amended Return” box. These forms and

be required to file a federal return if: corresponding instructions are available on our website at tax.wv.gov.

• Your West Virginia adjusted gross income is greater than your allowable You must file a West Virginia amended return if any of the following

deduction for personal exemptions ($2,000 per exemption, or $500 if conditions occur:

you claim zero exemptions). Your income is to be determined as if you • To correct a previously filed return; or

had been required to file a federal return. Your exemptions are to be • You filed an amended federal income tax return and that change

determined following the rules on page 16. affected your West Virginia tax liability; or

• You are claiming a SCTC or HEPTC credit OR • The Internal Revenue Service made any changes to your federal return

• You are due a refund. (i.e., change in federal adjusted gross income, change in exemptions,

You are not required to file a West Virginia return if you and your etc.).

spouse are 65 or older and your total income is less than your exemption If a change is made to your federal return, an amended West Virginia

allowance plus the senior citizen modification. For example, $2,000 per return must be filed within ninety (90) days. A copy of your amended

exemption plus up to $8,000 of income received by each taxpayer who is federal income tax return must be enclosed with the West Virginia

65 or older. However, if you are entitled to a refund you must file a return. amended return. Do not enclose a copy of your original return.

If you are changing your filing status from married filing jointly to married

RESIDENCY STATUS filing separately or from married filing separately to married filing jointly,

IT-140 RESIDENT you must do so in compliance with federal guidelines. If your original

return was filed jointly and you are amending to file separately, your

A resident is an individual who: spouse must also file an amended separate return.

• Spends more than 30 days in West Virginia with the intent of West If the amended return is filed after the due date, interest and penalty for

Virginia becoming his/her permanent residence; or

• Maintains a physical presence in West Virginia for more than 183 late payment will be charged on any additional tax due. An additional

days of the taxable year, even though he/she may also be considered a penalty will be assessed if you fail to report any change to your federal

resident of another state. return within the prescribed time.

IT-140 PART-YEAR RESIDENT Space is provided on page 47 to explain why you are filing an amended

return.

A part-year resident is an individual who changes his/her residence

either: NONRESIDENT/PART-YEAR RESIDENT

• From West Virginia to another state, or A part-year resident is subject to West Virginia tax on the following:

• From another state to West Virginia during the taxable year.

• Taxable income received from ALL sources while a resident of West

IT-140 FULL-YEAR NONRESIDENT Virginia;

A full-year nonresident is an individual who is: • West Virginia source income earned during the period of nonresidence; and

• A resident of West Virginia who spends less than 30 days of the taxable • Applicable special accruals.

year in West Virginia, and maintains a permanent place of residence WEST VIRGINIA SOURCE INCOME

outside West Virginia; or The West Virginia source income of a nonresident is derived from the

• A resident of another state who does not maintain a physical presence following sources included in your federal adjusted gross income:

within West Virginia and does not spend more than 183 days of the • Real or tangible personal property located in West Virginia;

taxable year within West Virginia. • Employee services performed in West Virginia;

IT-140 SPECIAL NONRESIDENTS • A business, trade, profession, or occupation conducted in West Virginia;

• A S corporation in which you are a shareholder;

A Special Nonresident is an individual who is: • Your distributive share of West Virginia partnership income or gain;

• A resident of Kentucky, Maryland, Ohio, Pennsylvania, or Virginia for • Your share of West Virginia estate or trust income or gain and royalty income;

the entire taxable year; and • West Virginia Unemployment Compensation benefits;

• Your only source of West Virginia income was from wages and salaries. • Prizes awarded by the West Virginia State Lottery.

Nonresidents who DO NOT have West Virginia source income or West Virginia source income of a nonresident does not include the

withholdings are not required to file a West Virginia return. following income even if it was included in your federal adjusted gross

Mark the nonresident special box on the front of the return and income:

complete Part II of Schedule A. • Annuities and pensions;

• Interest, dividends or gains from the sale or exchange of intangible

IT-140 NRC- COMPOSITE RETURN personal property unless they are part of the income you received from

Nonresident individuals who are partners in a partnership, shareholders in conducting a business, trade, profession, or occupation in West Virginia.

