Enlarge image

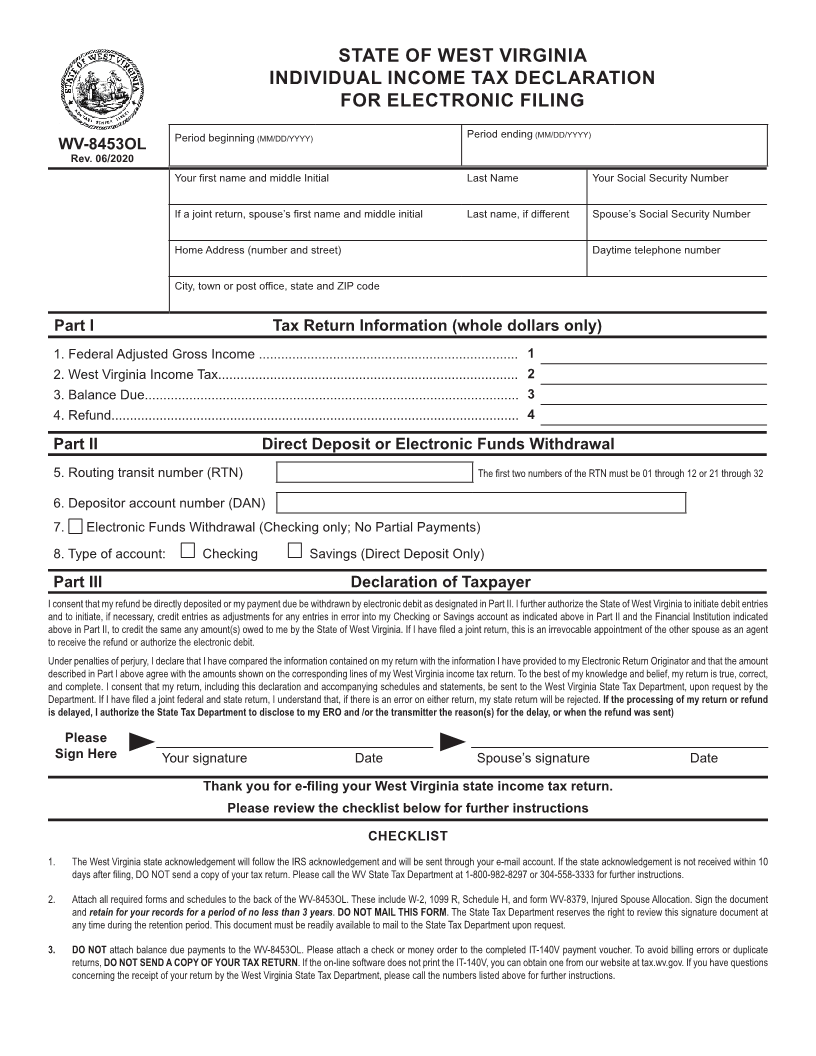

STATE OF WEST VIRGINIA

INDIVIDUAL INCOME TAX DECLARATION

FOR ELECTRONIC FILING

Period beginning (MM/DD/YYYY) Period ending (MM/DD/YYYY)

WV-8453OL

Rev. 06/2020

Your first name and middle Initial Last Name Your Social Security Number

If a joint return, spouse’s first name and middle initial Last name, if different Spouse’s Social Security Number

Home Address (number and street) Daytime telephone number

City, town or post o ffice, state and ZIP code

Part I Tax Return Information (whole dollars only)

1. Federal Adjusted Gross Income ...................................................................... 1

2. West Virginia Income Tax................................................................................. 2

3. Balance Due..................................................................................................... 3

4.Refund.............................................................................................................. 4

Part II Direct Deposit or Electronic Funds Withdrawal

5.Routing transit number (RTN) The first two numbers of the RTN must be 01 through 12 or 21 through 32

6.Depositor account number (DAN)

7. Electronic Funds Withdrawal (Checking only; No Partial Payments)

8.Type of account: Checking Savings (Direct Deposit Only)

Part III Declaration of Taxpayer

I consent that my refund be directly deposited or my payment due be withdrawn by electronic debit as designated in Part II. I further authorize the State of West Virginia to initiate debit entries

and to initiate, if necessary, credit entries as adjustments for any entries in error into my Checking or Savings account as indicated above in Part II and the Financial Institution indicated

above in Part II, to credit the same any amount(s) owed to me by the State of West Virginia. If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent

to receive the refund or authorize the electronic debit.

Under penalties of perjury, I declare that I have compared the information contained on my return with the information I have provided to my Electronic Return Originator and that the amount

described in Part I above agree with the amounts shown on the corresponding lines of my West Virginia income tax return. To the best of my knowledge and belief, my return is true, correct,

and complete. I consent that my return, including this declaration and accompanying schedules and statements, be sent to the West Virginia State Tax Department, upon request by the

Department. If I have filed a joint federal and state return, I understand that, if there is an error on either return, my state return will be rejected. If the processing of my return or refund

is delayed, I authorize the State Tax Department to disclose to my ERO and /or the transmitter the reason(s) for the delay, or when the refund was sent)

Please

Sign Here Your signature Date Spouse’s signature Date

Thank you for e- filing your West Virginia state income tax return.

Please review the checklist below for further instructions

CHECKLIST

1. The West Virginia state acknowledgement will follow the IRS acknowledgement and will be sent through your e-mail account. If the state acknowledgement is not received within 10

days after filing, DO NOT send a copy of your tax return. Please call the WV State Tax Department at 1-800-982-8297 or 304-558-3333 for further instructions.

2. Attach all required forms and schedules to the back of the WV-8453OL. These include W-2, 1099 R, Schedule H, and form WV-8379, Injured Spouse Allocation. Sign the document

and retain for your records for a period of no less than 3 years. DO NOT MAIL THIS FORM. The State Tax Department reserves the right to review this signature document at

any time during the retention period. This document must be readily available to mail to the State Tax Department upon request.

3. DO NOT attach balance due payments to the WV-8453OL. Please attach a check or money order to the completed IT-140V payment voucher. To avoid billing errors or duplicate

returns, DO NOT SEND A COPY OF YOUR TAX RETURN. If the on-line software does not print the IT-140V, you can obtain one from our website at tax.wv.gov. If you have questions

concerning the receipt of your return by the West Virginia State Tax Department, please call the numbers listed above for further instructions.