a S corporation or beneficiaries of an estate or trust that derives income • Gambling winnings, other than prizes awarded by the West Virginia

from West Virginia sources may elect to be included on a nonresident State Lottery as described above, unless you are engaged in the

composite return. If the election is made, the IT-140NRC is filed by the business of gambling (file a Schedule C related to gambling activity for

federal income tax purposes) and you engage in that business, trade,

pass-through entity and eliminates the need for the individual to file a profession, or occupation in West Virginia.

separate nonresident/part-year resident return for income reported on the

NRC. A $50 processing fee is required for each composite return filed.

tax.wv.gov 2020 Personal Income Tax Information and Instructions — 15

|

Enlarge image |

NONRESIDENTS AND PART-YEAR RESIDENTS MUST FIRST DECEASED TAXPAYER

COMPLETE LINES 1 THROUGH 7 OF FORM IT-140, THEN

COMPLETE SCHEDULE A. Income earned outside of West Virginia A return must be filed for a taxpayer who died during the taxable year. Check

may not be claimed on Schedule M as other deductions. Please use the box “DECEASED” and enter the date of death on the line provided. If

Schedule A. To compute tax due, use the calculation worksheet located on a joint federal return was filed for the deceased and the surviving spouse,

page 12. (Line by line instructions for Schedule A can be found on pages the West Virginia return may be filed jointly. The surviving spouse should

24 through 26.) write on the signature line for the deceased “filing as surviving spouse”.

If a refund is expected, a completed Schedule F must be enclosed with

INCOME the return so the refund can be issued to the surviving spouse or to the

In Column A of Schedule A, you must enter the amounts from your federal decedent’s estate. Schedule F may be found on page 7.

return. Income received while you were a resident of West Virginia must be

reported in Column B. Income received from West Virginia sources while a EXEMPTIONS

nonresident of West Virginia must be reported in Column C. While you can no longer claim personal exemptions on your federal income

ADJUSTMENTS tax return, West Virginia has retained personal exemptions under the same

rules applicable under federal law in prior years. The West Virginia

The amounts to be shown in each line of Column B and/or Column C of

personal exemption allowance is $2,000 per allowable exemption, or $500

Schedule A are those items that were actually paid or incurred during your

if someone else can claim an exemption for you on their return. See the

period of residency, or paid or incurred as a result of the West Virginia

rules for personal exemptions on page 20.

source income during the period of nonresidence. For example, if you made

payments to an Individual Retirement Account during the entire taxable ITEMIZED DEDUCTIONS

year, you may not claim any payments made while a nonresident unless

the payments were made from West Virginia source income. However, you The State of West Virginia does not recognize itemized deductions for

may claim the full amount of any payments made during your period of personal income tax purposes. Consequently, itemized deductions claimed

West Virginia residency. on the federal income tax return cannot be carried to the West Virginia

return. Gambling losses claimed as itemized deductions on the federal

SPECIAL ACCRUALS income tax return cannot be deducted on the West Virginia tax return.

In the case of a taxpayer changing from a RESIDENT to a NONRESIDENT Consequently, there is no provision in the West Virginia Code to offset

status, the return must include all items of income, gain, or loss accrued gambling winnings with gambling losses.

to the taxpayer up to the time of his change of residence. This includes

any amounts not otherwise includible on the return because of an election PROPERTY TAX CREDITS

to report income on an installment basis. The return must be filed on the The Senior Citizen Tax Credit and Homestead Excess Property Tax Credit

accrual basis whether or not that is the taxpayer’s established method of are available to low-income taxpayers. Some taxpayers may qualify for

reporting. both. A return must be filed in order to receive either of these refundable

For example, a taxpayer who moves from West Virginia and sells his West credits even if you are not required to file a federal return.

Virginia home or business on an installment plan must report all income

from the sale in the year of the sale, even though federal tax is deferred until SENIOR CITIZENS TAX CREDIT

the income is actually received. Credit eligibility is restricted to taxpayers who participate in the Homestead

Exemption program (administered by the county assessor’s office), who

FILING STATUS incur and pay property taxes and whose federal adjusted gross income is

There are five (5) filing status categories for state income tax purposes. less than 150% of federal poverty guidelines.

Your filing status will determine the rate used to calculate your tax. The maximum federal adjusted gross income level is $19,140 for a single

• Single person household plus an additional $6,720 for each additional person in

• Head of Household the household (e.g., $25,860 for a two-person household).

• Married Filing Jointly. You must have filed a joint federal return to be You should receive form WV SCTC-1 by mail if you participate in the

eligible to file a joint state return. If you filed a joint federal return, you Homestead Exemption program. Form WV SCTC-1 must be included with

may elect to file your state return as either “Married Filing Jointly” using your return to claim the Senior Citizen Tax Credit.

the state’s tax Rate Schedule I or as “Married Filing Separately” using

Rate Schedule II. Additional information can be found on page 30 of this booklet and in

• Married Filing Separately. If you are married but filed separate federal Publication TSD-411 which can be found on our website at tax.wv.gov.

returns, you MUST file separate state returns. If you file separate returns

you must use the “Married Filing Separately” tax Rate Schedule II to HOMESTEAD EXCESS PROPERTY TAX CREDIT

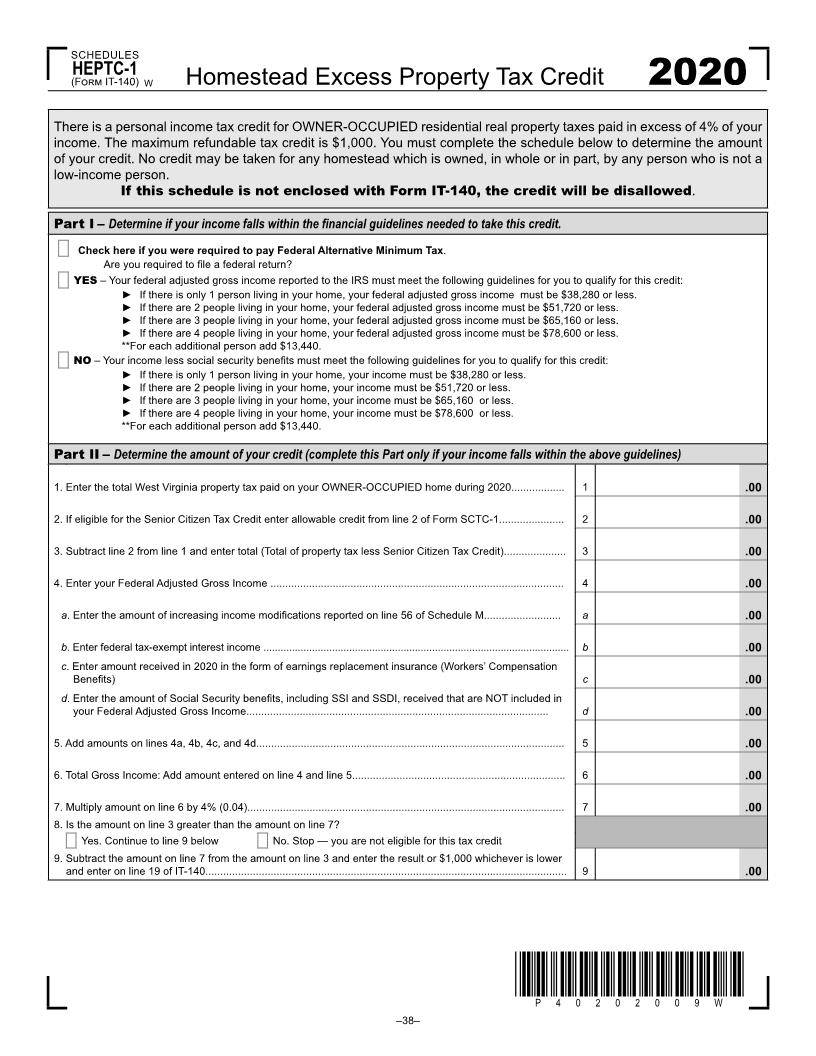

determine your state tax. The Homestead Excess Property Tax Credit provides a refundable credit of

• Widow(er) with a dependent child. up to $1,000 for low-income property owners whose real property tax, less

When joint federal but separate state returns are filed, each spouse must senior citizen tax credit, paid on your OWNER-OCCUPIED home exceeds

report his/her federal adjusted gross income separately as if the federal 4% of your income (gross household income including social security

adjusted gross income of each had been determined on separately filed benefits). Low-income is defined as federal adjusted gross income that is

federal returns. 300% or less of the federal poverty guideline, based upon the number of

If one spouse was a resident of West Virginia for the entire taxable year and individuals in the family. Eligibility for the Homestead Exemption program

the other spouse a nonresident for the entire taxable year and they filed a is not necessary to qualify for this credit. Schedule HEPTC-1 on page 38

joint federal income tax return, they may choose to file jointly as residents must be completed in its entirety to determine eligibility to claim the credit.

of West Virginia. The total income earned by each spouse for the entire A COMPLETED SCHEDULE HEPTC-1 MUST BE FILED WITH YOUR

year, regardless of where earned, must be reported on the joint return as RETURN to claim the Homestead Excess Property Tax Credit.

taxable to West Virginia. No credit will be allowed for income taxes paid

to the other state.

A joint return may not be filed if one spouse changes residence during

the taxable year, while the other spouse-maintained status as a resident or

nonresident during the entire taxable year.

16 — 2020 West Virginia Personal Income Tax Information and Instructions tax.wv.gov

|

Enlarge image |

SPOUSES OF UNITED STATES MILITARY support of the OCO, regardless of whether they are deployed overseas or

SERVICE MEMBERS stateside. This income is shown on Schedule M, line 34, as a decreasing

modification to your federal adjusted gross income. A copy of your

Effective for taxable year 2009, spouses of military service members military orders and W-2 must be included with the return when it

may be exempt from West Virginia income tax on wages received from is filed.

services performed in West Virginia if all three of the following conditions Active Military Separation: If you are a West Virginia resident and

are met: were on active duty for at least 30 continuous days and have separated

• The service member is present in West Virginia in compliance with from active military service, your active duty military pay from the armed

military orders; forces of the United States, the National Guard, or Armed Forces Reserve

• The spouse is in West Virginia solely to be with the service member; is an authorized modification reducing your federal adjusted gross income

and only to the extent the active duty military pay is included in your federal

• The spouse maintains domicile in another state. adjusted gross income for the taxable year in which it is received. A copy

It is not a requirement for both spouses to have the same state of domicile, of your military orders, DD 214, and W-2 must be included with your

nor in the case of border installations, live in the state where the service return when filed.

member is stationed. Eligible spouses wishing to claim this exemption from

income tax may file a revised Form IT-104 with the spouse’s employer CERTAIN STATE AND FEDERAL RETIREMENT

and must also attach a copy of their “spouse military identification card” SYSTEMS

when providing this form to their employer.

The modification for pensions and annuities received from the West Virginia

Any refunds for taxable year 2020 may be claimed on a properly filed Public Employees’ Retirement System, the West Virginia Teachers’

IT-140 indicating “Nonresident Military Spouse” above the title on the Retirement System, and Federal Retirement is limited to a maximum of

first page. Military spouses should check the Nonresident Special box on $2,000 and entered on Schedule M. The State of West Virginia does not

Form IT-140 and complete Part II of Schedule A. A copy of their State of impose tax on the retirement income received from any West Virginia state

Legal Residence Certificate, form DD2058, must be enclosed with their or local police, deputy sheriffs’ or firemen’s retirement system, federal

return when it is filed. law enforcement retirement, or military retirement, including survivorship

Nonresident military service members and their spouses may be liable for annuities. See instructions for Schedule M on page 21.

West Virginia income tax on other types of West Virginia income such

as business income, interest income, unemployment compensation, etc. US RAILROAD RETIREMENT

These types of income are reported on the Schedule A (see pages 11 & The State of West Virginia does not tax this income. All types of United

12). States Railroad Retirement Board benefits, including unemployment

compensation, disability and sick pay included on the federal return

MEMBERS OF THE ARMED FORCES should be entered on Schedule M, line 38. See instructions on page 22.

If your legal residence was West Virginia at the time you entered military

service, assignment to duty outside the state does not change your West AUTISM MODIFICATION

Virginia residency status. You must file your return and pay the tax due For tax years beginning on or after January 1, 2011 a modification was

in the same manner as any other resident individual unless you did not created reducing federal adjusted gross income in the amount of any

maintain a physical presence in West Virginia for more than 30 days qualifying contribution to a qualified trust maintained for the benefit of

during the taxable year. a child with autism. Any established trust must first be approved by the

If, during 2020, you spent more than 30 days in West Virginia, you are West Virginia Children with Autism Trust Board. The modification is

considered to be a West Virginia resident for income tax purposes and claimed on line 41 of Schedule M with maximum amounts of $1,000 per

must file a resident return and report all of your income to West Virginia. individual filer and persons who are married but filing separately and

If there is no West Virginia income tax withheld from your military $2,000 per year for persons married and filing a joint income tax return.

income, you may find it necessary to make quarterly estimated tax TAXPAYERS OVER AGE 65 OR DISABLED

payments using Form IT-140ES.

If, during 2020, you did not spend more than 30 days in West Virginia An individual, regardless of age, who was certified by a physician as being

and had income from a West Virginia source, you may be required to permanently and totally disabled during the taxable year, or an individual

file an income tax return with West Virginia as any other nonresident who was 65 before the end of the taxable year may be eligible for certain

individual, depending upon the type of income received. modifications that will reduce their federal adjusted gross income for

West Virginia income tax purposes up to $8,000. See instructions for

A member of the Armed Forces who is domiciled outside West Virginia Schedule M on page 21.

is considered to be a nonresident of West Virginia for income tax

purposes; therefore, his/her military compensation is not taxable to West SURVIVING SPOUSE

Virginia even though he/she is stationed in West Virginia and maintains a

permanent place of abode therein. Check the Nonresident Special box on Regardless of age, a surviving spouse of a decedent may be eligible for

Form IT-140 and complete Part II of Schedule A. A copy of your military a modification reducing his/her income up to $8,000 provided he/she did

orders and Form DD2058 must be enclosed with the return. not remarry before the end of the taxable year. The modification is claimed

Combat pay received during 2020 is not taxable on the federal income on Schedule M. The decedent must have attained the age of 65 prior to his/

tax return. Therefore, it is not taxable on the state return. her death or, regardless of age, must have been certified as permanently

and totally disabled. See instructions for line 46 of Schedule M on page

ACTIVE DUTY MILITARY PAY 23 to determine if you qualify for this modification. The surviving spouse

A West Virginia National Guard and Reserve service member is entitled should write on the signature line for the deceased “filing as surviving

to the Schedule M reducing modification for income while on active duty spouse”.

in support of the contingency operation as defined in Executive Order A surviving spouse who has not remarried at any time before the end of

13223 and subsequent amendments-- such as those called to active duty as the taxable year for which the return is being filed may claim an additional

part of Operation Noble Eagle, Operation Enduring Freedom, Operation exemption for the two (2) taxable years following the year of death of his/

Iraqi Freedom, Operation New Dawn, and Operation Inherent Resolve, as her spouse.

well as any other current or future military operations deemed to be part

of the OCO. The President’s memorandum applies to any West Virginia

National Guard and Reserve service members called to active duty in

tax.wv.gov 2020 Personal Income Tax Information and Instructions — 17

|

Enlarge image |

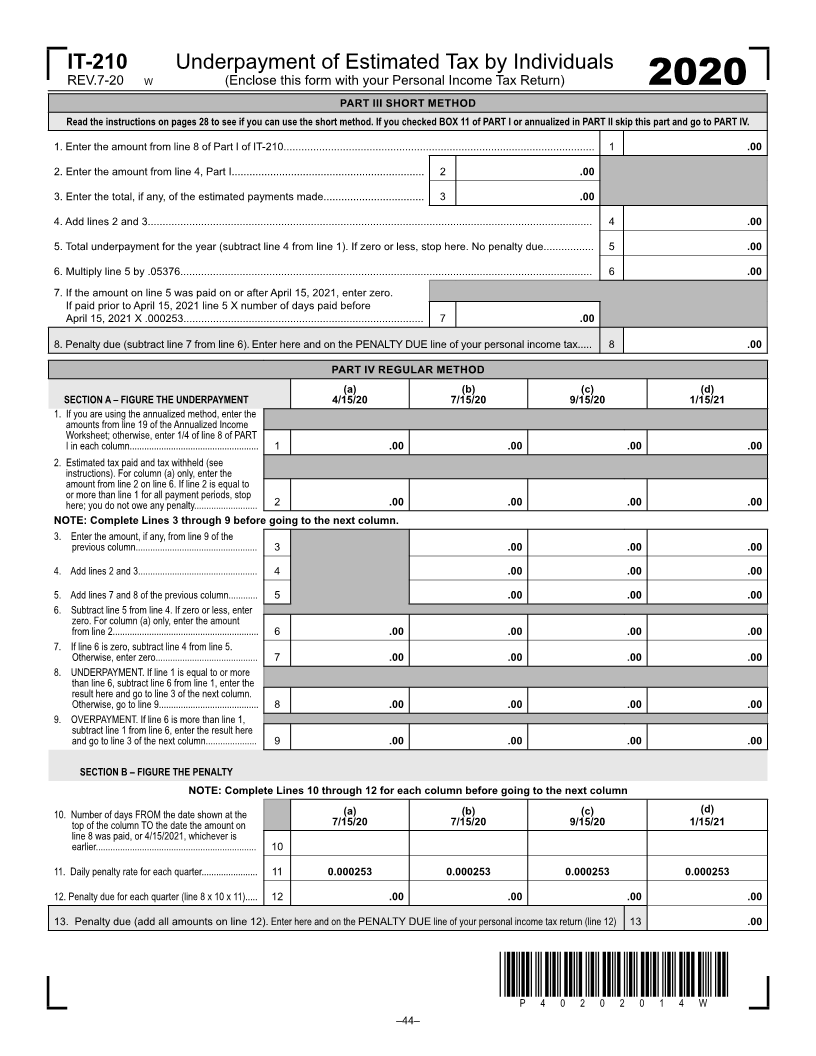

WEST VIRGINIA COLLEGE SAVINGS PLAN AND PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

PREPAID TUITION TRUST FUNDS If your return shows a balance due greater than $600, you may be subject

Taxpayers making payments or contributions to programs of the West to a penalty for not prepaying enough personal income tax through

Virginia Prepaid Tuition Trust and/or West Virginia Savings Plan Trust, withholding and/or quarterly estimated tax payments. The penalty is

operated under the trade names of SMART529 or TMWest Virginia computed separately for each installment date. Therefore, you may owe

Prepaid College Plan, may be eligible for a modification reducing the the penalty for an earlier due date even if you paid enough tax later to

federal adjusted gross income. This deduction can be claimed in the make up the underpayment. This is true even if you are due a refund when

amount and in the year that the contribution is made or the remainder you file your tax return. However, you may be able to reduce or eliminate

of the reducing modification may be carried forward for a period not to the penalty by using the annualized income installment method. Use Form

exceed five taxable years beginning in the tax year in which the payment IT-210 on page 43 to calculate your penalty. Instructions can be found on

or contribution was made. For more information regarding participation page 27. If you do not complete form IT-210, the West Virginia State Tax

in this program, contact SMART529 TMService Center at 1-866-574-3542. Department will calculate the penalty for you. You will receive a notice

for the amount of penalty due.

FILING REQUIREMENTS FOR CHILDREN UNDER To avoid future penalties, you should increase your withholding or begin

AGE 18 WHO HAVE UNEARNED (INVESTMENT) making quarterly estimated payments for tax year 2021.

INCOME

RETURNED PAYMENT CHARGE

Any child under the age of 18 who has investment income and whose

parents qualify and elect to report that income on their return, is not There will be a charge of $15 for each payment (Check or EFT) that is

required to file a return with the State of West Virginia. This election is returned due to insufficient funds. There will be a $28 fee for returned checks.

made in accordance with federal guidelines.

CREDIT FOR ESTIMATED TAX

Any child under the age of 18 whose income is not reported on his/her

parent’s return must file their own West Virginia return and report all You must make quarterly estimated tax payments if your estimated tax

of their income. If the child is claimed as an exemption on their parent’s liability (your estimated tax reduced by any state tax withheld from your

return, he/she must claim zero exemptions on the state return and claim a income) is at least $600, unless that liability is less than ten percent (10%)

$500 personal exemption allowance. of your estimated tax. The total estimated tax credit to be claimed on your

return is the sum of the payments made with the quarterly installments for

REFUND OF OVERPAYMENT taxable year 2020, any overpayments applied from your 2019 personal

income tax return and any payments made with your West Virginia

A return must be filed to obtain a refund of any overpayment. In order Application for Extension of Time to File (WV 4868).

to receive a refund of an overpayment of $2 or less, you must enclose a

signed statement with your return requesting that the refund be sent to you. EXTENSION OF TIME

DIRECT DEPOSIT If you obtain an extension of time to file your federal income tax return,

you are automatically allowed the same extension of time to file your

You may have your refund directly deposited into your bank account. West Virginia income tax return. Enter on your West Virginia return the

To avoid delay of your direct deposit, verify your routing and account date to which the federal extension was granted. If a federal extension

numbers from a check before filing your return. Refunds are issued in the was granted electronically, write “Federal Extension Granted” and the

form of United States currency. If you choose to have your refund direct confirmation number at the top of the West Virginia return. Enter the

deposited, your depositor must be capable of accepting US currency. extended due date in the appropriate box. A copy of Federal Schedule

4868 must be enclosed with your return. If you need an extension of time

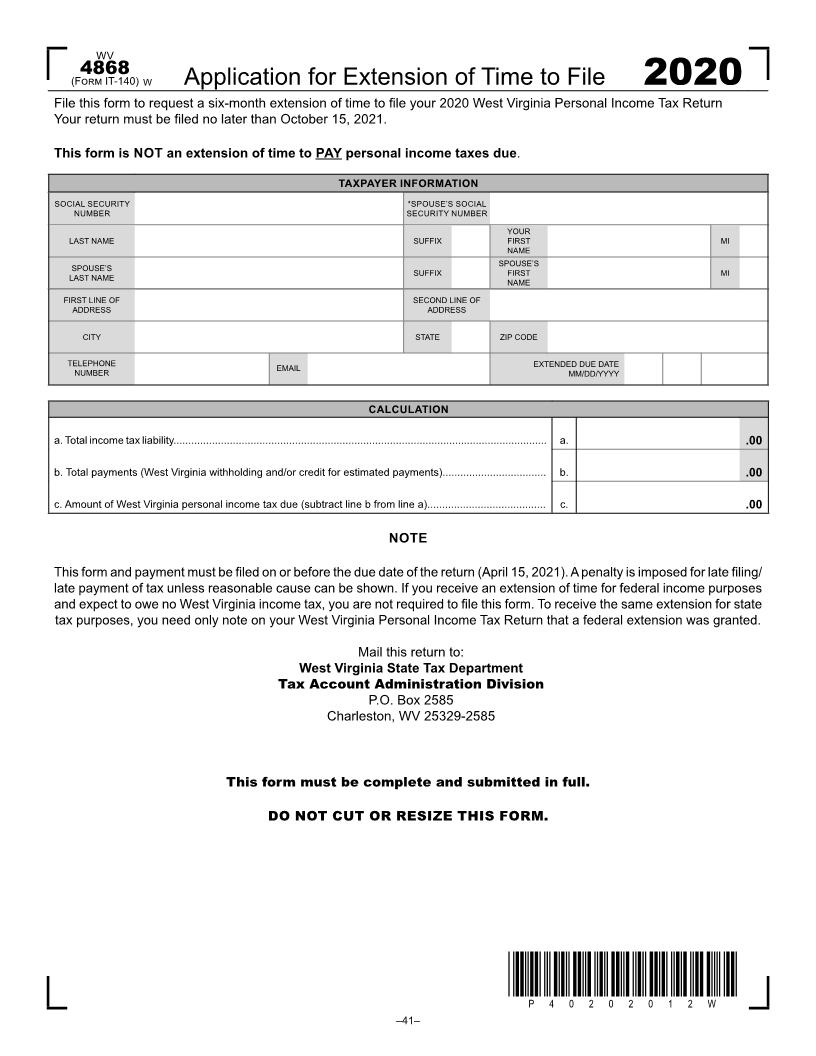

PENALTIES AND INTEREST for West Virginia purposes but not for federal purposes, or if you expect

Interest must be added to any tax due that is not paid by the due date of to owe tax to West Virginia, you must submit a completed West Virginia

the return even if an extension of time for filing has been granted. The Application for Extension of Time to File (WV 4868) and pay any tax

rate of interest will be fixed every year to equal the adjusted prime rate expected to be due. See page 41. This is not an extension to pay.

charged by banks (as of the first business day of the preceding December)

plus three percentage points. Visit www.tax.wv.gov in order to obtain the SIGNATURE

current interest rate. Your return MUST be signed. A joint return must be signed by both

Penalties (i.e. Additions to Tax) for late filing can be avoided by sending spouses. If you and your spouse (if filing a joint return) do not sign the

in your return by the due date. The law provides that a penalty of five return, it will not be processed. If the return is prepared by an authorized

percent (5%) of the tax due for each month, or part of a month, may be agent of the taxpayer, the agent must also sign on the line provided and

imposed for the late filing of the return up to a maximum of twenty-five enter his/her address and telephone number. If a joint federal return was

percent (25%) unless reasonable cause can be shown for the delay. filed for a deceased taxpayer, the surviving spouse should write on the

The law provides that an additional penalty may be imposed for not signature line for the deceased “filing as surviving spouse”.

paying your tax when due. This penalty is one-half of one percent (½ of

1%) of the unpaid balance of tax for each month, or part of a month, the WEST VIRGINIA INCOME TAX WITHHELD

tax remains unpaid, up to a maximum of twenty-five percent (25%). Electronic Filing – It is not necessary to submit withholding documents since

You may access an Interest and Additions to Tax Calculator on our this information will transmit electronically once entered within the software.

website at tax.wv.gov or you may call (304) 558-3333 or 1-800-982-8297 Paper Filed Returns – Enter the total amount of West Virginia tax

for assistance. withheld as shown on your withholding documents. If you are filing

The West Virginia Tax Crimes and Penalties Act imposes severe penalties a joint return, be sure to include any withholding for your spouse.

for failing to file a return or pay any tax when due, or for making a false Original withholding documents (W-2’s, 1099’s, K-1’s, and NRW-

return or certification. The mere fact that the figures reported on your 2’s) must be enclosed with your paper return. Failure to submit this

state return are taken from your federal return will not relieve you from documentation will result in the disallowance of the credit claimed.

the imposition of penalties because of negligence or for filing a false or Note: Local or municipal fees cannot be claimed as West Virginia income

fraudulent return. The statute of limitations for prosecuting these offenses tax withheld. If the withholding source is for a nonresident sale of real

is three years after the offense was committed. estate transaction, a form WV NRSR must be completed and on file with

the State Tax Department prior to submitting a tax return. Additionally,

18 — 2020 West Virginia Personal Income Tax Information and Instructions tax.wv.gov

|

Enlarge image |

a federal Schedule D and federal Form 8949 must be submitted. If INJURED SPOUSE

withholding is related to WV NRSR, please indicate in the box provided

on line 15 and submit Form NRSR and Schedule D and Form 8949 from You may be considered an injured spouse if you file a joint return and

your federal return. all or part of your refund was, or is expected to be, applied against your

spouse’s past due child support payments or a prior year tax liability. You

FAILURE TO RECEIVE A WITHHOLDING TAX must file an injured spouse allocation form (Form WV-8379) to claim

STATEMENT (W-2) your part of the refund if all three of the following apply:

If you fail to receive a withholding tax statement (Form W-2, W-2G, or • You are not required to pay the past due amount;

1099) from an employer by February 15th, you may file your income tax • You received and reported income (such as wages, taxable interest,

return using a substitute form. All efforts to obtain a W-2 statement from etc.) on a joint return; and

the payer must be exhausted before a substitute form will be accepted. • You made and reported payments such as West Virginia tax withheld

West Virginia Substitute W-2 (Form WV IT-102-1) must be completed from your wages or estimated tax payments.

and retained for your records in the same manner as Form W-2 for a If all of the above apply and you want your share of the overpayment

period of not less than three years. This information may be obtained from shown on the joint return refund, you must:

your pay stub(s). The federal Form 4852 (Substitute for Form W-2) does 1. Check the injured spouse box on the front of the return;

not provide all the information necessary to process your state return. It 2. Complete the West Virginia Injured Spouse Allocation Form, WV-8379; and

WILL NOT be accepted in lieu of Form WV IT-102-1. 3. Enclose the completed form with your West Virginia personal income tax

return.

PRIOR YEAR TAX LIABILITIES DO NOT check the injured spouse box unless you qualify as an injured

Taxpayers who have delinquent tax liabilities, state or federal, may not spouse and have enclosed the completed form with your return. This will

receive the full amount of their tax refund. If you have an outstanding cause a delay in the processing of your refund.

state or federal tax lien, your refund will be reduced and applied to your

past due liability. If a portion of your refund is captured, you will receive TAX DEPARTMENT PROCESSING AND

a notice and the balance of the refund. Any final unpaid West Virginia PROCEDURES

personal income tax liabilities may be referred to the United States

Treasury Department in order to capture that amount from your federal The Tax Department has implemented a modern tax system that allows us to